The equilibrium level of investment is a state where economic forces are balanced and market supply and demand are equal. This balance results in stable prices. When demand exceeds supply, prices rise to encourage more production, and when supply is higher, prices drop to stimulate demand. In a state of equilibrium, there is no incentive for buyers or sellers to change their behaviour, and the market is stable.

Economic equilibrium is a theoretical concept, and markets are rarely in a perfect state of equilibrium. However, the concept is important for understanding market behaviour and predicting future economic conditions.

What You'll Learn

- The equilibrium level of income is where aggregate demand equals aggregate supply

- The equilibrium is reached when investment equals savings

- The equilibrium price is where the supply of goods matches demand

- Economic equilibrium is a theoretical construct

- The equilibrium level of income is a perfect ideal

The equilibrium level of income is where aggregate demand equals aggregate supply

The equilibrium level of income is a key concept in economics, referring to a state where aggregate demand is equal to aggregate supply. This equilibrium is a theoretical ideal, a point of balance where there is no tendency for income and output to change. It is a level that markets strive towards but may never actually reach.

In a market, the equilibrium level of income is where the supply of goods matches demand, and prices are stable. This is a desirable state for companies, as they are meeting demand without waste or excess, and for consumers, as they can access goods without paying inflated prices.

The equilibrium level of income can be calculated using the formula: Y = C + I + G + (X – M), where Y = national income, C = consumption, I = investment, G = government expenditure, X = exports, and M = imports. This formula can be simplified to Y = C + I + G if there is no export or import activity.

The equilibrium level of income is important for investors, particularly those involved in the production of goods. It helps them understand the stability of a company and predict future economic conditions. It also helps determine optimal levels of government intervention and monetary policy.

In conclusion, the equilibrium level of income is a theoretical state where aggregate demand and supply are equal, resulting in a stable market with balanced prices. This concept is crucial for investors and policymakers alike, helping them make informed decisions about resource allocation and economic strategy.

The College Conundrum: Is Higher Education Worth the Investment?

You may want to see also

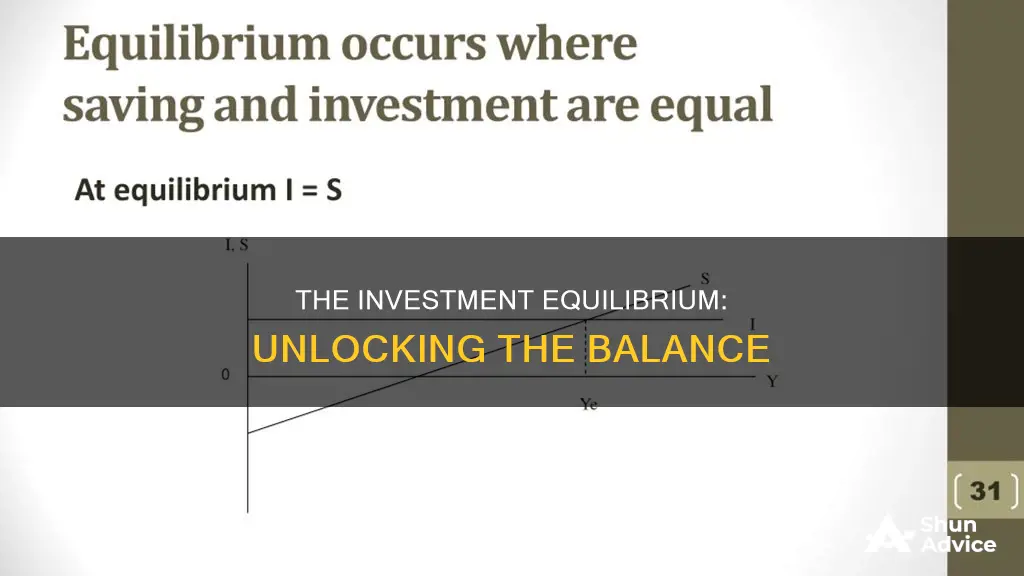

The equilibrium is reached when investment equals savings

Economic equilibrium is a state in which economic forces are balanced. In economics, this balance is often observed between the variables of price and quantity. The equilibrium price is where the supply of goods matches the demand.

The equilibrium level of investment is a concept that is reached when investment equals savings. This is because savings represent a leakage from the economy, while investment represents an injection. Given that money cannot disappear, savings should be equal to investment.

In a simplified Keynesian economic model, the equation S=I represents a state of equilibrium in the economy where savings (S) are equal to investment (I). This assumes that all savings are invested and all investments are financed by savings.

The equilibrium level of income is where aggregate demand equals aggregate supply. This can be calculated using the formula: aggregate demand (AD) = aggregate supply (AS).

In reality, markets are rarely in a perfect state of equilibrium. However, prices tend to fluctuate around the equilibrium levels. If prices rise too high, sellers will be incentivised to produce more, and if prices are too low, additional buyers will bid up the price. These activities keep the equilibrium level relatively balanced over time.

Hedging Strategies: Protecting Other's Wealth

You may want to see also

The equilibrium price is where the supply of goods matches demand

The equilibrium price is a state in which market supply and demand balance each other, resulting in stable prices. An over-supply of goods or services generally causes prices to go down, leading to higher demand. Conversely, an under-supply or shortage causes prices to go up, resulting in less demand. This balancing effect of supply and demand results in a state of equilibrium.

The equilibrium price can be determined by setting the supply function and demand function equal to one another and solving for the price. This is done by plotting the demand and supply curves on a graph, with the quantity of a good or service on the x-axis and the price on the y-axis. The point at which these curves intersect is the equilibrium price, where the quantity demanded equals the quantity supplied.

The law of supply and demand combines two fundamental economic principles that describe how changes in the price of a resource, commodity, or product affect its supply and demand. Supply rises while demand declines as the price increases, and supply constricts while demand grows as the price drops. The law of demand holds that the demand level for a product or resource will decline as its price rises and rise as the price drops. The law of supply states that higher prices boost the supply of an economic good, while lower prices tend to diminish it.

The equilibrium price is a theoretical construct, and markets are rarely in perfect equilibrium. However, prices tend towards equilibrium over time.

The S&P 500: A Safe Harbor for Retirement Savings?

You may want to see also

Economic equilibrium is a theoretical construct

Economic equilibrium is a theoretical concept borrowed from the physical sciences, where it refers to a state of balance between observable physical forces. In economics, it is used to describe a state where economic forces are balanced, and variables such as price and quantity remain unchanged without external influences.

The concept of economic equilibrium is based on the idea that market prices, supply, and demand function similarly to physical forces like velocity, friction, heat, or fluid pressure. For example, if the price of a product is too low, the quantity demanded will exceed the quantity supplied, resulting in a market disequilibrium. To restore balance, buyers will have to offer higher prices to induce sellers to part with their goods, bringing the market closer to equilibrium.

Economic equilibrium is a useful theoretical framework for understanding how supply and demand interact and tend towards balance in an economy with multiple markets. This is known as general equilibrium theory, which was developed by French economist Leon Walras in the 19th century. It is important to note that economic equilibrium is a theoretical construct, and markets never actually reach a perfect state of equilibrium. Instead, they are constantly moving towards it.

The equilibrium level of investment, therefore, refers to a state where the aggregate demand for investment equals the aggregate supply. This concept is crucial for investors, as it represents a point of perfect balance where there is no excess or shortage of investment opportunities, and all resources are optimally allocated.

John Cabot's First Expedition: Investors' Motives

You may want to see also

The equilibrium level of income is a perfect ideal

The equilibrium level of income is a theoretical ideal where economic forces are perfectly balanced. It is a state where aggregate demand equals aggregate supply, and all economic transactions that "should" occur, do occur.

In reality, markets are never in perfect equilibrium, but the concept is useful for investors and governments. For investors, it is a goal to strive towards, where there is no waste, and all machinery is running smoothly. Companies can aim for this equilibrium by matching their supply to demand, thus maximising efficiency and minimising costs. For governments, understanding the equilibrium level of income can help determine the optimal level of intervention and monetary policy.

The equilibrium level of income can be calculated using the formula: Y = C + I + G + (X – M), where Y = national income, C = consumption, I = investment, G = government expenditure, X = exports, and M = imports. This formula can be simplified if there is no export or import activity.

While markets may never reach a true equilibrium, they are constantly moving towards it. This is driven by entrepreneurs making educated guesses about economic conditions and being rewarded for their accuracy through profits. Information about economic conditions is also more readily available, which helps guide the market towards equilibrium.

In conclusion, the equilibrium level of income is a perfect ideal, a theoretical concept that provides a goal for investors and governments. It represents a state of balance, where supply meets demand, and all economic transactions occur as they should.

Pre-Paying Debts or Investing: The Retirement Dilemma

You may want to see also

Frequently asked questions

The equilibrium level of income is where aggregate demand equals aggregate supply. This is a state where market forces are balanced and there is no incentive to shift away from that outcome.

The equilibrium level of income is calculated using the formula AD = AS, where AD is aggregate demand and AS is aggregate supply.

The formula for equilibrium income in the Keynesian model is Y = C + I + G, where Y = aggregate supply, C = consumption, I = investment, and G = government expenditure.

According to the 'saving and investment' approach, equilibrium is reached when investment equals savings (I=S). When savings are more than investment, producers expand output to bring inventory back to the desired level. When investment is more than savings, firms reduce output to clear the unwanted increase in inventory.