What Works in Investing is a podcast that delves into the world of finance and investment strategies. Each episode, the hosts interview industry experts, analysts, and successful investors to uncover the secrets behind their success. The podcast covers a wide range of topics, including market trends, investment techniques, risk management, and the psychology of investing. By exploring real-world case studies and sharing practical insights, the podcast aims to educate and inspire listeners to make informed investment decisions and navigate the complex world of finance with confidence.

What You'll Learn

- Market Analysis: Understanding trends, indicators, and market sentiment

- Investment Strategies: Exploring various approaches like value investing, growth investing, and more

- Risk Management: Techniques to protect capital and navigate market volatility

- Portfolio Construction: Building a well-diversified portfolio for long-term success

- Behavioral Finance: Impact of emotions on investment decisions and strategies to overcome biases

Market Analysis: Understanding trends, indicators, and market sentiment

Market analysis is a critical skill for investors, enabling them to make informed decisions and navigate the complex world of financial markets. It involves a systematic examination of various factors that influence market behavior, trends, and sentiment. Understanding these elements is essential for investors to identify potential opportunities and manage risks effectively. Here's an overview of how to approach market analysis, focusing on trends, indicators, and market sentiment.

Trends: Identifying market trends is fundamental to market analysis. Trends represent the overall direction of prices or values over a specific period. Investors can analyze historical data to recognize patterns and make predictions about future movements. For example, a rising trend in stock prices over several months could indicate a bullish market sentiment, suggesting that investors are optimistic about the companies' performance. Conversely, a downward trend might signal a bearish market, where investors are cautious or pessimistic. Traders often use trend lines, moving averages, and technical analysis tools to identify and confirm trends, helping them make strategic trading decisions.

Indicators: Financial indicators are statistical measures or signals that provide insights into market conditions and potential price movements. These indicators can be categorized into two main types: leading and lagging. Leading indicators anticipate future market changes, such as the Consumer Confidence Index or the Purchasing Managers' Index (PMI). These indicators help investors predict shifts in market sentiment and economic trends. On the other hand, lagging indicators reflect past market conditions, like the Price Earnings Ratio (P/E ratio) or the Moving Average Convergence Divergence (MACD). These lagging indicators are useful for confirming trends and identifying potential support or resistance levels. Investors can use a combination of leading and lagging indicators to make more accurate predictions and adjust their investment strategies accordingly.

Market Sentiment: Understanding market sentiment is crucial as it reflects the overall attitude and emotions of investors towards a particular market or asset. Positive sentiment often leads to buying pressure, driving prices higher, while negative sentiment can result in selling pressure, causing prices to decline. Market sentiment can be influenced by various factors, including news, economic data, company-specific events, and global trends. Investors can gauge sentiment through various methods, such as analyzing social media trends, monitoring news headlines, and studying investor surveys or sentiment indicators. For instance, a surge in positive news coverage about a technology company might indicate a positive market sentiment, encouraging investors to buy the stock.

In market analysis, investors should combine technical analysis (studying price charts and indicators) with fundamental analysis (evaluating financial data and company fundamentals). This comprehensive approach allows for a more accurate assessment of market trends, potential opportunities, and risks. Additionally, staying informed about global economic events, geopolitical factors, and industry-specific news can provide valuable context for interpreting market sentiment and making well-informed investment choices.

Buy and Hold: A Long-Term Investment Companion

You may want to see also

Investment Strategies: Exploring various approaches like value investing, growth investing, and more

When it comes to investment strategies, there are numerous approaches that investors can adopt, each with its own set of principles and objectives. One popular strategy is value investing, which involves identifying and purchasing securities that are believed to be undervalued in the market. The core idea behind this approach is to buy these undervalued assets at a discount, with the expectation that their true value will be recognized over time, leading to potential capital appreciation. Value investors often focus on fundamental analysis, studying financial statements, and assessing a company's intrinsic value to make informed investment decisions.

Growth investing, on the other hand, is a strategy that targets companies with strong growth potential. These investors seek out businesses that demonstrate consistent revenue and earnings growth, often in industries with high barriers to entry. The goal is to capitalize on the company's ability to expand and generate substantial returns over the long term. Growth investors may consider factors such as market share, competitive advantage, and future expansion plans when making their picks.

Another strategy that has gained traction is momentum investing, which involves investing in securities that have demonstrated positive price trends. Momentum investors believe in the persistence of past performance and aim to capitalize on the continued upward trajectory of these stocks. This approach often requires a keen eye for identifying trends and can be more short-term focused compared to value or growth investing.

Additionally, investors can explore the concept of sector-specific investing, where they focus on specific industries or sectors that they believe will outperform the broader market. This strategy requires a deep understanding of the sector's dynamics and the factors driving its growth. For example, an investor might choose to invest in healthcare, technology, or renewable energy, aiming to benefit from the unique opportunities and challenges presented by these sectors.

It's important to note that each investment strategy has its own set of risks and rewards, and investors should carefully consider their risk tolerance, investment goals, and time horizon before deciding on a particular approach. Diversification is also a key principle, as it helps mitigate risk by spreading investments across various assets and sectors. By exploring these different strategies, investors can develop a comprehensive understanding of the investment landscape and make informed decisions to align with their financial objectives.

Unveiling Angel Investing in India: A Comprehensive Guide

You may want to see also

Risk Management: Techniques to protect capital and navigate market volatility

Risk management is a critical aspect of investing, and it's essential to understand the various techniques and strategies to protect your capital and navigate the often-volatile markets. Here are some key approaches to consider:

Diversification: One of the most fundamental principles of risk management is diversification. This strategy involves spreading your investments across different asset classes, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. For example, if you invest in a mix of stocks, bonds, real estate, and commodities, a decline in one area may be offset by gains in another. Diversification helps to smooth out the volatility of your portfolio, providing a more stable investment experience.

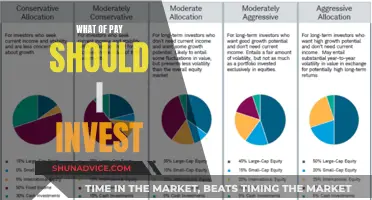

Asset Allocation: This technique is closely related to diversification and involves dividing your investment portfolio into different asset categories based on your risk tolerance and investment goals. A common approach is to allocate a percentage of your portfolio to each asset class, such as stocks, bonds, cash, and alternative investments. For instance, a 60/40 stock-bond allocation is a popular strategy, where 60% of the portfolio is in stocks for potential growth, and 40% is in bonds for stability and income. Regularly reviewing and rebalancing your asset allocation ensures that your portfolio remains aligned with your risk preferences and market conditions.

Stop-Loss Orders: Implementing stop-loss orders is a practical way to limit potential losses. A stop-loss order is an instruction to sell an asset when it reaches a certain price. This technique is particularly useful for investors who want to protect their capital from significant downturns. For instance, if you own a stock and set a stop-loss at $50, the order will trigger a sell if the stock price falls to $50 or below. By using stop-loss orders, you can automatically sell assets before they experience substantial losses, thus minimizing potential negative impacts on your portfolio.

Risk Assessment and Monitoring: Regularly assessing and monitoring the risk exposure of your investments is crucial. This involves analyzing the potential risks associated with each investment and understanding the overall market risks. You can use various tools and metrics to gauge risk, such as volatility measures (e.g., standard deviation), beta (a measure of systematic risk), and value-at-risk (VaR) models. By staying informed about market trends, economic indicators, and individual stock performance, you can make more informed decisions and adjust your portfolio accordingly to manage risk effectively.

Additionally, it's important to stay disciplined and avoid emotional decision-making. Market volatility can lead to panic selling or impulsive buying, which may not always be in your best interest. A well-defined risk management strategy, combined with a long-term investment perspective, can help you weather market fluctuations and make rational choices. Remember, successful investing often requires a balanced approach, where risk management is an integral part of your overall investment strategy.

Buy-to-Let Investing: A Guide to Building Wealth Through Property

You may want to see also

Portfolio Construction: Building a well-diversified portfolio for long-term success

In the world of investing, constructing a well-diversified portfolio is a cornerstone of long-term success. It involves a strategic approach to asset allocation, ensuring that your investments are spread across various asset classes, sectors, and geographic regions. This diversification strategy aims to reduce risk and optimize returns over time. Here's a comprehensive guide to building a robust and well-balanced investment portfolio:

Understand Your Risk Tolerance: The first step is to assess your risk tolerance, which refers to your ability and willingness to withstand fluctuations in the value of your investments. Are you a conservative investor seeking steady growth with minimal risk, or are you more aggressive, aiming for higher returns despite potential volatility? Understanding your risk tolerance will guide your asset allocation decisions. For instance, a conservative investor might allocate a larger portion of their portfolio to bonds and stable investments, while a more aggressive investor may lean towards stocks and growth-oriented assets.

Define Your Investment Goals: Clearly defining your investment goals is essential. Are you saving for retirement, a child's education, or a specific financial milestone? Each goal may require a different time horizon and risk profile. For long-term goals, such as retirement, a well-diversified portfolio is crucial to weather market volatility. Consider the potential returns and risks associated with each asset class and adjust your allocation accordingly.

Asset Allocation: Diversification starts with asset allocation, which involves dividing your portfolio among different asset classes like stocks, bonds, cash, and alternative investments. Historically, stocks have provided higher returns over the long term, but they also come with greater risk. Bonds offer lower risk and steady income but with lower potential returns. A common strategy is to allocate a larger portion of your portfolio to stocks for growth, especially if you have a long investment horizon. Then, allocate a significant portion to bonds for stability and risk mitigation. You can further diversify by investing in various sectors and regions to reduce concentration risk.

Sector and Geographic Diversification: Within the asset classes, sector and geographic diversification is key. Invest in a range of sectors such as technology, healthcare, financials, and energy. Each sector has its own set of risks and growth potential. For instance, technology stocks may offer high growth but are more volatile, while healthcare stocks might provide steady growth and are less susceptible to market downturns. Similarly, diversify your investments across different countries and regions to reduce country-specific risks. International investments can provide exposure to emerging markets and diverse economic conditions.

Regular Review and Rebalancing: Portfolio construction is an ongoing process that requires regular review and adjustment. Market conditions, economic trends, and personal circumstances can change, impacting your investment strategy. Periodically assess your portfolio's performance and rebalance it to maintain your desired asset allocation. For example, if stocks have outperformed bonds, you might reallocate some of your stock holdings to bonds to restore the original balance. This disciplined approach ensures that your portfolio remains aligned with your risk tolerance and investment goals.

Consider Exchange-Traded Funds (ETFs) and Index Funds: ETFs and index funds are excellent tools for diversification. These funds track specific indexes, providing instant diversification across a particular market or asset class. For instance, an S&P 500 ETF offers exposure to 500 large U.S. companies, instantly diversifying your portfolio. Similarly, bond ETFs provide access to various bond markets, reducing the risk associated with individual bond investments.

In summary, building a well-diversified portfolio is a strategic process that requires careful consideration of your risk tolerance, investment goals, and market dynamics. By allocating your assets wisely, diversifying across sectors and regions, and regularly reviewing your portfolio, you can navigate the investment landscape with confidence and work towards your long-term financial objectives. Remember, diversification is a powerful tool to manage risk and optimize returns in the ever-changing world of investing.

Morningstar's Guide for Senior Investors

You may want to see also

Behavioral Finance: Impact of emotions on investment decisions and strategies to overcome biases

The field of behavioral finance explores the intricate relationship between human psychology and financial decision-making, offering valuable insights into why investors often make irrational choices. It highlights the significant impact of emotions on investment decisions, revealing how our feelings can drive us to make poor choices that contradict rational financial principles. Understanding these emotional biases is crucial for investors aiming to improve their decision-making and potentially enhance their investment outcomes.

One of the most well-known biases is the 'loss aversion' bias, where investors are more likely to avoid losses than to seek gains. This bias can lead to a reluctance to sell investments that have decreased in value, even when it might be rational to do so. For instance, an investor might hold onto a stock that has dropped significantly in price, hoping it will recover, while ignoring the potential for further losses. This behavior can be attributed to the powerful emotional response to the fear of losing money.

Another common bias is the 'availability heuristic', where investors overestimate the importance of information that is readily available or memorable. This can result in overconfidence in one's investment choices, as individuals might rely heavily on recent events or trends that are easily recalled, even if they are not statistically significant. For example, an investor might make a decision based on a single piece of news or a short-term market fluctuation, ignoring the broader market context and long-term fundamentals.

To overcome these emotional biases, investors can employ several strategies. Firstly, developing a disciplined investment process can help. This involves creating a clear set of rules and criteria for buying and selling investments, based on objective financial analysis rather than emotional responses. By sticking to a well-defined strategy, investors can reduce the influence of short-term market noise and emotional impulses.

Additionally, diversification is a powerful tool to manage risk and emotional stress. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the impact of any single negative event or market trend. Diversification helps to smooth out the volatility of returns, providing a more stable and less emotionally charged investment experience.

Lastly, seeking professional advice and maintaining a long-term perspective are essential. Consulting with a financial advisor can provide an objective view of the market and help investors make more rational decisions. A long-term investment horizon allows investors to ride out short-term market fluctuations, focusing instead on the underlying value of their investments and the potential for long-term growth.

In summary, behavioral finance emphasizes the critical role of emotions in investment decisions and the potential pitfalls they can create. By recognizing these biases and implementing strategies such as disciplined investment processes, diversification, and seeking professional guidance, investors can make more informed choices and potentially improve their overall investment performance.

Savings Strategies: Where to Invest Right Now

You may want to see also

Frequently asked questions

The podcast delves into the world of investment strategies, offering insights and discussions on various topics related to finance and investing. It covers a wide range of subjects, including market trends, investment techniques, and financial planning, providing valuable knowledge for both novice and experienced investors.

The hosts are financial experts and analysts with extensive experience in the investment industry. They bring a wealth of knowledge and diverse perspectives to the show. One host is a former Wall Street analyst, while the other is a seasoned investor, offering a unique blend of analytical and practical insights.

New episodes are typically released weekly, ensuring a consistent flow of content for listeners. The podcast is available on major streaming platforms such as Spotify, Apple Podcasts, and Google Podcasts. Subscribers can also follow the show on social media for updates and bonus content.

The podcast's strength lies in its ability to simplify complex financial concepts and make them accessible to a broad audience. It offers practical advice and real-world examples, bridging the gap between theory and practice. Additionally, the hosts' engaging style and ability to provide actionable insights make it a go-to resource for investors seeking to enhance their financial literacy.