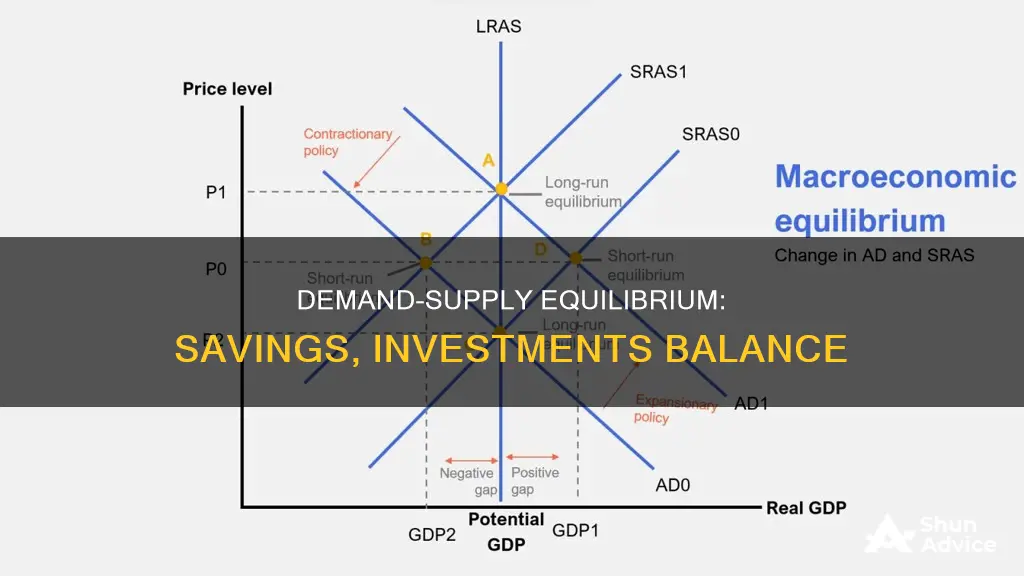

Aggregate demand and aggregate supply are macroeconomic terms that represent the total demand and supply within an economy for all goods and services at a certain price point. When aggregate demand equals aggregate supply, it indicates a state of equilibrium in the market, where the total amount of goods and services demanded by consumers is equal to the total amount supplied by producers. In this scenario, the concept of savings and investments also comes into play. Savings refer to the income that individuals or entities choose not to spend on consumption or other purposes, while investments represent the funds allocated by businesses or organizations to support current output and increase production capacity. In a situation where aggregate demand equals aggregate supply, the level of savings in the economy would be equivalent to the amount of investments. This equilibrium suggests that the funds that individuals or entities choose to save are being utilized by businesses for investment purposes, resulting in a balanced economic state.

| Characteristics | Values |

|---|---|

| Aggregate demand | The total demand for all finished goods and services in the market during a certain time |

| Aggregate supply | The total supply of final goods and services produced by companies that they plan to sell at a certain price within a specific time |

| Relationship between aggregate demand and supply | When aggregate demand equals aggregate supply, savings equal investments |

| Components of aggregate demand | Consumer consumption, investments, government spending, and net exports |

| Factors affecting aggregate demand | Interest rates, foreign exchange rates, inflation, and income levels |

| Factors affecting aggregate supply | Changes in the size and quality of labor, technological innovations, production costs, producer taxes and subsidies, and changes in inflation |

What You'll Learn

The relationship between aggregate demand and gross domestic product (GDP)

Aggregate demand is a macroeconomic term that measures the total demand for all finished goods and services in an economy at a specific price level and point in time. It is influenced by factors such as consumer spending, investment spending, government spending, and net exports. On the other hand, gross domestic product (GDP) represents the total amount of goods and services produced in an economy, indicating the supply side.

The relationship between aggregate demand and GDP is essential in understanding the overall health and dynamics of an economy. When aggregate demand equals GDP, it means that the total demand for goods and services is met by the supply, resulting in a balanced economy. This equilibrium suggests that resources are being utilised efficiently, and there is neither excess demand nor surplus supply. However, it is important to note that this equilibrium is often theoretical and challenging to achieve in practice due to the constant fluctuations in economic conditions.

Typically, aggregate demand and GDP move together. An increase in aggregate demand leads to an increase in GDP as businesses ramp up production to meet the higher demand. Conversely, a decrease in aggregate demand results in a decrease in GDP as businesses produce fewer goods and services. This relationship highlights the interdependence between the demand and supply sides of an economy.

While aggregate demand and GDP usually move in tandem, there can be instances where they diverge. For example, during economic crises, such as the COVID-19 pandemic, aggregate demand can decrease due to factors like social distancing measures and reduced consumer confidence. In such cases, businesses may not be able to respond proportionally to the decrease in demand, leading to a more significant decline in aggregate demand compared to GDP.

It is also important to consider the long-run versus short-run perspectives. In the short run, aggregate demand may not always equal GDP due to adjustments for inflation and other economic factors. However, in the long run, after accounting for price level changes, aggregate demand and GDP tend to align.

Yotta Savings: A Smart Investment Strategy for Your Money

You may want to see also

The components of aggregate demand

Consumption Spending:

This refers to the demand by individuals and households within the economy. It is the largest component of an economy's aggregate demand and depends on factors such as disposable income, per capita income, debt, consumer expectations, and interest rates.

Investment Spending:

This represents businesses' investments to support current output and increase production capability. It includes spending on new capital assets, machinery, equipment, changes in inventories, and investments in structures. Investment spending is influenced by interest rates, future economic expectations, and government incentives.

Government Spending:

This includes the demand produced by government programs such as infrastructure spending, public goods, defense, military equipment, public sector facilities, healthcare services, and government employees. Government spending can stimulate or reduce aggregate demand, and changes in tax policies can also impact consumption and investment spending.

Net Exports:

Net exports represent the demand for domestic goods by foreign markets (exports) and the demand for foreign goods by the domestic market (imports). It is calculated by subtracting the total value of a country's exports from the total value of all imports. Changes in relative growth rates and prices between countries can impact export and import demand.

These four components interact to determine the overall level of aggregate demand in an economy. Changes in any of these components can shift the aggregate demand curve, resulting in either an increase or decrease in aggregate demand.

Explore Saving and Investment Options for Your Future

You may want to see also

The impact of interest rates on aggregate demand

Interest rates have a significant impact on aggregate demand, influencing both consumers and businesses. When interest rates rise, the cost of borrowing increases, which discourages individuals and firms from taking out loans and making purchases, particularly for big-ticket items like appliances, vehicles, and homes. Higher interest rates also lead to reduced disposable income, as more money is spent on interest payments, leaving less for other areas of consumption. This, in turn, leads to a decline in consumer spending.

Additionally, higher interest rates make saving more attractive than spending, as individuals can earn interest on their deposits. This shift in behaviour further contributes to a decrease in aggregate demand. Moreover, higher interest rates can cause a currency to appreciate, making exports less competitive and leading to a decline in exports and an increase in imports, which also reduces aggregate demand.

On the other hand, lower interest rates encourage borrowing and spending. They lower the borrowing costs for consumers and businesses, leading to increased investment and consumption. For instance, companies can borrow at lower rates to fund capital spending, while consumers are more likely to take out loans for significant purchases.

Monetary policy plays a crucial role in managing aggregate demand. Contractionary monetary policy, which leads to higher interest rates and a reduced quantity of loanable funds, tends to decrease aggregate demand by discouraging investment and consumption. Conversely, expansionary monetary policy, characterised by lower interest rates and a higher quantity of loanable funds, stimulates investment and consumption, thereby increasing aggregate demand.

Loans: Saving or Investing? Understanding the Financial Impact

You may want to see also

The role of government spending in aggregate demand

Aggregate demand is a macroeconomic term that measures the total demand for all finished goods and services in an economy at a certain price point. It is influenced by consumer spending, investment spending, government spending, and net exports. Government spending represents the demand created by government programs, such as infrastructure projects and public goods. It plays a crucial role in shaping aggregate demand and can have both short-term and long-term impacts on economic growth.

Government spending can directly influence aggregate demand by increasing or decreasing government purchases of goods and services. For example, during economic downturns, governments may engage in expansionary fiscal policy by increasing spending on infrastructure, public works, or other initiatives to stimulate the economy. This increase in government demand can lead to higher growth rates in the short term. Additionally, government spending can have a "multiplier effect" on aggregate demand. For instance, if government spending creates jobs, the newly employed individuals will have more income to spend, further boosting aggregate demand in multiple sectors of the economy.

The impact of government spending on aggregate demand also depends on how it is financed. If it is financed by higher taxes, the tax rises may counterbalance the higher spending, resulting in no net increase in aggregate demand. On the other hand, if the government borrows from the private sector, it can lead to "crowding out," where private sector spending is reduced as their savings for investment decrease.

The effectiveness of government spending in boosting aggregate demand may depend on the state of the economy. If the economy is close to full capacity, increased government spending may cause inflationary pressures with little impact on real GDP growth. However, if the economy is in a recession, government borrowing and spending can act as an expansionary fiscal policy, stimulating economic growth.

In the long run, government spending can also impact the supply side of the economy. For example, spending on infrastructure can lead to increased productivity and a growth in long-run aggregate supply. Investments in education and training can enhance labour productivity, enabling higher long-term economic growth. However, spending on welfare benefits or pensions may not have a direct impact on boosting productivity, but it can reduce inequality and help the labour market function more efficiently.

Overall, government spending plays a crucial role in shaping aggregate demand and can be a powerful tool for influencing economic growth and stability.

The PVF Savings Investment: A Smart Financial Move

You may want to see also

The influence of exchange rates on aggregate demand

Exchange rates can have a significant influence on aggregate demand, which is the total demand for all finished goods and services in an economy at a given price level and point in time. This influence is particularly notable in international trade, where movements in exchange rates can impact incentives to export and import, thus affecting aggregate demand.

When a country's currency depreciates or weakens compared to another, it becomes relatively cheaper to buy goods and services from that country, making their exports more attractive to foreign buyers. This increase in exports leads to more revenue flowing into the economy, boosting aggregate demand. On the other hand, a stronger currency can discourage exports as the costs of production become higher relative to sales revenue earned abroad.

For example, if the US dollar weakens against the euro, it will be cheaper for European consumers to buy American goods, increasing US exports and aggregate demand in the US. Conversely, a stronger euro might make European goods more expensive for American consumers, reducing European exports to the US and decreasing aggregate demand in Europe.

Fluctuations in exchange rates can also impact firms that rely on imported inputs for production or compete with imported goods. Sharp movements in exchange rates can lead to substantial changes in profits and losses for these businesses. Additionally, exchange rate fluctuations can disrupt international trade and cause issues in a country's banking system, further influencing aggregate demand.

It's important to note that the relationship between exchange rates and aggregate demand is complex and subject to various economic factors, including interest rates, inflation, and income levels.

From Saving to Investing: Strategies for Your Financial Journey

You may want to see also

Frequently asked questions

Aggregate demand is a macroeconomic term that refers to the total demand for all finished goods and services in the market during a certain time. It is commonly expressed as a dollar figure, specifically the prices at which consumers pay for finished products.

Aggregate supply is the total amount of goods and services produced at a specific price point for a particular period. It is the opposite of aggregate demand.

Aggregate demand is the total expenditure of a company, which includes consumer consumption, investments, government spending, and net exports. The higher the aggregate demand, the lower the savings, and vice versa.

Aggregate supply is influenced by investments, particularly in terms of technological innovations and changes in production costs. Higher investments in technology can increase aggregate supply, while higher production costs can decrease it.