Compound interest is when interest is earned on both the initial principal of an investment or loan, and the interest accumulated over time. This is in contrast to simple interest, where interest payments are based only on the principal. The more compounding periods there are, the higher the future value of the investment. For example, four compounding periods per year are better than two.

| Characteristics | Values |

|---|---|

| Definition | Compound interest is when interest is earned on both the initial balance (the principal) and the interest that is added to the balance over time. |

| Examples | Certificates of deposit, fixed annuities, dividend reinvestment plans |

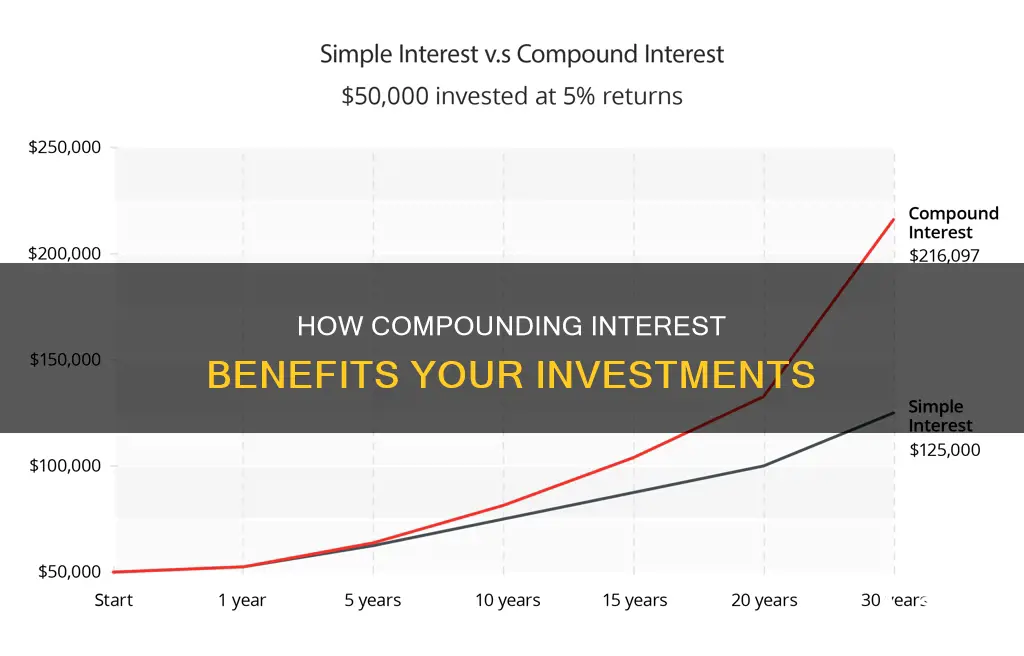

| Benefits | Compounding helps a sum of money grow faster than if simple interest were calculated on the principal alone. The greater the number of compounding periods, the greater the compound interest growth will be. |

What You'll Learn

Compound interest on savings accounts

Compound interest is when you earn interest on both the money you've saved and the interest you earn. It is a direct realisation of the time value of money (TMV) concept. For savings and investments, compound interest is beneficial as it multiplies your money at an accelerated rate. The more compounding periods there are, the higher the future value of the investment. For example, four compounding periods per year are better than two.

Compound interest takes advantage of previous gains to grow your money more. This is in contrast to simple interest, where interest payments are based only on the principal. Any accumulated interest does not impact future interest payments.

For example, let's say you have a savings account with a $6,000 balance that earns a 3.5% interest rate. With simple interest, you would earn $210 in interest over the course of a year. However, with compound interest, you would earn $214.59 in interest over the same period. This is because, with compound interest, you are earning interest on both your initial balance and the interest that is added to your balance over time.

Many corporations offer dividend reinvestment plans (DRIPs) that allow investors to reinvest their cash dividends to purchase additional shares of stock. Reinvesting in more of these dividend-paying shares compounds investor returns because the increased number of shares will consistently increase future income from dividend payouts, assuming steady dividends.

Maximizing Your Money: Home Interest Investments

You may want to see also

Compound interest on investments

Compound interest is when interest is earned on both the initial principal of an investment or loan and the accumulated interest from previous periods. In other words, you earn interest on the interest. This is in contrast to simple interest, where interest payments are based only on the principal.

The more compounding periods there are, the higher the future value of the investment. For example, four compounding periods per year are better than two, and two are better than one. This is because the greater the number of compounding periods, the greater the compound interest growth will be.

Compound interest is crucial in finance, and the gains attributable to its effects are the motivation behind many investing strategies. For example, many corporations offer dividend reinvestment plans (DRIPs) that allow investors to reinvest their cash dividends to purchase additional shares of stock. Reinvesting in more of these dividend-paying shares compounds investor returns because the increased number of shares will consistently increase future income from dividend payouts, assuming steady dividends.

For savings and investments, compound interest is beneficial, as it multiplies your money at an accelerated rate. However, if you have debt, the compounding of the interest you owe can make it increasingly difficult to pay off.

Reporting Investment Interest Expense: A Comprehensive Guide

You may want to see also

Compound interest on loans

Compound interest is when interest is earned on both the initial principal of an investment or loan, and the accumulated interest from previous periods. In other words, it involves earning or owing interest on your interest. The more compounding periods there are, the higher the future value of the investment. For example, four compounding periods per year are better than two, and two are better than one.

Compound interest is crucial in finance, and the gains attributable to its effects are the motivation behind many investing strategies. For example, many corporations offer dividend reinvestment plans (DRIPs) that allow investors to reinvest their cash dividends to purchase additional shares of stock. Reinvesting in more of these dividend-paying shares compounds investor returns because the increased number of shares will consistently increase future income from dividend payouts, assuming steady dividends.

Compound interest can be your friend when it comes to savings and investments, as it multiplies your money at an accelerated rate. However, if you have debt, the compounding of the interest you owe can make it increasingly difficult to pay off.

Maximizing Investment Returns: Understanding Interest Calculations

You may want to see also

The time value of money

Compound interest is when interest is earned on both the initial balance (the principal) and the interest that is added to the balance over time. This is in contrast to simple interest, where interest payments are based only on the principal. For example, if you have a balance of $6,000 that earns 3.5% interest, you will earn more with compound interest than with simple interest.

Compounding is crucial in finance, and the gains attributable to its effects are the motivation behind many investing strategies. For example, many corporations offer dividend reinvestment plans (DRIPs) that allow investors to reinvest their cash dividends to purchase additional shares of stock. Reinvesting in more of these dividend-paying shares compounds investor returns because the increased number of shares will consistently increase future income from dividend payouts, assuming steady dividends.

However, compounding can also work against you. If you have debt, the compounding of the interest you owe can make it increasingly difficult to pay off.

Maximizing Returns: Best Interest Rates for $30K Investments

You may want to see also

Dividend reinvestment plans

Compound interest is when interest is earned on both the initial investment and the interest that has been added to the balance over time. This is in contrast to simple interest, which is based only on the principal. Compounding is crucial in finance, and the gains attributable to its effects are the motivation behind many investing strategies.

For example, let's say an investor owns 100 shares of a company that pays a $1 dividend per share annually. The investor's total dividend income for the year would be $100. If the investor enrols in a DRIP, they could use that $100 in dividend income to purchase additional shares of the company's stock. If the stock price is $10 per share, the investor could purchase 10 additional shares with their dividend income.

The following year, the investor would receive a dividend payout based on their new total of 110 shares. Assuming the dividend remains at $1 per share, the investor's total dividend income for the year would be $110. This process can be repeated year after year, with the investor's dividend income and number of shares owned steadily increasing.

DRIPs can be a powerful tool for investors to grow their wealth over time. By reinvesting dividends and taking advantage of compound interest, investors can increase their returns and build their investment portfolio.

California's Maximum Investment Interest Rates Explained

You may want to see also

Frequently asked questions

Compound interest is when interest you earn in a savings account or on certain types of investments earns interest of its own. In other words, you earn interest on both your initial balance (the principal) and the interest that's added to the balance over time.

The more compounding periods throughout the year, the higher the future value of the investment. For example, four compounding periods per year are better than two.

Simple interest is when interest payments are based only on the principal. Any accumulated interest does not impact future interest payments.