The relationship between interest rates and investment is a complex and multifaceted topic. While it is commonly believed that lower interest rates stimulate investment, there are instances where this relationship is not as straightforward. In this discussion, we will explore the scenario where interest rates have no discernible effect on investment. This intriguing phenomenon raises important questions about the underlying factors that influence investment decisions and the potential implications for economic growth and stability. By examining this unique case, we can gain valuable insights into the dynamics of investment and the role of interest rates in shaping economic behavior.

What You'll Learn

- No Interest Sensitivity: Investment remains stable regardless of interest rate changes

- Fixed Investment: Investment is not influenced by interest rate fluctuations

- Autonomous Spending: Investment is independent of interest rate variations

- Stable Investment Function: Interest rates do not affect the level of investment

- No Interest Elasticity: Investment is not responsive to changes in interest rates

No Interest Sensitivity: Investment remains stable regardless of interest rate changes

In the context of macroeconomics, the concept of "No Interest Sensitivity: Investment remains stable regardless of interest rate changes" refers to a scenario where the investment behavior of businesses and individuals is not influenced by fluctuations in interest rates. This idea is often associated with the concept of the "Investment Curve" or "Investment Function," which illustrates the relationship between interest rates and investment. When interest rates are not a significant factor in investment decisions, it implies a certain level of stability in the investment landscape.

In an economy with no interest sensitivity, businesses might have already made their investment choices based on long-term strategies and market conditions. This could mean that they have already allocated their capital for expansion, research, or infrastructure development, regardless of the current interest rate environment. As a result, changes in interest rates, whether rising or falling, would not significantly impact their investment plans. This stability in investment can be a positive indicator for the overall health of the economy, suggesting that businesses are confident in their long-term prospects and are not overly influenced by short-term monetary policy shifts.

For individuals, this concept could imply that personal investment decisions, such as those related to housing, education, or business ventures, are not heavily dependent on interest rates. For instance, a person might decide to purchase a property based on their financial goals and the current market conditions, rather than solely considering the interest rate offered by banks. This individual-level stability in investment can contribute to a more resilient economy, as it suggests that personal financial decisions are driven by personal circumstances and long-term goals rather than short-term market fluctuations.

The absence of interest sensitivity in investment can be a result of various factors. One possibility is that businesses and individuals have already optimized their investment strategies to take advantage of low-interest rates, and now they are focused on maintaining and growing their investments. Additionally, certain industries or sectors might have inherent characteristics that make them less responsive to interest rate changes. For example, infrastructure projects often have long lead times and are funded through a combination of debt and equity, making them less sensitive to short-term interest rate variations.

Understanding this concept is crucial for policymakers and economists as it provides insights into the underlying factors driving investment. If interest rates are not a primary determinant of investment, then other factors, such as technological advancements, consumer confidence, or regulatory changes, might play a more significant role. This knowledge can inform economic policies and strategies, helping to create a more stable and sustainable investment environment.

Uncover the Interest-Earning Potential of Your Investments

You may want to see also

Fixed Investment: Investment is not influenced by interest rate fluctuations

The concept of fixed investment is an intriguing one, especially when considering its relationship with interest rates. In the context of macroeconomics, fixed investment refers to the act of investing in capital goods, such as machinery, equipment, and infrastructure, which are expected to provide a steady return over a long period. Unlike variable investment, which can be adjusted based on short-term economic conditions, fixed investment is often seen as a long-term strategy, requiring a stable and predictable environment.

Now, when we consider the impact of interest rates on investment, the relationship is not as straightforward as one might expect. Interest rates play a crucial role in the economy by influencing borrowing costs and, consequently, investment decisions. Typically, lower interest rates encourage borrowing, leading to increased investment as businesses and individuals can access cheaper credit. However, the concept of fixed investment challenges this conventional wisdom.

Fixed investment is characterized by its insensitivity to interest rate changes. This means that even if interest rates fluctuate, the decision to invest in fixed assets remains relatively unchanged. For instance, a company might decide to purchase new machinery to increase production capacity, regardless of whether interest rates are high or low. This investment is often driven by long-term strategic goals, technological advancements, or market expansion plans, rather than short-term economic incentives.

The reasoning behind this behavior is rooted in the nature of fixed investment itself. When a business commits to fixed investment, it is typically a significant financial decision with long-term implications. The benefits of such an investment are often realized over an extended period, providing a steady stream of returns. As a result, the immediate impact of interest rates on the cost of borrowing becomes less relevant compared to the potential long-term gains.

In summary, fixed investment represents a unique aspect of economic behavior, where the decision to invest is not solely driven by interest rates. This concept highlights the importance of long-term strategic planning and the willingness to commit to investments that may not be directly influenced by short-term economic fluctuations. Understanding this dynamic is crucial for economists and policymakers to grasp the full picture of investment behavior and its impact on the overall economy.

Understanding the Power of Compounding: How Often Does It Matter?

You may want to see also

Autonomous Spending: Investment is independent of interest rate variations

The concept of autonomous spending is crucial to understanding the relationship between interest rates and investment. When we talk about autonomous spending, we refer to the idea that certain types of spending or investment are not directly influenced by changes in interest rates. This is a fundamental principle in macroeconomics, often associated with the concept of the investment function.

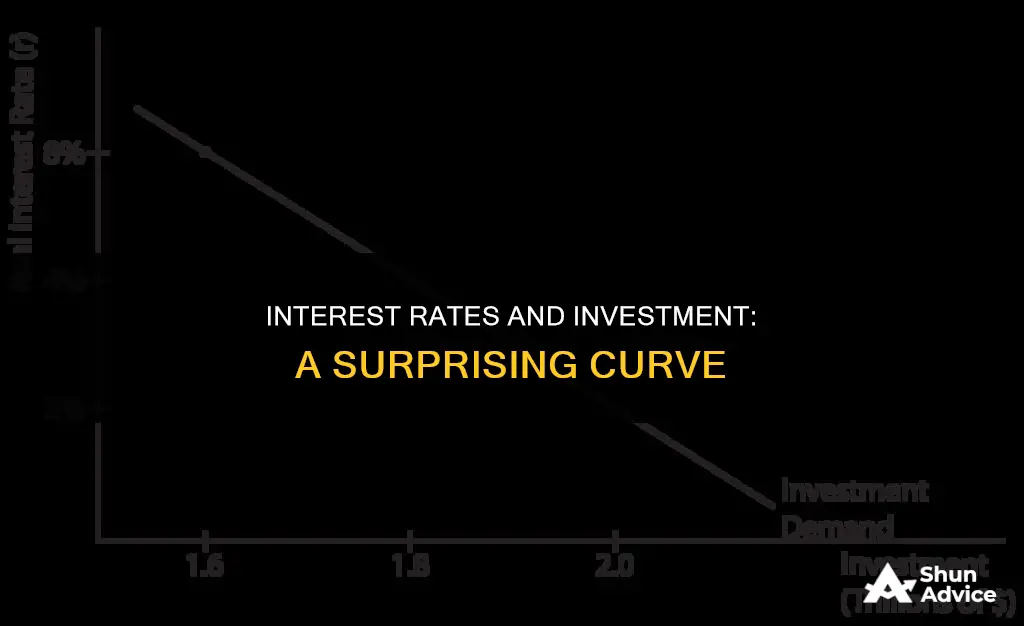

In a simplified model, the investment function illustrates the relationship between the interest rate and the level of investment. Typically, this function is represented as a downward-sloping curve, indicating that as the interest rate decreases, investment tends to increase, and vice versa. However, the key idea of autonomous spending suggests that there is a certain level of investment that is not sensitive to these interest rate fluctuations.

This type of investment is considered 'autonomous' because it is driven by factors other than the cost of borrowing or lending. For instance, consider a company that decides to invest in new machinery regardless of the current interest rate. This investment is autonomous because it is based on the company's assessment of its future profitability, technological advancements, or market opportunities, rather than the cost of capital. The interest rate may influence the overall cost of this investment, but it does not determine whether the investment is made or not.

The presence of autonomous investment has significant implications for the economy. When interest rates change, they may affect the cost of borrowing for businesses, potentially influencing their investment decisions. However, the existence of autonomous spending ensures that the overall investment level remains stable or even increases during periods of interest rate fluctuations. This is because the autonomous investments are not directly tied to the interest rate, providing a consistent and reliable component of aggregate demand.

In summary, the concept of autonomous spending highlights that investment can be independent of interest rate variations. This is a critical aspect of understanding the dynamics of economic activity, as it suggests that certain types of investment are driven by factors other than the cost of capital. By recognizing this, economists and policymakers can better comprehend the potential impact of interest rate changes on the overall investment landscape and make more informed decisions regarding monetary and fiscal policies.

Unlocking Capital: A Guide to Securing Initial Investment with Simple Interest

You may want to see also

Stable Investment Function: Interest rates do not affect the level of investment

The concept of a stable investment function, where interest rates have no impact on investment levels, is an intriguing economic idea. This scenario suggests a consistent and unchanging relationship between interest rates and investment, which could have significant implications for economic planning and policy-making.

In a stable investment function, the level of investment remains unaffected by changes in interest rates. This implies that regardless of whether interest rates are high or low, the amount of investment in the economy stays the same. Such a situation could be a result of various factors. For instance, if the investment is driven by long-term projects or technological advancements, the immediate fluctuations in interest rates might not significantly influence the decision-making process. Companies might have already committed to large-scale investments, and the interest rate environment becomes a secondary consideration.

This stability could also be attributed to the nature of the investment itself. If the investment is primarily in fixed assets like machinery, infrastructure, or research and development, the timing of interest rate changes may not be a critical factor. These investments often have long pay-off periods, and the decision to proceed might be based on long-term strategic goals rather than short-term financial incentives.

Furthermore, the presence of a stable investment function could indicate a robust and resilient economy. It suggests that the market has developed mechanisms to ensure a consistent level of investment, regardless of the monetary policy environment. This could be a result of diverse investment opportunities, a strong domestic market, or a well-developed capital market that provides alternative sources of funding.

In summary, the idea of a stable investment function, where interest rates do not affect investment levels, presents a unique economic scenario. It highlights the potential for investment decisions to be driven by factors other than interest rates, such as long-term strategic goals, technological advancements, or the nature of the investment itself. Understanding this concept can provide valuable insights into the dynamics of investment behavior and the overall health of an economy.

Navigating the Market: Strategies for Investing in a Low-Interest Rate World

You may want to see also

No Interest Elasticity: Investment is not responsive to changes in interest rates

The concept of "No Interest Elasticity" suggests that investment is not responsive to changes in interest rates, which is an intriguing idea in the field of economics. This phenomenon implies that the relationship between interest rates and investment is not directly proportional, contrary to the conventional wisdom that lower interest rates stimulate investment. When interest rates are not a significant factor in investment decisions, it indicates a unique economic environment where other factors play a more dominant role.

In this scenario, the investment curve might exhibit a flat or horizontal shape when plotted against interest rates. This means that even with fluctuations in interest rates, the level of investment remains relatively stable. Such a situation could arise in various economic contexts, such as during periods of technological innovation or when there is a high level of business confidence that is not directly influenced by interest rates. For instance, if a company is developing a groundbreaking technology, it might invest heavily in research and development regardless of the interest rate environment.

The implications of No Interest Elasticity are far-reaching. It suggests that traditional monetary policy tools, which often rely on adjusting interest rates to influence economic activity, may have limited effectiveness in certain situations. Instead, other policy measures or factors could be more influential in shaping investment behavior. This could include government incentives, regulatory changes, or even cultural and social factors that drive business decisions.

Understanding this concept is crucial for policymakers and economists as it challenges conventional economic theories. It highlights the importance of considering a broader range of factors when analyzing investment patterns. By recognizing that interest rates may not always be the primary driver of investment, economists can develop more nuanced models and strategies to explain and influence economic behavior.

In summary, No Interest Elasticity implies a unique economic relationship where investment is not directly tied to interest rates. This concept encourages a more comprehensive analysis of investment decisions, considering various factors beyond interest rates. It serves as a reminder that economic policies and theories should be adaptable to different market conditions and that a one-size-fits-all approach may not always be effective.

Venture Capitalists' Interest Rates: A Battle of Funding Strategies

You may want to see also

Frequently asked questions

If interest rates had no impact on investment, it would imply a unique economic scenario. Typically, higher interest rates tend to discourage investment as borrowing becomes more expensive, and lower rates can stimulate investment by making credit cheaper. However, in a hypothetical scenario where interest rates do not affect investment, it could suggest that other factors, such as technological advancements, consumer confidence, or regulatory changes, are the primary drivers of investment behavior. This could lead to an interesting economic equilibrium where interest rates are not the primary lever for managing investment.

In an economy where interest rates do not play a role in investment, the traditional mechanism of monetary policy would be absent. Central banks often use interest rates as a tool to control inflation and stabilize the economy. Without this tool, governments and central banks might need to explore alternative methods to manage economic fluctuations. This could involve direct government spending, tax policies, or other fiscal measures to stimulate investment and economic growth.

While it is challenging to find precise historical examples, certain economic periods might provide insights. For instance, during the early stages of industrialization, some countries experienced rapid investment and growth despite relatively stable or low-interest rates. This could be attributed to factors like technological innovation, resource availability, or unique market conditions that drove investment independently of interest rates. However, it is essential to note that such cases might be exceptions and not representative of a broader economic principle.

A scenario with no interest rate impact on investment could have several implications. It might lead to increased volatility in the financial markets, as traditional interest rate adjustments would no longer be a stabilizing factor. Additionally, it could result in a shift in the focus of economic policies, with a greater emphasis on non-monetary tools for economic management. This change could also impact savings, consumption, and overall economic behavior, potentially requiring a reevaluation of existing economic theories and practices.

In a hypothetical world without interest rates affecting investment, businesses and investors might need to adopt new strategies. They could focus more on long-term growth prospects, market trends, and risk assessments rather than short-term interest rate fluctuations. Alternative financial instruments and investment vehicles might gain prominence, and companies might need to explore innovative ways to attract investment. This adaptation process could drive the development of new economic models and investment philosophies.