Gilt funds are investment vehicles that invest in government-backed securities, offering moderate returns with minimal risk. They are ideal for investors seeking low-risk opportunities, particularly during periods of falling interest rates. However, it's important to note that gilt funds carry interest rate risk, making them susceptible to market volatility. Before investing, individuals should carefully consider their financial goals, risk appetite, and investment horizon. This decision should not be based solely on recent performance but also on a comprehensive understanding of the market and one's own financial situation.

| Characteristics | Values |

|---|---|

| Best time to invest | When interest rates are falling |

| Investment horizon | At least three to five years |

| Risk | Low |

| Returns | Moderate |

| Volatility | High |

| Liquidity | High |

| Suitability | Risk-averse investors |

| Investment type | Debt instruments |

| Underlying securities | Government-issued |

| Tax implications | Capital gains are taxable |

What You'll Learn

Gilt funds are best for investors when interest rates are declining

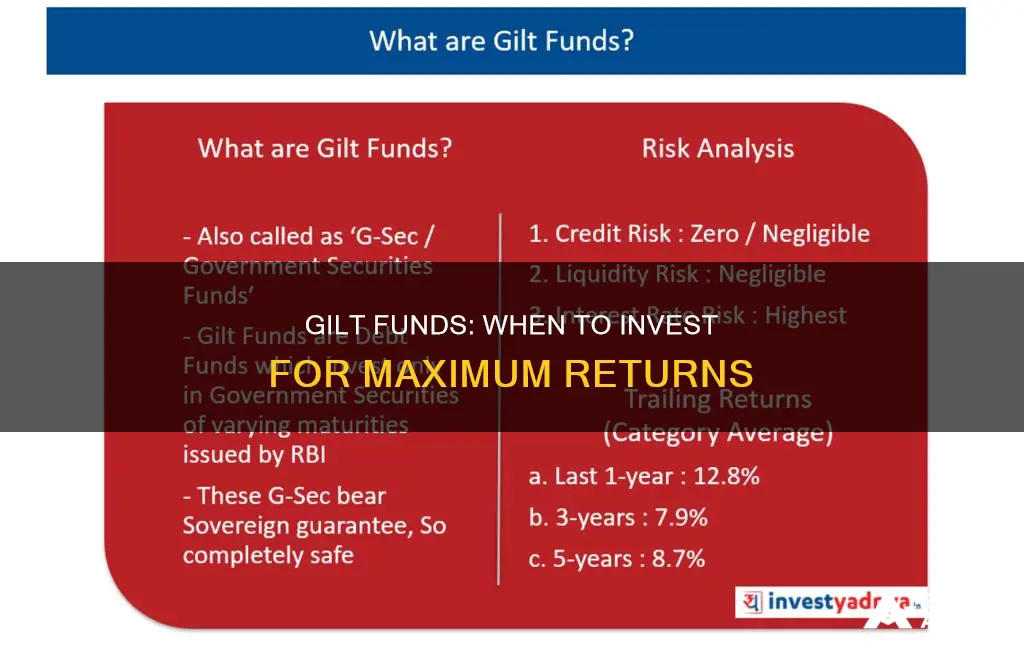

Gilt funds are a type of investment vehicle that primarily deals with government-issued securities or bonds. They are considered a conservative, low-yield investment option with relatively low risk. When deciding whether to invest in gilt funds, it is important to consider the interest rate environment.

The maturity or duration of the gilt fund is another important factor to consider. Gilt funds with longer maturities tend to be more sensitive to interest rate movements. Short-term gilt funds typically have a duration of less than a year, while long-term gilt funds can have maturities of up to 15 years. The average maturity of a gilt fund portfolio usually ranges from three to five years, so investors should be prepared to hold their investments for at least this long.

It is worth noting that gilt funds can still be a good investment option even when interest rates are rising, provided that investors are confident in their ability to time their entry and exit points accurately. Additionally, gilt funds are considered a relatively safe investment due to the low credit risk associated with government-backed securities. However, they are not entirely risk-free, as they are subject to interest rate risk and can be highly volatile.

Target Date Funds: Understanding Your Investment Options

You may want to see also

Gilt funds are not risk-free

Gilt funds are investment vehicles that invest in gilt securities, which are the UK equivalent of US Treasury securities. They are considered low-risk investments, but they are not entirely risk-free. While gilt funds carry minimal credit risk due to their investment in government securities, they are subject to interest rate risk. This means that their value fluctuates with changes in interest rates, and investors may experience negative returns if interest rates rise.

Gilt funds are sensitive to interest rate changes, and their performance is highly dependent on the movement of interest rates. When interest rates fall, gilt funds appreciate, and their returns increase. However, if interest rates rise, the value of gilt funds decreases, and investors may experience losses. This interest rate risk is the primary source of risk associated with gilt funds.

The interest rate risk in gilt funds can be significant, especially for funds with longer maturity periods. Gilt funds can invest in government securities with medium to long-term maturities, typically ranging from three to five years but potentially up to 30 years or more. The longer the maturity of the gilt fund, the greater the potential impact of interest rate changes on its value. Therefore, investors in gilt funds should carefully consider the potential for interest rates to rise when making investment decisions.

Additionally, while gilt funds are considered low-risk, they do carry some degree of default risk. Although the risk of a government defaulting on its obligations is low, it is not impossible. Investors should also be aware that gilt funds may include company stocks or corporate bonds, which can introduce additional risks.

In summary, while gilt funds are generally considered low-risk investments due to their focus on government securities, they are not entirely risk-free. The main risk associated with gilt funds is interest rate risk, which can lead to negative returns if interest rates rise. Investors should carefully consider the potential for changing interest rates and the maturity periods of gilt funds before investing.

Mutual Funds: Exploring Superior Investment Opportunities

You may want to see also

Gilt funds are volatile

Gilt funds are a type of investment vehicle that can be subject to high levels of volatility. This volatility is driven primarily by changes in interest rates, which have an inverse relationship with gilt fund returns. When interest rates rise, the net asset value (NAV) of gilt funds tends to fall, leading to potential losses for investors. Conversely, when interest rates fall, gilt funds appreciate, resulting in gains for investors. This dynamic is due to the nature of gilt funds as interest-rate-sensitive investments.

The volatility of gilt funds can be further exacerbated by the duration and average maturity of the fund. Funds with longer durations and higher average maturities tend to be more sensitive to interest rate movements. As a result, sharp increases or decreases in interest rates can have a more pronounced impact on the NAV of these funds, leading to higher volatility.

Gilt funds are also susceptible to interest rate risk, which can impact their returns. When interest rates for new government borrowings rise, the prices of existing gilt funds can decline as investors seek out newer options with better rates. This can result in NAV losses for investors. Conversely, when interest rates for new government borrowings fall, the prices of gilt funds can increase, leading to NAV appreciation and potential gains for investors.

The volatile nature of gilt funds makes them a risky investment, especially for newbie investors. It is crucial to carefully consider the potential risks and have a robust investment strategy before investing in gilt funds. Additionally, investors should be prepared to hold their investments for a minimum of three to five years to realise their investments fully.

While gilt funds offer the advantage of low credit risk due to their government backing, it is important to recognise that they are not entirely risk-free. The extreme volatility in returns makes gilt funds one of the riskiest debt mutual fund categories. Therefore, investors should carefully evaluate their risk tolerance and investment goals before allocating a significant portion of their portfolio to gilt funds.

Bond Fund Investment: What Percentage is Smart to Invest?

You may want to see also

Gilt funds are not suitable for parking emergency money

Gilt funds are investment vehicles that invest in gilt securities, which are the U.K. equivalent of U.S. Treasury securities. They are considered low-risk and low-yield, conservative investments. However, they carry an interest-rate risk, which means that their value fluctuates with changes in interest rates. When interest rates go down, gilt funds appreciate, and when interest rates go up, their value decreases.

Due to their sensitivity to interest rate movements, gilt funds are not suitable for investors who need quick access to their money in case of emergencies. The NAV of gilt funds can drop sharply during times of increasing interest rates, resulting in potential losses for investors. Therefore, careful timing of entry and exit is crucial when investing in gilt funds, which may not be possible with emergency funds.

Additionally, gilt funds are not guaranteed to provide positive returns. While they are considered low-risk due to their government backing, they are still subject to market volatility. Investors can make capital gains or losses depending on the movement of interest rates. Therefore, it is essential for investors to consider their investment horizon, typically a minimum of three to five years, and be prepared for potential fluctuations in the value of their investments.

In summary, while gilt funds offer a conservative investment option with moderate returns, they are not suitable for parking emergency money due to their high volatility and the need for careful timing of entry and exit. Investors should consider other investment options for their emergency funds to ensure quick access to their funds without the risk of potential losses.

Best S&P Index Funds: Top Picks for Your Portfolio

You may want to see also

Gilt funds are not a good investment for the short term

Gilt funds are debt funds that invest primarily in government securities. They are considered low-risk investments with moderate returns. However, they are not suitable for short-term investments due to their interest rate risk and volatility.

Gilt funds are highly dependent on interest rate movements. When interest rates go down, gilt funds appreciate, and when interest rates increase, the net asset value (NAV) of the fund drops sharply. This interest rate risk can significantly impact the returns of gilt funds in the short term. Therefore, it is essential to invest in gilt funds when interest rates are falling to take advantage of potential capital gains.

Additionally, gilt funds can be very volatile, especially in response to changes in the interest rate outlook. The recent rally in gilt funds due to rate cuts by the Reserve Bank of India (RBI) is a prime example of their volatile nature. As a result, investors should not base their investment decisions on the recent performance of gilt funds but rather consider their long-term horizons.

Gilt funds have medium to long-term maturity periods, typically ranging from three to five years. This long-term nature of gilt funds makes them unsuitable for short-term investments. To reduce the risk associated with interest rate fluctuations, investors should aim for an investment horizon of at least three to five years.

In conclusion, while gilt funds offer low-risk and moderate-return investment opportunities, they are not ideal for short-term investments due to their interest rate risk, volatility, and long-term maturity periods. Investors should carefully consider the potential risks and ensure they have a sufficiently long investment horizon before investing in gilt funds.

Pension Funds: Exploring Their Diverse Investment Strategies

You may want to see also

Frequently asked questions

It is better to invest in gilt funds when interest rates have been rising steadily over the last 3 to 5 years and look likely to peak in the near future. While predicting such peaks is tricky, the 10-year gilt yield can be used as a guide.

It is advisable to hold gilt funds for 3 to 5 years, similar to other mutual funds. This is enough time to realise your investment.

Gilt funds are best for investors when interest rates in the economy are declining, and the investment horizon is at least three to five years. They are also a good option for those who want little to no credit risk.

Gilt funds carry interest rate risk and can be very volatile. They are arch-rivals with interest rates, meaning there is an inverse relationship between gilt funds and interest rates. An increase in interest rates will cause the value of gilt funds to decrease and vice versa.