Municipal bonds are debt securities issued by states, cities, counties and other government entities to fund day-to-day operations and finance capital projects such as building schools, highways or sewer systems. By purchasing municipal bonds, investors are essentially lending money to the bond issuer in exchange for regular interest payments and the return of the original investment, known as the principal, upon maturity of the bond.

Municipal bonds are generally considered a low-risk investment, with a low historical default rate. They also offer tax advantages, as the interest on these bonds is typically exempt from federal income tax and may also be exempt from state and local taxes for investors residing in the state where the bond is issued.

However, it is important to note that municipal bonds are not entirely risk-free. There is a possibility that the issuer may experience financial difficulties and fail to make interest payments or repay the principal upon maturity. Additionally, municipal bonds generally offer lower interest rates compared to corporate bonds.

When deciding whether to invest in municipal bond funds, it is crucial to consider factors such as your financial goals, risk tolerance, tax bracket, and the overall mix of stocks and bonds in your portfolio.

What You'll Learn

Municipal bond funds for high-income-bracket investors

Municipal bond funds can be a good investment for high-income-bracket investors, but only if they are investing in a taxable account. Municipal bonds are issued by state or local governments to fund their day-to-day operations or to raise funds for public projects such as schools, hospitals, highways, bridges, and roads. The interest paid on these bonds is usually exempt from federal income taxes and may also be exempt from state and local taxes for investors who live in the same state or municipality where the bond was issued.

Municipal bonds often pay out less than taxable bonds, but they can be appealing for investors in higher tax brackets, especially now that fewer people are able to take itemized deductions. The tax-equivalent yield can be calculated by taking the nominal or pretax yield for the tax-advantaged vehicle and dividing it by the percentage of income you'll keep after taxes, or 1 minus your tax rate. This calculation represents how much income you would need to receive from a taxable investment to make it more competitive than the municipal choice. For example, if you're in the 32% tax bracket and own a municipal bond fund with a nominal yield of 3.27%, you'd have to earn more than a 4.81% yield from a taxable investment for the latter to be more attractive after taxes.

Municipal bonds are generally considered to have a low level of default risk relative to other bond types. They are also less risky than stocks, although they are still subject to interest-rate risk and credit risk. Interest-rate risk refers to the possibility that the market price of a bond will decline as interest rates rise. Credit risk refers to the risk that a municipal bond issuer won't be able to repay its debt.

When deciding whether to invest in municipal bond funds, it's important to consider the risks involved, as well as the tax implications. Consult a tax professional to discuss the bond's tax implications, including the possibility that your bond may be subject to the federal alternative minimum tax or eligible for state income tax benefits.

Vanguard's Anti-Gun Investment: Funds for a Safer Future

You may want to see also

Municipal bond funds for investors in high-tax states

Municipal bond funds can be a good investment for those in a higher tax bracket, especially if you live in a high-tax state. Municipal bonds are typically exempt from federal taxes and, in many cases, state and local taxes as well, especially if the bonds are issued by your state of residence.

Municipal bonds are issued by state or local governments to fund their day-to-day operations or to raise funds for public projects such as roads, bridges, schools, and hospitals. The interest paid on these bonds is usually exempt from federal income taxes and may also be exempt from state and local taxes for investors who live in the same state or municipality where the bond was issued.

Municipal bonds often pay out less than taxable bonds but can be appealing for investors in higher tax brackets, especially now that fewer people are able to take itemized deductions. The best way to figure out how they stack up is to calculate a taxable-equivalent yield, which allows you to compare the after-tax income from taxable and tax-exempt investments.

For example, if you're in the 32% tax bracket and own a municipal bond fund with a nominal yield of 3.27%, you'd have to earn more than a 4.81% yield from a taxable investment for the latter to be more attractive after taxes. That calculation doesn't include any adjustments for state or local taxes, so if you live in a high-tax state, you can gain additional tax benefits by choosing a fund that invests in bonds issued within your home state.

- IShares California Muni Bond ETF (CMF)

- IShares New York Muni Bond ETF (NYF)

- Vanguard Tax-Exempt Bond ETF (VTEB)

- Fidelity Municipal Bond Index Fund (FMBIX)

- Schwab Tax-Free Bond Fund (SWNTX)

- Vanguard High-Yield Tax-Exempt Fund Investor Shares (VWAHX)

It's important to note that municipal bonds are not entirely free of taxes. There may be state income taxes on the interest, and if you receive Social Security, your municipal bond interest will count towards your adjusted gross income, potentially increasing the taxable amount of your Social Security income. Additionally, there may be tax implications related to the de minimus tax and the alternative minimum tax.

Municipal bonds also carry interest rate risk. If your money is tied up for a long period and interest rates rise, you may be stuck with a poor-performing investment, and the bond will lose value.

Mutual Funds: Best Time to Invest for Maximum Returns

You may want to see also

The pros and cons of investing in individual municipal bonds vs. municipal bond funds

Municipal bonds, or "munis", are debt securities issued by states, cities, counties, and other government entities to fund day-to-day operations and finance capital projects such as building schools, highways, or sewer systems. They are often exempt from federal income taxes and may also be exempt from state and local taxes, depending on the investor's residence and the bond's place of issuance.

There are two main ways to invest in municipal bonds: by purchasing individual bonds or by purchasing a fund. Here are the pros and cons of each approach:

Investing in Individual Municipal Bonds:

Pros:

- Simpler and more straightforward: You simply collect your semiannual interest (coupon payment) until the bond's maturity date, when you receive the principal value back.

- Tax advantages: Municipal bonds are typically exempt from federal income taxes and may also be exempt from state and local taxes, depending on the investor's residence and the bond's place of issuance. This perk is especially beneficial for those in higher tax brackets.

- Lower risk: Compared to stocks, municipal bonds have a lower volatility and a minimal probability of default.

- Steady stream of income: Municipal bonds usually have fixed interest rates, providing routine payments every six months until the bond reaches maturity.

Cons:

- Low yields: The interest rates on municipal bonds are typically lower compared to stocks, exchange-traded funds, or mutual funds.

- Liquidity issues: Municipal bonds may not be easy to sell, as investors might not find an active market for their bonds, preventing them from selling them at the desired price.

- Trading costs: Trading costs for individual municipal bonds can be prohibitive, with bid-ask spreads ranging between 1% and 4%.

- Limited diversification: Investing in individual municipal bonds might not provide the same level of diversification as funds, which spread investments across many different bonds and sectors.

Investing in Municipal Bond Funds:

Pros:

- Lower trading costs: Mutual funds or exchange-traded funds (ETFs) that invest in municipal bonds offer lower trading costs compared to purchasing individual bonds.

- Professional management: These funds are managed by professionals, who have the expertise to navigate the complex and diverse municipal bond market.

- Diversification: Municipal bond funds provide instant diversification across dozens or even hundreds of different municipal bonds, reducing the risk associated with any single bond or municipality.

- Reinvestment flexibility: Municipal bond funds allow investors to reinvest proceeds at higher interest rates if interest rates are trending upwards.

- Lower costs for index funds: Broadly diversified index funds that invest in municipal bonds have lower costs compared to actively managed funds.

Cons:

- Potential capital losses: While individual municipal bonds can be held until maturity to get back the full capital, it is possible to suffer capital losses with municipal bond funds when interest rates rise.

- Load fees: Some municipal bond mutual funds may charge high load fees, which can offset the benefits of investing in the fund.

- Bid-ask spread: Municipal bond ETFs may have high bid-ask spreads, especially for low-volume ETFs, which can reduce returns.

In summary, investing in individual municipal bonds offers the advantage of simplicity and a steady stream of income, but it may come with higher trading costs and limited diversification. On the other hand, municipal bond funds provide lower trading costs, professional management, broader diversification, and the flexibility to reinvest at higher interest rates. However, investors need to be mindful of potential capital losses, load fees, and bid-ask spreads when considering municipal bond funds.

Fixed Income Funds: Where Are Your Investments Going?

You may want to see also

The risks of investing in municipal bonds

Municipal bonds, or "munis", are debt securities issued by local, county, and state governments. They are often exempt from taxes, making them attractive to investors in higher tax brackets. However, investing in municipal bonds does come with risks.

Firstly, there is call risk, which refers to the potential for an issuer to repay a bond before its maturity date. This is often done if interest rates decline, similar to a homeowner refinancing a mortgage to benefit from lower rates. Bond calls are less likely when interest rates are stable or rising. Many municipal bonds are "callable", so investors who want to hold a bond until maturity should research the call provisions before investing.

Secondly, there is credit risk, or the risk that the bond issuer will experience financial difficulties and be unable to pay interest or principal in full. Credit ratings are available for many bonds and can help investors estimate the relative credit risk compared to other bonds. However, a high rating does not mean there is no chance of default.

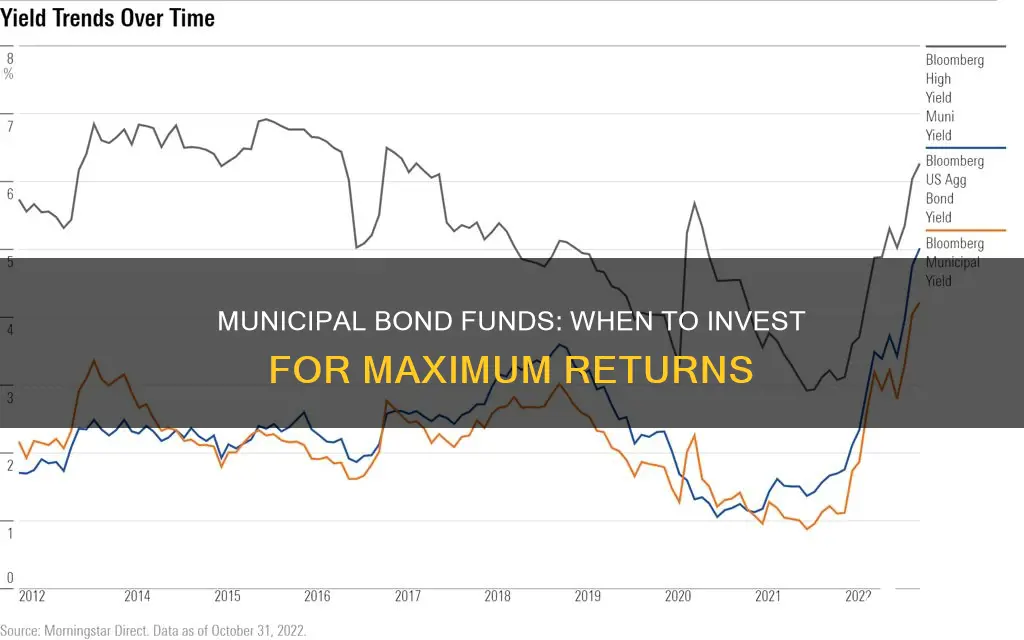

Thirdly, there is interest rate risk. Bonds have a fixed face value, known as the "par" value. If interest rates rise, the market value of existing bonds will decline, and investors could lose money if they sell before maturity. Bonds with longer maturities are more susceptible to interest rate changes.

Fourthly, there is inflation risk. Inflation reduces purchasing power, affecting investors with fixed interest rates. It can also lead to higher interest rates and lower market values for existing bonds.

Lastly, there is liquidity risk, or the risk that investors won't find an active market for the municipal bond, preventing them from buying or selling when desired. The market for municipal bonds may not be particularly liquid as many investors buy and hold them.

In addition to these risks, investors should also consider the tax implications and broker compensation when investing in municipal bonds.

Vision Fund's WeWork Investment: A Bold, Early Move

You may want to see also

How to calculate a taxable-equivalent yield

Municipal bonds are debt securities issued by states, cities, counties, and other government entities to fund day-to-day operations and finance capital projects such as building schools, highways, or sewer systems. The interest on municipal bonds is generally exempt from federal income tax, and may also be exempt from state and local taxes if the investor resides in the state where the bond is issued.

The tax-equivalent yield is a calculation that allows investors to compare the returns of a tax-free municipal bond with those of a taxable alternative. This calculation is especially useful for investors in higher tax brackets.

The formula for calculating the taxable-equivalent yield is as follows:

> Return on fully taxable equivalent yield = Return on tax-exempt investment / (1 - Investor's marginal tax rate)

For example, an investor in the 22% federal income tax bracket owns a tax-exempt municipal bond with an 8% coupon rate. To calculate the fully taxable equivalent yield that a taxable bond would need to have to match the municipal bond's yield, we use the formula:

8% / (1 - 0.22) = 10.26%

So, a taxable bond would need to have a yield of 10.26% to match the 8% return of the tax-free municipal bond after taxes.

It is important to note that municipal bonds are not always tax-free. Federal taxes may apply if the Internal Revenue Service (IRS) does not interpret the funded project as being for the benefit of the entire public. Additionally, the interest income from municipal bonds may be subject to state taxes.

Fund Setter: Minimum Investment Requirements and More

You may want to see also

Frequently asked questions

Municipal bond funds are investment funds that pool money from multiple investors to purchase municipal bonds. Municipal bonds are debt securities issued by states, cities, counties, and other governmental entities to fund public projects or day-to-day operations. The interest payments on these bonds are typically exempt from federal income taxes and may also be exempt from state and local taxes.

Municipal bond funds offer several advantages, including tax benefits, relatively low risk, and current income. The tax advantages can be particularly appealing for investors in higher tax brackets. Additionally, municipal bond funds provide professional management, broader diversification, and lower trading costs compared to purchasing individual bonds.

While municipal bonds are considered low-risk investments, they are not risk-free. There is a possibility of the issuer defaulting on their debt or failing to make interest payments. Other risks include interest rate risk, credit risk, liquidity risk, and inflation risk. It's important to carefully consider these risks before investing.

There are a few ways to invest in municipal bond funds. You can purchase individual bonds directly, invest in a mutual fund or exchange-traded fund (ETF) that focuses on municipal bonds, or buy and sell bonds on the secondary market through a broker. It's important to understand the fees, management expenses, and potential markups associated with each investment option.

Municipal bond funds can be a good investment option, especially if you are in a higher tax bracket and investing through a taxable account. They are suitable for investors who want to preserve capital while generating a tax-free income stream. However, it's important to consider your financial goals, risk tolerance, and the overall mix of stocks and bonds in your portfolio when deciding whether to invest in municipal bond funds.