Taxable investment accounts are a great way to buy and sell assets like stocks, bonds and exchange-traded funds. They are ideal for investors who want to benefit from additional liquidity, save more for retirement, avoid RMDs in retirement, maximise an inheritance, or save for college. However, it's important to note that the profits from these accounts are taxed at your normal income tax rate or a long-term capital gains tax rate, depending on how long you owned the asset before selling. Therefore, it is crucial to understand the tax implications and seek advice from a financial advisor or tax professional before investing in taxable accounts.

What You'll Learn

- Taxable investment accounts offer more flexibility and liquidity than tax-advantaged accounts

- Taxable accounts are ideal for short- and long-term goals

- Taxable accounts are a good option if you've maxed out your annual contribution limits to your retirement accounts

- Taxable accounts are useful if you need to make big-ticket purchases before retirement

- Taxable accounts are beneficial if you want to take risks with your extra cash

Taxable investment accounts offer more flexibility and liquidity than tax-advantaged accounts

Liquidity and Withdrawal Flexibility

Taxable investment accounts offer greater liquidity and flexibility when it comes to withdrawals. With a taxable account, you can withdraw your money at any time, for any purpose, without incurring penalties or early withdrawal fees. This makes taxable accounts ideal for short-term financial goals or when you need quick access to your funds.

Investment Options

Taxable accounts typically provide a broader range of investment options compared to tax-advantaged accounts. They are suitable for investors who want more control over their investment strategies and the types of assets they hold. For example, investors interested in cryptocurrency or options trading may find taxable accounts more accommodating.

No Required Minimum Distributions

Traditional IRAs and 401(k) plans require you to start withdrawing money at a certain age, typically 72. However, with taxable accounts, there is no mandatory age for taking distributions. You can leave your money invested for as long as you want without worrying about required minimum distributions.

Tax Savings for Heirs

If you pass away with funds in a taxable account, your heirs will receive what is known as a "step-up" in basis. This means that when they inherit the investments, the cost basis of the assets is adjusted to the value at the time of your death. As a result, they will pay lower taxes on capital gains when they eventually sell the investments.

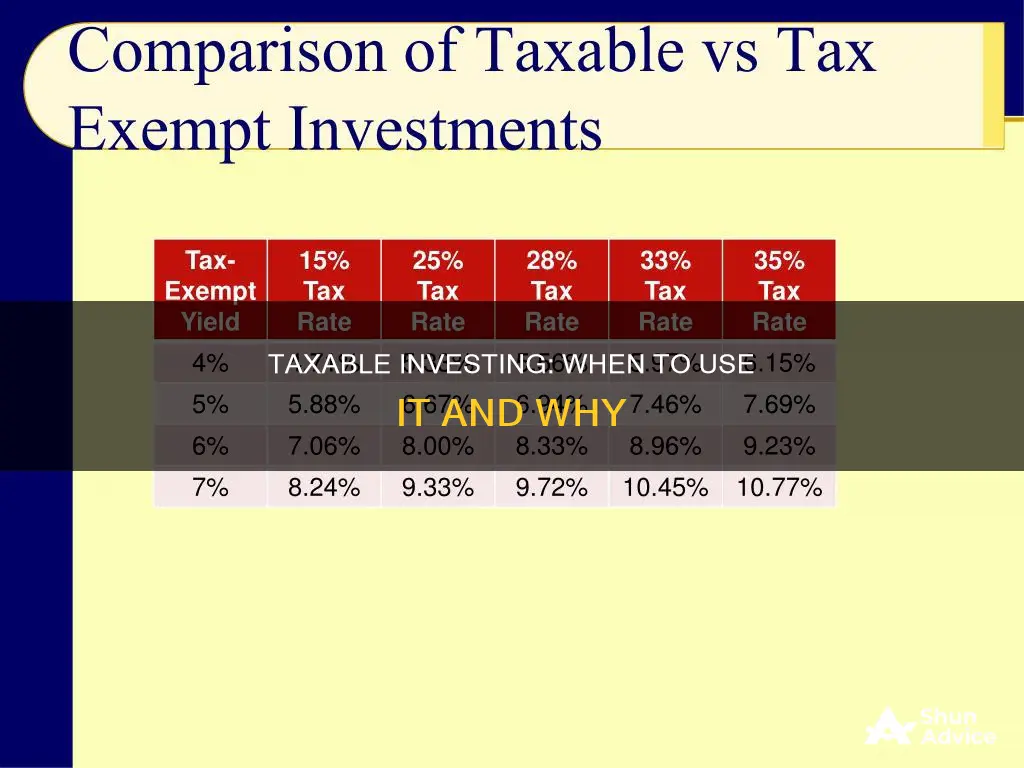

Tax Efficiency with the Right Investments

Even though taxable accounts are subject to taxes, you can minimize your tax liability by choosing the right types of investments. For example, investing in broad-range index funds or municipal bonds in your taxable account can help reduce capital gains taxes.

In conclusion, taxable investment accounts offer advantages that complement the benefits provided by tax-advantaged accounts. By understanding the features and flexibility offered by taxable accounts, investors can make informed decisions about how to allocate their investments to maximize returns and achieve their financial goals.

Is Building Purchase with Cash an Investment Strategy?

You may want to see also

Taxable accounts are ideal for short- and long-term goals

Taxable investment accounts are a great way to buy and sell assets like stocks, bonds, and exchange-traded funds. They are ideal for short- and long-term goals, offering more flexibility and liquidity than tax-advantaged accounts. Here are some reasons why taxable accounts are a good choice:

Additional Liquidity

Liquidity is a significant advantage of taxable investment accounts. There are no age restrictions on accessing funds, unlike retirement plans such as 401(k)s or traditional IRAs, which typically have early withdrawal penalties. With taxable accounts, investors can access their money at any time without age-related restrictions.

Save More for Retirement

Taxable investment accounts can be a great option if you've maxed out your contributions to tax-advantaged retirement accounts like 401(k)s or IRAs and want to save more for the future. You can still minimise taxes within a taxable account by investing in tax-exempt bonds or tax-managed funds.

Avoid Required Minimum Distributions (RMDs)

Taxable accounts can help you avoid RMDs, the mandatory minimum withdrawals required from certain retirement accounts once you reach your early 70s. With taxable accounts, you are not obligated to take distributions, allowing you to leave your money invested for a longer period.

Greater College Savings Flexibility

When saving for education, taxable investment accounts offer more flexibility than dedicated college savings plans like 529 plans or Coverdell accounts. With a taxable account, you can use the funds for any purpose, including expenses that might not be covered by traditional college savings plans, such as room and board during school breaks or travel costs.

More Investment Options

Taxable investment accounts provide investors with greater control and a broader range of investment options. For example, investors interested in cryptocurrency or options trading may find that taxable accounts offer more opportunities to explore these areas than tax-advantaged accounts, which often have limitations.

Investing Cash: Strategies for Smart Money Allocation

You may want to see also

Taxable accounts are a good option if you've maxed out your annual contribution limits to your retirement accounts

Taxable investment accounts can be a good option for investors who have already maxed out their annual contribution limits to their retirement accounts. Here are some scenarios where investing in a taxable account would make sense:

Benefit from Additional Liquidity

Liquidity is a significant advantage of taxable investment accounts. Unlike retirement plans such as 401(k)s, annuities, and traditional IRAs, which have age restrictions on withdrawals, taxable accounts offer investors greater flexibility in accessing their money at any time without age restrictions. This makes taxable investment accounts ideal for goals that are at least a few years down the road.

Save More for Retirement

If you've maxed out your contributions to non-taxable accounts like 401(k)s or IRAs and still have additional funds to invest, taxable investment accounts can be a sensible option. You can still minimise taxes within a taxable account by investing in tax-exempt bonds or tax-managed funds.

Avoid RMDs in Retirement

Taxable accounts can help you avoid required minimum distributions (RMDs), the mandatory minimum withdrawals that the government requires from certain retirement accounts once you reach your early 70s. With taxable accounts, there is no obligation to take a distribution, allowing you to leave your money in the market for a longer period.

Greater College Savings Flexibility

If you're saving for education using a 529 plan or a Coverdell account, you're restricted to using the funds only for qualified educational expenses. A taxable investment account can provide increased flexibility, allowing you to pay for any expenses that aren't considered qualified, such as room and board, travel, and incidental expenses.

Maximise an Inheritance

Retirement accounts with untaxed dollars can create unexpected tax burdens for your heirs, as they are now required to withdraw the funds within 10 years. In contrast, taxable accounts don't have clocks on their withdrawal schedules, and investments qualify for a tax-free stepped-up basis when you pass away. This means that your beneficiaries would inherit all the gains in the account tax-free and would owe capital gains tax only on any increases after receiving the account.

Maximizing Investor Funding: Strategies for Entrepreneurs

You may want to see also

Taxable accounts are useful if you need to make big-ticket purchases before retirement

For example, if you plan to retire early, you'll need to cover your living expenses until you reach the age when you can withdraw money from your retirement accounts without a penalty. In this case, it makes sense to keep some money in a taxable brokerage account.

Additionally, if you're saving for education in a 529 plan or a Coverdell account, you can only use the funds for qualified educational expenses. If you want to pay for anything outside of this, such as room and board or travel, a taxable investment account can provide increased flexibility.

It's important to note that while taxable accounts offer more flexibility and liquidity, they also come with tax implications. When you earn dividend income or profits from the sale of assets in a taxable account, you must report them to the IRS for tax purposes. Depending on how long you owned the asset, your profits may be taxed at your normal income tax rate or a long-term capital gains tax rate.

Investing with a Revocable Living Trust: A Guide

You may want to see also

Taxable accounts are beneficial if you want to take risks with your extra cash

Taxable investment accounts are a great way to buy and sell assets like stocks, bonds, and exchange-traded funds. They are ideal for investors who want to take advantage of additional liquidity and avoid the age restrictions that come with traditional retirement accounts. With taxable accounts, there are no age restrictions on when you can access your money, giving you the flexibility to invest for the short or long term.

One of the key benefits of taxable accounts is the ability to take risks with your extra cash. If you're looking to speculate and take chances, a taxable brokerage account can be a good option. You can invest in speculative stocks, options, or even cryptocurrency, knowing that you can access your money at any time without paying a penalty. This makes taxable accounts ideal for those who are planning for early retirement or have other financial goals that require more immediate access to funds.

Additionally, taxable accounts offer greater investment options for adventurous investors. For example, you may want to invest in cryptocurrency or engage in options trading, which may be limited by some brokerages in retirement accounts. Taxable accounts give you more control over your investment strategies and allow you to pursue opportunities that may not be available in tax-advantaged accounts.

It's important to note that the earnings from taxable accounts, such as dividend income or profits from the sale of assets, must be reported to the IRS for tax purposes. Depending on how long you owned an asset, your profits could be taxed at your normal income tax rate or a long-term capital gains tax rate. However, with careful planning and the right investment choices, you can still build a tax-efficient portfolio within a taxable account.

The Technology Behind Rocky's Cinematic Success

You may want to see also

Frequently asked questions

Taxable investing is a good option if you want to benefit from additional liquidity, as there are no age restrictions on when you can access your money. It's also a good option if you've maxed out your annual contribution limits to your retirement accounts, or if you're saving for college and want more flexibility with your funds.

Taxable investing offers more flexibility and greater liquidity for investors beyond the tax-advantaged savings vehicles common in retirement and educational savings. It also allows you to avoid required minimum distributions (RMDs) in retirement, as there is no obligation to take a distribution from a taxable investment account.

Municipal bonds, municipal bond funds, money market funds, I bonds, Series EE bonds, equity exchange-traded funds (ETFs), and master limited partnerships (MLPs) are some investment options that can be tax-efficient for taxable accounts.