Annuities are financial products that offer a guaranteed income stream and are typically purchased by retirees. They are contracts issued and distributed by insurance companies and bought by individuals. The cash value of a variable annuity is based on the performance of its underlying investment funds. Variable annuities are regulated by the Securities and Exchange Commission (SEC) and state insurance commissioners. They are not the same as fixed annuities, which provide a guaranteed payment and are not considered securities. Variable annuities allow the account holder to invest in a variety of funds, similar to mutual funds, and the performance of these investments directly impacts the cash value and the amount of periodic payments the annuitant will receive.

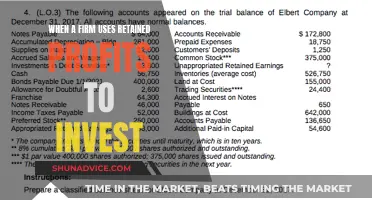

| Characteristics | Values |

|---|---|

| Type of annuity with cash value based on performance of underlying investment | Variable annuity |

| Other types of annuities | Fixed annuity, immediate annuity, indexed annuity |

| Regulator | Regulated by state insurance departments and the federal Securities and Exchange Commission |

| Cash value | Based on performance of underlying investment funds |

| Underlying investment funds | Stocks, bonds, mutual funds |

What You'll Learn

Fixed annuities

A fixed annuity can pay out immediately, or payments can be deferred. The payouts can be structured to provide income for the rest of the recipient's life. The insurance company sets a minimum guaranteed interest rate during the accumulation phase, and the annuitant begins receiving guaranteed income during the payout phase.

Understanding Cash Investing Activities: A Beginner's Guide

You may want to see also

Variable annuities

The payout phase begins when the investor chooses to "annuitize" their contract. This means they will start receiving their contract value as a stream of income payments at regular intervals. The amount of each periodic income payment will depend, in part, on the time period selected for receiving payments. It's important to note that annuities generally do not allow withdrawals once the payout phase has started.

Examples of Cash Investments: Where to Put Your Money

You may want to see also

Immediate annuities

An immediate annuity is an insurance contract where the annuitant pays a lump sum premium in exchange for an income stream that begins within a month to a year of purchase. The income stream can be a fixed or variable amount, paid out either immediately or at some point in the future.

The accumulation phase is the first stage of an immediate annuity, during which investors fund the product with a lump-sum payment. The annuitant then begins receiving payments after the annuitization period for a fixed period or the rest of their life.

Understanding Non-Cash Investments: An Alternative Investment Option

You may want to see also

Indexed annuities

There are two phases to an indexed annuity contract: the accumulation (savings) phase and the annuity (payout) phase. During the accumulation phase, the purchaser makes either a lump-sum payment or a series of payments to the insurance company, which are allocated to one or more indexed investment options. The insurance company then credits the purchaser's account with a return based on the performance of the chosen index. During the annuity phase, the insurance company makes periodic payments to the purchaser, or the purchaser may choose to receive their contract value in one lump sum.

While indexed annuities offer the potential for higher returns than fixed annuities, they also come with some risks and limitations. Certain provisions in these contracts, such as participation rates and rate caps, can limit the potential upside to only a portion of the market's rise. Additionally, indexed annuities may not offer the full upside of a rising market, as gains may be limited by a participation rate and a rate cap. The guaranteed rate of return may also fail to keep pace with inflation, resulting in a loss of purchasing power over time.

It is important to note that indexed annuities are not considered securities and are not regulated by the SEC or FINRA. Instead, they are regulated by state insurance departments. However, if an indexed annuity is registered as a security, it will be regulated by the SEC, and a prospectus will generally be delivered to the purchaser.

Cashing Out Putnam Investments: A Step-by-Step Guide

You may want to see also

Equity-indexed annuities

EIAs offer a guaranteed minimum interest rate, typically at least 87.5 per cent of the premium paid at 1 to 3 per cent interest, as well as an additional interest rate tied to the performance of one or more market indices. While an investor's principal is generally guaranteed, their interest rate, which includes the market-linked component, usually is not.

Earnings from equity-indexed annuities are usually slightly higher than traditional fixed-rate annuities and lower than variable-rate annuities, but with better downside risk protection than variable annuities typically offer. This makes them appealing to moderately conservative investors who want a higher investment return than what is available from traditional fixed-rate annuities while still having some protection against downside risk.

A key feature of equity-indexed annuities is the participation rate, which limits the extent to which the annuity owner participates in market gains. For example, if an annuity has an 80 per cent participation rate and the index to which it is linked shows a 15 per cent profit, the annuity owner will participate in 80 per cent of that profit, realising a 12 per cent profit.

Invest to Conceal Cash: Strategies for Discreet Money Management

You may want to see also

Frequently asked questions

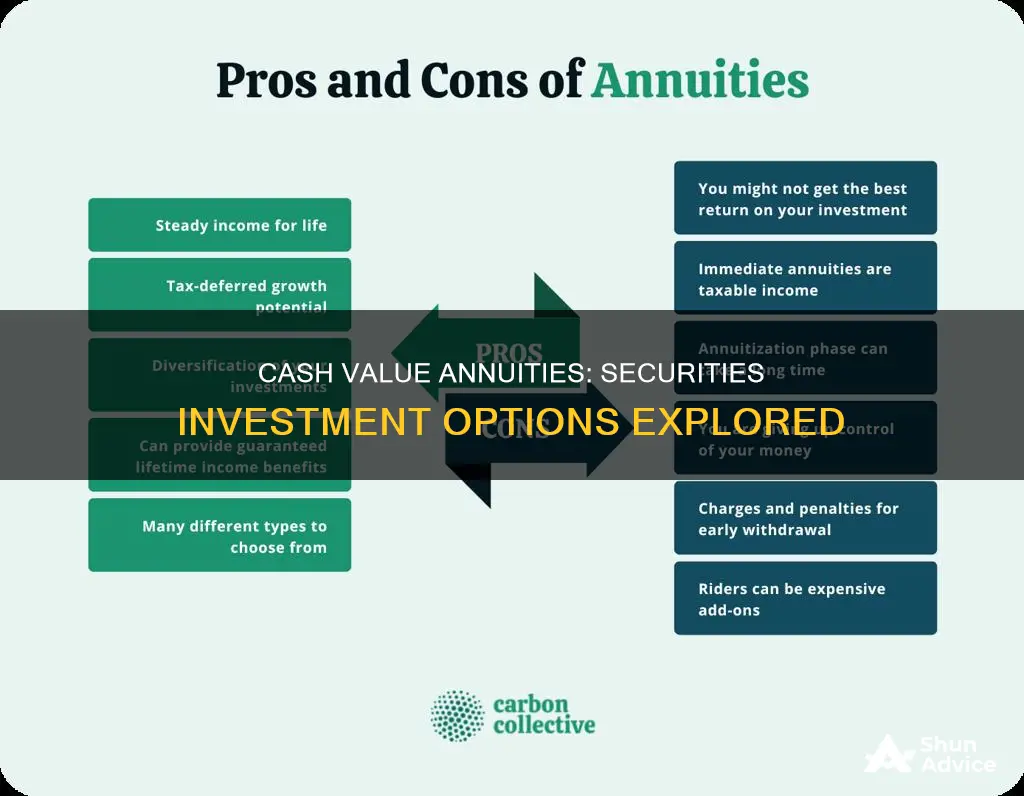

A cash value annuity is a type of annuity that allows individuals to accumulate wealth over time, offering a guaranteed income stream for retirement. The two main types of annuities are fixed and variable.

Variable annuities are invested in securities, such as mutual funds, stocks, or bonds. The cash value and periodic payments fluctuate based on the performance of these underlying investments. Variable annuities are regulated by state insurance departments and the federal Securities and Exchange Commission.

Variable annuities are generally best suited for experienced investors who are comfortable with market risk and understand the different types of mutual funds and their associated risks. These individuals are willing to take on risk to generate larger profits.

Variable annuities offer the potential for higher returns compared to fixed annuities. They also provide tax-deferred growth and the opportunity to customise payouts, making them a flexible option for retirement planning.