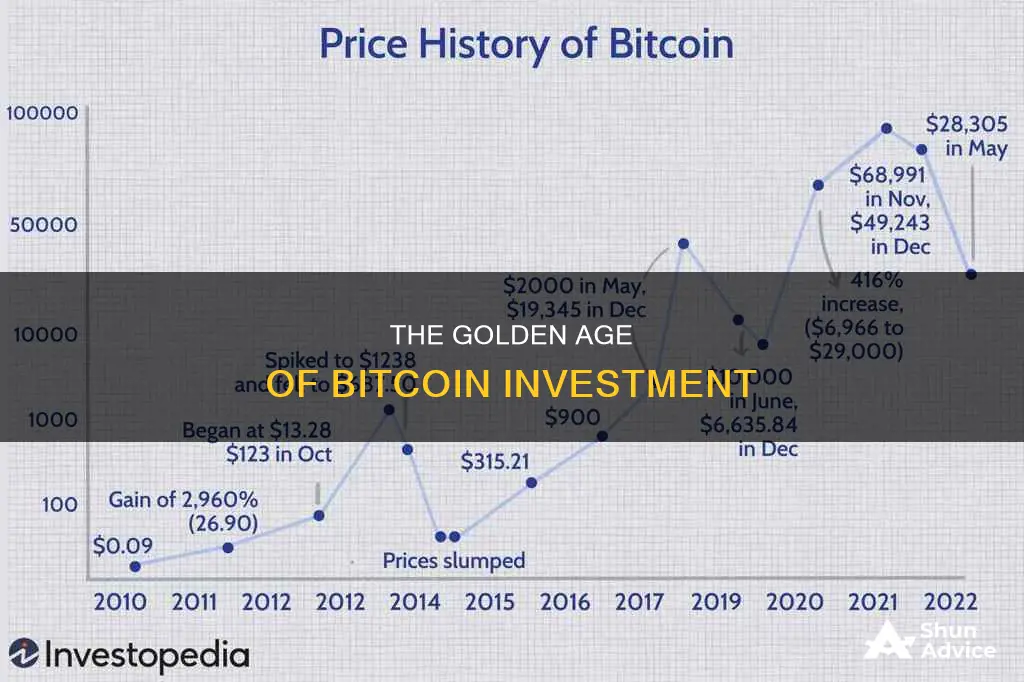

Bitcoin is prone to price volatility, with wide swings to the upside and downside. The cryptocurrency has experienced a recent rally, buoyed by institutional demand, and is currently trading at around $62,800. This is a significant improvement from December 2022, when it fell to $17,000.

So, was the best time to have invested in Bitcoin during its recent rally?

Well, that's a tricky question. Bitcoin is a highly speculative asset, and its value is influenced by several factors, including supply and demand, media coverage, and public interest. While some analysts believe that Bitcoin's price will continue to climb, others are more sceptical about its prospects.

Ultimately, the best time to invest in Bitcoin depends on your investment strategy and risk tolerance. If you're feeling confident in your strategy and are financially ready to enter the market, then now could be a good time to invest. However, it's important to remember that Bitcoin is a high-risk asset, and you should never invest more money than you are willing to lose.

| Characteristics | Values |

|---|---|

| Best time of the day to buy Bitcoin | Early in the morning before the NYSE opens |

| Best time of the week to buy Bitcoin | Monday |

| Best time of the month to buy Bitcoin | End of the month |

| Best time of the year to buy Bitcoin | End of the year |

| Best time horizon for investing in Bitcoin | Long-term |

What You'll Learn

The best time to buy Bitcoin during the day

The best time of day to buy Bitcoin depends on various factors, including market volatility, global trading patterns, time zones, and news events affecting prices. Here are some insights to help you determine the optimal time to purchase Bitcoin during the day.

Market Volatility and Price Fluctuations:

Bitcoin and the cryptocurrency market are known for their high volatility, which means that prices can fluctuate significantly throughout the day. This volatility is driven by constant shifts in supply and demand within the market. Therefore, it is essential to monitor the market and stay informed about any breaking news, regulatory updates, economic indicators, and even social media sentiment that can impact prices.

Global Trading Patterns and Time Zones:

The global nature of cryptocurrency trading means that it occurs across different time zones, 24 hours a day. Understanding how different time zones and trading patterns overlap can help identify optimal windows for buying Bitcoin. For example, increased trading volume during the overlap between American, European, and Asian market hours can lead to significant price changes.

News and Events Affecting the Market:

News and events can significantly influence cryptocurrency prices. Announcements regarding government regulations, economic indicators, geopolitical tensions, and technological advancements can all impact the market. Therefore, staying informed about relevant news and considering how it may affect the market is crucial when deciding the best time to buy Bitcoin.

Daily and Hourly Trends:

While there is no perfect formula, some daily and hourly trends have been observed. Bitcoin prices tend to be lower in the early morning, particularly before the New York Stock Exchange (NYSE) opens, as values tend to rise as the day goes on. Fridays at 6 am UTC have consistently produced some of the lowest Bitcoin prices, possibly due to lower trading activity in Asian markets and before European and North American markets open.

Additionally, Bitcoin prices often drop in the late afternoon as traders close their positions and take profits towards the end of the day, resulting in lower demand and prices.

Personal Schedules and Investment Goals:

When deciding the best time to buy Bitcoin, consider your personal schedule and investment goals. If you have time to monitor prices during the day, you may be able to take advantage of midday dips. Alternatively, if you're an early riser, mornings might be ideal for monitoring price movements before the markets become more active. Remember that the cryptocurrency market is open 24/7, so you can buy or sell at any time that suits your schedule.

In conclusion, while there is no exact science to determining the best time of day to buy Bitcoin, understanding market trends, volatility, and global trading patterns can help you make more informed decisions. Remember to also consider your personal circumstances and investment strategy when timing your Bitcoin purchases.

Bitcoin's Legitimacy: A Viable Investment Option?

You may want to see also

The best time to buy Bitcoin during the week

While the cryptocurrency market is volatile and unpredictable, there are certain days of the week that are generally considered better for buying Bitcoin than others.

Bitcoin's price usually drops over the weekend, with its lowest point being on Sunday evenings. This is because trading volumes on crypto exchanges drop over the weekend. Therefore, Sunday and Monday are considered the best days to buy Bitcoin.

Some sources suggest that Tuesday is the best day to buy crypto, followed by Thursday and Saturday. However, this is based on data from 2022, which saw steep and random drops in prices due to fears of the market dropping further.

It's important to note that the cryptocurrency market is unpredictable, and these patterns may not always hold true.

Virtual Coin Investment: Best Bets for Your Money

You may want to see also

The best time to buy Bitcoin during the month

However, it is important to note that the crypto market is constantly changing, and these trends may not always hold true. Additionally, the volatility of the cryptocurrency market makes it difficult to identify reliable patterns. Therefore, the best time to buy crypto is when the buyer is feeling confident in their strategy and financially ready to make a move.

Best time of the week to buy Bitcoin

Generally, cryptocurrency prices start low on Monday and rise throughout the week. When the weekend hits, prices tend to drop until market activity picks up again the following Monday. Therefore, Monday is typically the best day of the week to buy crypto.

Best time of the day to buy Bitcoin

Bitcoin (BTC), Ether (ETH), Binance (BNB), Solana (SOL), and Cardano (ADA) trading activity tends to rise and fall at roughly the same time. Looking at data from before September 7, 2022, the best time of day to purchase these cryptocurrencies in the United States was generally in the afternoon.

Experts say that the best time of day to buy cryptocurrency is early in the morning before the New York Stock Exchange (NYSE) opens, as values tend to rise as the day goes on.

Bitcoin's Decade: A Look Back at Early Investors

You may want to see also

The impact of the broader market on Bitcoin's price

The price of Bitcoin is impacted by several factors, including supply and demand, media attention, regulations, and the broader market conditions. Here is an analysis of the impact of the broader market on Bitcoin's price:

Bitcoin's price is influenced by the performance of the broader financial markets, including equities, bonds, real estate, and other asset classes. During periods of economic uncertainty and weak growth, investors may be more inclined to sell risky assets like Bitcoin and seek safer investments such as government bonds. This shift in investor sentiment can lead to a decrease in demand for Bitcoin, putting downward pressure on its price.

For example, the broader selloff in 2022 across equities, bonds, and real estate also impacted the crypto market, with Bitcoin experiencing a decline during this period. The performance of the NASDAQ stock market index has also been correlated with Bitcoin's price movements. When the NASDAQ suffered a drawdown in 2000, Bitcoin's price followed a similar pattern. However, it's important to note that the correlation between the two has declined recently.

Additionally, the state of the global economy and macroeconomic factors can impact Bitcoin's price. For instance, rising interest rates by central banks to curb inflation can lead to a decrease in risk appetite among investors, causing a selloff in risky assets like Bitcoin. On the other hand, during periods of economic growth and accommodative monetary policies, investors may be more willing to allocate a portion of their portfolios to riskier assets, including Bitcoin.

Moreover, the strength of traditional safe-haven assets, such as gold, can also influence Bitcoin's price. When gold performs well, it may attract investors who are seeking a store of value or a hedge against inflation, potentially reducing the demand for Bitcoin. Conversely, when gold struggles, investors may view Bitcoin as an alternative safe haven, increasing its demand and pushing up its price.

The broader market conditions, including the performance of other asset classes and the macroeconomic environment, play a crucial role in driving investor sentiment and risk appetite, which, in turn, impact the demand for and price of Bitcoin.

Coinbase Crypto: Best Bets for Your Digital Wallet

You may want to see also

The risks of investing in Bitcoin

Bitcoin and other cryptocurrencies are highly speculative and risky investments. Here are some of the key risks to consider:

Volatility and Fluctuating Market: The price of Bitcoin is highly volatile and constantly changing, making it difficult to predict if you will get a return on your investment. The market can be unpredictable, and there is a risk of losing money if you don't closely monitor it.

Cyberattacks and Hacking: Bitcoin is technology-based and relies on digital wallets and exchanges, making it vulnerable to cyberattacks and hacking. If your Bitcoin is stolen or lost, there is often no way to retrieve it.

Fraud: The lack of regulation in the Bitcoin market increases the risk of fraud. Fake exchanges and fraudulent transactions can result in investors losing their money.

Little or No Regulation: The Bitcoin market currently operates with little to no major regulations, as governments and regulatory bodies are still figuring out how to approach cryptocurrency. The lack of regulation can create uncertainty and increase the risk of fraud.

Technology Reliance: Bitcoin is entirely reliant on technology, and any issues with the underlying technology can impact its value. Unlike traditional investments like gold or real estate, Bitcoin has no physical collateral backing it up.

Block Withholding: Bitcoin mining relies on solving mathematical equations called "blocks." However, mining pools can use computational power to hide these blocks from honest miners, allowing a select few to benefit while others lose out.

Tax and Regulatory Uncertainty: The tax treatment of Bitcoin and cryptocurrency gains can vary across jurisdictions, and the regulatory landscape is constantly evolving. Investors need to stay informed about the latest tax and regulatory developments to ensure compliance and avoid legal risks.

Decentralized Status: Bitcoin's decentralized nature, without a central authority, can create legal complications and make it difficult to resolve transaction disputes or ownership issues.

Fraud and Money Laundering: Cryptocurrencies have been associated with criminal activities, including fraud and money laundering. This perception can impact the reputation and value of Bitcoin and may lead to increased regulatory scrutiny.

Digital Security: While developers work to create secure digital wallets and exchanges, the risk of cyberattacks and hacking attempts remains. The digital security of Bitcoin and other cryptocurrencies is an ongoing challenge.

When considering investing in Bitcoin, it is essential to understand these risks and conduct thorough research. Diversifying your investments and consulting with financial professionals can help mitigate some of these risks.

Dogecoin: The Only Crypto You Need

You may want to see also

Frequently asked questions

The best time to have invested in Bitcoin was in 2009 when it was first created. This is because Bitcoin is a speculative asset and its value has increased over time.

There is no definitive answer to this question as it depends on a variety of factors, including market conditions, risk tolerance, and investment strategy. However, some sources suggest that the end of the month and early in the morning are good times to buy cryptocurrencies like Bitcoin as prices tend to be lower at these times.

It is important to remember that Bitcoin is a highly volatile and speculative investment. Before investing, individuals should ensure they have a diversified portfolio and are financially ready to make a move. It is also crucial to understand the risks involved and only invest money that can be afforded to lose.