Two Harbors Investment Corp. (TWO) is a real estate investment trust that focuses on investing in, financing, and managing various financial assets, including mortgage-backed securities. The company has announced dividends for the second quarter of 2024, with the last ex-dividend date being July 5, 2024. TWO has an annual dividend of $1.80 per share, with a forward yield of 13.03% to 13.14%. The dividend is typically paid quarterly, with the next dividend expected to be paid in 16 days, as of July 13, 2024. TWO's dividend yield is calculated by dividing its annual dividend payment by the prevailing share price.

What You'll Learn

Two Harbors Investment Corp's dividend history

Two Harbors Investment Corp (TWO) has an annual dividend of $1.80 per share, with a forward yield of 13.03% to 13.14%. The dividend is paid quarterly, with four dividends paid per year (excluding specials). The last ex-dividend date was July 5, 2024, and the next dividend will be paid in 16 days, on July 29, 2024. The dividend amount is $0.45 per share.

On April 29, 2024, Two Harbors Investment Corp announced a dividend of $0.45 per share, with an ex-dividend date set for April 3, 2024. Prior to this, the company had announced its first-quarter 2024 common and preferred stock dividends in March 2024.

Two Harbors Investment Corp's dividend yield is calculated by dividing its annual dividend payment by the prevailing share price. As of July 17, 2024, the company's share price was $13.70.

The company's dividend capture strategy is based on historical data, where investors buy TWO shares one day before the ex-dividend date and sell them when the price recovers.

Wealthy Secrets: Where the Rich Invest

You may want to see also

The company's dividend yield and growth rates

Two Harbors Investment Corp (TWO) has a strong track record of dividend payments, with a yield and growth rate that make it an attractive investment opportunity.

TWO's dividend yield, calculated as the annual dividend payment divided by the prevailing share price, has been consistently high. On 28 October 2023, the dividend yield stood at 27.2%, and on 10 January 2024, it was 13.5%. This indicates that TWO has been able to maintain a high dividend payout relative to its share price, providing attractive returns to investors.

In terms of growth rates, TWO has demonstrated impressive performance. The forward dividend yield, calculated by multiplying the most recent dividend payout amount by its frequency and dividing it by the previous close price, is estimated to be 13.03%. This puts TWO in the top 15% of dividend-paying stocks. Additionally, the company has achieved a 38% dividend Compound Annual Growth Rate (CAGR) over the last three years, placing it in the top 20% of companies.

The company's dividend growth can also be observed in its dividend payout history. TWO has been paying regular quarterly dividends, with the most recent dividend of $0.45 per share paid on 29 April 2024. The previous dividend, also at $0.45, was paid three months prior. At the time of writing, TWO is predicted to pay a dividend of $0.45 in 16 days. This consistency in dividend payments, along with the growth in dividend yield, showcases TWO's commitment to providing returns to its investors.

TWO's dividend performance is further supported by its investment rating from Argus Research. TWO Harbors Investment Corp has received a "BUY" investment rating from Argus, with a target price of $17.00. The company has also received high subratings in management, safety, financial strength, and value. Additionally, TWO's growth subrating is "Medium," indicating that Argus expects the company's dividends and overall performance to continue growing at a steady pace.

Investing in Startups: Where to Begin?

You may want to see also

Annual dividend of $1.80 per share

Two Harbors Investment Corp (TWO) has an annual dividend of $1.80 per share, with a forward yield of 13.14%. This dividend is paid quarterly, with the last payment made on April 29, 2024, and the next expected on July 29, 2024. The ex-dividend date for the upcoming payment was July 5, 2024.

TWO's dividend yield is calculated by dividing the annual dividend payment of $1.80 by the prevailing share price. As of July 12, 2024, TWO's dividend yield was 13.14%. TWO's dividend yield has varied over time, with a yield of 27.2% on October 28, 2023, and 13.5% on January 10, 2024.

TWO's dividend payout record can be used to assess the company's long-term performance. TWO has a history of consecutive annual dividend increases, indicating its commitment to providing returns to its shareholders. The company's dividend yield and growth rates are essential considerations for investors.

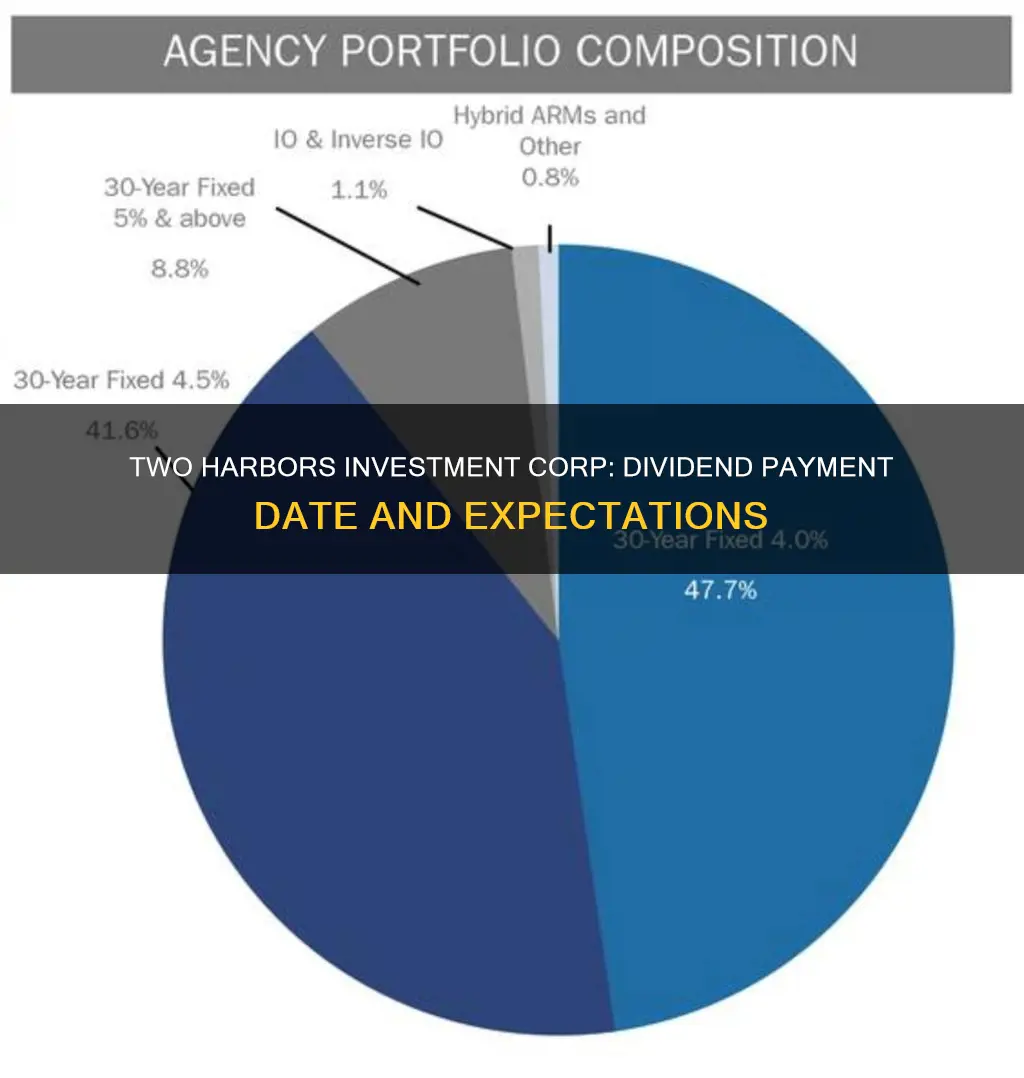

TWO, a real estate investment trust, focuses on investing in, financing, and managing agency residential mortgage-backed securities, non-Agency securities, mortgage servicing rights, and other financial assets. The company aims to provide risk-adjusted returns to its stockholders over the long term, primarily through dividends, and secondarily through capital appreciation. TWO's investment rating is "BUY," with a target price of $17.000000 and high ratings in safety, financial strength, and value.

Vanguard Investors: How Many?

You may want to see also

Quarterly dividend payments

Two Harbors Investment Corp (TWO) pays quarterly dividends. The company recently announced a dividend of $0.45 per share, payable on 29 April 2024, with the ex-dividend date set for 3 April 2024. The previous dividend was also $0.45, paid three months earlier. TWO has an annual dividend of $1.80 per share, with a forward yield of 13.14%. The last ex-dividend date was 5 July 2024.

TWO typically pays four dividends per year, excluding specials. The company's dividend yield is calculated by dividing the annual dividend payment by the prevailing share price. TWO's dividend yield today was 27.2% on 28 October 2023 and 13.5% on 10 January 2024.

The next TWO dividend will be paid in 16 days from 13 July 2024. The ex-dividend date was eight days ago. TWO's dividend history can be used to gauge the company's long-term performance when analysing individual stocks.

Strategic Investing: Unlocking the Key to Mortgage Freedom

You may want to see also

Dividend capture strategy

Two Harbors Investment Corp is a real estate investment trust that pays dividends quarterly. The company's next dividend payment will be made in 16 days, with the previous one paid three months ago.

Now, a dividend capture strategy is an income-focused stock trading strategy that is popular among day traders. It is an active trading strategy that involves frequent buying and selling of shares, holding them for a short period of time, typically just long enough to collect the dividend the stock pays. The underlying stock could sometimes be held for only a single day.

The strategy is centred on the timing of dividend payments and involves four key dates:

- Declaration date: The board of directors announces the dividend payment, specifying the amount. This occurs well in advance of the payment.

- Ex-dividend date: The security starts trading without the dividend. The day before this date is the last day to buy a stock and be eligible for the dividend. The stock price often drops in accordance with the declared dividend amount.

- Date of record: The company records which shareholders are eligible to receive the dividend.

- Pay date: The company issues dividend payments.

The dividend capture strategy involves buying a stock just before the ex-dividend date to receive the dividend and then selling it immediately after the dividend is paid. This strategy aims to profit from the fact that stocks do not always trade in strictly logical ways around dividend dates.

For example, let's say XYZ Corp pays a $1 dividend and trades at $100 per share before the ex-dividend date. On the ex-dividend date, the price should theoretically drop to $99. However, if the stock is still trading at $100 on the ex-dividend date, an investor could buy it, collect the $1 dividend, and then sell it at $99.50, resulting in a total return of $0.50.

While this strategy can lead to big profits, it also has several drawbacks, including negative price adjustments on the ex-dividend date, loss of favourable tax treatment, market action, brokerage fees, and the risk of negative market movements.

Utilities: Invest or Avoid?

You may want to see also

Frequently asked questions

Two Harbors Investment Corp pays dividends every three months.

The dividend per share is $1.80.

The last dividend was paid on 29 April 2024.