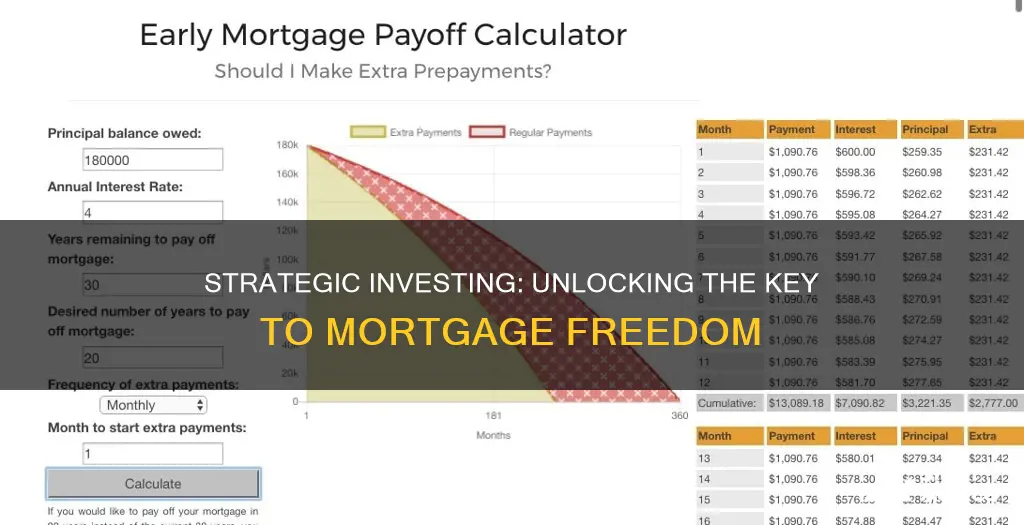

Paying off your mortgage early or investing your money elsewhere is a common dilemma for homeowners. The right choice depends on your financial situation, risk tolerance, and long-term goals. Here's an introduction to help you decide which option is best for you.

Paying off your mortgage early can provide several benefits. Firstly, it eliminates your monthly mortgage payments, freeing up extra funds for other financial goals. Secondly, it can save you thousands of dollars in interest over the life of the loan. Additionally, it offers peace of mind and a sense of financial security, especially for those approaching retirement. Paying off your mortgage early also allows you to build equity in your home faster, which can be leveraged for a home equity line of credit (HELOC) or refinancing.

On the other hand, investing your money in the stock market or other financial instruments can potentially provide higher returns compared to the interest saved by paying off your mortgage early. Historically, the stock market has yielded higher returns than the average mortgage rate. By investing, you also maintain liquidity, as stocks and other investments are easier to convert to cash compared to your home. Investing in a retirement account can also provide tax advantages and potential employer matching contributions.

However, investing does come with higher risks. The stock market is volatile, and you could gain or lose significant amounts of money. Additionally, investing doesn't eliminate your debt, and you'll still need to make payments on your mortgage or other loans.

Ultimately, the decision to pay off your mortgage early or invest depends on your financial priorities, risk tolerance, and long-term goals. Carefully consider the pros and cons of each option before making a decision, and if needed, consult a financial advisor for personalised advice.

| Characteristics | Values |

|---|---|

| Interest savings | You could save thousands or tens of thousands of dollars in interest payments. |

| Peace of mind | Paying off your mortgage early can ease your burden and prevent the risk of losing your home. |

| Build equity | Paying down your mortgage faster means building equity in your home more quickly, which can help you qualify for refinancing. |

| Opportunity cost | Any extra money you spend on paying down your mortgage faster is money you aren't able to use for other financial goals. |

| Wealth is tied up | Property is an illiquid asset, meaning you can't convert it to cash quickly or easily. |

| Loss of tax breaks | You may lose out on tax deductions for mortgage interest if you normally itemize. |

| Higher returns | The stock market has, on average, returned significantly higher than mortgage rates. |

| Liquid investment | Stocks, bonds and other market investments mean you can easily sell and access your money if you need to. |

| Employer match | If your employer offers a match on retirement account contributions, you get to enjoy compound earnings over time. |

| Higher risk | There is more volatility in the stock market than in the housing market. |

| Increased debt | Choosing to invest your money may not be the best option if you don't like the idea of having debt. |

What You'll Learn

Paying off your mortgage early vs investing: the pros and cons

Paying Off Your Mortgage Early vs. Investing: The Pros and Cons

When it comes to the question of paying off your mortgage early versus investing, there are several factors to consider. Both options have their own advantages and disadvantages, and the best decision for you will depend on your financial situation, risk tolerance, and personal preferences. Here are some of the key pros and cons of each option:

Paying off your mortgage early:

Pros:

- Lower total interest paid: One of the biggest advantages of paying off your mortgage early is reducing the total amount of interest you pay over the life of the loan. This can save you thousands of dollars in the long run.

- Increased equity: By making extra payments towards your principal balance, you build equity in your home faster, increasing your net worth and potentially providing more financial flexibility in the future.

- Peace of mind: Being mortgage-free can give you a sense of financial security and peace of mind, especially if you're risk-averse or nearing retirement age.

Cons:

- Opportunity cost: Paying off your mortgage early means tying up a significant amount of money in an illiquid asset (your home). This money could otherwise be invested in financial markets with the potential for higher returns.

- Potential for higher returns in investments: Historical data suggests that investing in stocks and bonds over the long term typically yields higher returns than paying off low-interest mortgage debt.

- Limited tax benefits: Depending on your location and tax situation, the mortgage interest you pay may be tax-deductible, which could reduce the effective cost of your mortgage. By paying off your mortgage early, you may lose out on these tax benefits.

Investing instead of paying off your mortgage early:

Pros:

- Potential for higher returns: Investing in stocks, bonds, or other financial instruments typically offers the potential for higher returns over the long term compared to paying off low-interest debt like a mortgage.

- Liquidity: Investments are generally more liquid than real estate, meaning you can easily access your money if needed without having to sell your home or borrow against it.

- Diversification: Investing allows you to diversify your portfolio and not have all your wealth tied up in a single asset (your home).

Cons:

- Risk of market losses: Investments carry the risk of losing value, especially in the short term. If your investments perform poorly, you could end up with less money than if you had simply paid off your mortgage.

- Potential for higher overall costs: If your investments don't earn a higher return than the interest rate on your mortgage, you may end up paying more in total costs by investing instead of paying off your mortgage early.

- Emotional factor: Investing often comes with emotional ups and downs as markets fluctuate, which may be stressful for some individuals.

In conclusion, both options have their merits, and the right decision for you will depend on your financial circumstances, risk tolerance, and personal preferences. Consider seeking advice from a financial advisor to help you make an informed decision that aligns with your long-term financial goals.

Rights: A CMO Investor's Guide

You may want to see also

How to decide between paying off your mortgage early and investing

Overview

The decision to pay off your mortgage early or invest depends on your financial situation, risk tolerance, and long-term goals. While paying off your mortgage early can provide peace of mind and save you money on interest, investing may offer higher returns but comes with higher risk and reduced liquidity.

Paying off your mortgage early

Pros

- Interest savings: You could save thousands or tens of thousands of dollars in interest payments.

- Peace of mind: Being debt-free can ease your financial burden and provide a sense of security, especially if you're nearing retirement.

- Build equity: Paying off your mortgage faster can help you build equity in your home, which can be leveraged for refinancing or home improvement projects.

Cons

- Opportunity cost: Paying off your mortgage early may hinder your ability to invest in other financial goals, such as retirement savings or emergency funds.

- Wealth is tied up: Property is an illiquid asset, meaning it can't be quickly converted into cash. If you need money for an emergency or investment opportunity, you'll have to sell your house and wait for a buyer.

- Loss of tax breaks: Paying off your mortgage early may cause you to lose tax deductions for mortgage interest and miss out on tax advantages associated with certain investment options.

Investing instead of paying off your mortgage early

Pros

- Higher returns: Historically, the stock market has provided higher returns than mortgage rates, allowing you to potentially earn more by investing.

- Liquid investment: Investing in stocks, bonds, and other market instruments provides easier access to your money if you need it.

- Employer match: Investing in a retirement account with an employer match gives you additional money through compound earnings.

Cons

- Higher risk: The stock market is more volatile than the housing market, and there is a risk of losing money on your investments.

- Increased debt: If you invest instead of paying off your mortgage, you will remain in debt for a longer period, and there is a risk of losing your home if you can't make the payments.

A balanced approach

If you're unsure about choosing between paying off your mortgage early and investing, consider a balanced approach. You can refinance your mortgage to take advantage of lower interest rates and invest the money you save through refinancing. This allows you to reduce your overall mortgage costs while still benefiting from the higher returns of the stock market.

Investing Strategies for Volatile Times

You may want to see also

The opportunity cost of paying off your mortgage early

Paying off your mortgage early can be a double-edged sword. While it can be a good thing in some cases, it can also hinder your financial goals. Here are some opportunity costs to consider:

- Interest savings: Paying off your mortgage early means you'll save thousands in interest payments. This is essentially a guaranteed return on your investment.

- Peace of mind: Being debt-free can give you peace of mind and ease your financial burden. In the case of a financial emergency, you won't have to worry about missing mortgage payments and the risk of foreclosure.

- Building equity: Paying down your mortgage faster helps build equity in your home, which can be beneficial if you decide to refinance or take out a home equity loan or line of credit.

- Opportunity cost: Any extra money spent on paying off your mortgage early is money that could have been invested in other financial goals, such as retirement savings or emergency funds.

- Limited liquidity: Property is an illiquid asset, meaning it can't be quickly converted into cash. If you need money for an emergency or investment opportunity, you'll have to go through the lengthy process of selling your house.

- Loss of tax breaks: Paying off your mortgage early may cause you to lose out on certain tax breaks, such as tax deductions for mortgage interest.

- Missed investment opportunities: Historically, the stock market has provided higher returns than mortgage rates. By investing your money instead of paying off your mortgage early, you could potentially earn more through these higher returns.

NIO Stock: Buy or Bye?

You may want to see also

The impact of interest rates on your decision

Interest rates play a significant role in your decision to pay off your mortgage early with investments. Here are some key points to consider:

Impact of Interest Rates on Investment Returns

- Historically, the stock market has provided higher returns than mortgage interest rates. For instance, the S&P 500 has returned an average of 10-11% annually since its inception, significantly higher than most mortgage rates.

- However, investing in the stock market comes with risks. While you can potentially earn higher returns, there is also volatility and the possibility of losing money.

- On the other hand, paying off your mortgage early provides a guaranteed return on investment in the form of interest savings.

Impact of Mortgage Interest Rates on Savings

- When mortgage rates are low, it becomes cheaper to hold debt. This presents an opportunity to invest your money in other instruments that offer higher returns than the interest you're paying on your mortgage.

- For example, if you have a low mortgage rate of 3% and you pay off your mortgage early, you're essentially turning down the chance to invest that money elsewhere at a higher interest rate, such as in Treasury bills or high-yield savings accounts offering over 4.5%.

- By investing your money instead of paying off your mortgage early, you can potentially earn more in interest than you would save by paying off your mortgage early.

Impact of Interest Rates on Opportunity Cost

- Opportunity cost refers to the potential returns you could earn by investing your money elsewhere instead of paying off your mortgage early.

- When interest rates on safe investments are higher than your mortgage rate, the opportunity cost of paying off your mortgage early increases. This means you're potentially giving up higher returns by choosing to pay off your mortgage early.

- For example, if you have a mortgage rate of 5% and you can invest in a risk-free Treasury bill offering 4.5%, paying off your mortgage early becomes less attractive as you're giving up the chance to earn a higher return.

Impact of Interest Rates on Financial Goals

- Paying off your mortgage early can impact your financial goals, especially if you have other investments or debts.

- If you have high-interest credit card debt, student loans, or other types of loans with interest rates higher than your mortgage rate, it may be more beneficial to focus on paying off those debts first.

- Additionally, consider your financial goals, such as saving for retirement, building an emergency fund, or investing in a child's education. Balancing these goals with paying off your mortgage early is essential.

In summary, the impact of interest rates on your decision to pay off your mortgage early with investments depends on several factors, including the potential returns on investments, the cost of holding mortgage debt, opportunity costs, and your overall financial goals. It's important to weigh these factors carefully before making a decision.

Apple: A Popular Investment Choice

You may want to see also

Weighing up the risks of investing vs paying off your mortgage early

Overview

The decision to pay off your mortgage early or invest your extra funds depends on your risk tolerance and long-term goals. While investing may offer higher returns, paying off your mortgage early can provide peace of mind and reduce your debt. Here are some key considerations to help you weigh up the risks of both options.

Investing your extra funds

Pros

- Higher returns: Investing in the stock market has historically provided higher returns compared to mortgage rates, allowing you to potentially earn more by investing rather than paying off your mortgage early.

- Liquid investment: Investing in stocks, bonds, and other market investments provides easy access to your money if you need it.

- Employer match: Investing in a retirement account with an employer match gives you additional free money and compound earnings.

Cons

- Higher risk: The stock market is more volatile than the housing market, and you need to ensure your investment strategy matches your risk tolerance.

- Increased debt: Investing instead of paying off your mortgage means you still have debt tied to your name, and there is a risk of losing your home if you can't make the payments.

Paying off your mortgage early

Pros

- Interest savings: Paying off your mortgage early can save you thousands in interest payments, providing a guaranteed return on your investment.

- Peace of mind: Being debt-free can ease your burden and provide mental relief, especially when considering living on a fixed income during retirement.

- Build equity: Paying off your mortgage faster helps you build equity in your home, which can qualify you for refinancing and provide access to home equity loans or lines of credit.

Cons

- Opportunity cost: Paying off your mortgage early means sacrificing other financial goals, such as retirement savings, emergency funds, or other investment opportunities.

- Wealth is tied up: Property is an illiquid asset, and accessing your money can be challenging and time-consuming if you need it for financial emergencies or investment opportunities.

- Loss of tax breaks: Paying off your mortgage early may result in losing tax deductions for mortgage interest and retirement account contributions.

Art That Pays: Unveiling the Secrets to Smart Investing

You may want to see also

Frequently asked questions

Paying off your mortgage early can save you thousands of dollars in interest and free up funds for other investments. You will also be debt-free and can leverage your equity.

You may cut into your savings, miss out on tax deductions, and face prepayment penalties. It might also be your only investment, meaning you could be neglecting other important investments, such as your retirement fund.

The pros of investing instead of paying off your mortgage early include potentially seeing a higher rate of return, increasing your future wealth, and having better asset liquidity. There is also the potential for an employer match if you're investing in a retirement account. However, investing is riskier, and you will still be making payments. Additionally, investing won't make your debt go away.