If you have received a 1099-R form from Fidelity Investments, you may be wondering about the payer name and address. Fidelity Investments Institutional Operations Co. is a subsidiary of Fidelity Investments and provides tax forms for Fidelity brokerage accounts.

What You'll Learn

- Fidelity Investments Institutional Operations Co. is a subsidiary of Fidelity Investments

- The company provides tax forms for Fidelity brokerage accounts

- The company is based in Covington, Kentucky

- The company provides general information about tax forms on their website

- The company does not provide tax advice

Fidelity Investments Institutional Operations Co. is a subsidiary of Fidelity Investments

Fidelity Investments Institutional Operations Co., as a subsidiary, provides investment advisory services and offers investment products, brokerage, and trading services specifically to financial intermediary firms. The company's address is 100 Magellan Way KW1C Covington, KY, 41015-1987, and it is responsible for providing tax forms for Fidelity brokerage accounts.

While Fidelity Investments Institutional Operations Co. is a part of the larger Fidelity Investments company, it is important to note that neither entity provides tax advice. Customers and investors are advised to consult with tax professionals for specific guidance on reporting information on their tax forms.

Fidelity Investments, with its various subsidiaries and divisions, has a broad reach and offers a diverse range of financial services. The company has a long history and has evolved over the years to become a significant player in the global financial industry.

Jim Rogers' Commodity Fund: A Guide to Investing

You may want to see also

The company provides tax forms for Fidelity brokerage accounts

Fidelity Investments Institutional Operations Co. is a subsidiary of Fidelity Investments and provides tax forms for Fidelity brokerage accounts. These tax forms can be accessed online or by downloading a PDF and filling out a paper copy. Previous years' tax forms are available to view and download at any time.

Fidelity offers a range of tax forms, including those for income and dividends, retirement, and investments. The most common tax forms for income and dividends are under the umbrella of 1099s, which include Form 1099-INT for interest earned from cash deposits and Form 1099-DIV for dividends earned and other distributions. Form 1099-R, which is provided by Fidelity Investments Institutional Operations Co., is a type of 1099 tax form that reports distributions from retirement plans, IRAs, pensions, profit-sharing plans, annuities, and insurance contracts.

Fidelity also provides resources to help customers understand their tax forms, including a guide to IRS tax forms and a Tax Information page with information on the delivery schedule of forms. However, it is important to note that Fidelity does not provide tax advice, and customers are advised to consult a tax professional for specific guidance.

Quant Active Fund: Smart Investing Strategies for Beginners

You may want to see also

The company is based in Covington, Kentucky

Fidelity Investments Institutional Operations Company, Inc. is based in Covington, Kentucky, in the United States. The company is part of the Securities and Commodity Contracts Intermediation and Brokerage Industry and is a subsidiary of Fidelity Investments. It provides tax forms for Fidelity brokerage accounts.

The company's address is 100 Magellan Way, Covington, KY, 41015-1987, United States. It has 10 employees at this location, but there are 421 companies in the Fidelity Investments Institutional Operations Company, Inc. corporate family. The company's phone number is (859) 386-4000, and its website is www.fidelity.com.

Reviews of working at Fidelity Investments in Covington, Kentucky, are mixed. Some employees praise the company's benefits, pay, and work-life balance, while others criticise the micromanagement, monotonous work, and toxic environment based on metrics. Overall, the company has a rating of 3.9 out of 5 stars for work-life balance and compensation/benefits, and 3.5 out of 5 stars for job security/advancement and management.

Bull Market Strategies: Index Funds Investing Guide

You may want to see also

The company provides general information about tax forms on their website

Fidelity Investments Institutional Operations Co. is a subsidiary of Fidelity Investments that provides tax forms for Fidelity brokerage accounts. While Fidelity does not provide tax advice, it does offer online resources that provide general information about tax forms, including the delivery schedule, on its Tax Information page on the website. Here is some more information about the company's tax forms and website.

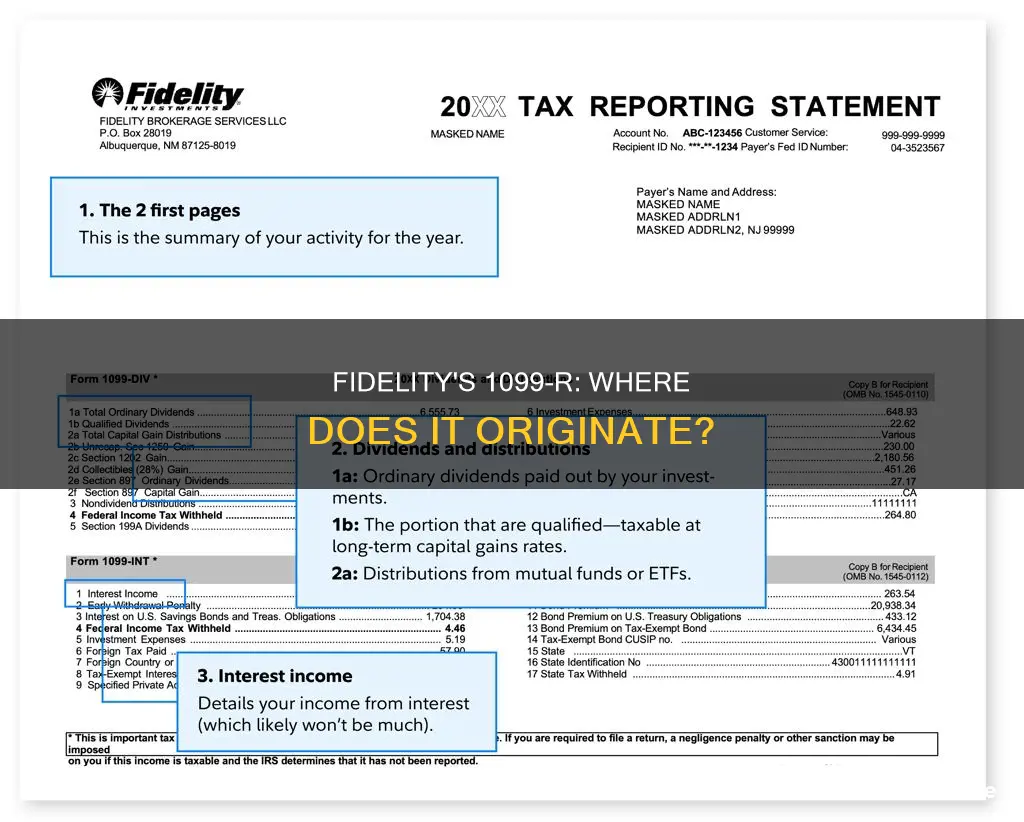

Fidelity consolidates several 1099 forms—the 1099-DIV, 1099-B, 1099-INT and 1099-MISC—into one tax reporting statement. There are eight key things to look for on this statement:

- The first two pages: This is a summary of your activity for the year.

- 1099-Div summary section: Details dividends and distributions.

- 1099-Int: Details interest income from money market funds.

- 1099-B section: Your cost basis represents your initial investment, including investing costs and adjustments.

- Short-term and long-term transactions column: Gains from short-term transactions are typically taxed at a much higher rate than long-term holdings.

- Total wash sales column: Investment losses are typically tax-deductible, but wash sales are an exception.

- 1099-B details section: After the summary pages, you get into the details of your transactions.

- Summary of supplemental information not reported to the IRS: If you trade on margin, you have to go deeper in the statement to find the interest paid on margin loans, which is often tax-deductible.

Fidelity's website also offers a range of other resources to help customers with their taxes. This includes a tax form schedule, information on the most common tax forms, and a tax preparation service with special discounts for Fidelity clients. In addition, the website provides answers to frequently asked questions about taxes, such as whether crypto is subject to capital gains taxes, what constitutes taxable income, and the tax advantages of a Roth IRA.

Mutual Fund SIP: A Guide to Getting Started

You may want to see also

The company does not provide tax advice

Fidelity does not provide tax advice. The information provided by the company is general in nature and for educational purposes only. It should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results.

Fidelity cannot guarantee the accuracy, completeness, or timeliness of the information provided. The company expressly disclaims any liability arising from the use of this information or any tax position taken in reliance on it. If you have questions about reporting the information on your tax forms, consult a tax professional.

Fidelity does offer online resources that provide general information about tax forms, including the delivery schedule, on its Tax Information page. You will also find a link to the IRS instructions for each tax form provided by the company.

Additionally, it's important to keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Castro's Education Legacy in Cuba: Fact or Fiction?

You may want to see also

Frequently asked questions

The full address is FIDELITY INVESTMENTS INSTITUTIONAL OPERATIONS CO. 100 MAGELLAN WAY KW1C COVINGTON, KY 41015-1987.

Yes, Fidelity Investments Institutional Operations Co. is a subsidiary of Fidelity Investments and provides tax forms for Fidelity brokerage accounts.

No, Fidelity does not provide tax advice. If you have questions about reporting the information on your tax forms, consult a tax professional.