Inheritance tax is a tax paid by the heirs of a deceased person on the assets they receive from the estate. While there are no federal inheritance taxes in the United States, certain states impose their own inheritance tax, and these vary from state to state. For example, Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania currently impose an inheritance tax. The amount of inheritance tax owed depends on factors such as the value of the assets and the relationship between the deceased and the heir. Heirs should also be aware of any federal taxes and the regulations and exemptions at the state level, which can impact their inheritance. This paragraph aims to provide an introduction to the topic of inheritance tax from mutual fund investments, which will be discussed in further detail in the following article.

| Characteristics | Values |

|---|---|

| Who pays inheritance tax? | The beneficiary who receives the assets. |

| Where is inheritance tax levied? | In the United States, at state level. |

| How is the amount of inheritance tax calculated? | Based on the value of the assets being inherited and the relationship between the deceased and their heir. |

| What is the difference between inheritance tax and estate tax? | Inheritance tax is paid by the heir on the assets they receive from the estate. Estate tax is paid by the estate itself, based on the net value of that estate. |

| Are there federal inheritance taxes in the US? | No, but certain states have their own laws. |

| How many states impose an inheritance tax? | 6: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. |

| What are the inheritance tax rates in Pennsylvania? | Range from 0% to 15% depending on the relationship between the deceased and the heir. Spouses are exempt, while direct lineal descendants pay 4.5%, siblings pay 12%, and other heirs pay 15%. |

| What are the inheritance tax thresholds? | Thresholds vary by state. |

| What are some strategies for reducing inheritance taxes? | Estate planning: making gifts to heirs or charities, or setting up an irrevocable trust. |

| What are the tax implications of inheriting mutual funds? | The transfer of a mutual fund is tax-free, but the income generated thereafter is taxable. The tax treatment depends on the type of mutual fund and the holding period. |

| What are the tax treatments of mutual fund investments? | Calculating capital gains: the holding period determines whether they are taxed at long-term or short-term capital gains rates. |

What You'll Learn

Mutual fund inheritance and federal tax

When it comes to inheriting mutual funds, the tax implications can be complex, and they vary depending on the type of account and the relationship between the deceased and the heir. Here is an overview of how mutual fund inheritance is taxed at the federal level and some specific scenarios to consider:

Federal Inheritance Tax:

At the federal level in the United States, there is no inheritance tax. However, this is different from estate tax, which is a tax paid by the estate of the deceased based on its net value. While there is no federal inheritance tax, some states do impose inheritance taxes, and the rates vary. Currently, only six states impose an inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. The tax rates in these states depend on the relationship between the deceased and the heir, with spouses usually being exempt.

Mutual Fund Inheritance in Taxable Accounts:

When inheriting mutual fund shares in regular taxable accounts, the tax basis is adjusted to the value of the shares on the date of the original owner's death. This is known as the "step-up" rule and applies to all fund shares, regardless of when they were purchased. This rule simplifies the tax liability for heirs, as they won't owe any taxes if they sell the shares immediately after the owner's death. However, if they hold on to the shares, they will owe taxes on the difference between the stepped-up basis and the sale price.

Mutual Fund Inheritance in Retirement Accounts:

The rules for inheriting mutual funds held in retirement accounts, such as traditional IRAs or 401(k)s, are more complicated. In these cases, the basis step-up rule does not apply. If the heir is a spouse, they can roll the funds into their own retirement account and postpone taxes until they reach the age of 73. For other heirs, the rules vary depending on the relationship to the deceased and the type of account. In general, the sale of funds inside the retirement account won't trigger taxes, but the distribution of proceeds will be taxable income.

Holding Period Considerations:

The holding period of inherited mutual funds also affects the taxation rate. If the funds are held for a short-term period (usually up to one year), any gains are taxed at short-term capital gains rates. If the funds are held for a longer period, the gains are taxed at long-term capital gains rates, which are typically lower. It's important to note that in cases of inheritance, the holding period is calculated from the original date of purchase by the deceased, not the date the current owner acquired the funds.

In conclusion, while inheriting mutual funds can seem daunting from a tax perspective, understanding the specific rules and regulations can help heirs make informed decisions and minimise their tax liability. Consulting with a financial advisor or tax professional is always recommended to ensure compliance with the applicable laws and to make the most of any available tax breaks.

High-Yield Bond Funds: When to Invest and Why

You may want to see also

State inheritance tax

As of June 2021, 17 states and Washington, D.C., levy an estate or inheritance tax. These include:

- Connecticut

- Hawaii

- Illinois

- Iowa

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Nebraska

- New Jersey

- New York

- Oregon

- Pennsylvania

- Rhode Island

- Vermont

- Washington

The federal government does not levy inheritance taxes, but some states impose them on bequests. It is important to check with your state revenue department to understand if your state has inheritance taxes.

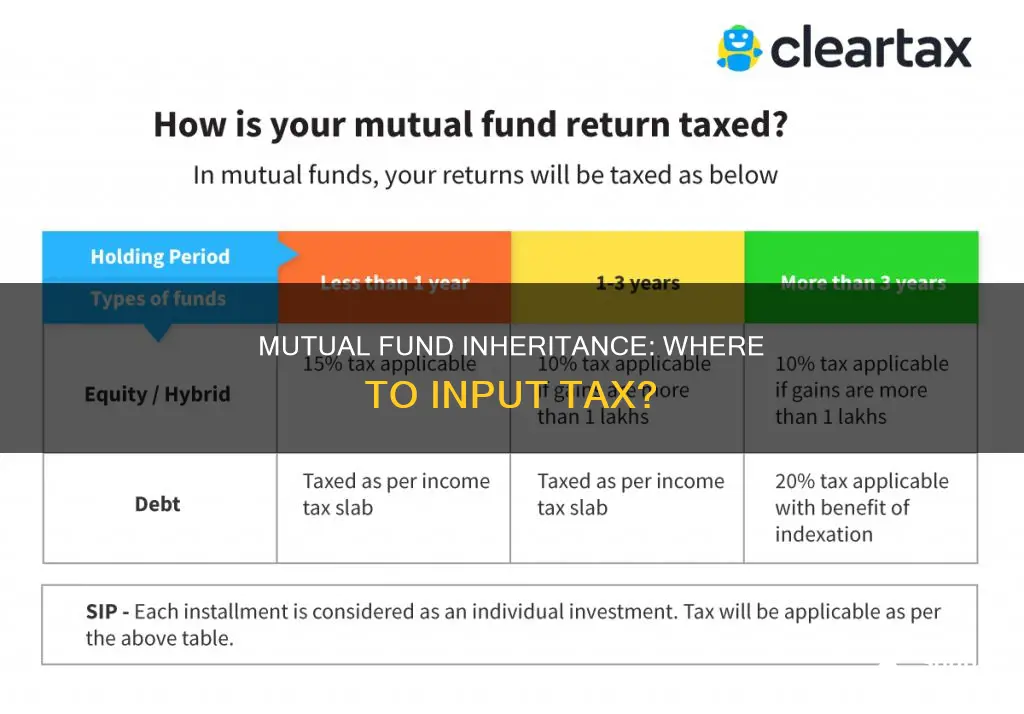

The tax treatment of mutual fund investments depends on whether they are classified as long-term or short-term capital assets, based on the holding period. For example, equity-oriented mutual funds held for up to a year are considered short-term capital gains and taxed at 15%, while those held for over a year are taxed at 10%.

The Mindset of Investment Fund Managers: Traits and Insights

You may want to see also

Capital gains tax

When it comes to inheriting mutual funds, the tax implications can be complex, and it's important to understand the different types of taxes that may be involved. One of the main taxes to consider is capital gains tax.

In the context of inheriting mutual funds, the holding period is calculated from the original date of purchase by the deceased owner, not the date the current owner received the funds. This means that if the mutual fund units are redeemed or sold after being transferred to the heir, the capital gains tax will be calculated based on the difference between the original purchase price and the sale price. Any profit made will be subject to capital gains tax.

For equity-oriented mutual funds, if the holding period is up to one year, the gains are considered short-term capital gains and are typically taxed at a higher rate, such as the ordinary income tax rate. On the other hand, if the holding period exceeds one year, the gains are classified as long-term capital gains, often taxed at a lower rate. It's important to note that specific tax rates may vary depending on the jurisdiction and applicable tax laws.

For non-equity-oriented mutual funds, the distinction between short-term and long-term capital gains is different. If the holding period is up to three years, the gains are considered short-term capital gains and are added to the taxpayer's income, taxed according to their income tax slab. When the holding period exceeds three years, the gains are classified as long-term capital gains and typically taxed at a specified long-term capital gains tax rate.

It's worth noting that in some jurisdictions, there may be exemptions or thresholds for long-term capital gains, where a certain amount of gain is exempt from taxation. Additionally, the process of transferring mutual fund units to a nominee or legal heir after the death of the original owner is usually not subject to any tax. However, once the units are transferred, the new owner may be liable to pay capital gains tax if they choose to redeem or sell the units, regardless of the timing.

When dealing with inherited mutual funds, it's important to consult with a tax professional or financial advisor to ensure compliance with the applicable tax laws and to take advantage of any available tax breaks or exemptions.

Index Funds: Where to Start Your Investment Journey

You may want to see also

Tax basis for inherited mutual fund shares

When you inherit mutual fund shares, you will need to consider the tax basis and the tax implications if you want to sell them for reinvestment or cash. The tax basis for inherited mutual fund shares is generally subject to what is known as the basis step-up rule. This means that the tax basis is "stepped up" to the fair market value of the shares on the date of the original owner's death. This is true for all fund shares, regardless of when they were bought or how they were obtained.

The basis step-up rule simplifies the tax implications for heirs and can result in significant tax savings compared to the potential tax liability that the deceased person would have paid on a sale. For example, if your father paid $75 for shares that were worth $575 on the day he died, your basis would be $575. You won't owe any taxes if you sell the shares immediately, but if you hold on to them, you will owe taxes (or be eligible to claim a loss) on the difference between $575 and the sale price.

It is important to notify the investment account custodian of the date of death to ensure that you get the benefit of the step-up in basis. Working with a qualified tax advisor can help you take full advantage of your inherited assets and ensure you are complying with the relevant tax laws.

It is worth noting that the basis step-up rule does not apply to inherited mutual fund shares held in retirement accounts, such as IRAs or 401(k)s. These shares follow the same distribution and tax rules as they would for the original owner. Additionally, while there are no inheritance taxes at the federal level in some jurisdictions, there may be state-level inheritance taxes that apply to your mutual fund inheritance.

IRA Investment Strategies: Where to Invest for Maximum Returns

You may want to see also

Tax exemptions

The federal government does not impose inheritance tax, but certain states do. As of 2023, six states have an inheritance tax in place. However, there is a federal estate tax, which is imposed on the assets of the deceased, including real estate, cash, insurance, securities, and business interests. This is separate from the state inheritance tax, which is levied against the inheritors.

In states with an inheritance tax, the amount being distributed to inheritors will typically have to reach a certain threshold for the inheritance tax to apply. The exact threshold varies from state to state, and inheritors may be able to take advantage of more state-level exemptions depending on their relationship to the deceased and other factors.

For example, spouses can enjoy certain tax breaks and exemptions that are not available for adult children or other heirs. If one spouse dies, the surviving spouse can usually take over the IRA as their own and will not be taxed on the sale of the funds inside the retirement account. Required minimum distributions would typically begin at age 73.

If you inherit a traditional IRA from someone other than your spouse, you can transfer the funds to an inherited IRA in your name. You can then decide on a distribution method: either based on your life expectancy or by taking the money out all at once by the end of the year after the account holder died. If the decedent was under 73, you also have the option to take out all the money within ten years after the year of the account holder's death.

There is also a tax exemption for those who inherit a Roth IRA. While you are still required to deplete the account within ten years, the withdrawals are tax-free.

The tax basis for inherited mutual fund shares in taxable accounts is also exempt from taxes. This is known as the basis step-up rule. The tax basis gets "stepped up" to whatever the fund's value was on the date of the original owner's death, regardless of when the funds were bought or whether they were obtained through outright purchase or reinvestment of fund distributions. This means that if you sell inherited fund shares shortly after death, you will likely only have a minimal gain or loss, as long as the fund's share price hasn't changed dramatically.

IRA Investment Options: Mutual Funds or ETFs?

You may want to see also

Frequently asked questions

In the US, there is no federal inheritance tax. However, certain states do impose inheritance tax on bequests, so you may owe money from your mutual fund inheritance depending on where you live.

The amount of inheritance tax owed is calculated based on the value of the assets being inherited and the relationship between the deceased and the heir. For example, in Pennsylvania, spouses are exempt from paying inheritance tax, while direct lineal descendants must pay 4.5% on inherited property, siblings of the deceased must pay 12%, and other heirs must pay 15%.

The beneficiary who receives the assets is responsible for paying the inheritance tax. You should check the specific laws for your state to understand your personal liability.

Yes, through estate planning, there are several ways to reduce or eliminate inheritance taxes. For example, during their lifetime, benefactors could consider making gifts to their heirs or setting up an irrevocable trust. Trusts can be used to transfer assets in a way that minimizes inheritance tax liability.