The Vanguard 529 Plan is a tax-advantaged college savings plan that can be used to save for college, vocational school, or trade school. Sponsored by the state of Nevada, the plan offers low costs, experience, and easy-to-manage savings options. It provides a variety of investment choices, including target enrollment portfolios, individual portfolios, money market portfolios, and U.S. and international stock and bond portfolios. The Vanguard 529 Plan is available to residents of any state and offers tax benefits such as state tax deductions and tax-free withdrawals for qualified education expenses. With more than 350,000 investors across all 50 states, it is one of the largest 529 plans in the country.

| Characteristics | Values |

|---|---|

| Name | The Vanguard 529 College Savings Plan |

| Administered by | The office of the Nevada State Treasurer |

| Available to | Residents of any state |

| Investment options | Age-based, static, individual |

| Minimum investment amount | $1 |

| Investment portfolios | Over 30, including money market, U.S. bond, U.S. stock, international bond, international stock |

| Tax benefits | State tax deductions, tax-deferred growth, tax-free withdrawals for qualified education expenses |

| Use of savings | Tuition, apprenticeship programs, room and board, fees, books, supplies, equipment, computer hardware and software, internet access |

| Beneficiary | Child, grandchild, or any qualified family member |

What You'll Learn

State tax benefits

The Vanguard 529 College Savings Plan is a Nevada Trust, but investors do not need to be Nevada residents, nor does the beneficiary need to attend a Nevada school. The plan is sponsored by the state of Nevada and administered by the office of the Nevada State Treasurer.

The Vanguard 529 Plan is a tax-advantaged account, specifically for education savings. Your contributions could be state tax-deductible, and you could benefit from tax-deferred growth and tax-free withdrawals for qualified education expenses.

Some states allow you to invest in any 529 plan and get a state tax deduction. For example, New York and Colorado offer generous tax deductions for their residents who sign up for their 529 plans, which include Vanguard investments.

If you are not a Nevada taxpayer, consider whether your home state offers any state tax benefits that are only available for investments in its qualified tuition program. Other state benefits may include financial aid, scholarship funds, and protection from creditors.

The availability of tax or other benefits may be contingent on meeting other requirements. You should consult your own tax advisor for more information on the tax implications and benefits or disadvantages of investing in a 529 plan based on your particular circumstances.

Why Investment Funds Need Broker-Dealers: A Strategic Partnership

You may want to see also

Fees and costs

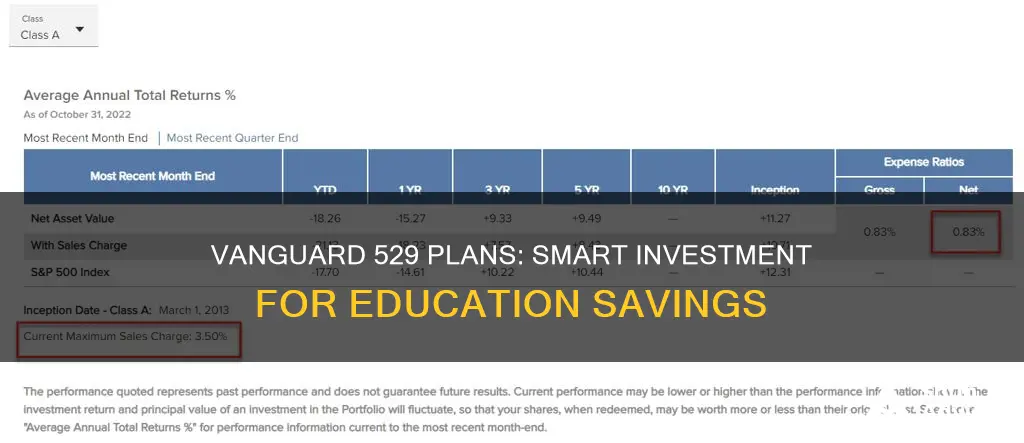

The expense ratios for the Vanguard 529 Plan are as follows:

- Target Enrollment portfolios: 0.14%

- Individual portfolios: 0.12%–0.42%

It's worth noting that Vanguard has cut its expenses 10 times since the plan was introduced in 2002, demonstrating its commitment to keeping costs low for investors.

When comparing 529 plans, it's important to consider the impact of fees and costs on your savings. Even a small difference in expense ratios can make a significant difference over time. For example, with a $10,000 investment and an average annual 6% return over 18 years, a 0.50% expense ratio would result in $2,328.73 less in your final balance compared to a 0.14% expense ratio.

In addition to the Vanguard 529 Plan, Vanguard also manages 529 plans for other states, such as Iowa, New York, and Colorado, which have lower minimum investment requirements. For example, New York's plan has no minimum contribution, while Colorado's plan has a minimum of $25. These plans may offer different fee structures, so be sure to review the details of each plan before making a decision.

Overall, when choosing a 529 plan, it's important to consider the fees and costs involved, as they can significantly impact your savings over time. Vanguard's 529 plans offer low expense ratios and no additional fees, making them a competitive option for those looking to maximize their education savings.

Choosing a Fund: Key Factors for Smart Investing

You may want to see also

Investment choices

Target Enrollment Portfolios (TEPs)

TEPs are ideal for those who want a hands-off approach to investing. These portfolios automatically adjust their allocation to account for risk based on your student's expected year of enrollment. Vanguard offers a range of TEPs with target enrollment years from 2022/2023 to 2042/2043.

Individual 529 Portfolios

If you prefer a more hands-on approach, you can design your own investment strategy by choosing from Vanguard's 20 individual portfolios. You can select up to 5 portfolios at a time and manage the mix based on your time horizon and risk tolerance.

Money Market Portfolios

These portfolios provide limited exposure to market risk and are suitable for short-term cash needs.

U.S. Bond Portfolios

U.S. bond portfolios offer the potential for income and help offset the risk of stock portfolios within a well-balanced portfolio. Investing in U.S. bonds can provide diversification and stability to your investment strategy.

U.S. Stock Portfolios

U.S. stock portfolios offer the most potential for growth compared to money market and bond portfolios. However, they also come with a higher level of risk, which can be mitigated by including bond portfolios in a well-balanced portfolio.

International Bond Portfolios

International bond portfolios add diversification to a U.S.-focused portfolio and provide the potential for income. They help offset the risk of stocks and provide exposure to global bond markets.

International Stock Portfolios

International stock portfolios add a layer of diversification to your U.S. holdings and provide more growth potential compared to international bonds. While they carry a higher level of risk, this can be managed by including bonds in your overall portfolio.

The Vanguard 529 Plan allows you to build a portfolio that aligns with your investment goals and risk tolerance. Whether you prefer a hands-off approach with TEPs or the flexibility of designing your own portfolio, Vanguard offers a range of investment choices to help you save for education.

Mutual Fund Strategies: Deposits and Investments Timeline

You may want to see also

Initial investment amount

When choosing a 529 plan, it's important to consider the initial investment amount that fits your budget. Contributing a large sum of money upfront is an effective way to jump-start your savings journey. However, it's understandable that this may not be feasible for everyone.

The Vanguard 529 Plan, sponsored by the state of Nevada, does not impose a minimum contribution requirement. This flexibility allows you to start saving for your education goals without being constrained by a predetermined initial investment amount. Whether you're saving for college, vocational school, or a trade school, The Vanguard 529 Plan offers a range of investment portfolios to choose from.

In addition to The Vanguard 529 Plan, there are other 529 plans associated with Vanguard that you can consider. For instance, if you reside in New York, you can benefit from the New York's 529 College Savings Program Direct Plan, which also features Vanguard investments. This plan has no minimum contribution requirement, making it accessible for those who want to start saving without a large initial investment. Moreover, New York state residents who enrol in this plan can take advantage of a substantial tax deduction.

On the other hand, if you're based in Colorado, the Colorado CollegeInvest® Direct Portfolio College Savings Plan is another option. This plan has a low minimum contribution of $25 to open an account and $15 for additional contributions. Similar to the New York plan, Colorado residents who enrol can benefit from a tax deduction.

By considering the initial investment amount that aligns with your financial situation, you can make informed decisions about which 529 plan to choose, ensuring that you're on the right path towards achieving your education savings goals.

Mutual Fund Investment: Strategies, Risks, and Rewards

You may want to see also

Investment options

The Vanguard 529 Plan, sponsored by the state of Nevada, offers a variety of investment options. The plan is available to residents of any state and offers low costs, experience, and easy-to-manage savings options.

The Vanguard 529 Plan includes over 30 portfolios to choose from, including Target Enrollment Portfolios (TEPs) and individual 529 portfolios. TEPs are ideal for those who want a hands-off approach to investing, as the portfolio automatically adjusts its allocation to account for risk based on the student's expected year of enrollment. Individual 529 portfolios, on the other hand, allow investors to design and manage their own investment strategies by choosing from a range of individual portfolios. Vanguard offers 20 individual portfolios, and investors can select up to five portfolios at a time to create a customised mix based on their time horizon and risk tolerance.

The Vanguard 529 Plan also offers money market portfolios, which provide limited exposure to market risk and serve as a short-term cash parking place. US bond portfolios are another option, offering potential income and helping to offset the risk of stock portfolios within a balanced portfolio. US stock portfolios provide the most potential for growth but also come with higher risk, which can be mitigated by including bond portfolios in a balanced portfolio.

International bond and stock portfolios are also available, adding diversification to US-focused portfolios and providing income and growth potential. These portfolios can invest in hundreds or even thousands of international bonds or stocks, respectively.

Vision Fund's WeWork Investment: A Bold Move?

You may want to see also