Mutual funds are a popular investment vehicle for both individual and professional investors, providing a way to diversify one's portfolio and access a wide range of assets. When considering which country to invest in mutual funds, it is important to understand that each country has its own regulatory environment and rules governing the construction of mutual funds. For example, a mutual fund based in Europe will have different regulations than one certified for investment accounts in Hong Kong. Additionally, international funds, which invest in companies outside of the investor's home country, can provide access to global markets and potentially higher returns, but they also carry greater risk. When deciding where to invest in mutual funds, it is crucial to consider factors such as the country's economic stability, market performance, and the investor's risk tolerance.

| Characteristics | Values |

|---|---|

| Top investment destination in Europe | Luxembourg |

| Top investment destination in the world | United States |

| Top destination for business purposes in Asia | Hong Kong |

| Top destination for private wealth management services | Singapore |

| Top investment fund jurisdiction in Europe | Malta |

| One of the most appreciated financial centres in the world | Switzerland |

| Top investment fund destination in Europe | Liechtenstein |

| Top investment destination in the Middle East | UAE |

| Top investment destination in the US | Delaware |

What You'll Learn

Mutual funds differ around the world

For example, in the United States, mutual funds must be registered with the Securities and Exchange Commission (SEC) and comply with US securities laws. This provides protection for US investors, as they can be confident that the funds they invest in are regulated according to US standards. On the other hand, funds in Hong Kong are governed by two regulatory bodies: the Securities and Futures Commission (SFC) and the Mandatory Provident Fund Schemes Authority (MPFSA). The MPFSA has more restrictive rules, as it specifically focuses on protecting the retirement savings of Hong Kong residents by limiting investments in speculative assets.

In Europe, mutual funds are governed by the Undertakings for Collective Investment in Transferable Securities (UCITS) regulations, which ensure diversification and risk monitoring. To market a fund across all member countries of the European Union, registration in one EU country under the authority of that country's financial regulator is sufficient. Luxembourg, for instance, is a top investment destination in Europe, offering a wide range of investment vehicles for all types of investors.

Other countries, such as the Netherlands, Ireland, and Cyprus, also have their own regulatory frameworks for mutual funds, which may be influenced by EU directives. For instance, the Netherlands has implemented the Alternative Investment Fund Managers Directive, which regulates hedge fund startups and similar investment vehicles.

Outside of Europe and North America, countries like Panama, Seychelles, and Singapore are also attractive destinations for investment funds due to their favourable tax regimes and strong banking industries. Singapore, in particular, is expected to become the world-leading jurisdiction for private wealth management services by 2020.

When considering mutual fund investments, it is essential to understand the specific regulations and structures of the country or region in which the fund is based. These differences can significantly impact the funds available, the level of investor protection, and the potential risks and returns.

Hedge Fund GPs: Benefits of Investing in Their Own Fund

You may want to see also

International diversification

By investing internationally, investors can buffer against potential stagnation and potentially reap above-average returns. Scott Klimo, chief investment officer at Saturna Capital, explains that adding international stocks to a portfolio can "dampen volatility and improve returns" as the US economy and international regions may face challenges at different times. Mitigating currency risk is also a factor, as the US dollar may strengthen or weaken against other currencies.

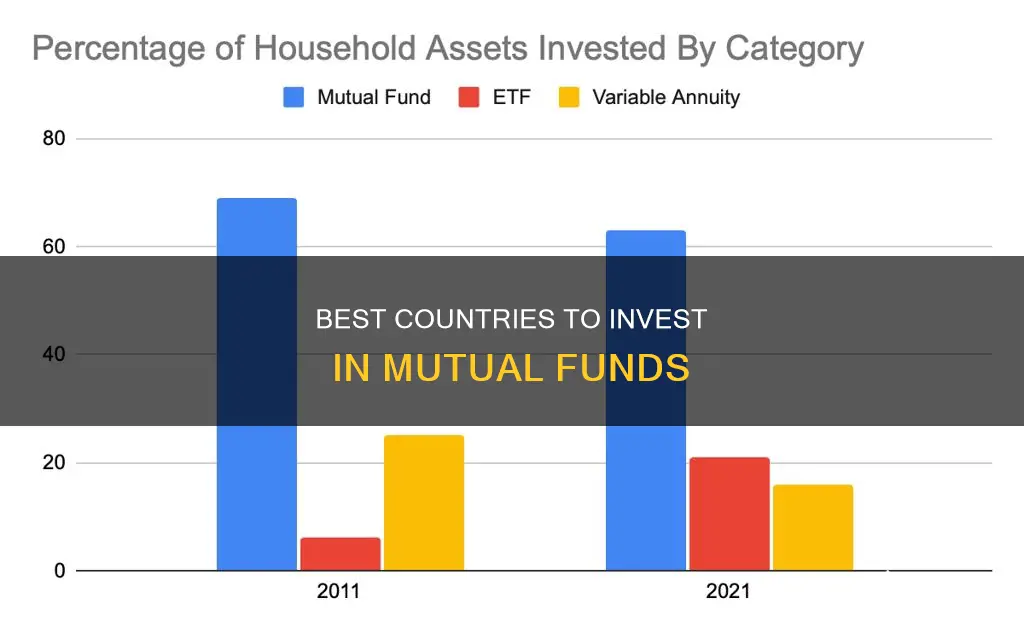

There are now more opportunities than ever to access international markets, with mutual funds and exchange-traded funds (ETFs) offering a straightforward alternative to dealing with American depositary receipts (ADRs) or currency conversions.

- Fidelity International Index Fund (FSPSX)

- Vanguard Total International Stock ETF (VXUS)

- IShares Core MSCI EAFE ETF (IEFA)

- IShares Core MSCI Emerging Markets ETF (IEMG)

- Schwab Fundamental International Small Company Index Fund (SFILX)

- KraneShares CSI China Internet ETF (KWEB)

- Emerging Markets Internet & Ecommerce ETF (EMQQ)

It is important to note that investing in foreign markets can involve greater risk and volatility than US investments due to various factors such as adverse market conditions, currency fluctuations, economic and political issues, and regulatory differences.

TSP F Fund: Best Times to Invest and Why

You may want to see also

Top investment destinations

When it comes to investing in mutual funds, there are several countries that stand out as attractive destinations. Here are some of the top investment destinations to consider:

Luxembourg

Luxembourg is a top investment destination in Europe. The country's economy is primarily based on financial services, and it offers a wide range of investment vehicles that cater to all types of investors. Luxembourg's investment market is characterized by three main pillars: UCITS (Undertakings for Collective Investment in Transferable Securities), alternative investment funds, and funds dedicated to responsible investments. The country's legislation is designed to accommodate a variety of local and foreign investors, including institutional, retail, and qualified investors.

The Netherlands

The legislative framework for investment funds in the Netherlands follows the regulations for UCITS and AIFs (Alternative Investment Funds). As a member state of the European Union, the Netherlands adheres to the directives of the EU. The country has also implemented the Alternative Investment Fund Managers Directive, which regulates the registration and activity of hedge fund startups and similar investment vehicles. Investors can benefit from certain exemptions related to tax compliance and licensing requirements, depending on the type of fund they invest in.

Ireland

Ireland has transformed itself into one of the leading financial centers in Europe, making it an attractive destination for investors interested in hedge fund startups. The country is home to a large number of fund managers and a significant proportion of international fund managers have established Irish investment funds. In 2017, the Irish investment market was characterized by a large proportion of assets held under UCITS funds, with a total value of EUR 1,831 billion, while EUR 566 billion was held in AIFs.

Singapore

Singapore is a top destination for foreign investors looking for attractive conditions in private wealth management services. This sector is expected to grow and become a world-leading jurisdiction by 2020. Singapore is also a top destination for infrastructure investments.

The United States – Delaware

When considering the United States as an investment destination, Delaware stands out as a top choice among professional investors worldwide. Hedge funds are the most appealing type of investment fund in Delaware due to the various tax advantages offered. Additionally, investment companies administering funds can benefit from tax exemptions under the Securities Act and the Investment Company Act. Other advantages of choosing Delaware include the absence of income, sales, or property taxes, enhanced privacy for founders when created through a limited liability company, and low registration taxes.

Other Notable Destinations

Other countries that are worth considering for mutual fund investments include Switzerland, Liechtenstein, Bermuda, the United Arab Emirates, and Malta. These countries offer favorable tax regimes, stable economic and banking systems, and a variety of investment fund options.

Tax-Exempt Bond Funds: When to Invest for Maximum Returns

You may want to see also

Tax advantages for foreign investors

The United States is a popular destination for foreign investment, offering a robust economy and diverse market sectors. The US tax code provides several benefits to foreign investors, including:

Reduced Tax Rates

The US has tax treaties with many countries that effectively reduce tax rates on certain types of income, such as dividends, interest, and royalties. These treaties lower the tax liabilities for foreign investors.

Tax Credits

Some specific investments may qualify for tax credits, directly reducing the amount of tax owed. For example, investments in renewable energy projects may qualify for the Renewable Energy Tax Credit.

Depreciation Deductions

Foreign investors with real estate in the US can take advantage of depreciation deductions, which allow them to deduct a portion of the property's cost each year, reducing their taxable income.

Exemption from Estate Tax

Under certain conditions, foreign investors who plan to pass their US assets to heirs may be exempt from US estate tax.

EB-5 Investor Visa Program

While not a direct tax benefit, the EB-5 visa program offers a pathway to permanent residency for foreign investors who make significant investments in new commercial enterprises that create jobs for US workers. This provides indirect tax advantages and other benefits, such as freedom to live, work, and study in the US.

Foreign Tax Credit

If a foreign investor pays income tax in their home country on their US-sourced income, they may claim a foreign tax credit on their US tax return, reducing their US tax liability. This helps to avoid double taxation, a common concern for international investors.

Bond Funds: Best Time to Invest and Why

You may want to see also

Mutual funds for foreign investors in the US

Foreign investors are legally allowed to purchase US mutual funds, however, there are some restrictions and additional steps that investors should be aware of.

Firstly, it is important to understand that US securities laws do not prohibit investments by foreign investors, but they do offer the same protections to foreign investors as they do to US citizens. Many companies that sell proprietary mutual funds have internal restrictions that prevent investors who cannot provide a US address from investing. Therefore, foreign investors who have a US address and want to buy mutual funds will likely be required to supply an IRS Form W-8BEN, which certifies the foreign status of the beneficial owner of the mutual fund account.

For foreign investors residing abroad, mutual fund companies are often less comfortable with the potential application of foreign securities laws, and sales may be restricted even for US citizens living abroad. In these cases, foreign investors can explore alternative options to direct investment, such as using brokerage accounts or working with financial institutions in their home countries to gain access to mutual fund investments.

When investing through a brokerage account, the broker must be comfortable working with foreign investors, as purchases made through the account will not trigger issues with the mutual fund company. This option may be more feasible for investors from countries with close economic ties to the US, as financial institutions in these countries can more easily facilitate foreign investment.

Additionally, foreign investors should be aware of the requirements of the Patriot Act, which mandates that US financial institutions and brokerages identify investors before conducting business. This typically involves providing an official photo ID, such as a passport, and some brokerages may also require face-to-face meetings to positively confirm the investor's identity.

Furthermore, federal tax regulations require foreign investors to register with the IRS by completing an IRS Form W-8BEN Certificate of Foreign Status of Beneficial Owner. This form can be completed by the investor directly or through an American brokerage or financial institution. Foreign nationals living outside the US can also apply for an exemption from American tax withholding on their investment returns by filing an IRS form. This exemption is typically granted to those who never enter the US or visit only occasionally.

It is worth noting that US mutual funds are regulated differently from those in other countries. All mutual funds marketed to US retail investors must be registered with the Securities and Exchange Commission (SEC) and must abide by the rules set forth under the Investment Company Act of 1940, often referred to as the '40s Act'. These regulations aim to protect consumers and ensure that asset managers act in the best interests of the investors.

When considering investing in US mutual funds, foreign investors should carefully review the available options and ensure they understand the applicable laws and regulations. By working with the right financial institutions and seeking appropriate advice, foreign investors can successfully navigate the process of investing in US mutual funds.

Sovereign Wealth Funds: Global Investment Strategies and Secrets

You may want to see also

Frequently asked questions

Mutual funds are a popular investment tool for those looking to beat the market or simply access a wide range of investments. They offer diversification, professional management, and a variety of offerings.

Mutual funds have high fees, commissions, and other expenses. They also often have a large cash presence in portfolios and lack transparency in holdings.

This depends on your risk tolerance and investment objectives. For those looking for international diversification, mutual funds in developed markets such as Japan, Germany, France, Australia, and the UK have yielded strong returns. For higher risk tolerance, emerging markets such as China, India, Brazil, Russia, and South Africa have delivered stellar returns.