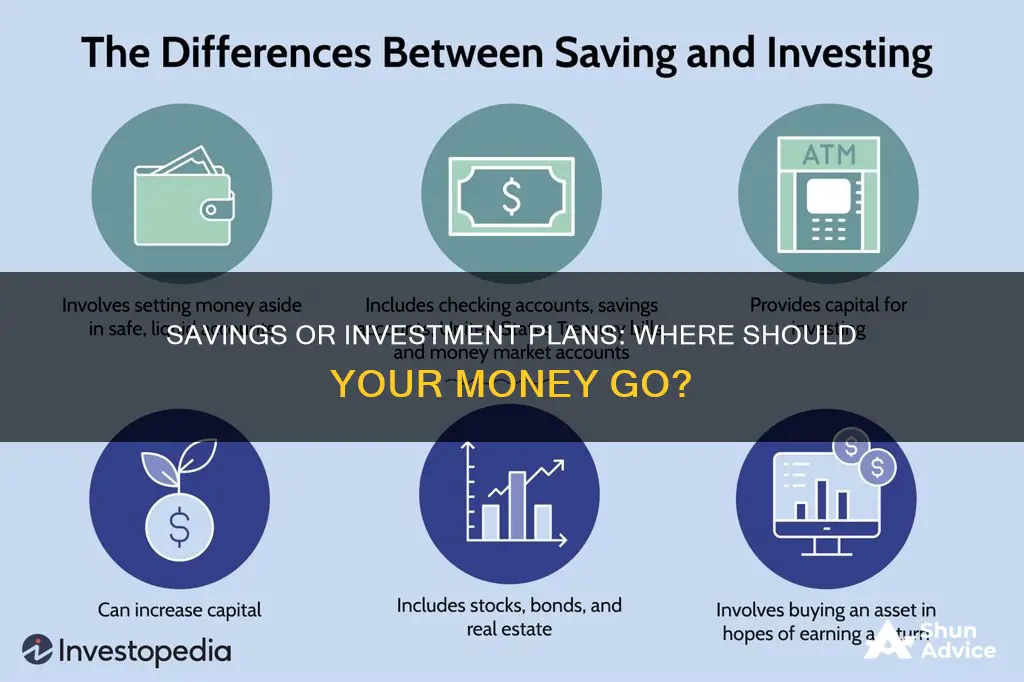

Savings and investment plans are both important for building a sound financial future, but they serve different purposes and come with distinct advantages and drawbacks. Saving typically involves lower risk and provides more immediate access to funds, making it ideal for short-term goals and emergency funds. On the other hand, investing offers the potential for higher returns but carries a higher risk of loss and is more suitable for long-term financial goals. Understanding the differences between these options is crucial for effective financial planning.

| Characteristics | Values |

|---|---|

| Risk | Savings plans are safer than investment plans but have lower returns |

| Returns | Savings plans have lower returns than investment plans |

| Time horizon | Savings plans can be used for long-term goals or emergencies, while investment plans are long-term commitments |

| Returns | Savings plans can be participating or non-participating, rewarding long-term customers with bonuses or offering guaranteed returns, respectively |

| Returns | Investment plans are market-linked and usually offer higher returns |

| Risk | Savings plans are suitable for those who are not willing to take a higher risk and can tolerate moderate risk |

| Risk | The risks associated with investment plans are higher as the money is invested in market-linked products |

| Wealth creation | Investment plans are a preferred tool for wealth creation |

| Inflation | Investment plans are designed to deliver returns to combat inflation |

| Returns | Investment plans have the potential to generate high returns over the long term |

| Risk | Savings plans are for those with a lower tolerance for risk |

| Life insurance | Part of the premium for savings plans goes towards a life insurance cover |

What You'll Learn

Liquidity and accessibility

Savings plans typically offer high liquidity, meaning you can easily access your funds in case of emergencies or unexpected expenses. Traditional savings accounts generally allow up to six monthly withdrawals without incurring a penalty. While there may be some restrictions and penalties for early withdrawals, savings plans provide relatively quick access to your money. This makes savings plans suitable for short-term financial goals and emergency funds.

On the other hand, investment plans usually have a longer investment horizon and are designed for long-term financial goals. While investing in stocks, bonds, mutual funds, or exchange-traded funds (ETFs) offers the potential for higher returns, it also comes with a higher level of risk. There is always the possibility of losing some or all of your investment capital. Therefore, investment plans are better suited for long-term commitments, where you are willing to take on higher risk to protect and increase the value of your savings.

When it comes to accessibility, savings plans are more readily accessible through traditional banks or credit unions. You can often manage your savings account online, via mobile banking, or in-person at a branch. In contrast, investment plans may require opening an account with an independent broker or a brokerage arm of a bank. Popular online investment brokers include platforms like Charles Schwab, Fidelity, and Interactive Brokers.

It is worth noting that both savings and investment plans serve different purposes and come with their own sets of advantages and disadvantages. Savings plans offer lower returns but with minimal risk, while investment plans provide the opportunity for higher returns but carry a higher risk of loss. Ultimately, the decision between a guaranteed savings plan and an investment plan depends on your financial goals, risk tolerance, and time horizon.

Tracking Savings and Investments: Quicken's Smart Money Management

You may want to see also

Risk and volatility

Guaranteed savings plans are considered a safer option as they offer a fixed or guaranteed return on your savings. These plans typically involve low risk and provide a moderate return over the long term. The returns are usually predetermined and remain constant throughout the duration of the plan. This means that, regardless of market conditions, you can be certain that your savings will yield a specific amount. This type of plan is ideal for those with a low-risk appetite who want to avoid potential losses.

On the other hand, investment plans carry a higher level of risk. These plans often involve investing in market-linked products such as stocks, bonds, mutual funds, or a combination of different asset classes. The returns on investment plans are generally higher than those of savings plans but are not guaranteed. The performance of your investments will depend on market conditions and the specific assets you choose. While there is a potential for significant gains, there is also the possibility of losing some or all of your investment.

The level of risk you are comfortable with will depend on your financial goals, risk tolerance, and time horizon. If you are saving for short-term goals or need immediate access to your funds, a guaranteed savings plan may be more suitable. This type of plan provides stability and security, ensuring that your savings remain relatively unaffected by market volatility.

However, if you are saving for long-term goals and are willing to take on more risk, investment plans offer the potential for higher returns. By investing in a diverse range of assets, you can mitigate some of the risks associated with market volatility. Additionally, investment plans can help combat inflation and preserve the value of your money over time.

It's important to remember that both options have their advantages and disadvantages, and the right choice depends on your individual circumstances. Conducting thorough research and seeking professional advice can help you make an informed decision that aligns with your financial goals and risk tolerance.

Saving and Investing: Pros, Cons, and Your Money

You may want to see also

Returns and yield

The returns and yield of a savings or investment plan are important factors to consider when deciding which is better for your financial goals. Both options offer different potential outcomes in terms of returns and risk. Here's a more detailed look at the returns and yield of guaranteed savings plans and investment plans:

Guaranteed Savings Plans

Guaranteed savings plans offer a moderate level of risk and potential returns. These plans typically fall into two categories: participating and non-participating. Participating plans reward long-term customers with bonuses, while non-participating plans offer guaranteed returns without any bonus component. The returns on guaranteed savings plans are generally lower compared to investment plans, but they come with less risk. These plans are ideal for individuals with a lower risk tolerance who want to secure their savings and accumulate a corpus over the long term. The returns on guaranteed savings plans are also predictable and stable, making them a good option for those who want to avoid the volatility associated with investments.

Investment Plans

Investment plans, on the other hand, offer the potential for higher returns but come with a higher level of risk. These plans are typically market-linked, which means their performance is tied to the financial markets. While there is a chance of losing some or all of your investment, the potential for higher returns makes investment plans attractive for those seeking wealth creation. The returns on investment plans can be influenced by various factors, such as market conditions, fund performance, and the expertise of fund managers. By investing in different asset classes such as equity funds, debt funds, or a combination of both, investment plans aim to maximize returns over the long term. However, it's important to note that investment plans usually have a longer timeline, and individuals need to remain invested for a longer period to maximize their returns.

Comparison

When comparing the returns and yield of guaranteed savings plans and investment plans, it's clear that investment plans offer a higher potential for returns but come with a higher level of risk. Guaranteed savings plans, on the other hand, offer more moderate returns with less risk involved. The choice between the two depends on your financial goals, risk tolerance, and time horizon. If you are comfortable with taking on more risk and have a long-term investment horizon, investment plans may be more suitable. On the other hand, if you prefer a more stable and secure option with guaranteed returns, guaranteed savings plans might be a better choice. Ultimately, the decision should be based on your individual circumstances and financial objectives.

How Interest Rates Affect Savings and Investments

You may want to see also

Time horizon and commitment

The time horizon for savings plans and investment plans differs significantly. Savings plans are typically designed to help individuals meet their long-term financial goals or to provide a safety net during emergencies. On the other hand, investment plans are long-term commitments focused on protecting and increasing the value of savings over time.

When choosing a savings plan, individuals can opt for either a participating plan or a non-participating plan. Participating plans offer bonuses as rewards for long-term customers, while non-participating plans provide guaranteed returns without any bonus component. These savings plans allow individuals to accumulate a corpus systematically over the long term while also providing a life insurance element.

Investment plans, on the other hand, are financial products designed to create wealth for investors over the long term. These plans enable individuals to invest systematically in different asset classes, such as equity funds, debt funds, or a combination of both, to achieve their future life goals. The allocation of funds across various assets is managed by professional fund managers, reducing risk and maximising returns.

The key difference in time horizon and commitment lies in the nature of the investments. Savings plans are more conservative, offering moderate risks and returns, while investment plans are market-linked and carry a higher risk with the potential for higher returns.

Individuals should carefully consider their financial goals, risk tolerance, and time horizon before deciding between a savings plan and an investment plan. It is essential to conduct thorough research and understand the level of commitment required for each option to make an informed decision that aligns with their financial objectives.

Savings Investment Strategies: Accessibility and Growth

You may want to see also

Tax implications

There are several tax implications to consider when deciding between a guaranteed savings plan and an investment plan.

Savings plans are a type of life insurance product that offers guaranteed returns and can help individuals accumulate a corpus in a systematic manner over the long term. The life insurance component provides security for loved ones, while the wealth creation component enables investment growth. Savings plans typically fall into two categories: participating and non-participating. Participating plans offer bonuses to long-term customers, while non-participating plans provide guaranteed returns without any bonus. The returns from savings plans are generally lower compared to investment plans, and there is a risk of losing purchasing power over time due to inflation. However, in the United States, the Federal Deposit Insurance Corporation (FDIC) guarantees bank accounts up to $250,000 per depositor, providing a level of security for savers.

On the other hand, investment plans are financial products that enable individuals to invest money systematically in different asset classes, such as equity funds, debt funds, or a combination of both. These plans are designed to create wealth over the long term and often serve as tax-planning tools, helping to reduce tax liability. Investment plans are generally market-linked and offer higher returns compared to savings plans. However, the returns may be subject to taxes, and there is a possibility of losing some or all of the invested capital.

When choosing between a guaranteed savings plan and an investment plan, it is essential to consider the tax benefits and implications of each option. Investment plans may provide opportunities for tax savings, while savings plans may offer tax advantages through the life insurance component. Additionally, the returns from savings plans are typically guaranteed and may be insured by organizations like the FDIC in the US, providing a sense of security. However, it is important to note that the returns from investment plans have the potential to outperform those of savings plans over the long term, even after considering taxes.

Therefore, individuals should carefully evaluate their risk tolerance, investment horizon, and tax situation before deciding between a guaranteed savings plan and an investment plan. Seeking advice from a financial advisor or tax consultant can help individuals make informed decisions that align with their financial goals and tax obligations.

Savings Strategies: Where to Invest for Maximum Returns

You may want to see also

Frequently asked questions

The biggest difference is the level of risk taken. Savings typically result in lower returns but with almost no risk. In contrast, investing allows the opportunity for higher returns, but you take on the risk of loss. Savings plans are ideal for those with lower risk tolerance, whereas investment plans are better for those with a substantial corpus seeking a high rate of return.

A guaranteed savings plan is a safe option with minimal fees and quick access to funds. However, the returns are also lower, and you may lose purchasing power over time due to inflation.

An investment plan offers the potential for much higher returns and is an excellent tool for wealth creation. It can also help beat inflation, which is crucial in a country with a high inflation rate like India. However, investing comes with higher fees and a greater risk of losing money.