Real estate and mutual funds are two distinct investment avenues with unique characteristics and potential benefits. While real estate investments offer tangible assets, diversification across various sectors and assets is provided by mutual funds. Real estate investments are generally considered less volatile and more stable than mutual funds in the long run, but mutual funds have proven to be a common option for investors who wish to accumulate wealth despite inflation.

Characteristics of Land Investment vs Mutual Funds

| Characteristics | Values |

|---|---|

| Returns | Land: 7-11% per annum; 10% average 10-year return |

| Mutual Funds: 12-19% per annum; 12-14% average 10-year return | |

| Liquidity | Land: Low liquidity; can take months to find a buyer |

| Mutual Funds: High liquidity; units can be redeemed at any time | |

| Investment Amount | Land: Requires a large amount of capital |

| Mutual Funds: Requires a small amount of capital | |

| Risk | Land: Risky during economic slowdown; property price may depreciate |

| Mutual Funds: Risk minimises over a long period | |

| Tax | Land: Comes with tax benefits |

| Mutual Funds: Also comes with tax benefits |

What You'll Learn

Mutual funds offer higher liquidity and diversification

Liquidity and diversification are two key factors that favour mutual funds over real estate investments.

Liquidity refers to the ease of converting an investment into cash. Mutual funds offer high liquidity, as investors can redeem their units at any time at the prevailing market price, receiving the money in their bank account within a few business days. On the other hand, selling real estate can take months, and it can be challenging to find a buyer willing to pay a fair price. This makes it difficult to access funds quickly in times of financial need.

Diversification is another advantage of mutual funds. They provide diversification across various sectors and assets by investing in a variety of securities, such as stocks and bonds. This reduces the risk of losing money due to the poor performance of a single security or sector. Real estate, on the other hand, offers tangible assets but limited diversification. Diversifying a real estate portfolio requires active management and a large amount of capital to invest in different property types and locations.

In addition to liquidity and diversification, mutual funds also offer other benefits such as lower initial investment requirements, ease of investment, and professional management. They are well-regulated, reducing the chances of litigation or disputes. Mutual funds have also shown better consistency and provided higher returns over the last few years, outperforming real estate investments.

However, it is important to consider the risks associated with mutual funds, such as market volatility and fund manager performance. Real estate investments, despite their lower liquidity and diversification, may be preferred by investors seeking stable, tangible assets and the potential for rental income.

Best Vanguard Funds for Your Roth IRA

You may want to see also

Real estate offers tangible assets and potential rental income

Real estate offers investors a range of benefits, including tangible assets and the potential for rental income.

Firstly, real estate provides investors with a tangible asset. This means that investors can physically see and touch their investment, which can be reassuring and provide a sense of security. Additionally, owning a tangible asset can make investors feel more in control of their investment than buying shares in companies through stocks and mutual funds.

Another advantage of investing in real estate is the potential for rental income. Investors can purchase properties and rent them out to tenants, providing a regular source of income. This can be particularly attractive to investors seeking regular cash flow and a hedge against inflation, as rents typically increase over time.

It's important to note that investing in real estate also comes with certain risks and drawbacks. For example, real estate investments typically require a large upfront investment and can be highly illiquid, making it difficult for investors to access their money quickly in times of financial need. Additionally, the value of real estate can fluctuate and may decline over time, and there may be high transaction costs and legal disputes involved.

However, for investors seeking tangible assets and potential rental income, real estate can be a compelling investment option. It is crucial to carefully consider the benefits and drawbacks of any investment decision and to diversify one's portfolio to mitigate risks.

Tax-Exempt Bond Funds: When to Invest for Maximum Returns

You may want to see also

Mutual funds have higher returns and are better inflation hedges

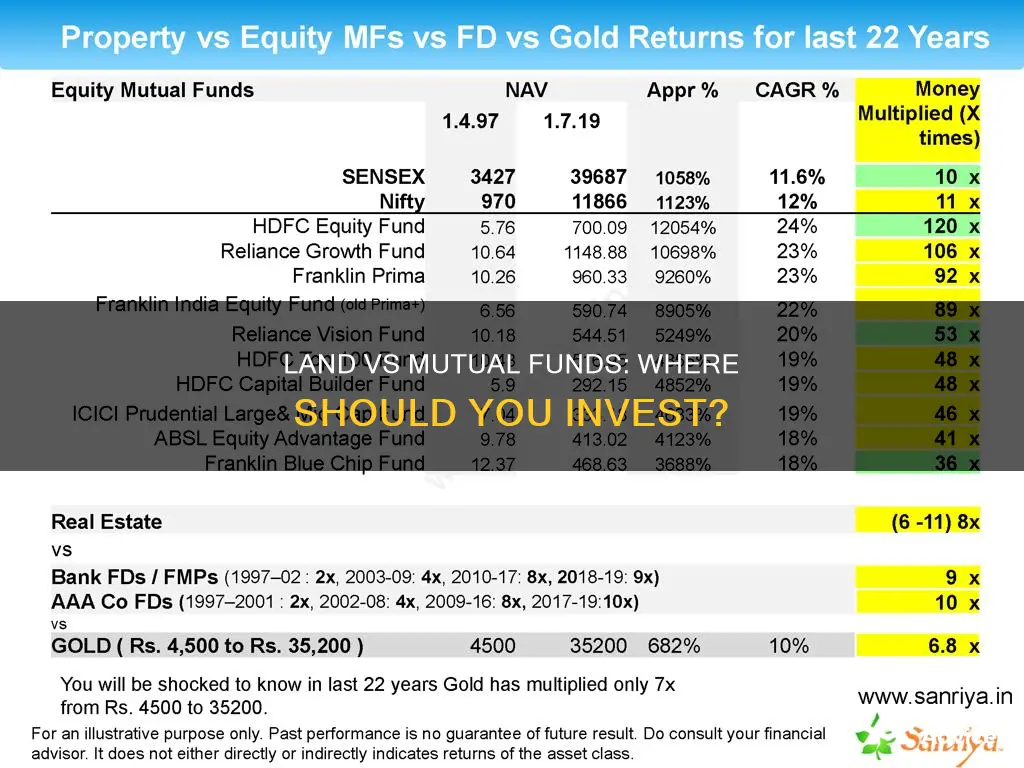

When it comes to investing, one of the key considerations is the potential for high returns. Mutual funds have consistently outperformed real estate investments in this regard, offering average returns of 12-14% in the last decade, with some schemes generating even higher returns. In contrast, real estate investments have yielded an average return of 10% over a ten-year period, with rates varying depending on the specific location.

The difference in returns becomes even more pronounced when considering post-tax returns. Mutual funds offer tax advantages, such as tax-free returns below a certain threshold and lower tax rates for long-term capital gains. On the other hand, real estate investments are subject to various taxes, including capital gains tax, stamp duty, and registration fees, which can eat into the overall returns.

Another critical factor in investment decisions is the ability to hedge against inflation. Mutual funds have proven to be a powerful tool for investors who wish to accumulate wealth despite inflation. The power of compounding in mutual funds helps generate higher returns over time, even as inflation erodes the purchasing power of money. In contrast, real estate investments often struggle to perform during inflationary periods, failing to keep up with the rising prices.

Additionally, mutual funds offer the advantage of diversification across various sectors and assets. By investing in a variety of securities, such as stocks and bonds, mutual funds reduce the risk associated with investing in a single asset class or company. This diversification is more challenging to achieve in real estate, where diversifying by location and property type requires significant capital and resources.

In summary, mutual funds offer higher returns and provide a better hedge against inflation when compared to real estate investments. The diversification, liquidity, and tax advantages of mutual funds contribute to their attractiveness as an investment option, particularly for those seeking to grow their wealth over the long term.

Hedge Funds vs Investment Banking: Choosing Your Financial Career

You may want to see also

Real estate investments are inconsistent and risky

Real estate investments are highly inconsistent and risky. The value of a property can decline even after development in the area. For example, increased traffic or poor access to the city can lower the value of a property over time. On the other hand, mutual funds have shown better consistency and provided inflation-beating returns over the last few years.

Real estate investments are also considered risky due to the inability to monitor the performance of the investments. Failure to track your investments can result in disputes over time if you have invested with partners. Mutual fund investments can be easily monitored online, and you can also track the performance of your funds. This ultimately brings down the probability of any dispute or litigation.

The performance of real estate investments falls behind that of mutual fund investments. Real estate investments are more or less considered like fixed deposits now as the returns generated are similar. However, mutual funds have proven to be a common option for investors who wish to accumulate wealth despite inflation. The power of compounding in mutual funds helps generate higher returns when compared to real estate investments, which fail to perform during inflation.

The last thing an investor would want is for their investments to become entangled in a legal dispute or litigation. A dispute can go on for a long time and prove tedious for the investor. There may also be instances where an investor has to shell out extra money during the dispute, which will not only bring down the value of the property but also lower the returns generated from the investments. Since mutual funds are well-regulated and controlled by the Securities Exchange Board of India (SEBI), the chance of litigation/dispute is highly unlikely.

Real estate investments involve a lot of procedures and paperwork. In addition, investors also incur other expenses such as CERSAI charges, stamp duty, and registration charges. It can be a tedious and time-consuming process for investors. On the other hand, investing in mutual funds is an easy and quick process.

Both real estate and mutual funds investments offer tax exemptions. However, mutual funds are more advantageous in this regard as they are also recognized as tax-saving investments among most investors. Under Section 80C of the Income Tax, 1961, you can be eligible for tax benefits of up to a maximum of Rs 1,50,000 on investments made towards mutual funds. Real estate investments can also help you save on taxes, but the tax exemptions offered are comparatively lower than those of mutual funds.

HOA Funds: Where to Invest for Maximum Returns

You may want to see also

Mutual funds are easy to monitor and regulated

When it comes to investing, mutual funds offer a range of benefits that make them easy to monitor and regulated. Here are some key reasons why mutual funds are a straightforward and well-regulated investment option:

Diversification and Professional Management

Mutual funds provide investors with diversification across various sectors and assets. By pooling money from many investors, mutual funds can buy a variety of securities like stocks and bonds, offering investors exposure to a wide range of investments. This diversification is inherently built into mutual funds, which makes it easier for investors to achieve than if they were buying individual securities on their own. Additionally, mutual funds offer professional management, with fund managers making investment decisions on behalf of the investors.

Liquidity and Ease of Investment

Mutual funds are known for their liquidity, meaning it's easy to convert your investment into cash. Open-ended mutual funds, in particular, offer high liquidity, allowing investors to redeem their units at any time at the prevailing market price. This liquidity provides investors with flexibility and quick access to their money if needed. Furthermore, mutual funds have a low barrier to entry, with some funds requiring as little as Rs. 100 per month to start investing. This makes mutual funds accessible to a wide range of investors, even those with limited capital.

Regulation and Tax Efficiency

Mutual funds are well-regulated and controlled by authorities like the Securities Exchange Board of India (SEBI) in India. This regulation helps protect investors and ensures that mutual funds operate within established guidelines. Additionally, mutual funds have different tax treatments depending on the type and duration of the fund, and they may offer tax advantages to investors. For example, in India, investors can be eligible for tax benefits of up to Rs. 1,50,000 on investments made towards certain mutual funds under Section 80C of the Income Tax, 1961.

Performance Monitoring and Online Access

Mutual fund investments can be easily monitored online, providing investors with transparency and the ability to track the performance of their funds over time. This accessibility also makes it convenient for investors to manage their investments and make informed decisions. Many mutual fund providers offer online platforms and brokerages that allow investors to create accounts, trade fund shares, and access research tools with just a few clicks.

Lower Risk Profile

While all investments carry some risk, mutual funds are designed to minimize risk by diversifying across different stocks and companies. This diversification reduces the impact of any single investment's performance on the overall portfolio. Additionally, mutual funds can offer moderate-risk options, such as debt funds or hybrid funds, which provide steady returns with lower volatility. As a result, mutual funds are often considered a less risky option than real estate, especially during economic slowdowns.

Funding Sources for Private Investment: Where Does Money Come From?

You may want to see also

Frequently asked questions

Investing in land offers the possibility of rental income, property appreciation, and tangible asset ownership. It can also act as a hedge against inflation and currency fluctuations, as the value of property tends to rise with the general price level.

Investing in land is expensive and illiquid. It is also highly inconsistent and can be risky due to the inability to monitor the performance of the investment.

Mutual funds provide diversification across various sectors and assets, liquidity, ease of investment, and professional management. They also have a shorter gestation period and the power of compounding generates higher returns over time.

Mutual funds are subject to market risk, liquidity risks, interest rate risk, credit risks, etc. The value of the investment can fluctuate depending on the performance of the underlying securities.