Mutual funds are a popular investment vehicle, especially for retirement accounts like 401(k)s, as they offer a relatively hands-off way to invest in a diverse range of assets. By pooling money from multiple investors, mutual funds can purchase a diversified portfolio of stocks, bonds, or other securities. This allows individual investors to benefit from economies of scale, while spreading risk across multiple investments.

Mutual funds are managed by professionals, who oversee the fund's portfolio and decide how to allocate money across different sectors and industries. While mutual funds provide a convenient way to invest, there are various fees and expenses associated with them, such as annual fees, expense ratios, and commissions, which can impact overall returns.

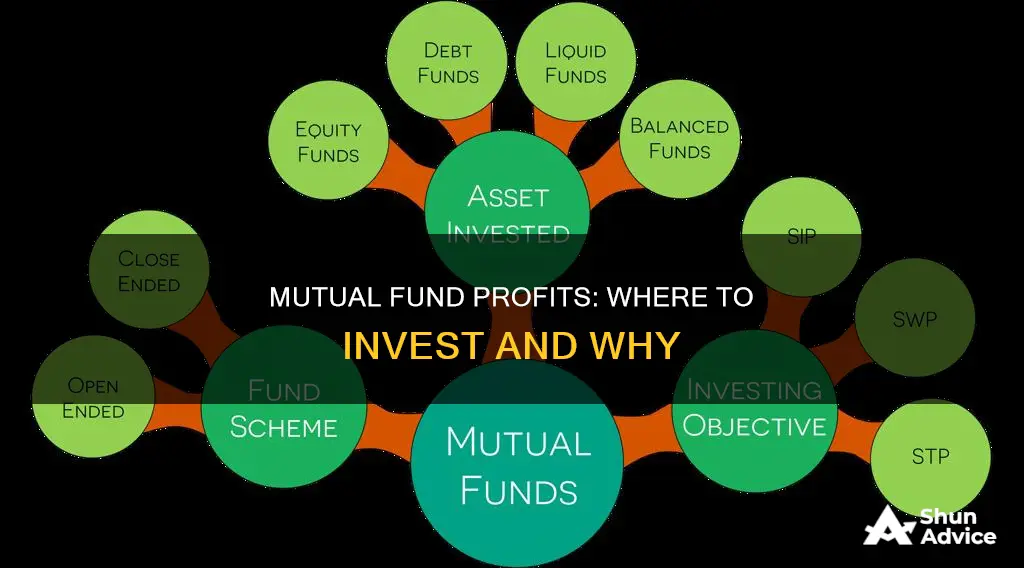

When choosing a mutual fund, it's important to consider factors such as investment goals, risk tolerance, and the types of assets in which the fund invests. Different types of mutual funds include stock funds, bond funds, target-date funds, and money market funds, each with varying investment profiles, risk levels, performance results, and fees.

Ultimately, mutual funds offer investors an opportunity to diversify their portfolios, access professionally managed portfolios, and benefit from the expertise of fund managers. However, it's crucial to carefully evaluate and compare different funds to make informed investment decisions.

| Characteristics | Values |

|---|---|

| Definition | A mutual fund is a collection of investors' money that fund managers use to invest in stocks, bonds, and other securities. |

| Investment Objective | A mutual fund pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities (according to the fund's stated strategy). |

| Benefits | Diversification, affordability, professional management, liquidity |

| Drawbacks | High fees, commissions, and other expenses, large cash presence in portfolios, difficulty in comparing funds, lack of transparency in holdings |

| Types | Stock funds, bond funds, money market funds, target-date funds |

| How to Invest | Decide between active and passive funds, calculate your budget, decide where to buy, understand fees, manage your portfolio |

| Fees | Expense ratio, sales load, 12b-1 fees, redemption fees, account fees, purchase fees, management fees, distribution fees |

| Average Annual Return | 12.86% (average return from 2002 to 2022) |

What You'll Learn

Mutual funds vs. index funds

Mutual funds and index funds are similar in many ways, but there are some key differences. Both are a collection of investors' money that fund managers use to invest in stocks, bonds, and other securities. They both offer a way to diversify and protect your investments. However, there are some important distinctions to be aware of when deciding between the two.

Management Style

The first difference is in their management style. Index funds are passively managed, meaning they are not actively managed by a fund manager. Instead, they track a specific market index, such as the S&P 500, and attempt to match its performance. On the other hand, mutual funds are actively managed by fund managers who pick and choose investments with the goal of outperforming the market.

Investment Objective

The second difference lies in their investment objective. Index funds aim to replicate the performance of a market index and provide market-average returns. In contrast, mutual funds try to beat the market and provide higher returns.

Cost

The third and perhaps most significant difference is the cost. Index funds are known for their low investment costs compared to actively managed mutual funds. Mutual funds charge higher fees to cover the expenses of active management, including investment manager salaries, bonuses, and marketing materials. These fees can eat into the returns of the fund, affecting your overall profit.

Other Considerations

When deciding between index funds and mutual funds, it's also important to consider your time horizon and risk appetite. Index funds offer a more hands-off approach and are suitable for those seeking a long-term investment strategy. Mutual funds, on the other hand, require more active management and may be more suitable for those willing to take on more risk in pursuit of higher returns.

Additionally, the level of diversification offered by index funds and mutual funds can vary. While both provide diversification, mutual funds may offer a wider range of investment choices as they are not limited to tracking a specific index.

In conclusion, both index funds and mutual funds have their advantages and disadvantages. Index funds are a good choice for those seeking a low-cost, passive investment strategy, while mutual funds may be preferable for those seeking a more active investment approach and are willing to pay higher fees for the potential of higher returns. Ultimately, the decision between the two depends on your investment goals, risk tolerance, and time horizon.

Vision Fund's WeWork Investment: A Bold, Early Move

You may want to see also

Mutual funds vs. ETFs

Mutual funds and ETFs (exchange-traded funds) are similar in many ways, but there are some crucial differences.

Both mutual funds and ETFs are managed "baskets" or "pools" of individual securities, such as stocks or bonds, that offer exposure to a wide variety of asset classes and niche markets. They are also both overseen by professional portfolio managers. However, mutual funds are usually actively managed, while ETFs are usually passively managed, tracking a market index or sector sub-index.

One of the key differences between ETFs and mutual funds is in how they're traded. You buy and sell shares directly with the fund provider with mutual funds, and transactions only occur after trading ends for the day. In contrast, ETFs trade more like stocks and can be bought and sold on the open market with other investors throughout the day, making them a better choice for active traders.

ETFs are often cheaper to invest in, too. Mutual funds typically have minimum investment requirements of hundreds or thousands of dollars, whereas you can invest in an ETF if you have enough money to buy a single share. ETFs are also usually passively managed, so ETF expense ratios are usually lower than those of mutual funds.

ETFs may also be more tax-efficient than mutual funds. As passively managed portfolios, ETFs tend to realise fewer capital gains than actively managed mutual funds. The creation and redemption process of ETFs means that, unlike mutual funds, the process of creating and redeeming shares does not usually trigger capital gains tax liabilities for shareholders.

Understanding IRA Fund Investment Timing

You may want to see also

Actively managed funds vs. passively managed funds

Actively managed funds and passively managed funds are two different types of mutual funds, each with its own advantages and disadvantages. Here is a detailed comparison between the two:

Actively Managed Funds:

- Actively managed funds are overseen by fund managers who actively select and monitor investments based on expectations of their performance. These managers employ rigorous methodologies, conduct thorough company research, and leverage their expertise to make informed decisions.

- Active fund management offers flexibility, as managers are not restricted to a specific index and can identify potential "diamond in the rough" stocks.

- Active management also allows for hedging strategies, such as short sales or put options, and the ability to exit specific stocks or sectors when risks become too high.

- It provides tax management benefits by enabling advisors to tailor strategies to individual investors, such as offsetting taxes on winning investments by selling losing ones.

- Active management comes with higher expenses due to the need for ongoing analysis, portfolio management, and transaction costs associated with frequent buying and selling.

- There is a management risk associated with active funds, as fund managers can make costly mistakes, and their performance may not consistently beat the market.

Passively Managed Funds:

- Passively managed funds, also known as index funds, aim to mirror the performance of a specific index, such as the S&P 500, by holding the same or similar securities in similar proportions.

- Passive investing is a more hands-off approach that requires less buying and selling, making it a cost-effective strategy for investors.

- Passive funds offer ultra-low fees since they simply follow an index and do not require stock picking or active management.

- They provide transparency, as it is clear which assets are included in the fund, and they tend to be tax-efficient due to their buy-and-hold strategy.

- However, passive funds may have limited investment options as they are tied to a specific index, and they rarely beat the market's performance.

- Passive investors rely on fund managers to make decisions and may not have a say in their specific investments.

In summary, actively managed funds offer more flexibility and the potential for higher returns but come with higher fees and management risks. On the other hand, passively managed funds are more passive, have lower fees, and provide transparency, but they may offer limited investment options and rely heavily on fund managers.

Equity Funds: When to Invest for Maximum Returns

You may want to see also

Mutual fund fees

Annual Fund Operating Expenses

Annual fund operating expenses are ongoing fees that cover the cost of paying fund managers, accountants, legal fees, marketing, and so on. These fees are also known as mutual fund expense ratios or advisory fees, and they typically range from 0.25% to 1% of your investment in the fund per year. They are expressed as a percentage of the fund's net average assets.

The following fees may be included in annual fund operating expenses:

- Management fees: The cost of paying fund managers and investment advisors.

- 12b-1 fees: Fees capped at 1% that cover marketing and selling the fund, as well as shareholder services.

- Other expenses: Custodial, legal, accounting, transfer agent expenses, and other administrative costs.

Shareholder Fees

Shareholder fees are sales commissions and other one-time costs incurred when buying or selling mutual fund shares. These include:

- Sales loads: Commissions paid when buying or selling mutual fund shares, which can be front-end (paid at the time of purchase) or back-end (paid at the time of sale).

- Redemption fee: Charged if you sell shares within a short period of buying them.

- Exchange fee: Charged by some funds if you exchange shares for another fund offered by the same investment company.

- Account fee: Charged for maintaining your account, often if your balance falls below a certain minimum.

- Purchase fee: Charged at the time of purchase (distinct from a front-end sales load).

It's important to note that even if a mutual fund doesn't charge sales loads, it may still charge redemption, exchange, account, and purchase fees.

Where Fund Managers Put Their Own Money

You may want to see also

How to invest in mutual funds

Mutual funds are a great way to invest in a diversified portfolio of securities with a relatively small minimum investment. They are a collection of investors' money that fund managers use to invest in stocks, bonds, and other securities.

- Decide between active and passive funds: Active funds are managed by professionals with the goal of outperforming the market, while passive funds are managed to track the market performance. Active funds usually have higher fees and don't always deliver better results.

- Calculate your investing budget: Mutual funds usually have a minimum investment amount, ranging from $100 to a few thousand dollars. You can choose to invest a specific dollar amount or buy a certain number of shares.

- Decide where to buy mutual funds: You can buy mutual funds through an online broker or directly from the fund manager. If you have an employer-sponsored retirement account, you might already be invested in mutual funds.

- Understand mutual fund fees: Mutual funds charge annual fees, expense ratios, or commissions, which will reduce your overall returns. These include management fees, marketing fees, and administrative costs.

- Choose a mutual fund: Consider whether the fund's investment objectives align with your long-term financial plan. Research the fund's overall approach, investment philosophy, and portfolio managers. Compare fees between similar funds.

- Buy the mutual fund: You can buy mutual funds through an online broker or the fund manager. You will receive the next available Net Asset Value (NAV) per share as your price.

- Manage your portfolio: Consider rebalancing your portfolio annually to keep it in line with your diversification plan. Avoid chasing short-term performance, and stick to your long-term investment strategy.

Remember, investing in mutual funds involves risk, and the value of your investment can fluctuate. Make sure to understand the fees and risks associated with any investment before committing your money.

Vanguard Funds: Best Investment Options for Now

You may want to see also

Frequently asked questions

Mutual funds are a collection of investors' money that fund managers use to invest in stocks, bonds, and other securities. They are a type of investment product where the funds of many investors are pooled into an investment product.

Mutual funds work by pooling money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Each share of a mutual fund represents a prorated amount of all the investments within the fund.

Mutual funds offer benefits such as diversification, affordability, professional management, and liquidity. They are also highly liquid, meaning they are easy to buy or sell.

All investments carry some risk, and mutual funds are no exception. The value of the fund's portfolio may decline, and bond interest payments or stock dividends can fall as market conditions change.

When choosing a mutual fund, consider factors such as your investment goals, risk tolerance, fees, and overall costs. Compare the performance of the fund over the last three, five, and ten years, and check if that performance has outpaced the S&P 500.