Investment management style is the method and philosophy used by an investor or money manager to select investments for a portfolio. It is based on several factors, including risk preference, growth vs. value orientation, and market cap. Common styles can be distinguished from one another based on risk tolerance, growth vs. value, and market capitalization. Investment style is an important aspect used by institutional managers in marketing and advertising funds to investors looking for a specific type of market exposure. It is also a crucial signal for investors when choosing a mutual fund, as it helps set expectations for risk and performance potential.

| Characteristics | Values |

|---|---|

| Risk tolerance | Conservative, moderate, or aggressive |

| Growth vs value | Growth stocks, value stocks |

| Market capitalization | Large-cap, mid-cap, small-cap |

What You'll Learn

Risk tolerance

Aggressive investors, also known as high-risk tolerant investors, are willing to risk losing money in pursuit of potentially better returns. They tend to be market-savvy and comfortable with volatile securities. Their investments are typically focused on capital appreciation rather than income preservation. As a result, their portfolios often consist predominantly of stocks, with little to no allocation to bonds or cash.

Moderate investors aim to balance opportunities and risks, adopting a "balanced" strategy. Their portfolios usually include a mix of stocks and bonds, such as a 50/50 or 60/40 structure.

Conservative investors, on the other hand, seek to minimise volatility in their portfolios. They prioritise capital preservation and often include retirees or individuals approaching retirement age. Conservative investors tend to favour low-risk investments such as bank certificates of deposit (CDs), money markets, or U.S. Treasuries, which offer guaranteed returns and high liquidity.

It's important to note that risk tolerance is not static and can change over time as an investor's financial situation, goals, and market conditions evolve. Additionally, risk tolerance is closely linked to risk capacity, which refers to an investor's financial ability to take on risk. While risk tolerance measures an investor's willingness to take risks, risk capacity assesses their financial ability to do so.

Understanding one's risk tolerance is essential for developing an investment strategy that aligns with an investor's financial goals and comfort level. It helps investors make informed decisions, ensuring they don't take on more risk than they are comfortable with or miss out on potential returns by being too risk-averse.

In conclusion, risk tolerance is a key consideration in investment management, influencing the types of investments an individual chooses and the overall composition of their portfolio. By assessing their risk tolerance, investors can make more confident decisions that align with their financial objectives and tolerance for market volatility.

Adjusting Your Investment Portfolio: Strategies for Success

You may want to see also

Growth vs. value

Growth and value are two common investment styles, differentiated by the type of stocks that are chosen for a portfolio.

Growth investors focus on companies with above-average earnings and prospective earnings. These stocks generally have a higher-than-average future earnings potential and trade with a higher P/E ratio. Growth investors are primarily concerned with earnings and the momentum of earnings.

On the other hand, value investors focus on value stocks, which are undervalued companies with low P/E ratios. These companies usually pay regular dividends, have low price-to-book ratios, and little to no debt. Value investors will look at book value, overall yield, dividend yield, P/E ratio, price-to-sales, and the capitalization of the company.

Growth stocks are those of companies that are considered to have the potential to outperform the overall market over time because of their future potential. They are typically young, early-stage companies with rapid growth in profits, revenue, or cash flow. Growth investors prefer capital appreciation, or sustained growth in the market value of their investments, rather than steady dividend income.

Value stocks are classified as companies that are currently trading below what they are actually worth and will, therefore, provide superior returns. They are usually larger, more well-established companies that trade below the price that analysts believe the stock is worth, based on financial ratios or benchmarks. Value stocks are considered to have a lower level of risk and volatility as they are often found among larger, more established companies.

The decision to invest in growth vs. value stocks depends on an individual investor's preference, risk tolerance, investment goals, and time horizon. For example, value stocks tend to outperform during bear markets and economic recessions, while growth stocks tend to excel during bull markets or periods of economic expansion.

Young Savers: Investing for the Future Now

You may want to see also

Market capitalization

Large-cap companies typically have a market capitalization of $10 billion or more and are major players in well-established industries. These companies are generally considered more stable and less volatile, offering consistent increases in share value and dividend payments over the long term. Examples of large-cap companies include Apple, Microsoft, and Alphabet Inc.

Mid-cap companies have a market capitalization ranging from $2 billion to $10 billion. They are established companies operating in industries expected to experience rapid growth. As they are in the process of expanding, they carry a higher risk than large-cap companies but are attractive for their growth potential. An example of a mid-cap company is Reddit, with a market cap of $9.84 billion as of June 18, 2024.

Small-cap companies have a market capitalization between $300 million and $2 billion. They are typically younger companies with promising growth potential or established businesses that have lost value. These companies are considered higher-risk investments due to their age, the markets they serve, and their size. An example of a small-cap company is JetBlue Airways, with a market cap of $1.93 billion as of June 18, 2024.

Micro-cap companies consist mostly of penny stocks and have market capitalizations between $50 million and $300 million. These companies often have a small valuation and limited trading activity, and they present a high-risk, high-reward investment opportunity.

Monitoring Your Investment Portfolio: A Comprehensive Guide

You may want to see also

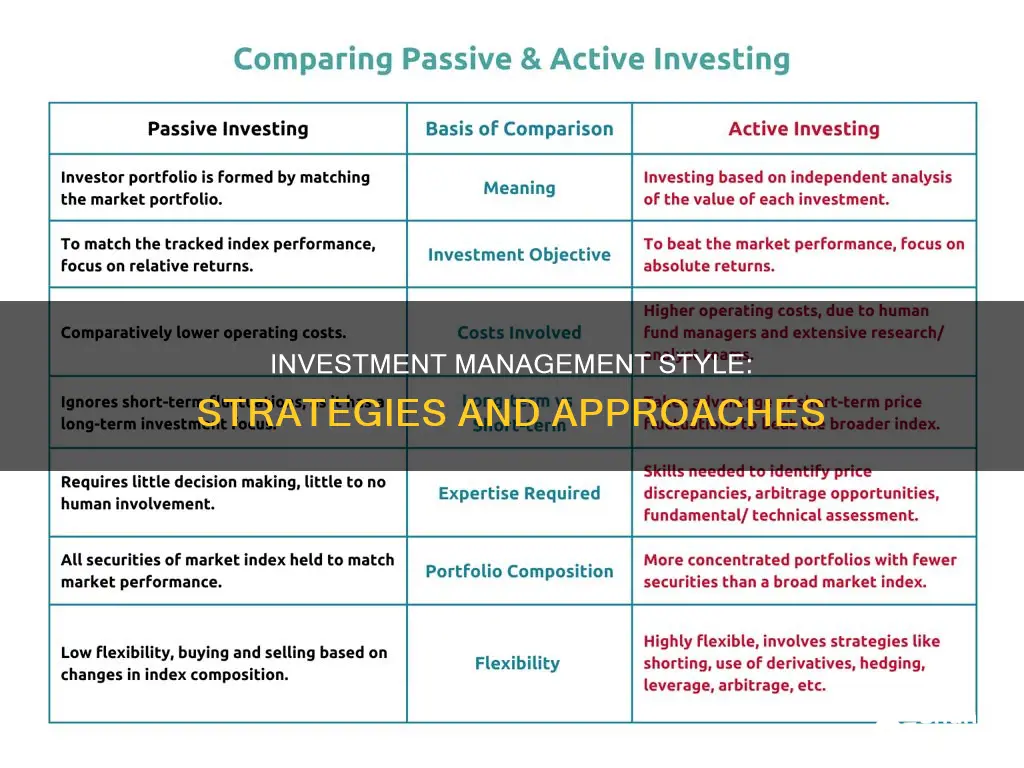

Active vs. passive

Active and passive investment management styles are two of the most common approaches to investing. They differ in their level of involvement, investment goals, risk tolerance, and fees. Here is a detailed comparison of the two:

Active Investment Management

Active investment management involves a hands-on approach, with frequent buying and selling of investments based on their short-term performance. The goal of active management is to outperform the average market returns and capitalise on short-term price fluctuations. It requires a deep analysis of investments, including price changes, returns, and company financial statements. Active management portfolios strive for superior returns but come with greater risks and larger fees.

Advantages of Active Management:

- Flexibility: Active managers are not restricted to a specific index and can invest in stocks they believe have high potential.

- Hedging: Active managers can use strategies like short sales and put options to hedge their bets.

- Risk Management: They can exit specific holdings or sectors when risks become too high.

- Tax Management: Active managers can employ tax strategies, such as selling losing investments to offset taxes on winning investments.

Disadvantages of Active Management:

- Expensive: Active management has higher fees due to transaction costs, research expenses, and analyst salaries.

- Active Risk: Active managers have the freedom to buy any investment that meets their criteria, which can lead to higher risk.

- Management Risk: Human fund managers can make costly mistakes.

Passive Investment Management

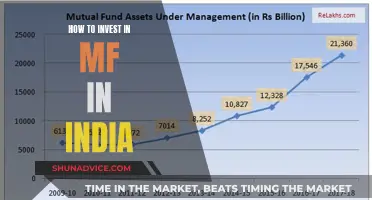

Passive investment management, also known as index fund management, involves buying and holding investments over the long term with minimal portfolio turnover. Passive investors typically invest in mutual or exchange-traded funds and rely on fund managers to ensure the investments are performing well. The goal of passive management is to replicate the performance of a specific market index or benchmark.

Advantages of Passive Management:

- Ultra-Low Fees: Passive funds have lower fees since they don't require stock picking and simply follow an index.

- Transparency: It is clear to investors which assets are included in a passive fund.

- Tax Efficiency: The buy-and-hold strategy of passive funds typically results in lower capital gains tax.

Disadvantages of Passive Management:

- Limited: Passive funds are restricted to a specific index or set of investments, providing less flexibility.

- Small Returns: Passive funds rarely beat the market and are limited by their core holdings.

- Reliance on Others: Passive investors rely on fund managers for decision-making and have less control over their investments.

Both active and passive investment strategies have their advantages and disadvantages. Active management offers more flexibility and potential for higher returns but comes with higher fees and risks. On the other hand, passive management provides low fees, transparency, and tax efficiency but may result in smaller returns and less flexibility. The choice between the two depends on an investor's risk tolerance, investment goals, and level of involvement they desire.

Investment Managers: Sharing Personal Information?

You may want to see also

Long-term investment strategy

Long-term investment strategies are a great way to secure your financial future. Here are some key aspects of long-term investment strategies:

Start Early

The first and most important rule of long-term investment is to start early. Time is a powerful factor in investment growth. For example, an investor who starts investing $200 per month at 25 years of age could have almost $300,000 by 65 with a 7% average annual return. However, if they were to start at 35 years of age, investing the same amount monthly until 65, they would only have around $245,000. Therefore, the longer you invest, the more you can accumulate, even with a smaller contribution amount.

Understand Your Risk Profile

Knowing your risk tolerance is crucial for long-term investment success. If you are a conservative investor, you may prefer income and fixed-income investments such as money market funds, loan funds, and bonds. Moderate-risk investors might opt for large-cap, blue-chip stocks or value investment styles. Aggressive investors, on the other hand, might favour growth funds, aggressive growth funds, capital opportunity funds, and alternative hedge fund investment styles.

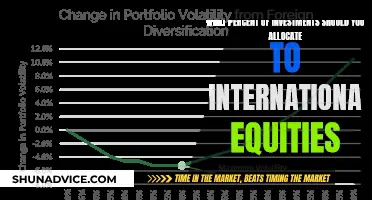

Diversification

Diversification is a key strategy to mitigate risk and enhance returns. It involves spreading your investments across various asset classes, sectors, and types of investments. This helps to reduce the impact of losses in any one investment and can lead to a more stable portfolio.

Keep Costs Low

Fees and taxes can eat into your investment returns over time. To minimize costs, consider investing in low-cost index funds or exchange-traded funds (ETFs) that track broad market indices. These funds offer instant diversification and often outperform actively managed funds after fees over the long term.

Avoid Get-Rich-Quick Schemes

Reliable long-term investment strategies are based on consistent, proven methods. Avoid "get-rich-quick" schemes that promise overnight wealth or guarantee astronomical returns. These investments are typically volatile and may be scams.

Stick to Your Strategy

It's important to stick to your long-term investment strategy and avoid the temptation to time the market. While the market may experience ups and downs, historically, it has always trended upwards over time. By staying invested, you can take advantage of the growth the market has to offer, even during volatile periods.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount regularly, regardless of the market price. This allows you to purchase more securities during dips, helping your portfolio grow over time. This strategy can be automated through monthly investment plans or contributions to retirement accounts like 401(k)s.

Roth IRA

A Roth IRA is a powerful long-term investment vehicle. It allows you to contribute after-tax dollars and offers tax-free growth and withdrawals in retirement. Unlike traditional IRAs, Roth IRAs are not subject to required minimum distributions at age 73, allowing for even longer tax-free growth.

Remember, long-term investing requires patience and discipline. By starting early, understanding your risk tolerance, diversifying your portfolio, minimizing costs, and sticking to a consistent strategy, you can set yourself up for financial success in the future.

Understanding Managed Investment Schemes in New Zealand

You may want to see also

Frequently asked questions

Investment style is the method and philosophy followed by an investor or money manager in selecting investments for a portfolio. It is based on several factors, including risk preference, growth vs. value orientation, and market cap.

Common styles can be distinguished based on risk tolerance, growth vs. value, and market capitalization.

Investors typically begin by considering their risk tolerance, which can be conservative, moderate, or aggressive. They then choose between active and passive investment strategies.

Active investment strategies involve regular buying and selling of securities to take advantage of market conditions and attempt to outperform a benchmark. Passive investment strategies, on the other hand, involve buying and holding securities for the long term, with less frequent buying and selling.

The investment style of a mutual fund helps set expectations for risk and performance potential. It is an important signal for investors, who can use tools like the style box to visualize and compare different funds.