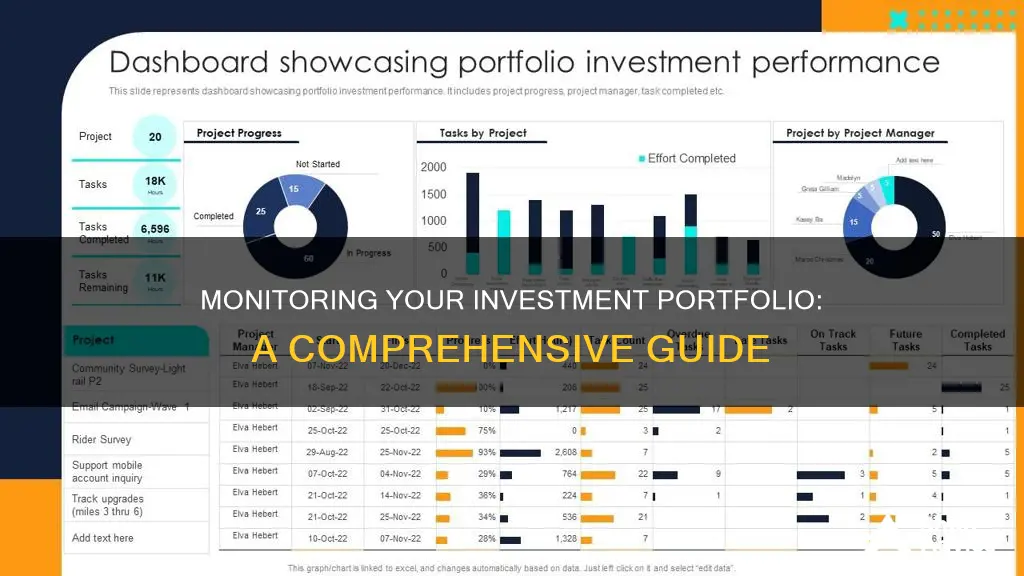

Monitoring your investment portfolio is essential to ensure your investments are performing as expected and are in line with your financial goals. While the stock market is ever-changing, regular reviews of your portfolio can help you stay informed and make necessary adjustments. Here are some key aspects to consider when monitoring your investments:

- Annualised Total Performance: Track your overall investment performance to make informed decisions.

- Diversification: Diversifying your portfolio helps manage risk and limits exposure to any single asset.

- Asset Allocation: Review your asset allocation to ensure it aligns with your risk appetite and investment strategy.

- Performance Assessment: Evaluate the returns of your portfolio to ensure they are on target to meet your goals.

- Fundamental Analysis: Focus on the fundamental aspects of the companies you invest in, including their financial performance and operational strength.

- News and Announcements: Stay updated on the latest news, corporate announcements, and macroeconomic events that can impact your investments.

- Benchmarking: Compare your portfolio's performance against market indexes or model portfolios to determine its relative performance.

| Characteristics | Values |

|---|---|

| Annual Review | Assess portfolio's performance, individual funds, asset allocation, and future goals |

| Diversification | Manage risk/return, limit exposure to any single asset, and align portfolio with appropriate level of risk |

| Software | Microsoft Money, Personal Capital, Mint.com, Morningstar.com, Quicken, QuickBooks, Fund Manager, etc. |

| Online Tools | Client Portals, This is Money's Power Portfolio, Sharesight, etc. |

| Spreadsheets | Microsoft Excel, Google Spreadsheets |

| News and Events | Stay updated on company news, quarterly results, corporate announcements, shareholding patterns, credit ratings, etc. |

What You'll Learn

Annualised Total Performance

To calculate the annualised total performance of your portfolio, you can use two different methods: the time-weighted rate of return and the dollar-weighted rate of return.

The time-weighted rate of return is a calculation that ignores investor behaviour, making it suitable for comparing the performance of investment managers and brokers. Here are the steps to calculate it:

- Find the difference between the beginning and ending values for each year.

- Divide the difference by the beginning value to get the simple rate of return. Multiply by 100 to get the percentage.

- Add 1 to each rate and multiply them together.

- Raise the total rate by an exponent of 1/n, where "n" is the number of years included in the calculations.

- Subtract 1 and multiply by 100 to get the annualised rate of return.

On the other hand, the dollar-weighted rate of return shows the impact of your deposits and withdrawals on your portfolio's performance. This method is best used to compare your portfolio's returns to those of another individual investor. Here are the steps to calculate it:

- Enter your contributions or withdrawals in a spreadsheet.

- Put the dates of the contributions or withdrawals in the spreadsheet.

- Input the following formula in a new row: =XIRR(values, dates, [guess]). "Values" refer to the range of cells containing contributions or withdrawals, and "dates" refer to the range of cells containing the corresponding dates. "Guess" is your estimated IRR, which can be left blank.

- Allow the program to compute the solution.

It is important to note that the annualised total return does not provide information about the volatility or price fluctuations of an investment. Therefore, it should be considered alongside other factors when making investment decisions.

Portfolio Investments: A Downward Trend and Its Implications

You may want to see also

Company fundamentals

Monitoring your investment portfolio is essential to ensure it aligns with your goals and risk appetite. Here are some key considerations for reviewing the fundamentals of your portfolio:

Review Performance

Assess the overall performance of your portfolio to understand how your investments are doing. Track your annualised total performance, including brokerage accounts, superannuation, employee shares, dividends, and brokerage fees. This will help you make informed decisions and avoid impulsive choices.

Evaluate Asset Allocation

Evaluating your asset allocation ensures your investment strategy remains balanced. Diversification is a crucial aspect of managing risk and exposure. Review your portfolio's composition across various dimensions, such as market, sector, industry, investment type, and country. This will help you identify if adjustments are needed to align with your goals and risk tolerance.

Analyse Individual Investments

Review the performance of your individual investments to ensure they are meeting expectations. Different fund managers excel in different circumstances, so it's important to assess if each investment is performing optimally. This includes examining the fundamentals of your mutual funds and stocks.

Understand Company Fundamentals

- Financial Statements: Dig into the company's financial statements to assess its profit and growth potential. Look at income statements, balance sheets, and cash flow statements to evaluate financial stability and performance.

- Ratios and Metrics: Calculate and analyse key financial ratios such as the debt-to-equity ratio, quick ratio, degree of financial leverage, and price-to-earnings ratio. These ratios provide insights into the company's financial health, stability, and valuation.

- Management and Structure: Evaluate the company's management structure and its effectiveness. Consider the management's experience, decision-making, and ability to maximise shareholder returns.

- Industry and Competition: Understand the industry as a whole and assess the company's position within it. Analyse the competition and market trends to gauge the company's performance relative to its peers.

- Growth Prospects: Assess the company's growth potential by analysing its historical and forecasted financial data. Identify if the company has viable frameworks and financial structures to support future growth.

- Risk and Stability: Evaluate the company's risk profile and financial stability. Consider factors such as debt management, cost control, and overall organisational management. A company with strong fundamentals is more likely to withstand economic downturns and may present less risk for investors.

Invest Your Savings Wisely: A California Guide

You may want to see also

Mutual fund fundamentals

Monitoring your investment portfolio is essential to ensure that it remains aligned with your goals and risk appetite. Here are some fundamentals to consider when monitoring your mutual fund investments:

Annualised Total Performance

Keep track of your annualised total performance to understand how your mutual fund investments are doing. Calculate your true returns by factoring in dividends, dividend reinvestment plans, brokerage fees, currency fluctuations, and the total annualised return. This information may not be readily available from your broker or on a spreadsheet, so consider using portfolio monitoring software to get a complete picture.

Asset Allocation

Review your asset allocation to ensure your investment strategy remains balanced according to your risk tolerance. Diversification is a crucial aspect of managing risk and return. Evaluate your portfolio's exposure to different assets, sectors, industries, and countries. Compare your portfolio's performance against a market-tracking index ETF to determine if you are "beating the benchmark" or "beating the market."

Fund Performance and Characteristics

Assess the performance of your individual mutual funds and how they contribute to your overall portfolio's performance. Different fund managers and investment strategies will perform well in different market conditions. Review the fund's prospectus, investment literature, and past results to understand how the fund aligns with your investment goals and risk tolerance.

Investment Goals and Risk Tolerance

Periodically reassess your investment goals and risk tolerance to ensure your mutual fund investments are still suitable. Ask yourself if your investment horizon and liquidity needs have changed. Are you investing for the long term, seeking capital appreciation, or do you need current income? Also, consider your ability to tolerate volatility and potential losses.

Fees and Expenses

Mutual fund fees can significantly impact your returns. Understand the different types of charges associated with your mutual fund investments, such as sales loads, management expense ratios, and 12b-1 fees. Compare the fees across different funds to make informed decisions. Remember that higher fees do not always translate to better performance.

Building a Solid Investment Portfolio: A Beginner's Guide

You may want to see also

Portfolio characteristics

Diversification

Diversification is a cornerstone of portfolio investments. By spreading investments across different asset classes, sectors, and geographical regions, investors can reduce the impact of any single asset's poor performance on the overall portfolio. This strategy helps to manage risk and can lead to more stable returns. Diversification ensures that while one part of the portfolio may shrink, other parts may grow. It is important to note that diversification should also be maintained within each asset category. For example, for stocks, this means including securities from different sectors, industries, geographic regions, and market capitalisations.

Long-Term Viability

A good investment portfolio should have a long-term outlook, ensuring the growth of investments over time. It is important to avoid stocks that may not grow in the next ten years. Long-term portfolio stocks aim to create value over time rather than reinvesting frequently. While it is beneficial to remain invested for the long term, investors should also have access to liquid funds to allow for sound investment choices and emergency funds.

Strong Financials

As an investor, it is crucial to analyse the financial information of potential investments to differentiate between good and bad options. Some critical financial factors to consider include the company's financial track record, the underlying price of the asset, and the benefits generated by the investment portfolio compared to the expenses incurred in managing it. It is also important to consider all costs, after-tax, and inflation implications to determine the cost efficiency of the portfolio.

Risk Management

Understanding and managing risk is a critical aspect of portfolio investment. The primary tool for managing risk is diversification, as it helps insulate the portfolio from the poor performance of any single investment or market sector. Regularly rebalancing the portfolio ensures that asset allocations remain aligned with the investor's risk tolerance and financial goals despite market volatility. Additionally, tools like stop-loss orders and options strategies can be used to automatically sell assets if they fall below a certain price or to hedge against potential losses.

Investment Allocation Styles

Investment allocation styles depend on an investor's risk tolerance, financial goals, and time horizon. These styles typically range from conservative to aggressive, with variations in between. Conservative investors generally prefer preserving their savings and have a higher proportion of bonds and cash equivalents. Income-focused allocations aim for regular cash flow from dividends and interest payments, while moderate allocations balance risk and return with a mix of stocks and bonds. Growth-oriented allocations emphasise capital appreciation, and aggressive allocations maximise exposure to high-risk assets, suitable for investors with a high-risk tolerance and longer investment horizons.

By incorporating these portfolio characteristics and regularly monitoring their investments, investors can make more informed decisions and work towards achieving their financial goals.

Savings, Investments, and the Economy's Vital Balance

You may want to see also

Asset allocation

When considering asset allocation, investors should think about the following:

- Stock-to-bond allocation: Stocks have historically provided higher returns than bonds but come with more volatility. Bonds reduce volatility but may result in lower returns. The decision depends on an investor's risk tolerance and financial goals.

- Geography: Whether to invest in domestic (U.S.) or international stocks and bonds.

- Market capitalization: Whether to focus on small or large companies.

- Alternatives: Including real estate, commodities, mutual funds, exchange-traded funds (ETFs), retirement accounts (401(k)s, IRAs), and other alternative investments.

There are several asset allocation models that provide a framework for investors:

- Income Portfolio: 70% to 100% in bonds, suitable for investors seeking stable income.

- Balanced Portfolio: 40% to 60% in stocks, offering a mix of income and growth.

- Growth Portfolio: 70% to 100% in stocks, suitable for long-term investors seeking higher returns.

To implement these models, investors can consider the following approaches:

- One-Fund Portfolio: Using a single target-date fund that diversifies investments across stocks and bonds, gradually shifting to favour fixed-income investments as the investor approaches retirement.

- Two-Fund Portfolio: Separating investments into two well-diversified index funds, one for stocks and one for bonds.

- Three-Fund Portfolio: Dividing the stock allocation between two mutual funds, one for U.S. equities and one for international equities, with the remaining allocation to a bond fund.

It's important to note that investment fees can impact returns, so keeping expenses low is crucial. Additionally, investors should regularly review their asset allocation to ensure it aligns with their goals and risk appetite.

Saving and Investment: Understanding the Fundamentals

You may want to see also

Frequently asked questions

It is recommended that you review your portfolio at least once a year to ensure it aligns with your goals. Regular reviews are necessary to make sure your portfolio stays on track.

Firstly, assess the performance of your portfolio and whether it is meeting your goals. Secondly, review your individual funds, as different fund managers perform well in different circumstances. Thirdly, evaluate your asset allocation to ensure your investment strategy is balanced according to your risk appetite and that your portfolio is sufficiently diversified.

There are various tools available to track your investments, including online client portals, investment tracking websites and software, and spreadsheets. Examples of popular investment tracking websites include Personal Capital, Mint.com, and Morningstar.com.