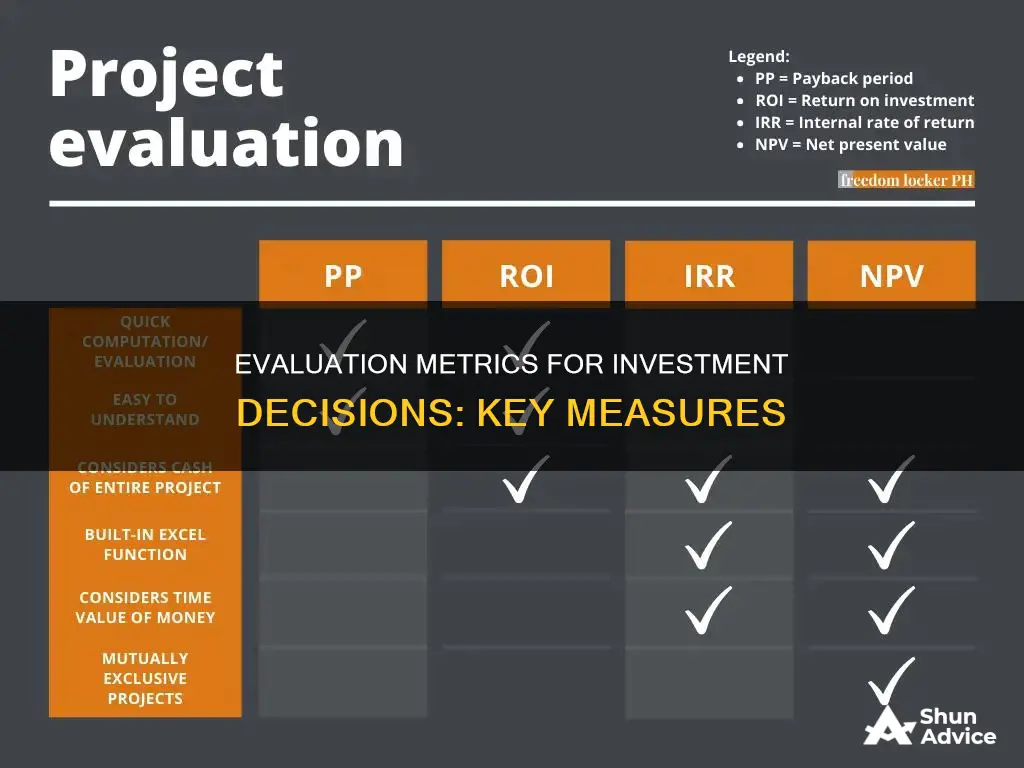

Evaluating an investment is a crucial step in making sound financial decisions. It involves assessing the potential benefits and risks of an investment to determine whether it is worth undertaking. This process can be done at different stages: pre-investment, investment, and post-investment. Various evaluation measures can be used, including static and dynamic methods, as well as financial and non-financial measures.

Static evaluation methods focus on monitoring cash benefits or measuring initial expenditures and typically include the average annual return, average payback period, and average percentage return. On the other hand, dynamic evaluation methods consider the time and risk factors and are based on discounting input parameters. Examples include the internal rate of return and accounting-based profitability measures.

Other common measures include yield, rate of return, and standard deviation. Yield is expressed as a percentage and measures the income generated by an investment over a specific period. The rate of return calculates the total money made or lost on an investment, while standard deviation measures the volatility of an investment's performance.

Additionally, cost-benefit analysis, payback period calculations, net present value, and internal rate of return are also used to evaluate investments.

| Characteristics | Values |

|---|---|

| Return on Investment (ROI) | Income as a percentage of assets employed |

| Residual Income (RI) | Dollar amount to evaluate performance |

| Yield | Income during a specific period divided by investment price |

| Rate of Return | Total money made or lost on an investment |

| Standard Deviation | Dispersion of data from its mean |

| Value at Risk (VaR) | Potential loss in value of a risky asset or portfolio in a given period |

| Conditional Value at Risk (CVaR) | Expected loss if loss is greater than VaR |

What You'll Learn

Return on Investment (ROI)

ROI is a versatile and simple metric, offering a rudimentary gauge of an investment's profitability. It can be applied to a wide range of investments, such as stock investments, business expansions, or real estate transactions. For example, an investor who bought shares in a company for $1,000 and sold them a year later for $1,200 would have an ROI of 20%.

However, ROI has some limitations. It does not account for the time value of money and can be challenging to compare meaningfully as some investments will take longer to generate a profit. It also fails to consider opportunity costs, the effect of inflation on investment returns, and the risk associated with investments.

Despite these limitations, ROI is a widely used metric that provides a straightforward calculation for determining the efficiency of an investment.

Etrade vs Direct Investing: Pros and Cons

You may want to see also

Residual Income (RI)

The concept of residual income is based on the economic principle of opportunity cost, which is the cost of foregone alternatives, or the value of the next best alternative that is given up in order to pursue a particular course of action. In the context of a company, the opportunity cost of capital is the return that could be earned by investing capital in alternative projects or opportunities of similar risk.

Residual income is calculated using the following formula:

RI = Operating Income - (Operating Assets x Target Rate of Return)

Alternatively, it can be calculated as:

Residual Income = Net Income - (Cost of Capital x Capital)

Where:

- Net Income = Operating income after taxes

- Cost of Capital = Weighted average cost of capital (WACC)

- Capital = Total capital employed by the company

The Weighted Average Cost of Capital (WACC) is a weighted average of the cost of debt and the cost of equity, with the weights being the proportion of debt and equity in the company's capital structure. The cost of debt is the interest rate that the company pays on its outstanding debt, while the cost of equity is the return that investors require to invest in the company's stock.

Residual income is often used to assess the performance of a manager of an investment center, which is a division within a business that is evaluated based on the return on investment (ROI) or Residual Income (RI).

One advantage of using residual income as a performance measure is that it provides a long-term perspective on a company's profitability. It takes into account the long-term value created by a company's investments, rather than focusing solely on short-term profitability.

Another advantage is that it aligns the interests of shareholders and managers. Since residual income is based on the opportunity cost of capital, it encourages managers to invest in projects that generate a return that exceeds the cost of capital, creating long-term value for shareholders.

However, there are also limitations to using residual income. One limitation is the difficulty in estimating the cost of capital accurately. Additionally, residual income may be influenced by non-operating items, such as gains or losses on investments or foreign exchange transactions.

In conclusion, Residual Income (RI) is a valuable tool for evaluating a company's financial performance, providing a comprehensive assessment that considers the opportunity cost of capital. While it offers advantages such as a long-term perspective and alignment of stakeholder interests, it also presents challenges in terms of accurately estimating the cost of capital and potential influence from non-operating factors.

Strategies for Shifting Investments to Cash Reserves

You may want to see also

Economic Value Added (EVA)

EVA is calculated by taking net operating profit and subtracting a finance charge. The finance charge captures the required rate of return on capital invested by the company. The formula for calculating EVA is:

> EVA = NOPAT – (WACC * Invested Capital)

NOPAT stands for Net Operating Profit After Tax, and WACC stands for Weighted Average Cost of Capital. Invested Capital can be calculated by taking Total Assets and subtracting Current Liabilities.

A positive EVA means the company is adding value, while a negative EVA means the company is destroying value. EVA is a useful performance indicator as it shows how and where a company created wealth, forcing managers to be aware of assets and expenses when making decisions.

However, EVA relies heavily on the amount of invested capital and is best used for asset-rich companies that are stable or mature. Companies with intangible assets, such as technology businesses, may not be good candidates for an EVA evaluation.

Cash Investment: Asset or Liability?

You may want to see also

Yield

For stocks, yield is calculated by dividing the year's dividend by the stock's market price. Stocks that do not pay dividends have no yield. The yield on stocks can be calculated in two ways: yield on cost (YOC) or cost yield, and current yield. YOC is calculated based on the purchase price, while current yield is calculated based on the current market price. The formula for calculating yield on stocks is:

> Stock yield = (dividends per share / stock price) x 100

For example, if a stock pays an annual dividend of $7.20 per share and has a share price of $175.50, the stock yield would be:

> Stock yield = ($7.20 / $175.50) x 100 = 4.1%

When it comes to bonds, yield refers to the interest paid to bondholders in return for their investment. The yield on bonds can be calculated as either cost yield or current yield. Cost yield measures the returns as a percentage of the original price of the bond, while current yield is measured in relation to the current price. The formula for calculating the yield on bonds is:

> Bond yield = (coupon / bond price) x 100

For instance, if a bond has a coupon rate of 4.5% and is priced at $98.25, the yield would be calculated as follows:

> Bond yield = ($4.50 / $98.25) x 100 = 4.58%

Mutual funds also have yields, which include income from dividends and interest received over a period. The yield on mutual funds is calculated by dividing the annual dividend by the fund's share price.

Real estate yield is another type of yield that takes into account net rental income after expenses to determine how much an investor makes in relation to the property's value. The formula for calculating real estate yield is:

> Real estate yield = (net rental income / real estate value) x 100

For example, if an investor purchases a property for $350,000 and rents it out for $2,200 per month, with monthly expenses of $1,050, the real estate yield would be calculated as follows:

> Real estate yield = [($2,200 x 12) - ($1,050 x 12)] / $350,000 = 3.94%

It is important to note that yield does not include capital gains, while return, another measurement of earnings from an investment, factors in capital gains, interest, and dividends. Yield is typically expressed as a percentage of the security's market value or initial investment, while return is often expressed as a dollar amount.

Warren Buffett's Investing: App Secrets Revealed

You may want to see also

Rate of Return

For example, if an investor buys a stock for $60 a share, owns the stock for five years, and earns a total of $10 in dividends, the RoR would be calculated as follows:

- Per-share gain = $80 - $60 = $20 (assuming the stock is sold for $80)

- Total gain = $20 gain + $10 dividend income = $30

- Rate of return = $30 gain per share / $60 cost per share = 50%

It is important to note that the simple rate of return does not account for the effect of inflation over time. To account for inflation, the real rate of return can be calculated, which represents the net amount of discounted cash flows (DCF) received on an investment after adjusting for inflation.

The rate of return is a useful metric for investors as it helps assess the performance and profitability of an investment. It allows investors to compare the returns of different assets and make informed investment decisions. However, it is important to consider other factors such as the time value of money, the holding period, opportunity costs, and the effect of inflation when evaluating investments.

Overall, the rate of return is a valuable tool for investors to assess and compare the performance of their investments, but it should be used in conjunction with other metrics and considerations to make well-informed investment decisions.

Unlocking Cash Flow Secrets for Smart Investments

You may want to see also