Cash flow from investing activities is a crucial aspect of a company's financial management, offering valuable insights into its long-term health and growth potential. This section of a company's cash flow statement details the cash inflows and outflows from investment activities, including the acquisition and disposal of long-term assets, investments in securities, and mergers or acquisitions. Positive cash flow from investing activities suggests a company is either selling assets or receiving dividends or interest, while negative cash flow indicates the purchase of new assets or loan payments. While negative cash flow may raise concerns, it could signal strategic investments in the company's future, such as research and development. Therefore, understanding cash flow from investing activities is essential for investors and analysts to assess a company's financial stability and potential.

| Characteristics | Values |

|---|---|

| Definition | Cash flow from investing activities (CFI) |

| Description | Inflow or outflow of cash from investments in property, plant, equipment, or financial assets |

| Financial Statement | Balance sheet, income statement, and cash flow statement |

| Importance | Shows how a company is allocating cash for the long term |

| Calculation | Sum of capital expenditures, money lent, and sale of investment securities |

| Types of Activities | Purchase of fixed assets, purchase of investments, sale of fixed assets, sale of investment securities, collection of loans and insurance proceeds |

| Positive Cash Flow | Indicates a company is generating more revenue than expenses |

| Negative Cash Flow | Does not always indicate poor financial health; may be due to investing in long-term health of the company |

What You'll Learn

Positive cash flow: a good sign, but not always

Positive cash flow is usually a good sign for a business. It indicates that a company is running its operations efficiently and has the potential for successful growth. However, this is not always the case.

A company's cash flow can be positive for a variety of reasons, some of which may not be indicative of strong financial health. For example, a company with positive cash flow may be selling off assets or investments to cover operating expenses, which is unsustainable in the long term. This is known as positive investing cash flow and negative operating cash flow, and it can signal trouble for the company.

Additionally, a company with positive cash flow may be investing in long-term assets such as property, equipment, or research and development. While this can lead to short-term losses, it could result in significant growth and gains in the long term if these investments are managed well. This type of negative cash flow from investing activities is often a positive sign, indicating that the company is positioning itself for future growth.

It's also important to note that positive cash flow does not always indicate profitability. A company can have positive cash flow while reporting negative net income. Net income is the profit a company has earned after all expenses have been deducted, and it is a measure of profitability. Positive cash flow, on the other hand, simply means that the company's liquid assets are increasing.

When evaluating a company's financial health, it is crucial to consider all aspects of its financial position, including both net income and cash flow. A comprehensive analysis of these factors will help investors make informed decisions.

Understanding Cash Flow: Investing Activities Analysis

You may want to see also

Negative cash flow: not always a bad omen

Negative cash flow, or when a company has more cash leaving than entering, is often seen as a negative indicator of a company's financial health. However, this is not always the case. While it can be a sign of poor performance, there are instances where negative cash flow is a positive indicator of a company's future growth.

Temporary Negative Cash Flow for Startups and Growing Businesses

For new and growing businesses, negative cash flow is common due to high start-up costs and investments in resources to increase brand awareness. These investments may offer high returns in the long term, making this type of negative cash flow temporary and attractive to investors seeking high returns. Once the customer base is established, the company's inflows should exceed outflows.

Temporary Negative Cash Flow for Expansion

Established businesses may also experience negative cash flow during periods of expansion. This could be due to increased salaries, new hires, dividend growth, and other overhead costs. Additionally, some businesses with seasonal growth may incur temporary negative cash flow during low-demand seasons.

Negative Cash Flow for Long-Term Investments

Negative cash flow from investing activities can be a positive sign that a company's management is investing in long-term assets, such as research and development, to support future growth. This type of negative cash flow is common among growing companies investing in long-term fixed assets and well-established companies making investments in property and equipment.

Chronic Negative Cash Flow: A Cause for Concern

When negative cash flow cannot be attributed to expansion or long-term investments, it could indicate that a company is overinvesting or losing money over time. This can lead to unpaid bills, increased layoffs, and potential financial issues in the future.

Evaluating Negative Cash Flow

To determine whether negative cash flow is positive or negative for a company, investors should review the entire cash flow statement and calculate the company's free cash flow. Free cash flow is the money left after paying for capital expenditures and operating expenses, and it indicates how effectively a company's management generates cash.

Gross PPE Cash Flow: Investing Strategies for Success

You may want to see also

Cash flow analysis: how to do it

Cash flow analysis is a crucial aspect of a company's financial management, providing insights into its cash position and overall financial health. It involves examining the cash inflows and outflows of a company to determine the net cash held and make informed decisions. Here's a step-by-step guide on how to perform cash flow analysis:

Step 1: Understand Cash Flow Concepts

Begin by understanding the basics of cash flow. Cash flow refers to the money flowing into and out of a business over a specific period. It includes cash and cash equivalents, such as securities. It is different from profit, which is the money left after deducting expenses from revenue.

Step 2: Identify the Types of Cash Flow

There are three main types of cash flow that companies should track:

- Cash Flow from Operating Activities: This includes cash received from customers, payments to suppliers and employees, and other expenses related to day-to-day operations.

- Cash Flow from Investing Activities: This covers cash inflows and outflows from the purchase and sale of long-term assets, such as property, equipment, and investments.

- Cash Flow from Financing Activities: This includes cash transactions related to debt, equity, and dividend payments, such as loan repayments and proceeds from issuing stock.

Step 3: Gather Financial Information

Collect financial data for a specific period, such as a month, quarter, or year. Identify all sources of income, including revenue from sales, investments, or asset disposals. Also, determine all business expenses, such as inventory purchases, accounts payable, deferred revenue, depreciation, and tax expenses.

Step 4: Prepare the Cash Flow Statement

Create a cash flow statement by organizing the financial information into the three categories mentioned above: operating activities, investing activities, and financing activities. This statement will show the sources and uses of cash during the specified period.

Step 5: Analyze the Cash Flow Statement

Examine the cash flow statement to identify patterns and draw conclusions. Look for positive cash flow, especially from operating activities, as it indicates financial stability. However, be cautious if there is positive investing cash flow and negative operating cash flow, as it may signal unsustainable practices. Analyze negative cash flow as well, as it could indicate investments in growth rather than financial trouble.

Step 6: Calculate Key Metrics

Calculate important metrics such as free cash flow, which is the cash left after paying for operating and capital expenditures. Additionally, calculate the operating cash flow/net sales ratio to assess how efficiently the company generates cash relative to sales.

Step 7: Make Informed Decisions

Use the insights gained from the cash flow analysis to make strategic decisions. For example, identify areas where cash outflows can be reduced or opportunities to reinvest cash into the business for growth. This analysis will help ensure the company can meet its financial obligations and support its long-term success.

Step 8: Utilize Software Tools

Consider using accounting software or ERP systems that offer cash flow analysis modules. These tools can automate complex calculations, provide accurate reporting, and facilitate trend analysis, making the process more efficient and insightful.

How Cashing Investments Affect Debt Service Coverage

You may want to see also

Cash flow statements: what they are

A cash flow statement is one of the three main financial statements that a business uses, alongside the balance sheet and income statement. It provides a detailed breakdown of how cash moves into and out of a company during a specific period.

The cash flow statement is divided into three sections: cash flow from operations, cash flow from investing, and cash flow from financing. Each section shows different sources and uses of cash.

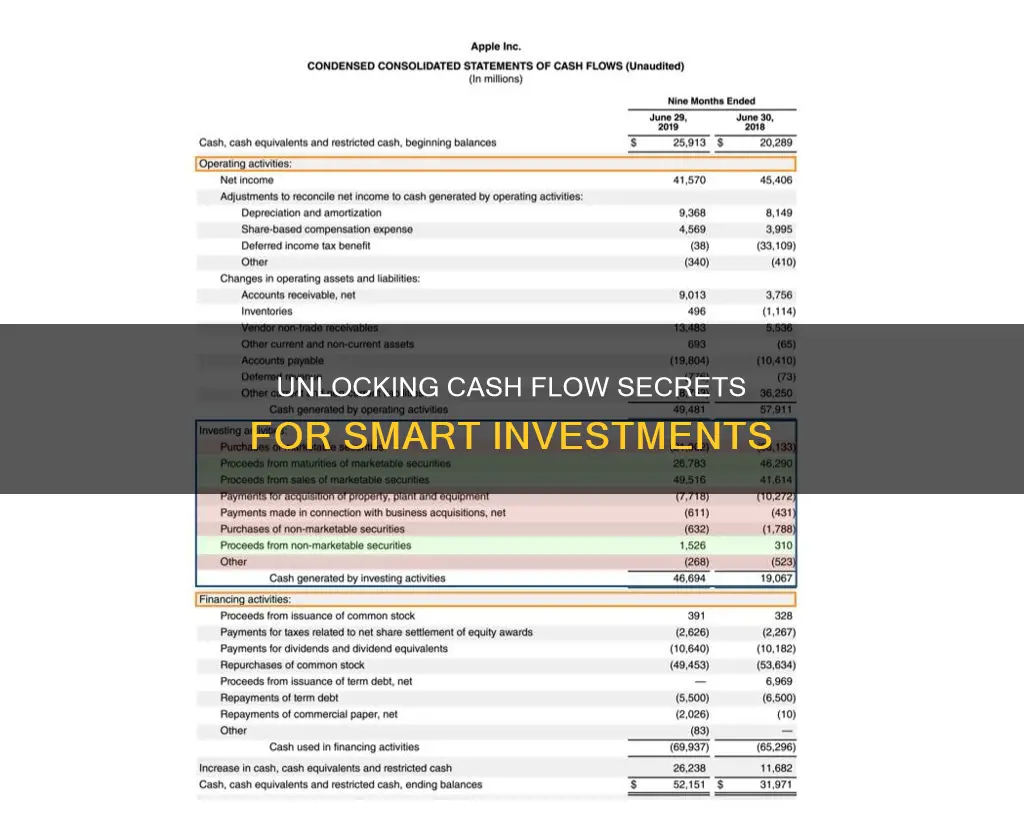

The cash flow from investing activities section of the cash flow statement reports the cash inflows and outflows resulting from investment activities. These activities primarily involve the acquisition and disposal of long-term assets such as property, plant, and equipment, as well as investments in marketable securities.

Positive cash flow from investing activities means more cash is received than spent, indicating that the business is either selling its assets or receiving interest or dividends. On the other hand, negative cash flow from investing activities suggests that the company is buying new assets or paying principal or interest on its loans.

The cash flow statement is useful for companies, investors, and analysts as it provides insight into a company's financial stability and health, helping inform decisions about potential investments. It also helps companies understand how well they generate cash and plan operations and activities to drive profits and growth.

Cash Investments: What Are They?

You may want to see also

Cash flow investments: how they help

Cash flow investments are an important part of a company's financial strategy, offering insights into its long-term health and growth potential. They are a section of a company's cash flow statement, which summarises the amount of cash and cash equivalents entering and leaving the business. This statement is one of three main financial statements used by companies, alongside the balance sheet and income statement.

Cash flow investments include the following:

- Sales of property, plant, and equipment

- Proceeds from sales of assets

- Purchases of marketable securities

- Purchase of property, plant, and equipment

- Investment in joint ventures

- Payments for business acquisitions

Positive vs Negative Cash Flow

Positive cash flow from investing activities means more cash is received than spent, indicating the business is either selling its assets or receiving interest or dividends. On the other hand, negative cash flow suggests the company is buying new assets or paying principal or interest on loans. However, negative cash flow is not always a bad sign, as it could indicate the company is investing in its future, for example, through research and development.

Benefits of Cash Flow Investments

Cash flow investments can help businesses maximise returns and financial growth in several ways:

- Expanding operations and market share – Investing in new assets and businesses can help a company expand its operations and increase its market share.

- Improving efficiency – Streamlining processes, reducing costs and enhancing quality can all be achieved through cash flow investments.

- Diversifying portfolios and reducing risk – Investing in different types of assets and industries can help reduce risk and ensure a regular income stream.

- Innovating and creating new products – Cash flow investments can be used to develop new, competitive products to meet customer needs.

Types of Cash Flow Investments

Businesses can choose from a variety of cash flow investments, including:

- Long-term and short-term investments – Long-term investments are held for over a year, while short-term investments are held for less than a year to generate quick returns.

- Real estate – Buying, selling, renting or developing real estate can provide benefits such as rental income, capital appreciation and tax advantages.

- Stocks and bonds – These provide consistent and predictable income through dividends, interest and capital gains, as well as offering diversification opportunities.

- REITs – Real Estate Investment Trusts can help with diversification and liquidity, while also generating income from rental fees, dividends and capital appreciation.

- Peer-to-peer lending – This connects borrowers and lenders online, allowing businesses to generate income from interest, fees or commissions.

- Other businesses – Buying other profit-generating businesses can provide income from sales, profits and royalties, as well as business ownership and control.

Investing Activities: Computing Cash Flows with GAAP

You may want to see also

Frequently asked questions

Cash flow from investing activities is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities. This includes the purchase or sale of physical assets, investments in securities, or the sale of securities or assets.

To calculate cash flow from investing activities, add the purchases or sales of property and equipment, other businesses, and marketable securities. You can also calculate it by subtracting total cash outflows from total inflows related to investing activities to find the net cash flow.

A positive net cash flow from investing activities indicates that a company is generating more cash from its investing activities than it is spending. This suggests that the company is effectively managing its investments and may be acquiring assets or making strategic investments to enhance future growth and profitability.