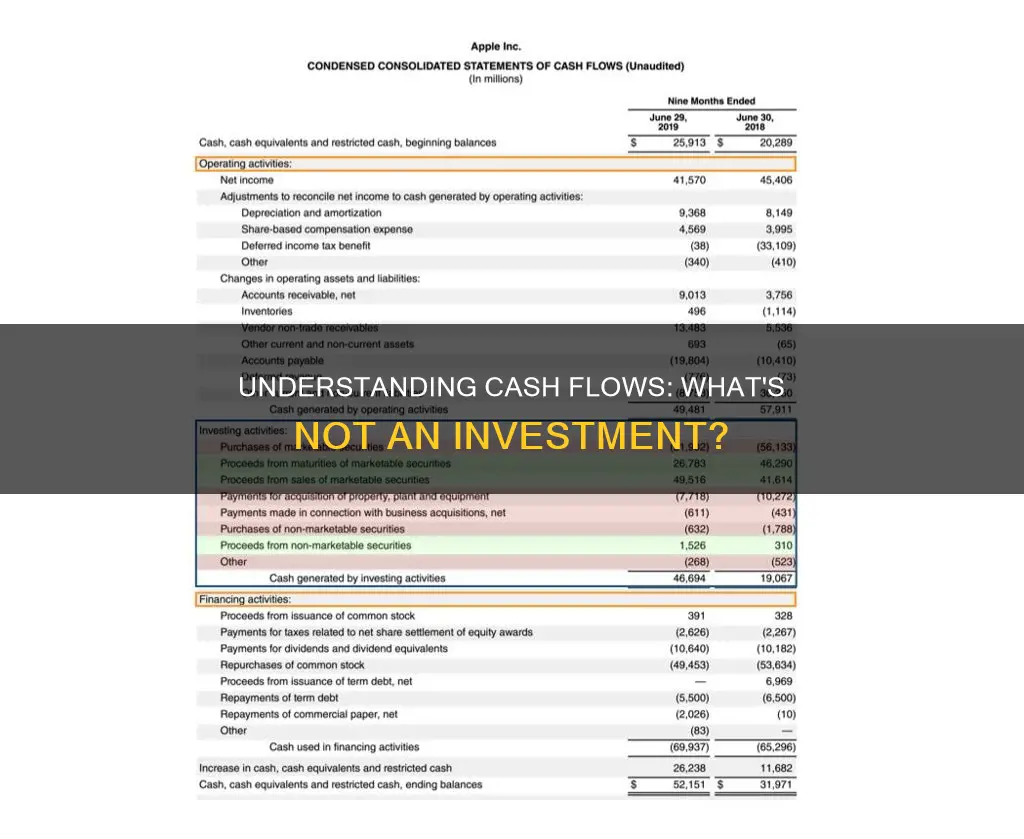

Cash flow from investing activities is a critical component of a company's financial statements, offering insights into its investment strategies and overall financial health. This section of the cash flow statement outlines the cash inflows and outflows from long-term investments, including purchases of physical assets, securities, and other businesses. While negative cash flow in this area can indicate significant investments in the company's future, it is important to distinguish it from the separate categories of cash flow from operating and financing activities.

| Characteristics | Values |

|---|---|

| Section of the financial statement | Cash flow statement |

| Type of activities | Long-term uses of cash |

| Examples of activities | Purchase or sale of fixed assets, proceeds from the sale of a division, cash out as a result of a merger or acquisition |

| Nature of activities | Inflows or outflows of cash |

| Period of activities | Specific time period |

What You'll Learn

Purchase of property, plant, and equipment

The purchase of property, plant, and equipment is an investing activity that impacts a company's cash flow. This type of expenditure is considered a capital expenditure (CapEx) and is an essential aspect of a company's growth and capital investment strategy.

When a company invests in property, plant, and equipment, it is acquiring long-term physical assets critical to the operation and growth of the business. These assets are expected to deliver value in the future and are listed as non-current assets on the balance sheet. The purchase of such assets is typically reported as a negative cash flow in the investing section of the cash flow statement, as it involves spending money.

For example, in Apple Inc.'s 2023 financial report, they reported cash flow negative investing activities, including payments for the acquisition of property, plant, and equipment totalling $10.96 billion.

It is important to note that a negative cash flow from investing activities does not necessarily indicate poor financial health. In fact, it often signifies that the company is making strategic investments in long-term assets, such as property, plant, and equipment, which are crucial for the company's future growth and performance.

The purchase of property, plant, and equipment can also be structured in various ways, and the method of transaction will influence how it is reported in the cash flow statement. For instance, if a company incurs debt directly related to the seller when purchasing equipment, this would be considered a financing transaction, and subsequent principal payments would be reported as financing cash outflows.

Overall, the purchase of property, plant, and equipment is a significant investing activity that impacts a company's cash flow and reflects its long-term investment strategies.

Strategies for Shifting Investments to Cash Reserves

You may want to see also

Proceeds from the sale of property, plant, and equipment

PP&E is a large line item on the balance sheet, and investors and analysts will look at the investing section of the cash flow statement to understand how much a company is spending on these assets. This section will also detail the sources and uses of funds for these investments.

The proceeds from the sale of PP&E are considered a positive cash flow for the company. This is because the company is receiving cash from the sale, even if the sale price is lower than the purchasing price, and so a loss is incurred.

For example, if a company sells an old factory for $5 million, that $5 million will be recorded in the investing section of the cash flow statement as a positive cash flow. This is the case even if the company bought the factory for $6 million and has therefore made a loss on the sale.

The cash flow statement is one of the three main financial statements used by companies, alongside the balance sheet and income statement. It is an important document for understanding a company's financial health, as it shows the sources and uses of a company's cash, both incoming and outgoing.

Oakmark's Cash Strategy: Liquidated Investments and Holdings

You may want to see also

Acquisitions of other businesses

Acquiring another business is an example of an investing activity that generates negative cash flow. This is because acquisitions require spending money, which results in a negative cash flow in the short term. However, this type of investment has the potential to generate positive cash flow in the long term if it contributes to the company's growth and performance.

For example, let's consider a hypothetical company that spent $1 billion on acquisitions as part of its investing activities. This $1 billion would be included in the calculation of the company's net cash flow from investing activities for the year.

It's important to note that negative cash flow from investing activities does not necessarily indicate poor financial health. In fact, it often signifies that the company is making strategic investments in assets, research, or other long-term initiatives that are crucial for the company's sustainability and future development.

Equity Investment Strategies: Cashing Out Startups Explained

You may want to see also

Proceeds from the sale of other businesses

Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets. These are considered long-term investments in the health or performance of the company.

When a company sells a division or business, it receives cash proceeds from the sale. This inflow of cash is recorded in the cash flow statement under investing activities as a positive number, indicating that the company is divesting.

It is important to note that the cash flow statement provides an overview of the company's investment-related activities for a specific period. The net cash flow includes the sum of all investing-related activities, both positive and negative, for the accounting period.

Other items that are included in the investing activities section of the cash flow statement are:

- Purchase of property, plant, and equipment (PP&E)

- Proceeds from the sale of PP&E

- Investments in marketable securities (stocks, bonds, etc.)

- Proceeds from the sale of marketable securities

- Acquisition of other businesses

How Cash Investments Impact Owners' Equity

You may want to see also

Purchases of marketable securities

A company's cash flow statement is a crucial document that offers insights into its financial health and activities. One of the sections of this statement is the cash flow from investing activities, which includes the purchase of marketable securities. These purchases represent a short-term investment strategy, often preferred over holding cash due to the potential for returns and profit generation.

Marketable securities are financial assets that can be converted to cash within a year. They are typically traded on exchanges and include stocks, bonds, certificates of deposit, and commodities contracts. These securities are listed as current assets on a company's balance sheet, reflecting their liquidity and ability to be converted into cash to cover expenses or pay down debts.

The purchase of marketable securities is considered an investing activity and can have a significant impact on a company's cash flow. For example, Apple Inc.'s statement of cash flows for the twelve months ending September 30, 2023, showed purchases of marketable securities totalling $29.52 billion, contributing to a negative cash flow from investing activities.

However, it's important to note that negative cash flow from investing activities does not necessarily indicate poor financial performance. It could mean that the company is investing in long-term strategies, such as research and development, that are crucial for its health and future growth.

Shares vs Cash: Where Should You Invest Your Money?

You may want to see also

Frequently asked questions

No, net income includes cash sales and sales made on credit, whereas cash flow only includes the money that has actually been received by the company.

Cash flow is the movement of money in and out of a company, whereas profit is the amount of money left after a company's expenses have been subtracted from its revenues.

The direct method calculates cash flow by adding up all cash payments and receipts, whereas the indirect method starts with net income and adjusts for changes in non-cash transactions.

Cash flow refers to the amount of money moving into and out of a company, whereas revenue is the income a company earns from the sales of its products and services.