Cash balance plans are a type of defined-benefit retirement savings plan that allows business owners to make significant tax-deductible contributions each year. They are often combined with 401(k) plans to increase tax advantages and flexibility. Cash balance plans are invested in a pooled trust account that is managed by the plan's investment advisor. The cash balance plan trust acts as the investment vehicle that is funded annually by the employer and managed by the plan's investment advisor to pay out benefits based on the cash balance being tracked for each participant in the plan. The assets in the cash balance plan trust are managed conservatively to avoid large losses and prevent the plan from becoming overfunded. A typical cash balance plan targets an annual return of approximately 5%.

What You'll Learn

Cash balance plans are a type of defined benefit plan

Cash balance plans are a type of defined-benefit plan. They are often compared to 401(k) plans, but there are some key differences. Cash balance plans are entirely funded by the employer, and the contribution/benefit formula for participants is clearly defined by the plan. Each participant has an account that resembles those in a 401(k) or profit-sharing plan. These accounts are maintained by the plan actuary, who generates annual participant statements.

The accounts grow annually through two mechanisms: a contribution, which is a percentage of pay or a flat dollar amount, and an interest credit, which is guaranteed and independent of the plan's investment performance. The rate of return is usually equal to the yield on 30-year Treasury bonds, which has been around 5% in recent years.

The popularity of cash balance plans surged after legislative relief provided by the 2006 Pension Protection Act. They are the fastest-growing segment of the qualified retirement plan marketplace, representing 40% of all defined benefit plans in 2017, up from 3% in 2001.

One of the main advantages of cash balance plans is that they allow business owners to make significant tax-deductible contributions each year and accumulate substantial retirement savings on a tax-deferred basis. The contribution limits are higher than those of a 401(k) plan, especially for older participants. For instance, individuals aged 55 and above can potentially receive an annual allocation of around $203,000 in a cash balance plan, compared to just over $300,000 in a 401(k) plan.

Another key difference between cash balance plans and 401(k) plans is that the assets in a cash balance plan are not maintained in separate accounts for participants, and participants cannot direct their own investments. Instead, the assets are invested in a "pooled" trust account managed by the plan's investment advisor. This approach ensures that gains or losses from investments do not affect the participants' balances but may impact the plan sponsor's contributions.

While cash balance plans offer several benefits, there are also some trade-offs to consider. One potential disadvantage is that they require a significant commitment from the business owner. The IRS wants the plan to be in place for at least five to seven years, and contributions must remain relatively consistent during that time. Additionally, cash balance plans can be more complex and may require more professional oversight to comply with IRS rules.

Uncertain Future Cash Flows: Navigating Investment Project Analysis

You may want to see also

They are invested in a pooled trust account

Cash balance plans are a type of defined-benefit retirement savings plan that allows business owners to make significant tax-deductible contributions each year and accumulate substantial retirement savings on a tax-deferred basis. The plans are funded by the employer, who is also responsible for any investment risks and rewards.

The assets in a cash balance plan are invested in a "pooled" trust account, which is maintained in the name of the plan and managed by the plan's investment advisor. This is a conservative investment strategy, targeting an annual return of approximately 5%. The pooled fund approach is used to avoid the possibility of large losses affecting the plan's ability to pay out benefits and to prevent the plan from becoming overfunded, which could limit future tax-deductible contributions.

The cash balance plan trust acts as the investment vehicle, funded annually by the employer and managed by the plan's investment advisor. The investment advisor's role is to ensure the fund achieves its target annual return, and their management of the fund is crucial to the success of the plan.

The pooled trust account is separate and distinct from the actual money invested to provide benefits. The plan's hypothetical account is the sum of all participant hypothetical account balances. The rate of return on the actual plan assets, compared to the plan's interest crediting rate (ICR), can impact funding policy objectives. If the actual plan assets earn more than the ICR, the plan can become overfunded, causing subsequent contributions to decrease. Conversely, if the plan underperforms and earns less than the ICR, subsequent contributions will need to increase to make up the difference.

The cash balance plan is a long-term commitment, with the IRS requiring the plan to be in place for at least five to seven years. Contributions must remain similar throughout that time, and the business must cover 40% of its workforce or up to 50 participants. The business is also required to commit to giving covered employees between 5% and 7.5% of their salary. These rules make cash balance plans more suitable for small businesses with a few employees or professional firms with partners and lower-paid administrative staff.

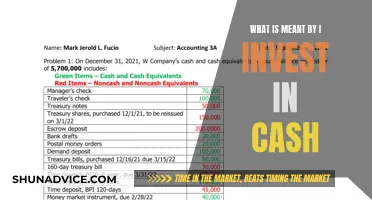

Cash Investments: What Are They?

You may want to see also

The plan's investment advisor manages the trust account

Cash balance plans are a type of defined-benefit retirement savings plan. They are often used by business owners to make significant tax-deductible contributions each year and to accumulate substantial retirement savings on a tax-deferred basis. The cash balance plan trust is the investment vehicle that is funded annually by the employer and managed by the plan's investment advisor. The plan's investment advisor manages the trust account conservatively to avoid the possibility of large losses affecting the plan's ability to pay out benefits. They also prevent the plan from becoming overfunded, which could limit the employer's future tax-deductible contributions. A typical cash balance plan trust targets an annual return of approximately 5%.

The cash balance plan trust is a "pooled" trust account, meaning that the assets are invested in a single fund. This is in contrast to a 401(k) plan, where assets are maintained in separate accounts for each participant. The pooled structure of the cash balance plan trust allows for gains or losses from investments to reduce or increase the plan sponsor's contribution over time, without affecting the participant's balances. This structure also ensures that all participants receive the same crediting rate, regardless of their investment style.

The investment advisor's management of the trust account is crucial in ensuring that the plan remains compliant with IRS rules. They aim to invest in a conservative manner to target a specific return, usually around 5%. This conservative approach helps to reduce volatility and provide a more predictable funding schedule for the employer. The investment advisor has the flexibility to adjust between different equity sectors, types of fixed-income instruments, and varying maturities based on the current market environment.

By managing the trust account and targeting a specific return, the investment advisor plays a key role in helping the cash balance plan achieve its objectives. Their expertise and proactive approach enable them to make informed investment decisions and advocate for the plan participants. Overall, the management of the trust account by the investment advisor is a critical aspect of the cash balance plan, ensuring its effectiveness and compliance.

Understanding E-Trade Cash Calls: What Investors Need to Know

You may want to see also

The pooled assets are managed conservatively

Cash balance plans are a type of defined-benefit retirement savings plan. They are managed by professionals, who pool the assets into a single fund. This fund is then invested in a conservative manner to avoid the risk of large losses and to prevent the plan from becoming overfunded. This conservative approach targets an annual return of approximately 5%.

The pooled assets in a cash balance plan are managed conservatively to protect the plan's ability to pay out benefits. This cautious approach aims to avoid the risk of significant losses, ensuring that the plan can meet its obligations when participants retire. By prioritising stability, the fund managers reduce the chances of negative returns impacting the plan's performance.

The conservative management strategy also helps prevent the plan from becoming overfunded. If the cash balance plan trust grows faster than the "cash balances" being tracked for participants, it can limit the employer's future tax-deductible contributions. Therefore, the fund managers adopt a cautious approach to maintain a stable and controlled growth rate.

The typical cash balance plan targets an annual return of around 5%. This target return is based on the set interest crediting rate offered by the plan, which is usually between 4% and 5%. By aiming for this modest return, the fund managers can help ensure that the plan remains stable and adequately funded without taking on excessive risks.

The conservative management of pooled assets in cash balance plans is a careful balancing act. It aims to generate steady returns while avoiding large losses and overfunding. This approach helps protect the interests of both the plan participants and the sponsoring employer, ensuring that retirement benefits can be paid out as promised while also managing tax implications.

Extra Cash: Smart Investment Strategies for Beginners

You may want to see also

The aim is to target an annual return of around 5%

Cash balance plans are a type of defined-benefit retirement savings plan. They are often combined with 401(k) profit-sharing plans to produce larger contributions, especially for principals and business owners. Cash balance plans are invested in a "pooled" trust account that is maintained in the name of the plan and managed by the plan's investment advisor.

The cash balance plan trust is managed conservatively to avoid the possibility of large losses affecting the plan's ability to pay out benefits. The plan's funding is also managed to prevent it from becoming overfunded, which could limit the employer's future tax-deductible contributions. A typical cash balance plan targets an annual return of around 5%.

The rate of return on the actual plan assets, as compared to the plan's interest crediting rate (ICR), can have a significant impact on the required plan contributions. If the actual plan assets earn more than the ICR, the plan can become overfunded, causing subsequent contributions to decrease. Conversely, if the actual plan assets earn less than the ICR, the plan can become underfunded, leading to an increase in contributions.

To achieve the target return of 5%, the plan assets are pooled and managed by professionals. This approach ensures that participants do not have to pick their own funds and manage their asset allocation. The conservative investment strategy typically involves a combination of equity and fixed-income investments, with a historical analysis showing that stocks outperform bonds over most long-term holding periods.

By targeting an annual return of around 5%, cash balance plans offer a balanced approach that provides retirement savings benefits to business owners and employees while managing the risks associated with investment performance.

Fidelity Branches: Can You Deposit Cash?

You may want to see also

Frequently asked questions

Cash balance plans are invested in a "pooled" Trust account that is maintained in the name of the plan and managed by the plan's investment advisor. The cash balance plan Trust acts as the investment vehicle funded annually by the employer and managed by the plan's advisor to pay out benefits based on the "cash balance" tracked for each participant.

A cash balance plan is a defined benefit plan that specifies both the contribution to be credited to each participant and the investment earnings to be credited based on those contributions. Each participant has an account that resembles those in a 401(k) or profit-sharing plan. These accounts are maintained by the plan actuary, who generates annual participant statements.

Cash balance plans offer much higher contribution limits than a 401(k)—especially for older participants, who can contribute more than $200,000 a year after age 55—and provide a guaranteed retirement benefit. A participant's contributions also grow tax-deferred at a set interest rate, typically 4% to 5%, rather than being based on investment performance.

Contributions to cash balance plans are tax-deductible to the sponsoring employer (or sole proprietor), resulting in significant tax savings. For example, a $100,000 cash balance plan contribution would immediately save $35,000 in federal taxes for a business owner in the 35% federal tax bracket.

A 401(k) plan is a "defined contribution plan", where each eligible participant can elect to have "salary deferral" amounts withheld from their paychecks and contributed to their account in the plan on a tax-deferred basis. On the other hand, a cash balance plan is a type of "defined benefit plan", where the plan is entirely employer-funded, and the contribution/benefit formula for participants is clearly defined by the plan.