Acorns offers a variety of investment portfolios to choose from, depending on your financial goals, risk tolerance, and time horizon. The Acorns app provides a compound interest calculator to help you understand how much your investments can grow over time. The platform also offers a Custom Portfolio feature, allowing you to add individual stocks and ETFs to your existing diversified portfolio. This gives you more control over your investments while maintaining safeguards to ensure your investments remain diversified.

Acorns' expert-built portfolios contain Exchange-Traded Funds (ETFs) from top investment firms like Vanguard and BlackRock. These portfolios can include a mix of stocks, bonds, real estate, cryptocurrency, and money market vehicles.

Additionally, Acorns provides a robo-advisor feature that automatically rounds up transactions from linked cards and invests your spare change. With Acorns Gold, you can also boost your retirement savings with a 3% IRA match on new contributions to your Acorns Later retirement account.

What You'll Learn

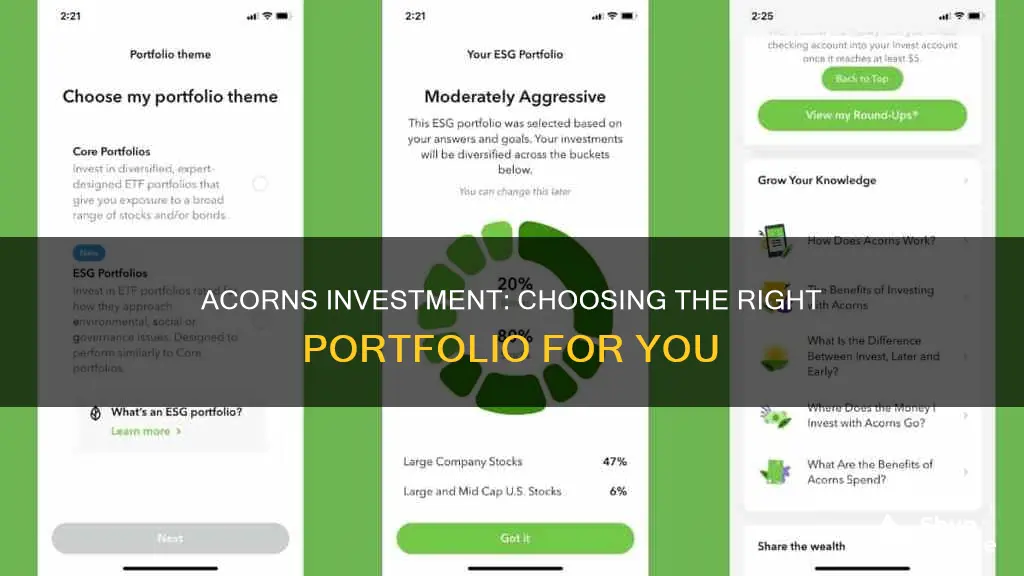

Sustainable ESG portfolios

The companies in these portfolios are rated by a third party on how they address ESG issues. For example, in the environmental category, companies are rated on their use of renewable energy, animal welfare practices, and CO2 emissions reduction. In the social category, companies are rated on their corporate social responsibility, support for local communities, and data security practices. In the governance category, companies are rated on their anti-corruption measures, board diversity, and ethical standards.

Acorns offers four different ESG portfolios, each composed of exchange-traded funds (ETFs) that contain a diverse mix of stocks and/or bonds. The ETFs in the ESG portfolios include:

- IShares ESG Aware MSCI USA ETF (ESGU)

- IShares ESG Aware MSCI EM ETF (ESGE)

- IShares ESG Aware MSCI USA Small-Cap ETF (ESML)

- IShares ESG Aware 1-5 Year USD Corporate Bond ETF (SUSB)

- IShares ESG Aware MSCI EAFE ETF (ESGD)

- IShares 1-3 Year Treasury Bond ETF (SHY)

- IShares MSCI USA ESG Select ETF (SUSA)

- IShares U.S. Treasury Bond ETF (GOVT)

- IShares MBS ETF (MBB)

- IShares ESG Aware USD Corporate Bond ETF (SUSC)

These portfolios are designed with diversification in mind and aim to perform similarly to Acorns' standard Core portfolios while allowing investors to align their investments with their values and support companies that prioritize ESG issues.

Investing My Daughter's Savings: Strategies for Long-Term Growth

You may want to see also

Bitcoin ETF

In January 2024, the first physical Bitcoin ETFs were approved by the Securities and Exchange Commission (SEC), with the first 10 funds launching on January 11, 2024. This came after a successful lawsuit by ETF issuer Grayscale, and around a decade of lobbying.

There are a variety of Bitcoin ETFs available, with different fees and promotional offers. Some examples include:

- IShares Bitcoin Trust (IBIT)

- Fidelity Wise Origin Bitcoin Fund (FBTC)

- WisdomTree Bitcoin Fund (BTCW)

- Invesco Galaxy Bitcoin ETF (BTCO)

- Valkyrie Bitcoin Fund (BRRR)

- Grayscale Bitcoin Trust (GBTC)

Acorns offers a Bitcoin-linked ETF as part of its portfolio options.

Savings and Investment: National Strategies for Economic Growth

You may want to see also

Expert-built portfolios

Acorns offers expert-built portfolios, diversified by professionals and designed for long-term investing. These portfolios include Exchange-Traded Funds (ETFs) managed by pros at top investment firms like Vanguard and BlackRock. The ETFs in these portfolios are described as baskets of different investments, including stocks and/or bonds, offering benefits such as diversification, lower costs, and potential tax efficiency.

The expert-built portfolios are tailored to your needs, with Acorns recommending a portfolio based on your age, time horizon, income, goals, and risk tolerance. The portfolios range from aggressive (all stocks) to conservative (all bonds), with options in between. You can switch portfolios without a charge or penalty, although changing portfolios may trigger a taxable event.

The expert-built portfolios are designed to weather the stock market's normal ups and downs. They are diversified, composed of a variety of assets, to balance performance over time. Acorns also provides automatic portfolio rebalancing to keep your allocations on track with your long-term goals.

Additionally, Acorns offers Sustainable ESG portfolios, which are composed of ETFs that invest in companies rated highly for their environmental, social, and governance practices. These portfolios provide an opportunity for values-aligned investing while still offering the benefits of diversification and expert management.

Understanding Investment Portfolios: The Role of Equity

You may want to see also

Custom portfolios

For example, if your investment profile is "Moderate", your Custom Portfolio can make up to 30% of your overall Invest account. You can choose individual securities or ETFs to fill up that 30%. The remaining 70%—your Base Portfolio—will remain the same portfolio that is diversified by experts and designed for long-term investing.

Once you’ve chosen which securities to include in your Custom Portfolio, Acorns will automatically allocate any future investments (e.g., Round-Ups®, Recurring Investments) across your Base Portfolio and newly created Custom Portfolio. You choose which securities you want to invest in and how much to allocate towards them, and Acorns will take care of the rest.

It is important to note that Custom Portfolios are not meant for short-term investing. Instead, they are designed as a long-term investing tool to help you work towards your financial goals.

Emergency Savings: Where to Invest for Peace of Mind

You may want to see also

Risk tolerance

There are three main types of investments, each with its own level of risk and potential returns: equities (stocks), fixed-income (bonds), and cash and equivalents (short-term, low-risk investments). Depending on your risk tolerance, you may prefer lower-risk investments that preserve your capital and protect against market volatility, or you may be comfortable with higher-risk investments that offer the potential for higher returns but also come with greater price fluctuations.

Acorns offers five core portfolios, ranging from aggressive (all stocks) to conservative (all bonds), with a mix in between. When you sign up for Acorns, they will recommend a portfolio for you based on factors such as your age, income, goals, time horizon, and risk tolerance. However, you can choose to override their recommendation and select your own portfolio.

It's important to regularly rebalance your portfolio to maintain your desired asset allocation. This involves buying and selling investments to return to your original allocation percentage. Acorns automatically rebalances your portfolio for you, typically on a quarterly basis, to ensure your investments align with your financial goals.

By understanding your risk tolerance and choosing an appropriate investment portfolio, you can make informed decisions about how to allocate your capital and work towards achieving your financial objectives.

Savings and Investments: Strategies for Success in Lean Times

You may want to see also

Frequently asked questions

An investment portfolio is a collection of all the assets you own, including stocks, bonds, real estate, cryptocurrency, and money market vehicles.

An Acorns investment portfolio can include stocks, bonds, and cryptocurrencies. Acorns portfolios are built by experts and include ETFs managed by investment firms like Vanguard and BlackRock.

Acorns will recommend a portfolio based on your age, time horizon, income, goals, and risk tolerance.

Diversification means spreading out the risk by investing in a wide variety of asset classes, sectors, and geographic locations. This helps to reduce market risk and smooth out returns, potentially improving long-term portfolio performance.

Custom Portfolios is a feature available to all customers with an Acorns Gold subscription. It allows you to add individual securities to your already diversified Acorns portfolio, giving you more control over how your money is invested.