India's bustling economy, massive population, and status as the world's fastest-growing major economy make it an attractive prospect for investors. The country's stock market capitalization surpassed Hong Kong's in 2024, reaching $4.33 trillion.

The two primary stock markets in India are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE is the country's oldest stock exchange, while the NSE is the largest in volume.

To invest in Indian stocks, individuals must open a Demat account, which serves as an electronic repository for shares, and a trading account, which is used to buy and sell securities. These accounts can be opened with the help of a broker or sub-broker registered with the Securities and Exchange Board of India (SEBI).

When investing in Indian stocks, it is important to consider factors such as financial goals, risk appetite, and the ability to withstand market volatility. Conducting thorough research and analysis of companies' fundamentals, such as stable revenue, good management, and growth potential, is crucial for making informed investment decisions.

Additionally, investors should consider diversifying their portfolios across different sectors and asset classes to mitigate risks and maximize opportunities.

What You'll Learn

How to open a Demat and trading account

To open a Demat and trading account in India, you need to follow a few steps. Here is a detailed guide:

Step 1: Approach a SEBI-registered broker

Firstly, you need to find a broker or sub-broker registered with the Securities and Exchange Board of India (SEBI). They will have a registration number starting with "INB" for brokers, "INS" for sub-brokers, or "INF" for banks. You can usually find this on their website and verify it on the SEBI website.

Step 2: Open a Demat account

A Demat account stores your shares or securities in dematerialized or electronic form. It is opened in the name of the investor to hold and transfer shares. You will need to sign a "Member Client Agreement" with your chosen broker or sub-broker to execute trades on your behalf.

The following documents are typically required to open a Demat account:

- Two to three passport-size photographs

- Proof of identity: PAN card, Aadhaar card, passport, voter ID card, driving license, etc.

- Proof of address: Ration card, passport, voter ID card, driving license, bank passbook, electricity bill, etc.

- Proof of bank account: Name of the bank, account number, or a canceled cheque

There are two types of Demat accounts: repatriable and non-repatriable. A repatriable account allows you to transfer funds abroad, while a non-repatriable account does not.

Step 3: Open a trading account

A trading account acts as a bridge between your Demat and bank accounts. It is created simultaneously when opening a Demat account, and the same KYC documents are used. Once you have a trading account, you can start buying and selling shares.

For example, when you buy shares, you fund your trading account to initiate the transaction, and the shares are then stored in your Demat account. When you sell shares, the amount is credited to your trading account, and you can transfer it to your bank account if desired.

Other Considerations:

- Clearing and Settlement: When you buy shares, the equivalent number of shares is transferred from the seller to the buyer's Demat account. The seller receives the funds in their trading account. This process can take around 2-3 working days to reflect in your account.

- Trading Orders: There are two common types of trading orders: market orders and limit orders. A market order instructs the broker to buy immediately at the current price, while a limit order allows investors to specify their desired price and amount of shares.

- Brokerage Charges: There may be brokerage charges associated with your trading account, such as a small amount per executed order.

Portfolio Management: Broker's Investing Strategy for You?

You may want to see also

The Bombay Stock Exchange and the National Stock Exchange

India has two primary stock markets: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE is India's oldest stock exchange, founded in 1875 by cotton merchant Premchand Roychand. It is the world's sixth-largest stock exchange, with a market capitalisation exceeding $5 trillion as of May 21, 2024. The NSE, founded in 1992, is the largest in volume. Both exchanges follow the same trading mechanism, hours, and settlement process. As of January 30, 2024, the BSE had 5,315 listed firms, while the NSE had 2,266 as of December 31, 2023. Almost all significant Indian firms are listed on both exchanges.

The two prominent Indian market indexes are Sensex and Nifty. Sensex is the oldest market index for equities, created in 1986, and includes shares of 30 firms listed on the BSE. The Nifty includes 50 shares listed on the NSE and was created in 1996.

Understanding Management Fees: Initial Investment Charges

You may want to see also

The benefits and risks of investing in stocks

Benefits

Investing in stocks can be a valuable part of your investment portfolio and can help you build your savings. Here are some of the key benefits:

- Better long-term returns: Historically, the stock market has produced generous returns for investors over time. While individual stock prices fluctuate daily, the overall stock market tends to grow in value.

- Protection from taxes and inflation: Equity investments can offer better tax treatment over the long term, helping to slow or prevent the negative effects of taxes and inflation on your wealth.

- Maximise income: Some companies pay shareholders dividends or special distributions, providing regular investment income and enhancing your returns.

- Voting privileges: Shareholders usually have the power to vote in the company's decisions, allowing them to have some control over how the company is run.

- Liquidity: Stocks are highly liquid assets, allowing you to buy or sell them immediately and turn them into cash quickly and with low transaction costs.

- Diversification: The stock market offers a wide range of financial instruments, such as shares, bonds, mutual funds, and derivatives, enabling investors to diversify their portfolios and reduce risk.

Risks

However, investing in stocks also comes with several risks:

- Company-specific risk: The most prevalent threat to investors is the risk of losing money if the company they have invested in fails to produce enough revenue or profits, or if its value drops due to poor operational performance.

- Headline risk: Negative media coverage about a company or an entire sector can lead to a market backlash and a crash in stock value.

- Market risk: Stock market crashes are an example of heightened market risk, which cannot be eliminated but can be hedged against.

- Liquidity risk: While most stocks are highly liquid, some penny stocks or small-cap stocks may present liquidity issues, making it difficult to buy or sell them seamlessly at their fair price.

Understanding Investment Portfolio Beta: A Beginner's Guide

You may want to see also

How to choose your first stock

India has two primary stock markets, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE is the older stock market, and the NSE is the largest in volume.

Step 1: Understand the Basics

Before investing in the stock market, it is important to understand how it works, including how shares are traded, basic investment strategies, and risk management.

Step 2: Do Your Research

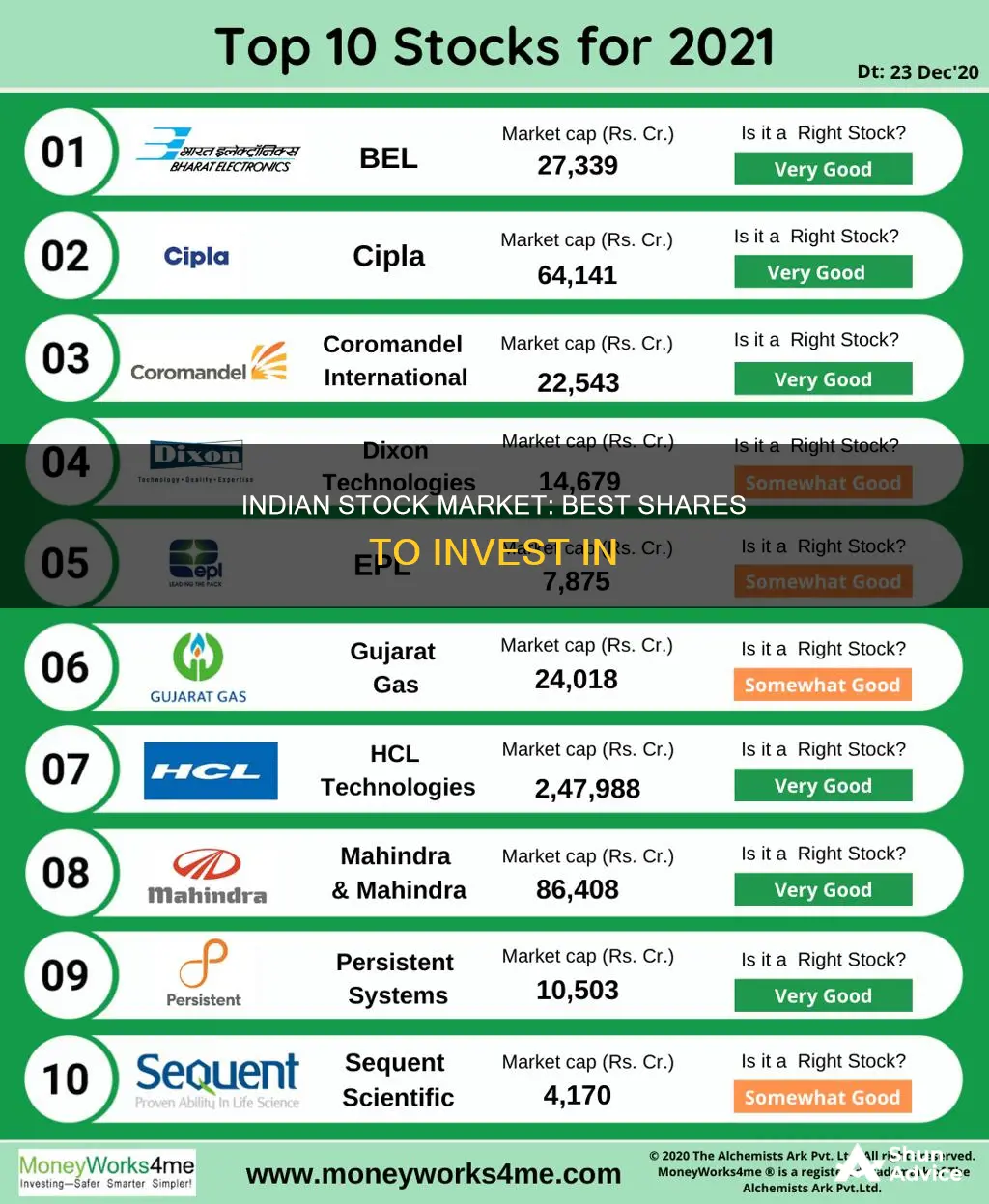

When choosing your first stock, it is crucial to research and analyse the fundamentals of the companies you are considering. Look for companies with stable revenue, good management, and growth potential. Consider buying blue-chip stocks first, as these are relatively more stable and less risky.

Step 3: Analyse Financial Metrics

When evaluating a company, there are several key financial metrics to consider:

- Price-to-Earnings Ratio (P/E Ratio): Compares a company's current share price to its per-share earnings. A lower P/E ratio might indicate an undervalued stock, which could be a good buy if the company has strong fundamentals.

- Return on Equity (ROE): Measures a company's profitability by revealing how much profit is generated relative to the money invested by shareholders. A higher ROE indicates effective use of equity and profitable operations.

- Operating Profit Margin (OPM): Shows what percentage of revenue remains after paying variable costs. A consistently high OPM suggests the company has control over its costs and can maintain profitability.

Step 4: Assess Revenue Growth

Consistent revenue growth is crucial, as it indicates the company is expanding its business. Look for companies with steady revenue growth, as this suggests a sustainable business model that can command higher valuations.

Step 5: Consider Qualitative Factors

In addition to financial metrics, consider the following qualitative factors:

- Market Position and Competitive Advantage: A company with a strong market position, brand strength, technology superiority, customer loyalty, or distribution networks may have a competitive edge that leads to sustainable earnings.

- Quality of Management and Corporate Governance: The leadership team's vision and capability can significantly impact the company's direction and success. Good governance ensures decisions are made in the best interest of all stakeholders and reduces the risk of scandals or mismanagement.

- Dividend Yield and History: Dividends provide a direct return on your investment. A company with a history of paying and increasing dividends can offer a steady income stream, which is appealing for investors seeking regular cash flow.

Step 6: Diversify Your Portfolio

It is important not to put all your eggs in one basket. Diversify your investments across different sectors and companies to mitigate risk. A retail investor should typically hold about 15-20 stocks in their portfolio.

Step 7: Stay Informed and Review Regularly

Market conditions change, so it is important to stay updated and review your investments regularly. Ensure they still meet your criteria and adjust your portfolio as needed to manage risk and maximise returns.

Remember, investing in stocks is a long-term strategy, and it's crucial to approach it with patience and a well-defined strategy.

Spice India: A Guide to Investing in India's Future

You may want to see also

Understanding volatility in the Indian stock market

Volatility is a statistical measure of the dispersion of returns for a given security or market index. It is often associated with big price swings in either direction. Volatile assets are considered riskier than less volatile ones because their prices are less predictable. Volatility is an important variable in options pricing, and it is also used to price options contracts.

How Volatility Works in the Indian Stock Market

The Indian stock market has two primary markets: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Most trading takes place on these two exchanges, and both follow the same trading mechanism, hours, and settlement process.

The BSE and NSE are regulated by the Securities Exchange Board of India (SEBI), which was formed in 1992 as an independent authority to develop, regulate, and supervise the country's stock market.

Measuring Volatility

There are several ways to measure volatility:

- Beta coefficients: A beta value approximates the overall volatility of a security's returns against a relevant benchmark, usually the S&P 500. A beta of 1 means the security's volatility mirrors the broader market.

- Option pricing models: Models like the Black-Scholes or binomial tree models are used to price options contracts.

- Standard deviations of returns: This is the most common way to measure market volatility. Bollinger Bands, a technical indicator, can be used to analyze standard deviation over time.

Impact of Volatility on Investments

Market volatility can lead to sudden and significant changes in investment values, resulting in short-term gains or losses. It increases risk levels and makes it challenging to predict future performance accurately. During volatile periods, trading volumes tend to rise as investors react to market movements, potentially leading to higher transaction prices and losses.

Tips for Investors in Volatile Markets

- Stay calm and avoid panic-driven decisions.

- Diversify your portfolio across different assets, industries, and geographies.

- Adopt a long-term investment strategy.

- Focus on fundamentals such as company performance, financial health, industry trends, and economic conditions.

- Consider seeking professional financial advice.

- Take advantage of short-term opportunities by engaging in tactical asset allocation or active trading.

- Use volatile periods to purchase additional shares in high-quality companies at lower prices.

- Avoid trying to time the market during volatile periods.

- Stick to your investment plan based on your financial objectives.

Blackstone REIT India: A Smart Investment Strategy

You may want to see also

Frequently asked questions

To invest in the Indian share market, you need to open a Demat account, which serves as an electronic repository for your shares, and a trading account, which allows you to buy and sell securities. Both accounts are mandatory and can be opened with the help of a broker or depository participant. You will also need to provide personal documents, such as proof of identity, address, and bank account details, along with passport-size photographs.

Investing in the Indian stock market offers the potential for significant returns, ownership rights in companies, liquidity, and diversification opportunities. However, there are also risks associated with stock price fluctuations, no guaranteed returns or dividends, and the complexity of stock investing, which requires constant analysis of financial reports and market trends.

When choosing your first stock, it is essential to do your research and analyse the fundamentals of the company. Look for companies with stable revenue, good management, and growth potential. Consider buying blue-chip stocks first, as they are relatively more stable and less risky. Diversifying your investment across different sectors can also help manage the risk of stock trading.

The tech sector in India is promising due to its rapid innovation in IT services, SaaS, and digital payments, as well as the surge in startups. The pharmaceutical sector is also strong, with India being known as the 'Pharmacy of the World' for its generic drug manufacturing and increasing focus on R&D. Additionally, the FMCG sector offers resilience due to the essential nature of its products and the rural market penetration.

When crafting an investment strategy for the Indian market, diversification is crucial. Invest across various sectors, asset classes, and geographical regions to spread the risk and maximise opportunities. Include a mix of large-cap, mid-cap, and small-cap stocks, and consider mutual funds, bank deposits, REITs, and gold for a well-rounded portfolio. Stay informed about market trends, company news, and economic indicators to manage investment risks effectively.