Safe harbor investments are a type of financial instrument that offers investors a level of protection and security. These investments are designed to provide a safe and stable environment for investors, especially during times of economic uncertainty or market volatility. They are typically characterized by their low-risk nature, as they are often backed by government guarantees or are considered to be in industries with a low risk of default. Safe harbor investments are an attractive option for risk-averse investors who seek to minimize potential losses while still aiming to grow their wealth over time.

What You'll Learn

- Tax Advantages: Tax benefits for investors in certain types of safe harbor investments

- Liquidity: Understanding the liquidity of safe harbor investments for easy access

- Regulation: Regulatory frameworks governing safe harbor investments and their compliance

- Diversification: Strategies to diversify portfolios with safe harbor investment options

- Risk Management: Techniques to manage risks associated with safe harbor investments

Tax Advantages: Tax benefits for investors in certain types of safe harbor investments

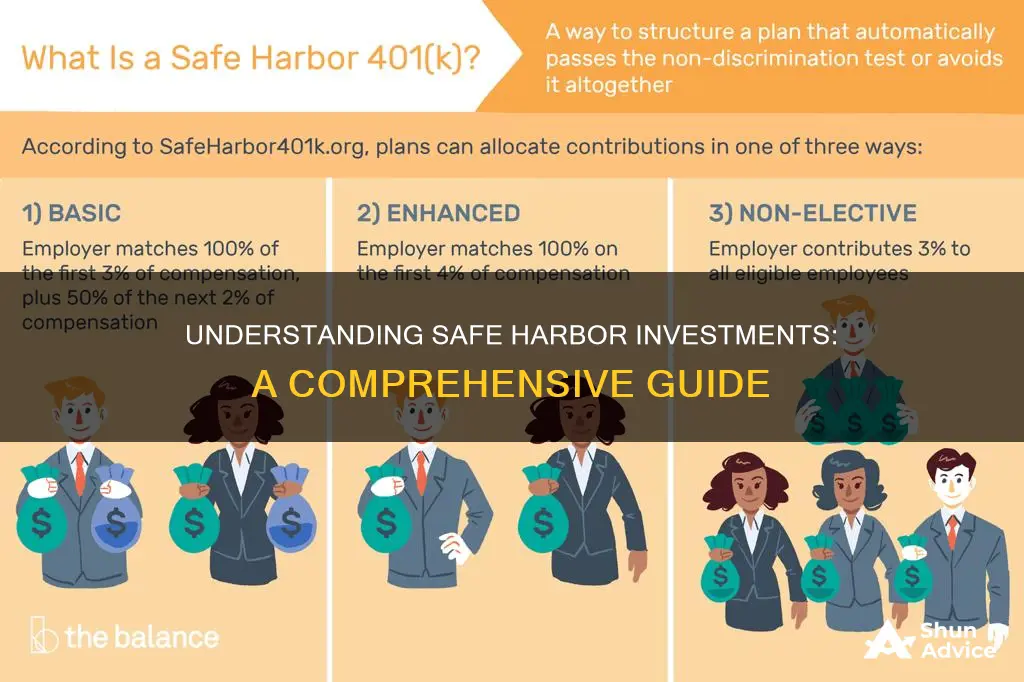

Safe harbor investments are a specific type of investment strategy that offers tax advantages to investors, particularly in the context of retirement savings plans. These investments are designed to provide a structured approach to tax-efficient savings and are often utilized within retirement accounts like 401(k)s or Individual Retirement Accounts (IRAs). The term "safe harbor" refers to the protection and stability these investments offer, ensuring that certain contributions and distributions meet specific tax-qualified criteria.

One of the key tax benefits associated with safe harbor investments is the ability to make contributions that are tax-deductible or tax-deferred. For example, in a 401(k) plan, employees can contribute a certain percentage of their paychecks pre-tax, reducing their taxable income. This pre-tax contribution strategy allows investors to save more for retirement while also lowering their current tax liability. Similarly, in an IRA, traditional IRA contributions are often tax-deductible, providing an immediate tax benefit.

Additionally, safe harbor investments often involve the use of specific contribution limits and distribution rules. These limits ensure that the investments remain within certain tax-qualified thresholds, preventing potential tax issues. For instance, in a 401(k) plan, the safe harbor contribution amount is typically set at a percentage of the employee's compensation, ensuring that the contributions are made in a tax-advantaged manner. This structured approach helps investors maximize their tax benefits while adhering to regulatory requirements.

The tax advantages of safe harbor investments extend beyond the contribution stage. When it comes to distributions, these investments often provide tax-deferred growth or tax-free growth, depending on the type of account. In a tax-deferred account, such as a traditional IRA, the earnings and investment growth are not taxed until withdrawal, allowing for potential tax savings over time. Tax-free growth accounts, like Roth IRAs, offer an even more favorable tax treatment, as contributions are made with after-tax dollars, and qualified withdrawals are tax-free.

Furthermore, safe harbor investments often provide investors with the flexibility to choose from various investment options within their retirement accounts. This includes a range of mutual funds, stocks, bonds, and other securities, allowing investors to tailor their portfolios to their risk tolerance and financial goals. By offering a diverse selection of investments, these plans enable investors to potentially optimize their tax efficiency while also diversifying their retirement savings.

Managing Investments: Qualifications for Success

You may want to see also

Liquidity: Understanding the liquidity of safe harbor investments for easy access

Liquidity is a critical aspect of any investment, especially when considering safe harbor investments, which are designed to provide a level of protection during financial downturns. Safe harbor investments are typically low-risk, highly liquid assets that can be quickly converted into cash without significant loss of value. Understanding the liquidity of these investments is essential for investors who want to ensure they can access their funds when needed.

Liquidity refers to how easily an asset can be bought or sold in the market without affecting its price. For safe harbor investments, this means that investors should be able to convert their holdings into cash relatively quickly and with minimal impact on the asset's value. Highly liquid assets are often those that are actively traded and have a large number of buyers and sellers in the market. This ensures that investors can enter or exit positions without causing a significant shift in the asset's price.

When evaluating the liquidity of safe harbor investments, investors should consider several factors. Firstly, the market depth of the investment is crucial. Market depth refers to the availability of buyers and sellers in the market at any given time. A market with high depth will have numerous participants willing to buy or sell the asset, ensuring that transactions can be executed swiftly. Secondly, the trading volume of the investment is essential. High trading volume indicates that the asset is actively exchanged, making it more likely that investors can find counterparties to buy or sell their holdings.

Additionally, the accessibility of the investment's market is vital. Safe harbor investments should be accessible through various channels, such as online trading platforms, brokerage firms, or financial advisors. This accessibility ensures that investors can easily manage their positions and react to market opportunities or unforeseen circumstances. Furthermore, the investment's historical trading data can provide valuable insights into its liquidity. Past trading patterns can indicate the asset's responsiveness to market changes and its ability to maintain stable prices during transactions.

In summary, liquidity is a key characteristic of safe harbor investments, enabling investors to access their funds quickly and efficiently. By assessing market depth, trading volume, accessibility, and historical data, investors can make informed decisions about the liquidity of these investments. Understanding the liquidity aspect ensures that investors can take advantage of safe harbor investments' benefits while also having the flexibility to respond to changing market conditions and personal financial needs.

Mastering Your Investment Portfolio with Excel

You may want to see also

Regulation: Regulatory frameworks governing safe harbor investments and their compliance

Safe harbor investments are a concept that falls under the purview of financial regulations, particularly in the context of private equity and venture capital. These investments are designed to provide a level of protection and transparency for investors, ensuring that certain investment vehicles meet specific criteria to be considered safe and compliant. The term "safe harbor" in this context refers to a legal framework that shields investors from certain risks and liabilities associated with certain types of investments.

Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, have established guidelines and rules to define what constitutes a safe harbor investment. These regulations aim to protect investors by ensuring that the investment structure, terms, and associated risks are clearly disclosed and understood. The primary goal is to prevent fraudulent activities and provide a level of certainty for investors, especially in the early stages of a company's lifecycle.

One of the key regulatory frameworks governing safe harbor investments is the Private Placement Memorandum (PPM). The PPM is a legal document that outlines the terms and conditions of a private placement offering, which is a common method for raising capital in private equity and venture capital. It provides detailed information about the investment, including the company's business, financial projections, risk factors, and the rights and obligations of the investors. By disclosing this information, the PPM acts as a safe harbor, allowing investors to make informed decisions and understand the potential risks and rewards.

Compliance with these regulatory frameworks is essential for investment managers and sponsors. They must ensure that all relevant documents, such as the PPM, are prepared and disclosed accurately and in a timely manner. This includes providing detailed financial statements, business plans, and risk assessments. Additionally, investment managers should maintain proper record-keeping and documentation to demonstrate compliance with the safe harbor regulations.

In summary, safe harbor investments are a critical aspect of financial regulation, designed to protect investors and maintain market integrity. The regulatory frameworks, such as the PPM, provide a structured approach to disclosing investment terms and risks. Compliance with these regulations is a responsibility for investment professionals, ensuring that investors receive the necessary information to make informed decisions and that the investment process adheres to legal standards. Understanding and adhering to these guidelines is essential for anyone involved in the private equity and venture capital sectors.

NRIAs: Are They a Safe Investment Choice?

You may want to see also

Diversification: Strategies to diversify portfolios with safe harbor investment options

Safe harbor investments are a crucial concept for investors seeking to diversify their portfolios and mitigate risks. These investments are considered low-risk and are often used as a strategy to protect capital and provide a stable foundation for long-term wealth accumulation. The term "safe harbor" refers to the idea that these investments offer a safe and secure environment for investors, especially during turbulent market conditions. By incorporating safe harbor investments, investors can create a balanced and resilient portfolio, ensuring that their assets are protected while still allowing for potential growth.

One of the primary strategies for diversification is to allocate a portion of your portfolio to safe harbor investments. These can include assets such as government bonds, treasury bills, high-quality corporate bonds, and certain types of real estate investments. For example, investing in US Treasury bonds is often considered a safe harbor due to their low-risk nature and the backing of the federal government. Similarly, investing in mortgage-backed securities or asset-backed securities can provide a safe haven for investors, as these securities are typically backed by collateral, reducing the risk of default.

Diversification with safe harbor investments can be achieved in several ways. Firstly, investors can create a core-satellite portfolio strategy. This involves a core allocation of safe harbor investments, which forms the foundation of the portfolio, providing stability. Around this core, investors can build a satellite portfolio, which includes more aggressive investments with higher potential returns. This approach allows for a balanced risk-reward profile, where the core provides safety, and the satellite portion offers growth opportunities.

Another strategy is to use safe harbor investments as a hedge against market volatility. For instance, during periods of economic uncertainty, investors can allocate a portion of their portfolio to gold or other precious metals, which are often considered safe-haven assets. Similarly, investing in large-cap stocks or index funds can provide a safe harbor during market downturns, as these investments tend to be less affected by short-term market fluctuations.

Additionally, investors can explore alternative safe harbor investments such as money market funds, which offer a high level of liquidity and minimal risk. These funds are typically backed by government securities and provide a safe and accessible investment option. Another strategy is to invest in exchange-traded funds (ETFs) that focus on safe-haven assets, allowing investors to diversify their holdings across multiple safe harbor investments simultaneously.

In summary, diversification with safe harbor investments is a powerful strategy for investors aiming to protect their capital and navigate market volatility. By allocating a portion of the portfolio to low-risk assets, investors can create a robust and resilient investment strategy. This approach ensures that the portfolio is well-balanced, providing both stability and the potential for growth, making it an essential tool for long-term wealth management.

The Eastern Promise: Investing in China and India's Future

You may want to see also

Risk Management: Techniques to manage risks associated with safe harbor investments

Safe harbor investments are a type of financial instrument that provides a level of protection for investors, ensuring that their capital is safeguarded under certain conditions. These investments are designed to offer a safe and secure environment for individuals to grow their wealth while minimizing potential risks. Understanding the risks associated with these investments is crucial for investors to make informed decisions and effectively manage their portfolios. Here are some techniques to manage the risks linked to safe harbor investments:

Diversification: One of the fundamental principles of risk management is diversification. When investing in safe harbor vehicles, it is essential to spread your investments across different asset classes, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. For example, if you invest in a safe harbor mutual fund, consider allocating a portion of your funds to various other funds with different investment strategies and underlying assets. This way, you mitigate the risk of being heavily exposed to a single market or asset class.

Risk Assessment and Monitoring: Regular risk assessment is vital to identify potential threats and vulnerabilities associated with safe harbor investments. Investors should analyze the investment's historical performance, market trends, and any relevant factors that could impact its value. By monitoring these risks, investors can take proactive measures to minimize potential losses. For instance, if a safe harbor investment is tied to a specific industry, investors should keep an eye on industry-specific risks, such as regulatory changes or technological disruptions, and adjust their investments accordingly.

Risk Mitigation Strategies: Implementing risk mitigation strategies is essential to protect your investments. One approach is to set stop-loss orders, which automatically sell an investment if it reaches a predetermined price level. This technique limits potential losses and ensures that investors don't incur significant financial setbacks. Additionally, investors can consider using options or derivatives to hedge against potential risks. For instance, buying put options can provide protection against downward price movements in safe harbor investments.

Regular Review and Rebalancing: Safe harbor investments should be regularly reviewed to ensure they remain aligned with your investment goals and risk tolerance. Market conditions and personal circumstances can change over time, so it's crucial to rebalance your portfolio periodically. Rebalancing involves adjusting your asset allocation to maintain your desired risk level. For example, if you initially invested in a 60/40 stock/bond allocation and now the stock market has outperformed bonds, you might consider selling some stocks and buying bonds to restore the original allocation.

Consultation with Financial Advisors: Given the complexity of financial markets, seeking professional advice is highly recommended. Financial advisors can provide valuable insights and guidance tailored to your investment needs. They can help assess your risk tolerance, recommend suitable safe harbor investments, and offer strategies to manage risks effectively. Regular consultations ensure that your investment strategy remains on track and adapts to changing market conditions.

Diverse Investment Portfolios: What's the Right Mix?

You may want to see also

Frequently asked questions

Safe Harbor investments are a type of investment strategy that provides a level of protection for investors, particularly in the context of retirement plans like 401(k)s. These investments are designed to ensure that a certain percentage of an employee's retirement savings is invested in a mix of asset classes, typically including stocks, bonds, and cash equivalents. The goal is to provide a balanced approach to investing while also offering some level of risk mitigation.

In a retirement plan, a Safe Harbor investment strategy is often used to meet the requirements of the Employee Retirement Income Security Act (ERISA). It involves automatically enrolling employees in a retirement plan and contributing a certain percentage of their pay to it. The investments are then diversified to manage risk, and the plan provider is responsible for ensuring the investments meet the Safe Harbor criteria.

One of the main advantages is the automatic enrollment and contribution, which helps employees start saving for retirement early. The diversification of investments also reduces risk, providing a more stable long-term growth potential. Additionally, these investments often come with lower management fees compared to actively managed funds, making them an attractive option for cost-conscious investors.

While Safe Harbor investments offer benefits, they may also limit investment choices. The diversification strategy might not suit all risk appetites, and some investors may prefer more control over their portfolio allocations. Additionally, the strategy's success relies on the plan provider's ability to meet the required investment standards.

These investment strategies are commonly used by employers offering retirement plans to their employees, especially in the US. It is a popular choice for small businesses and large corporations alike, as it simplifies the process of providing retirement savings options to employees while ensuring compliance with legal requirements.