The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the military. TSP offers five different individual fund options, each invested in either U.S. Treasury securities, bonds, or U.S. or international stocks. When enrolling in TSP, investors must decide how much to contribute and which investments to add to their portfolio. The best advice is usually based on saving early and consistently.

| Characteristics | Values |

|---|---|

| Age | The younger you are, the more you can invest in riskier funds. |

| Risk tolerance | The C fund is considered fairly conservative. The L funds are also conservative. |

| Time horizon | The longer the time horizon, the more risk you can take. |

| Pension | If you have a pension, you can take more risk. |

| Diversification | Diversification is important to offset risk. |

| Returns | The C and S funds have had the highest returns. The S fund has had significant negative returns in some years. |

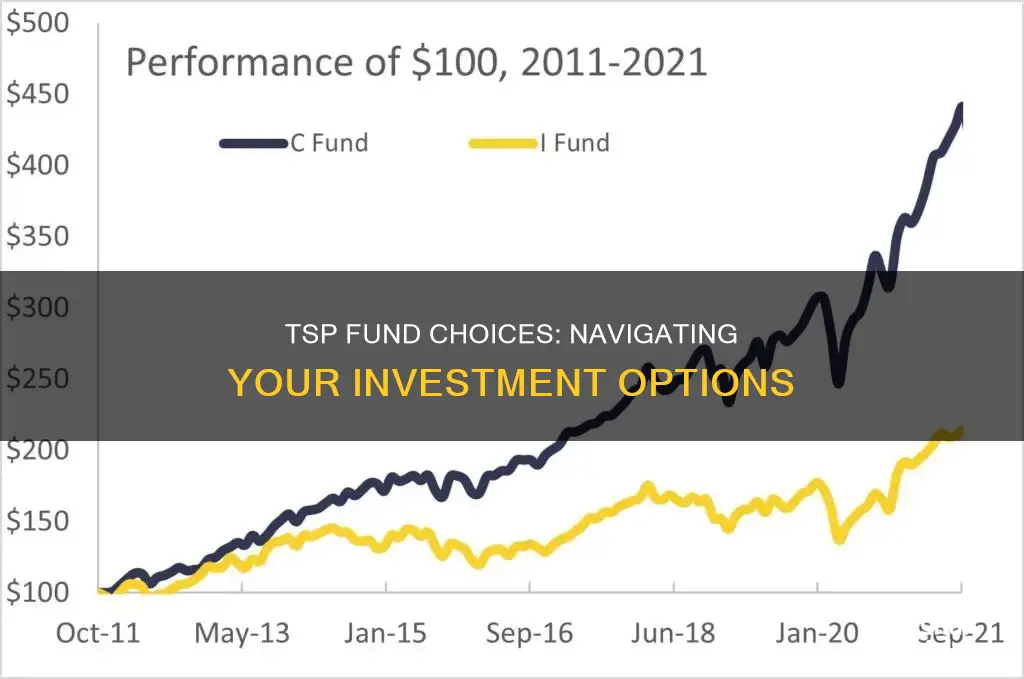

| Average returns (2002-2022) | C fund: 8.22%; S fund: 9.14%; I fund: 6.34% |

| Dave Ramsey's advice | 80% C fund, 10% S fund, 10% I fund |

C fund

The TSP C Fund (Common Stock Index Investment Fund) is a US large-cap stock index fund that tracks the S&P 500 index. The C Fund is invested in common stocks of 500 large to medium-sized US companies, spanning many different industries, and accounting for about 75% of the US stock market's value.

The C Fund offers investors the opportunity to experience gains from equity ownership of large and mid-sized US companies. The fund's performance is evaluated based on how closely its returns match those of the S&P 500 Index. As of December 31, 2023, the C Fund's top holdings included Microsoft Corporation, Alphabet Inc. (Class A and Class C), Meta Platforms Inc. Class A, and JPMorgan Chase & Co.

The C Fund can be a useful component of a diversified investment portfolio. It can help reduce exposure to market risk when combined with stock funds tracking other indexes, such as the TSP S and I Funds. Additionally, including a bond fund like the TSP F Fund in a portfolio containing the C Fund can further reduce volatility.

When considering investing in the C Fund, it is important to keep in mind the associated risks. The fund is subject to market risk as its returns move up and down with the prices of the stocks in the S&P 500 Index. There is also inflation risk, as there is no guarantee that the fund's investments will outpace or grow enough to offset the reduction in purchasing power over time.

Historically, the C Fund has delivered strong returns. As of October 4, 2024, the fund had a compound annual growth rate of 11.0%, an annualized standard deviation of 18.1%, and a Sharpe Ratio of 0.44. An initial investment of $1,000 on August 31, 1990, would have grown to $35,575.

When deciding whether to invest in the C Fund, it is essential to consider your investment goals, time horizon, and risk tolerance. It is also recommended to consult with a financial advisor to determine if the C Fund aligns with your specific financial situation and objectives.

Invest Wisely: Choosing the Right Army Fund

You may want to see also

S fund

The S Fund, or Small Capitalization Stock Fund, is one of the five core investment funds available in the Thrift Savings Plan (TSP). The TSP is a direct-contribution retirement plan offered to US government employees, similar to the 401(k) plans offered by private-sector employers. The S Fund is considered to be one of the two funds with the greatest risk in the TSP, and it has outperformed the C Fund with proportionately greater volatility over time.

The S Fund holds the same securities as the Dow Jones U.S. Completion Total Stock Market Index, which is composed of over 4,000 small-to-medium-sized US companies not included in the S&P 500 Index. As of December 31, 2023, the S Fund's top ten holdings included Snowflake Class A, Crowdstrike Holdings Inc Class A, and Workday Inc Class A.

The S Fund provides an opportunity for investors to experience gains from equity ownership of small-to-mid-sized US companies and is a good option for those seeking to further diversify their domestic equity holdings. However, it is important to note that investing in the S Fund carries market and inflation risks.

Some investors on Reddit recommend allocating a significant portion of their TSP contributions to the S Fund, especially for younger investors. One user mentions that they have been happy with a 50-50 split between the C and S Funds, while another mentions an allocation of 70% C and 30% S. However, it is important to note that investment decisions should be based on individual risk tolerance, investment goals, and time horizon.

College Fund: When to Shift to Safer Investments?

You may want to see also

G fund

The G fund is a government securities investment fund, invested in short-term US Treasury securities. It is a very safe investment option, with a guaranteed payment of principal and interest by the government. However, it may not keep up with inflation and has a low return compared to other funds. The G fund is suitable for those who are risk-averse or closer to retirement, as it offers protection from market volatility. It is also useful for those who want to preserve their capital and are not focused on high returns.

The G fund is often compared to other funds like the F fund (fixed-income index fund), C fund (common stock index fund), and S fund (small capitalisation stock index fund). The G fund is considered more stable than these funds but may not provide the same level of growth over time.

For federal employees, the G fund is a default option for their Thrift Savings Plan (TSP). However, it is recommended to diversify investments and consider other funds like the C and S funds, especially for those who are younger or have a longer investment horizon. The L fund, which is a mix of the G, F, C, and S funds, is also an option for those who want a more hands-off approach to their TSP.

Overall, the G fund can be a good choice for those who prioritise capital preservation over high returns and are closer to retirement. However, it may not be the best option for long-term growth, especially for younger investors who have a higher risk tolerance and a longer time horizon.

Who Should Invest in Mutual Funds?

You may want to see also

L fund

Some investors on Reddit opt for L funds because they don't want to actively manage their investments. One user commented, "L Fund is great. Sticking with that is fine." Another user wrote, "L funds are a good option if you either want to contribute and forget about it, or you aren't confident in your understanding of investing."

However, some Reddit users cautioned against L funds, arguing that they are too conservative for younger investors. One user said, "IMO the L funds are way too conservative for someone your age." Another user advised, "Don't go G fund that will not let your money compound like you'll want it to to build a retirement."

Ultimately, the decision to invest in L funds depends on individual factors such as risk tolerance, investment horizon, and investment goals. It's important to do your own research and consult with a financial advisor before making any investment decisions.

Mutual Fund Investors: Owners of a Diverse Portfolio

You may want to see also

I fund

The I fund is one of the five core Thrift Savings Plan (TSP) funds. The others are the C, S, F, and G funds. The I fund is an international stock fund that invests in stocks issued by companies in countries outside the United States.

- "I fund is just a dog and has been my entire 38-year career."

- "I fund is a winning combo."

- "I fund has not done great since inception but we have stock data going back hundreds of years in dozens of countries. You need to look at as much data as you can and look at how the index construction behind the funds would have historically behaved."

- "I fund does not conflict with clearances at all."

- "I fund has been really good but it will get bad in the future."

- "I fund is a good choice."

- "I fund is not the best way to get international exposure. It leaves out Canada, emerging markets, and small companies."

- "I fund is not as diversified as people think."

- "I fund is beneficial across the long term."

- "I fund is absolute garbage."

- "I fund is fine."

- "I fund is too aggressive."

Index Funds vs Roth IRA: Where Should You Invest?

You may want to see also

Frequently asked questions

The best TSP fund to invest in depends on your age, risk tolerance, and investment strategy. The C fund (based on the S&P 500) is generally recommended for those seeking higher returns over the long term, while the G fund is considered more conservative and stable. Younger investors may opt for riskier funds, while older investors may prefer a more conservative approach.

The TSP funds available for investment include the C fund (common stocks), S fund (small to mid-size companies), I fund (international stocks), F fund (bonds), and G fund (government securities). Each fund offers a different level of risk and potential return, with the C, S, and I funds considered riskier but potentially more rewarding, while the F and G funds are more conservative.

When choosing a TSP fund, consider your investment goals, risk tolerance, and time horizon. If you are comfortable with higher risk and potential volatility, the C, S, or I funds may be suitable. For a more conservative approach, consider the F or G funds. You can also diversify your investments by allocating percentages across multiple funds, such as a mix of C, S, and I funds, or using lifecycle (L) funds that automatically adjust their asset allocation over time.

Yes, there are several online resources available to help you decide which TSP fund is right for you. TSP.gov provides detailed information on each fund's performance and characteristics. Additionally, there are Facebook groups, such as "Thrift Savings Plan," and subreddits like r/ThriftSavingsPlan and r/AirForce, where investors share their experiences and strategies. TSPCalc is also mentioned as a useful tool for analysing seasonal trends.