Military personnel have access to a range of savings and investment opportunities, including some that are unavailable to civilians. These include the federal Thrift Savings Plan (TSP), Individual Retirement Accounts (IRAs), 529 College Savings Plans, and the Savings Deposit Program.

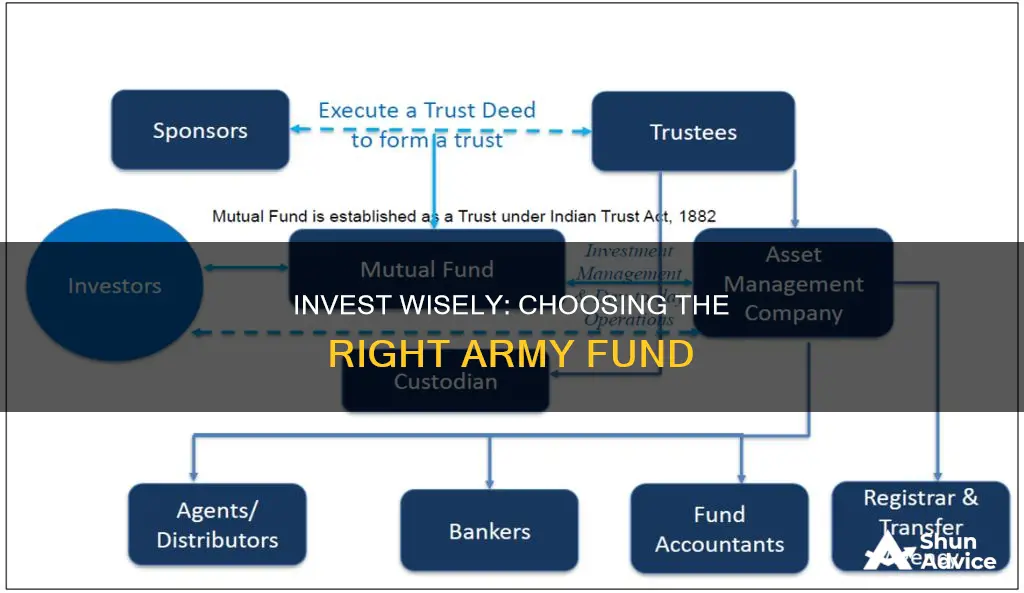

The TSP is a qualified retirement plan that provides a low-cost, tax-advantaged way for federal employees and service members to invest. It offers two account options: Roth and traditional. The former allows contributions of after-tax income, while the latter permits contributions of pre-tax income, thus lowering taxable income in the contribution year.

IRAs are another option, available in traditional (pre-tax) or Roth (after-tax) varieties. They offer greater flexibility than TSPs due to a wider range of investment choices but have lower contribution limits.

The Savings Deposit Program, offered by the U.S. Department of Defense, provides a guaranteed 10% annual return on deposited amounts of up to $10,000 for military personnel serving in designated combat zones.

Additionally, U.S. Savings Bonds, 529 College Savings Plans, and real estate investments are also options for military personnel.

It is important to carefully consider one's financial situation, goals, risk tolerance, and time horizon before investing.

| Characteristics | Values |

|---|---|

| Plan Name | Federal Thrift Savings Plan (TSP) |

| Type of Plan | Defined contribution plan |

| Who is Eligible? | Federal employees and service members |

| Tax Benefits | Yes |

| Payroll Deductions | Yes |

| Matching Contributions | Yes |

| Investment Choices | Wide range |

| Traditional TSP | Pretax plan; tax break in contribution year; taxes on withdrawal |

| Roth TSP | After-tax plan; no upfront tax benefits; tax-free withdrawals in retirement |

| Contribution Limit (2022) | $20,500 |

| Contribution Limit (2023) | $22,500 |

| Contribution Limit (Age 50 or Older, 2022) | $27,000 |

| Contribution Limit (Age 50 or Older, 2023) | $30,000 |

| Investment Options | Government Securities Investment Fund (G Fund), Fixed Income Index Investment Fund (F Fund), Common Stock Index Investment Fund (C Fund), Small Cap Stock Index Investment Fund (S Fund), International Stock Index Investment Fund (I Fund) |

What You'll Learn

The Thrift Savings Plan (TSP)

The TSP offers two types of tax treatments for contributions: Traditional and Roth. With the former, you get a tax break when you contribute and pay taxes when you withdraw funds during retirement. With the latter, you don't get upfront tax benefits, but qualified withdrawals are tax-free in retirement.

For 2022, the contribution limit for the TSP was $20,500, increasing to $22,500 in 2023. If you are aged 50 or older, you can contribute up to $27,000 in 2022 and $30,000 in 2023. If you are part of the Federal Employees Retirement System (FERS) or the Blended Retirement System (BRS), you can earn up to 5% more in matching contributions from the military. For example, if you contribute 5% of your paycheck to the TSP, the military will match that amount.

The TSP offers five individual investment funds with different objectives, strategies, and levels of risk: the Government Securities Investment Fund (G Fund), Fixed Income Index Investment Fund (F Fund), Common Stock Index Investment Fund (C Fund), Small Cap Stock Index Investment Fund (S Fund), and International Stock Index Investment Fund (I Fund).

Additionally, the TSP offers lifecycle funds that automatically adjust your investment mix based on your age and target retirement date. These funds invest in a combination of the five individual TSP funds and are designed to make retirement planning more convenient.

The TSP is a great option for military members to save for retirement, offering low fees and expenses, and the ability to keep your account even if you leave the military.

Best Vanguard Funds to Maximize Your 401(k) Returns

You may want to see also

Individual Retirement Accounts (IRAs)

For 2022, you can contribute up to $6,000 to your IRAs ($7,000 if you're aged 50 or older). These figures increased in 2023 to $6,500 and $7,500, respectively. IRAs are a good option even if you've maxed out your TSP contributions, allowing you to stash away more money for retirement.

The traditional IRA gives you a tax break in the year you make the contribution, but you'll pay taxes when you withdraw funds during retirement. On the other hand, the Roth IRA doesn't offer upfront tax benefits, but qualified withdrawals are tax-free in retirement.

With a wide range of investment choices and the ability to supplement your TSP, IRAs are a powerful tool to help you build a comfortable retirement nest egg.

Protect Your 401k: Invest in Mutual Funds for a Secure Future

You may want to see also

529 College Savings Plans

If you are a member of the military or have a family member who is, you may be looking for the best ways to save and invest your money. One option to consider is a 529 College Savings Plan, which is a tax-advantaged investment account that can be used to save for higher education expenses.

A 529 plan is a state-sponsored investment plan that enables you to save money for a beneficiary's education expenses. You can withdraw funds tax-free to cover a wide range of college costs, such as tuition, room and board, textbooks, and more. Additionally, under tax laws passed in 2017 and 2019, you can also use a 529 plan to pay for K-12 expenses. While contributions are not tax-deductible at the federal level, more than 30 states offer a full or partial tax deduction or credit. This means that a 529 plan can grow tax-free, and withdrawals are typically tax-free when used for qualified education expenses.

Anyone of any age can use a 529 plan to save for education, and you can be your own beneficiary. This makes it a flexible option for those looking to further their education or for parents, grandparents, or other family members looking to save for a child's future education. There are no income restrictions on 529 plan accounts, and you can contribute any amount. However, it's important to note that contributions over $16,000 per individual (the annual 2022 gift tax exclusion) may trigger federal gift taxes.

When considering a 529 plan, it's important to evaluate the fee structure, timing of withdrawals, and potential taxes and penalties. Additionally, like any investment, 529 plans carry some risk and may be impacted by market losses. However, with careful planning and consideration, a 529 College Savings Plan can be a powerful tool for saving for higher education expenses.

SEI Investment Operations: Exploring Mutual Fund Strategies

You may want to see also

Savings Deposit Program (SDP)

The Savings Deposit Program (SDP) is a savings scheme offered by the U.S. Department of Defense. It is designed to help military personnel serving in designated combat zones build their financial savings. The program offers a guaranteed annual return of 10% on savings of up to $10,000. This is a significantly higher rate than that offered by traditional savings accounts.

To be eligible for the scheme, military personnel must be receiving Hostile Fire Pay and be deployed for either 30 consecutive days or at least one day per month for three consecutive months. The 10% interest continues to accrue for 90 days after the redeployment, unless the individual requests an earlier withdrawal.

The income from the SDP is reported on a 1099-INT form in the year the funds are withdrawn, meaning individuals could owe taxes on the earnings.

The SDP is one of several savings and investment opportunities available to military personnel, including the Thrift Savings Plan (TSP), Individual Retirement Accounts (IRAs), and 529 College Savings Plans.

Bond Fund Investment: Where to Begin?

You may want to see also

Real estate

Financial Freedom

When you join the military, many of your large expenses are taken care of, including housing, food, health insurance, dental, and life insurance. This lack of expenses allows you to increase your savings rate and build wealth faster by investing wisely.

Service Member Civil Relief Act (SCRA)

The SCRA mandates that all lenders reduce the interest rates of any debt incurred before enlisting to 6%. This further decreases your expenses, giving you more financial flexibility.

Basic Allowance for Housing (BAH)

The BAH is a powerful benefit that can be used strategically. If you're stationed in a particular location for a longer period, you could consider purchasing a multi-unit home and renting out the extra space, allowing you to save a significant portion of your housing allowance.

Regular Change of Station

While relocating every few years can be challenging, it also provides an opportunity to familiarise yourself with different real estate markets. It broadens your horizons and allows you to pick the best markets to invest in. Additionally, it enables you to utilise the VA loan multiple times, which can be advantageous.

Long-Distance Investing

Being stationed away from your investment properties can be a blessing in disguise. It forces you to have solid systems in place and build a reliable team of professionals, including a property manager, realtor, lender, and contractor. This long-distance approach can result in truly passive real estate investments that require minimal attention and time.

VA Loan

The VA loan is a significant benefit for military real estate investors. It allows you to purchase a one- to four-unit home as your primary residence without a down payment. This strategy, known as the VA house-hack, enables you to have tenants pay the mortgage while you save a large portion of your BAH for future investments.

Stable Investment Markets

Military cities tend to have stable real estate markets due to the constant influx of military tenants. Renting to military personnel can be advantageous, but it's important to understand the nuances of this tenant demographic.

Discounts and Benefits

Many organisations offer discounts to military personnel, which can be beneficial when renovating properties or making other purchases. For example, Lowe's offers a 10% military discount, which can add up to significant savings.

REITs are another popular option for investing in real estate. They are companies that own, operate, or finance income-producing properties. By law, REITs must distribute 90% of their profits as dividends, resulting in high dividend yields for investors.

In conclusion, military service can provide unique advantages for those interested in real estate investing. With careful planning, a solid education, and strategic use of benefits and allowances, military personnel can build wealth and achieve financial freedom through real estate investments.

The Mindset of Investment Fund Managers: Traits and Insights

You may want to see also

Frequently asked questions

The TSP is a federal government-sponsored retirement savings and investment plan available to military members. It offers the same type of savings and tax benefits as many private corporations offer their employees under 401(k) plans. The TSP offers two account options: Roth and traditional. The former allows you to contribute after-tax income, while the latter allows you to contribute pre-tax income, lowering your taxable income in the year you make the contribution.

The SDP is a program by the U.S. Department of Defense that gives deployed military personnel serving in designated combat zones a guaranteed 10% annual return on deposited amounts of up to $10,000.

Apart from the TSP and SDP, military personnel can also invest in U.S. Savings Bonds, Individual Retirement Accounts (IRAs), 529 College Savings Plans, and real estate.

It is important to consider factors such as time until you need the money, your risk tolerance, and your investment goals. For example, if you are saving for a short-term goal, you may want to avoid high-risk investments. Additionally, it is crucial to diversify your investments to protect yourself from risk.

Military personnel should be cautious of affinity fraud, which targets members of identifiable groups by exploiting the trust within the group. Ponzi and pyramid schemes, pump-and-dump schemes, and offers promising "guaranteed returns" are also common types of fraud. It is important to research investments thoroughly and work with licensed and registered investment professionals.