Understanding the different types of cash flows is crucial for investors and financial analysts. In this context, we will explore the nature of short-term investments and their impact on cash flow. Short-term investments are assets that can be quickly converted into cash within a year or less, such as stocks, bonds, and money market funds. These investments are typically considered low-risk and are used to generate immediate returns or to provide liquidity when needed. By examining the characteristics of short-term investments, we can better understand how they influence cash flow and contribute to an investor's overall financial strategy.

What You'll Learn

- Liquidity: Short-term investments are highly liquid, easily convertible to cash within a year

- Maturity: These investments have a maturity period of less than 12 months

- Risk: Low-risk investments with minimal credit risk and market volatility

- Examples: Treasury bills, money market funds, and short-term corporate bonds

- Purpose: Short-term investments are for quick access to capital and meeting short-term financial obligations

Liquidity: Short-term investments are highly liquid, easily convertible to cash within a year

Liquidity is a critical aspect of short-term investments, and it refers to the ease with which an asset can be converted into cash without significant loss of value. In the context of short-term investments, liquidity is a key characteristic that distinguishes these assets from long-term ones. Short-term investments are highly liquid, meaning they can be quickly and efficiently turned into cash within a relatively short period, typically within a year or less. This characteristic is essential for investors who seek flexibility and the ability to access their funds promptly when needed.

Highly liquid short-term investments include assets such as money market funds, treasury bills, and certain corporate bonds. These investments are considered low-risk and are often used as a safe haven for investors who prioritize liquidity and capital preservation. For example, money market funds invest in short-term, high-quality debt instruments, ensuring that the fund's assets can be redeemed quickly and with minimal risk. Treasury bills, issued by governments, offer a highly liquid option with a maturity period of less than a year, making them an attractive choice for investors seeking immediate liquidity.

The high liquidity of short-term investments is particularly beneficial in times of financial uncertainty or when investors require quick access to their funds. It allows investors to take advantage of emerging opportunities or address unexpected financial needs without the constraints of long-term commitments. Moreover, liquidity ensures that investors can diversify their portfolios, managing risk and taking advantage of market fluctuations efficiently.

In summary, short-term investments are characterized by their high liquidity, enabling investors to access their funds swiftly and efficiently. This liquidity is a result of the short-term nature of these investments, which often involve low-risk, highly liquid assets. Understanding and prioritizing liquidity is essential for investors to make informed decisions, especially when considering the role of short-term investments in their overall financial strategy.

Long-Term Investment Strategies: Understanding Setup Investments

You may want to see also

Maturity: These investments have a maturity period of less than 12 months

When considering short-term investments, the concept of maturity becomes a crucial factor. These investments are designed to provide liquidity and capital preservation over a relatively short period, typically less than 12 months. This maturity period is significantly shorter compared to long-term investments, which often have durations of several years or more.

The shorter maturity of these investments means that they are more accessible and flexible for investors who require quick access to their funds. It also implies that the potential for significant capital appreciation is limited, as the investment is not given time to grow at a substantial rate. Instead, the focus is on maintaining the initial capital and generating a modest return within the specified timeframe.

In the context of short-term investments, various financial instruments come into play. Money market funds, for instance, are a popular choice, offering a safe and liquid option for investors. These funds primarily invest in short-term, highly liquid assets, ensuring that the money remains accessible and secure. Another example is treasury bills, which are issued by governments and have maturity periods ranging from a few days to a year, providing a low-risk investment avenue.

Additionally, short-term investments can include commercial paper, which is a form of unsecured promissory note issued by a corporation. These notes typically mature within 270 days, making them suitable for investors seeking short-term liquidity. Another option is certificates of deposit (CDs), which offer higher interest rates for a fixed period, often ranging from a few months to a year, providing a secure and predictable return.

Understanding the maturity period of these investments is essential for investors as it directly impacts their financial goals and risk tolerance. For those seeking immediate access to their funds or requiring a safe haven for their short-term savings, these maturity-focused investments can be an ideal choice, offering a balance between liquidity, safety, and a modest return.

Maximizing Managers' Long-Term Investment Strategies: Exploring Cash Allocation Options

You may want to see also

Risk: Low-risk investments with minimal credit risk and market volatility

When considering low-risk investments with minimal credit risk and market volatility, several options come to mind. These investments are ideal for those seeking a safe and stable return without exposing their capital to significant fluctuations. Here's an overview of some such investment types:

One of the most well-known low-risk investments is government bonds. These are issued by national governments and are considered one of the safest assets due to the backing of the government. Treasury bills, for instance, are short-term securities with maturities ranging from a few days to one year. They offer a secure and liquid investment option, making them a popular choice for risk-averse investors. The credit risk associated with government bonds is minimal, as governments have the power to tax and regulate to ensure repayment.

Another category of low-risk investments is money market funds. These funds invest in a diversified portfolio of short-term, high-quality debt instruments, such as commercial paper, certificates of deposit, and short-term government securities. Money market funds provide a safe haven for investors as they are highly liquid and offer a stable return. They are often used as a temporary holding or a source of emergency funds due to their low volatility and minimal credit risk.

High-quality corporate bonds also fall into this category. These bonds are issued by companies with strong credit ratings, indicating a low probability of default. Investors can benefit from the stability of these bonds while still enjoying a higher yield compared to government bonds. Corporate bonds with investment-grade ratings are considered low-risk, making them an attractive option for those seeking a balance between safety and potential returns.

Additionally, short-term certificates of deposit (CDs) offered by banks can be a low-risk investment. CDs provide a fixed interest rate for a specified period, typically ranging from a few months to two years. They offer a secure investment with guaranteed returns, making them an excellent choice for those seeking a safe and predictable cash flow.

In summary, low-risk investments with minimal credit risk and market volatility include government bonds, money market funds, high-quality corporate bonds, and short-term CDs. These options provide a safe and stable environment for investors, making them suitable for those who prioritize capital preservation and a consistent income stream.

QQQ: A Long-Term Investment Strategy for the Future?

You may want to see also

Examples: Treasury bills, money market funds, and short-term corporate bonds

When considering short-term investments, several financial instruments come into play, each offering unique characteristics and benefits. Let's explore some of the most common examples:

Treasury Bills: These are short-term debt securities issued by governments, typically with maturities ranging from a few days to one year. Treasury bills are considered one of the safest short-term investments due to their low risk and high liquidity. Investors can buy and sell these bills in the secondary market, making them easily accessible. For instance, the US Treasury offers various types of bills, including 4-week, 8-week, 13-week, and 26-week bills, providing investors with a range of options to suit their short-term financial goals.

Money Market Funds: Money market funds are a type of mutual fund that invests in a diversified portfolio of short-term, highly liquid assets. These assets include treasury bills, commercial paper, and short-term corporate bonds. Money market funds aim to provide a stable value and a high level of liquidity, making them an attractive option for investors seeking a safe and accessible short-term investment. They are often used by individuals and institutions as a means to park their cash temporarily while still earning a modest return.

Short-Term Corporate Bonds: These are debt securities issued by corporations with maturities typically ranging from a few months to one year. Short-term corporate bonds offer an opportunity for investors to earn a higher yield compared to government securities while still maintaining a relatively low level of risk. Companies use these bonds to manage their cash flow and finance short-term operations. Investors can purchase these bonds directly from the issuing company or through the secondary market, providing a flexible and potentially rewarding short-term investment strategy.

In summary, Treasury bills, money market funds, and short-term corporate bonds are all excellent examples of short-term investments. Each offers a unique set of advantages, catering to different investor preferences and risk tolerances. Understanding these options can help individuals make informed decisions about their short-term financial strategies, ensuring their cash flow is both secure and productive.

Unlocking Short-Term Wealth: Strategies for Quick Investment Returns

You may want to see also

Purpose: Short-term investments are for quick access to capital and meeting short-term financial obligations

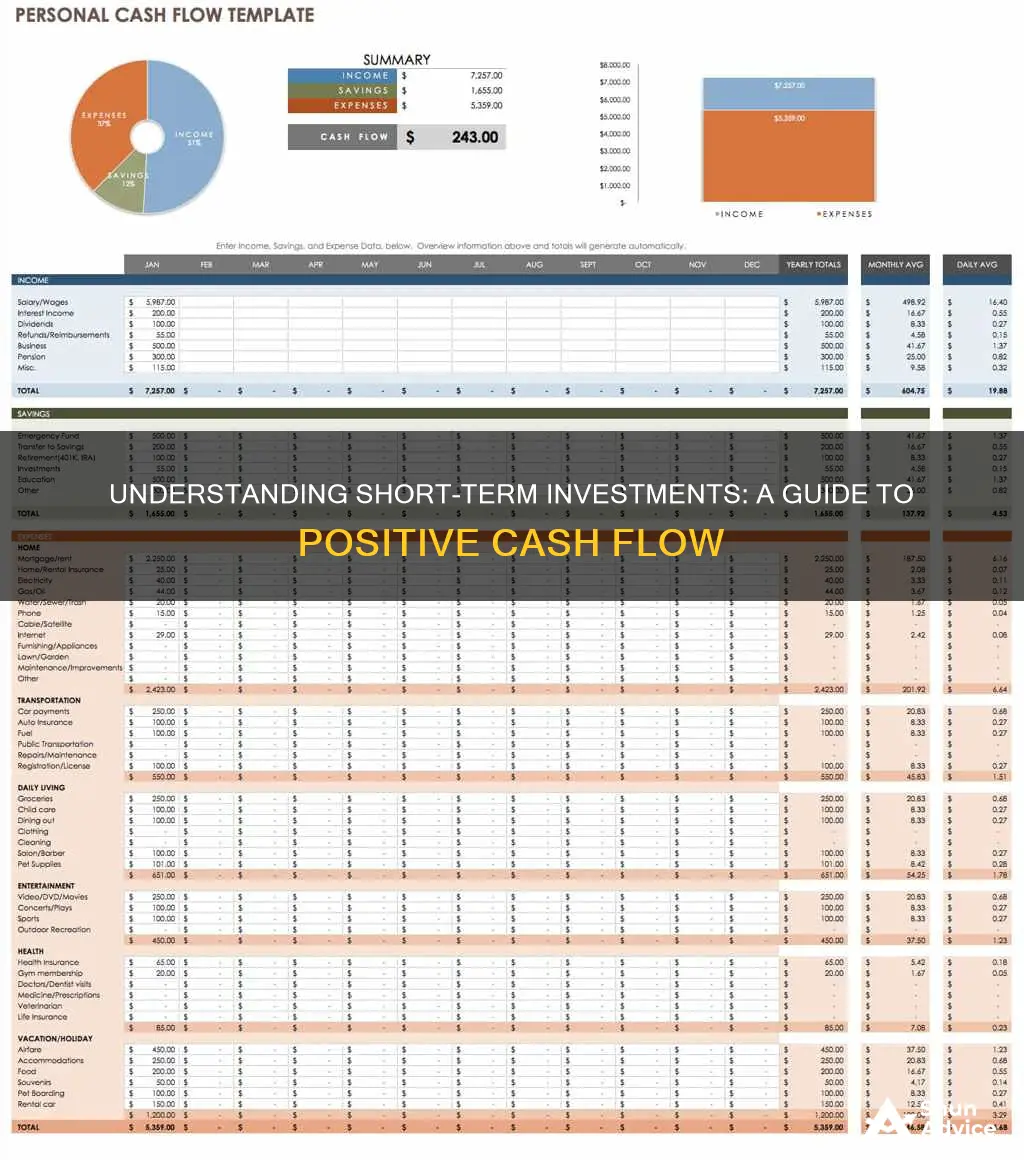

Short-term investments are a crucial component of effective financial management, designed to provide liquidity and meet immediate financial needs. These investments are typically made with the primary purpose of generating a quick return on investment while ensuring easy access to capital. The key objective here is to have funds readily available for short-term financial obligations, such as paying suppliers, covering operational expenses, or taking advantage of immediate investment opportunities.

In the realm of personal finance, short-term investments often involve assets that can be quickly converted into cash with minimal loss of value. This could include money market funds, certificates of deposit (CDs), treasury bills, and high-yield savings accounts. These options offer a balance between safety and liquidity, allowing individuals to access their funds without incurring significant penalties or losses. For instance, money market funds provide a safe haven for short-term investors, offering a higher interest rate than traditional savings accounts while still maintaining the ability to withdraw funds on short notice.

Businesses also rely on short-term investments to manage their cash flow effectively. Companies may invest in short-term assets like commercial paper, which is a short-term unsecured promissory note, or they might utilize the interbank market to borrow funds for a limited period. These strategies enable businesses to maintain a healthy cash flow, ensuring they can meet their short-term financial commitments and take advantage of opportunities as they arise.

The beauty of short-term investments lies in their ability to provide financial flexibility. Investors can quickly adapt to changing market conditions or unexpected financial needs without being tied down by long-term commitments. This flexibility is particularly valuable in volatile markets, where short-term investments can serve as a hedge against potential downturns while still offering the potential for growth.

In summary, short-term investments are a strategic financial tool, catering to the need for quick access to capital and the management of short-term financial obligations. Whether for personal or business purposes, these investments provide a safety net, ensuring that financial goals and commitments are met without compromising liquidity or incurring unnecessary risks. Understanding and effectively utilizing short-term investments can significantly contribute to a robust financial strategy.

Unlocking Long-Term Wealth: A Guide to Commodity Investing

You may want to see also

Frequently asked questions

Short-term cash flow refers to the cash inflows and outflows that are expected to be realized within one year or the operating cycle of the business, whichever is longer. It primarily includes cash received from customers and paid to suppliers, as well as other short-term financial activities.

Short-term investments are a part of the operating activities in the cash flow statement. These investments are typically made with the intention of holding them for a short duration, often to meet short-term financial obligations or to take advantage of immediate market opportunities. They can include investments in marketable securities, money market instruments, or other highly liquid assets.

Short-term investments are characterized by their liquidity and relatively low risk. They are often used to manage cash flow and provide a source of funds for day-to-day operations. In contrast, long-term investments are typically held for extended periods and may include assets like property, plant, and equipment, or long-term marketable securities. Long-term investments are usually not part of the regular cash flow cycle and may not be as liquid as short-term investments.