Investing in commodities can be a valuable strategy for long-term wealth building, offering a hedge against inflation and providing exposure to essential resources. This guide will explore the fundamentals of commodity investing, including understanding the various types of commodities, such as agricultural products, metals, and energy, and how to assess their market trends and potential. It will also delve into the different investment vehicles available, such as futures, options, and exchange-traded funds (ETFs), and provide insights into risk management and diversification techniques to help investors navigate the volatile commodity markets effectively.

What You'll Learn

- Market Research: Study trends, historical data, and expert analysis to identify potential investment opportunities

- Risk Management: Diversify your portfolio and set stop-loss orders to minimize potential losses

- Long-Term Strategy: Focus on fundamental analysis and hold positions for extended periods to benefit from market trends

- Financial Planning: Create a budget and allocate funds for commodity investments, considering tax implications and fees

- Stay Informed: Follow economic news, geopolitical events, and industry developments to make informed investment decisions

Market Research: Study trends, historical data, and expert analysis to identify potential investment opportunities

When considering long-term investments in commodities, market research is an essential step to ensure you make informed decisions. This process involves a comprehensive study of various factors that can influence the performance of commodities over an extended period. Here's a breakdown of how to approach this research:

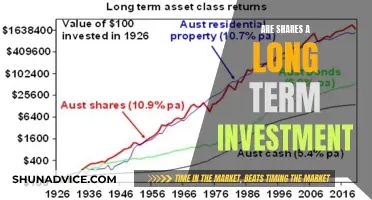

Trend Analysis: Start by examining the historical trends of the commodity you're interested in. Commodities like gold, silver, oil, or agricultural products have long-term price trends that can be influenced by global economic conditions, geopolitical events, and supply-demand dynamics. For example, gold often acts as a safe-haven asset during economic downturns, while agricultural commodities may be affected by weather patterns and changing dietary preferences. Understanding these trends can help you identify potential long-term investment opportunities.

Historical Data: Dive into the past performance of the commodity market. Historical data provides valuable insights into price fluctuations, market cycles, and the impact of various events. Analyze price charts, volume trends, and key milestones in commodity prices. For instance, studying the historical performance of oil can reveal how supply disruptions or geopolitical tensions have influenced prices over the years. This historical perspective is crucial for making informed predictions about future movements.

Expert Analysis and Reports: Seek out expert opinions and market research reports to gain a deeper understanding. Financial analysts, commodity researchers, and industry experts provide valuable insights and forecasts. Their reports often include detailed market analysis, including supply and demand forecasts, price targets, and potential risks. These reports can be a valuable resource for making informed investment decisions. Additionally, stay updated with news and publications from reputable sources to gather real-time market insights.

Economic and Geopolitical Factors: Consider the broader economic and geopolitical landscape, as these factors significantly impact commodity prices. Research global economic indicators, interest rates, and currency fluctuations, as they can affect the value of commodities. Also, keep an eye on geopolitical events, such as trade agreements, political stability in major producing regions, and international conflicts, which can create short-term volatility but also present long-term investment opportunities.

Supply and Demand Dynamics: A critical aspect of market research is understanding the fundamental forces driving commodity prices. Study the factors that influence supply and demand, such as production levels, consumption patterns, inventory changes, and government policies. For instance, in the energy sector, research the impact of renewable energy adoption on fossil fuel demand. This analysis will help you assess the long-term viability of commodity investments.

By conducting thorough market research, you can identify potential investment opportunities, manage risks, and make well-informed decisions when investing in commodities for the long term. It empowers you to navigate the complex commodity market with a strategic approach.

Understanding Long-Term Investment: A Guide to Current Asset Classification

You may want to see also

Risk Management: Diversify your portfolio and set stop-loss orders to minimize potential losses

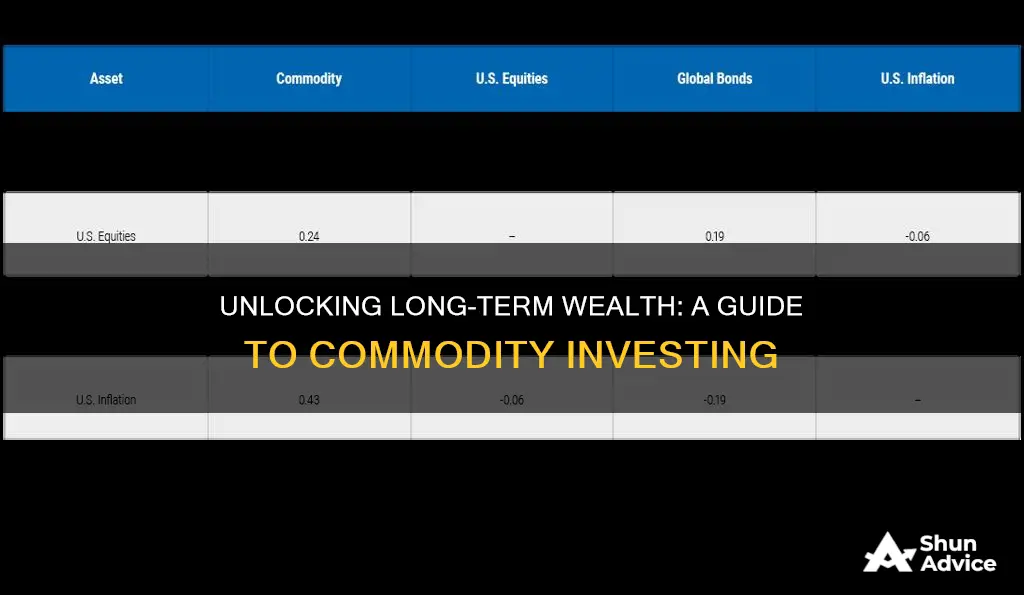

When investing in commodities over the long term, risk management is crucial to ensure your portfolio's stability and growth. One of the primary strategies to mitigate risks is portfolio diversification. This involves spreading your investments across various commodities, sectors, and asset classes. By diversifying, you reduce the impact of any single commodity's performance on your overall portfolio. For instance, if one commodity experiences a downturn, the positive performance of others can balance out the losses, thus minimizing the overall risk.

Diversification can be achieved in several ways. Firstly, consider investing in different types of commodities, such as agricultural products, metals, energy, and livestock. Each of these sectors has its own unique characteristics and drivers, and they don't always move in lockstep with each other. For example, while agricultural commodities might be affected by weather conditions and crop yields, metals could be influenced by industrial demand and geopolitical events. By holding a mix of these, you create a more resilient portfolio.

Another aspect of diversification is to invest in various geographic regions. Different countries and regions have distinct economic and political environments, which can affect commodity prices. For instance, a country's economic stability might impact the demand for its raw materials, while political events could influence the supply of certain commodities. By investing in a global portfolio, you can benefit from the growth of emerging markets while also mitigating the risks associated with any single region's economic or political instability.

In addition to diversification, setting stop-loss orders is a powerful risk management tool. A stop-loss order is an instruction to sell an asset when it reaches a certain price, which helps to limit potential losses. This strategy is particularly useful in volatile markets where commodity prices can fluctuate rapidly. By setting a stop-loss order, you automatically sell the commodity if it drops to a predetermined level, ensuring that you don't incur significant losses. It's important to set these orders based on your risk tolerance and the specific characteristics of the commodity you're investing in.

Lastly, regular review and adjustment of your portfolio are essential. Markets and economic conditions change over time, and what was once a well-diversified portfolio might become less so. Therefore, it's important to periodically assess your investments and make adjustments as necessary. This might involve rebalancing your portfolio to maintain the desired level of diversification or adjusting your stop-loss orders based on market trends and volatility. By staying proactive and responsive to market changes, you can effectively manage the risks associated with long-term commodity investments.

Navigating Short-Term Acquisitions: Strategies for Success

You may want to see also

Long-Term Strategy: Focus on fundamental analysis and hold positions for extended periods to benefit from market trends

When it comes to investing in commodities over the long term, a strategic approach is essential to navigate the volatile and often complex market. One of the most effective strategies is to focus on fundamental analysis, which involves a deep dive into the underlying factors that drive commodity prices. This method requires a thorough understanding of the supply and demand dynamics, economic trends, and geopolitical events that can significantly impact commodity markets. By studying these fundamentals, investors can identify long-term trends and make informed decisions about which commodities to invest in.

The key to this strategy is patience and a long-term perspective. Instead of frequent trading, investors should aim to hold positions for extended periods, allowing the market to play out its trends. This approach is particularly useful for commodities, as their prices can be influenced by various factors that may take time to materialize. For example, a new mining project might take years to come online, affecting the supply of a specific metal. Similarly, changes in agricultural practices or weather patterns can impact crop yields and, consequently, the supply and price of agricultural commodities.

Fundamental analysis involves examining various indicators such as production levels, inventory data, and economic indicators. Investors should look for commodities with strong supply-demand fundamentals, as these are more likely to exhibit consistent price movements over the long term. For instance, gold is often considered a safe-haven asset, and its price tends to increase during economic downturns or periods of high inflation. Understanding why certain commodities are in high demand or have limited supply can help investors make more accurate predictions about future price movements.

Holding positions for extended periods also allows investors to benefit from compounding returns. By carefully selecting commodities with strong long-term prospects, investors can build a diversified portfolio that grows over time. This strategy is particularly effective for commodities that are essential for various industries, as their consistent demand can provide a stable foundation for investment. Additionally, investors should consider the liquidity of the commodity market, ensuring that they can enter and exit positions without significantly impacting the price.

In summary, a long-term investment strategy in commodities should emphasize fundamental analysis and a patient approach. By studying supply and demand dynamics, economic trends, and geopolitical factors, investors can identify commodities with strong long-term potential. Holding positions for extended periods, allowing for compounding returns, and focusing on essential commodities can lead to successful long-term investments in the commodity market. This strategy requires discipline and a commitment to a thorough understanding of the market, but it can result in substantial gains over time.

Maximizing Short-Term Excess Cash: Strategies for Business Investment

You may want to see also

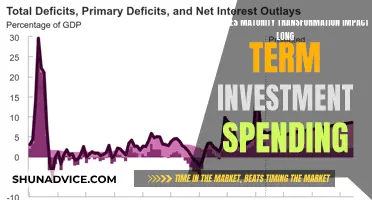

Financial Planning: Create a budget and allocate funds for commodity investments, considering tax implications and fees

When it comes to long-term commodity investments, financial planning is crucial to ensure your strategy is well-structured and aligned with your financial goals. Here's a step-by-step guide to creating a budget and allocating funds effectively:

- Assess Your Financial Situation: Begin by evaluating your current financial health. Calculate your net worth, which includes your assets and liabilities. This will give you a clear picture of the resources you have available for investment. Consider your income, savings, and any existing financial commitments. Understanding your financial position is essential to determine how much you can allocate for commodity investments without compromising your short-term financial needs.

- Set Clear Investment Goals: Define your investment objectives. Are you aiming for capital appreciation, income generation, or a combination of both? For long-term commodity investments, it's important to have a clear vision. Decide on the time horizon for your investment strategy and the level of risk you are willing to take. This will help you choose the right commodities and investment vehicles. For instance, if you're seeking long-term growth, you might consider investing in physical commodities like gold or silver, or in commodity-linked derivatives.

- Create a Realistic Budget: Develop a comprehensive budget that accounts for your commodity investment strategy. Start by listing all your expected income sources, including your salary, investments, or any other earnings. Then, categorize your expenses, such as housing, transportation, utilities, and discretionary spending. Allocate a portion of your income to savings and investments, ensuring that you have a realistic surplus for commodity investments. Consider using budgeting apps or spreadsheets to track your expenses and income accurately.

- Consider Tax Implications: Commodity investments may be subject to various taxes, including capital gains tax, income tax, and sales tax, depending on your jurisdiction. Research the tax laws and regulations related to commodity trading and investments. Consult a tax professional to understand the potential tax liabilities associated with your chosen investment vehicles. Proper tax planning can help you optimize your after-tax returns and ensure compliance with legal requirements.

- Account for Fees and Expenses: Commodity investments often come with associated fees and expenses. These may include brokerage fees, transaction costs, storage fees (for physical commodities), and management fees (if applicable). Calculate these costs and factor them into your budget. Understanding the total expense ratio (TER) of your investment products can help you make informed decisions. Some investment platforms or advisors may offer fee-free or low-fee options, which can significantly impact your long-term returns.

- Diversify and Reallocate: Diversification is a key principle in long-term investing. Spread your investments across different commodities, asset classes, and geographic regions to manage risk. Regularly review and rebalance your portfolio to ensure it aligns with your investment goals. As market conditions change, adjust your budget and allocations accordingly. This proactive approach will help you navigate market volatility and optimize your returns over the long term.

Remember, successful long-term commodity investing requires discipline, research, and a well-thought-out financial plan. By creating a detailed budget and considering tax and fee implications, you can make informed decisions and build a robust investment strategy.

Understanding Long-Term Investment Strategies: Key Factors to Consider

You may want to see also

Stay Informed: Follow economic news, geopolitical events, and industry developments to make informed investment decisions

Staying informed is crucial when it comes to investing in commodities over the long term. The commodity market is highly sensitive to global economic and political events, and keeping abreast of the latest news and developments can significantly impact your investment strategy. Here's a guide on how to stay informed and make well-informed decisions:

Economic News: Start by following reputable economic news sources that provide comprehensive coverage of global markets. Economic indicators such as inflation rates, interest rates, and GDP growth are essential factors that influence commodity prices. For instance, a rising inflation rate often leads to higher costs for producers, which can impact the prices of agricultural commodities or metals. Understanding these relationships and staying updated on economic trends will help you anticipate market movements. Financial news websites, newspapers, and magazines dedicated to economics offer a wealth of information, including expert analyses and forecasts.

Geopolitical Events: Global politics plays a significant role in commodity investments. Political decisions and events can affect supply chains, trade agreements, and even the stability of producing regions. For example, changes in government policies might impact the mining or extraction of specific commodities, while international conflicts can disrupt the flow of resources. Following international news, especially those related to the regions where your targeted commodities are sourced, is essential. This includes monitoring diplomatic relations, trade policies, and any geopolitical risks that could potentially impact your investments.

Industry Developments: The commodity market is diverse, with various sectors such as agriculture, energy, metals, and minerals. Each sector has its unique characteristics and challenges. Staying informed about industry-specific news is vital. Attend industry conferences, webinars, and workshops to gain insights from experts and stay updated on the latest trends and innovations. Industry publications and newsletters often provide in-depth analysis and reports, helping you understand the supply and demand dynamics, technological advancements, and regulatory changes that could affect commodity prices.

Additionally, consider using financial data platforms and analytics tools that aggregate and organize economic, political, and industry-specific news. These tools can provide real-time updates and alerts, ensuring you don't miss critical information. By combining these resources with your own research, you can develop a comprehensive understanding of the market and make more strategic investment choices.

Remember, investing in commodities long-term requires patience, a keen eye for detail, and a commitment to continuous learning. Staying informed will enable you to adapt to changing market conditions and make more profitable decisions.

Understanding the Difference: Current vs. Short-Term Investments

You may want to see also

Frequently asked questions

Investing in commodities for the long term can be a strategic move, and there are several approaches to consider. One popular method is through commodity-linked exchange-traded funds (ETFs) or mutual funds, which offer diversification across various commodities like gold, silver, oil, and agricultural products. These funds provide an easy way to gain exposure to the commodity market without directly purchasing physical assets. Another strategy is to invest in commodity futures or options, which allow you to speculate on price movements and potentially benefit from both rising and falling markets. However, it's crucial to understand the risks involved, as commodity prices can be volatile and influenced by numerous factors.

Risk management is essential when investing in commodities. One approach is to diversify your portfolio across different commodity sectors and asset classes. For instance, you could invest in a mix of energy, metals, and agricultural commodities. This diversification helps reduce the impact of any single commodity's price fluctuations. Additionally, consider using financial derivatives like futures, options, or swaps to hedge against potential losses. These instruments allow you to lock in prices and protect your investments from adverse market moves. It's also advisable to stay informed about global economic trends, geopolitical events, and industry-specific news that could affect commodity prices.

Absolutely! For beginners, a simple and accessible strategy is to invest in commodity-focused mutual funds or ETFs. These funds are professionally managed and provide instant diversification, making them less risky compared to individual commodity trading. Another beginner-friendly approach is to invest in companies that produce or are heavily involved in the commodity industry. By investing in these companies, you gain indirect exposure to the commodity market. For example, investing in oil and gas exploration companies or agricultural businesses can provide long-term gains tied to commodity prices. It's always recommended to start with a small investment and gradually educate yourself about the commodity market to make informed decisions.