Investment funds are distinguished not by the assets they hold but by their unique organisational structures, which separate investment assets and management assets into different entities with different owners. In this structure, the investments belong to funds, while the management assets belong to management companies. This structure benefits investors in the funds in a rather paradoxical way: it restricts their rights to control their managers and to share in their managers' profits and liabilities. The fund investors accept these restrictions because certain features common to most investment funds make these restrictions efficient.

| Characteristics | Values |

|---|---|

| Investment funds are distinguished by their unique organisational structures, not by the assets they hold. | Investment funds are distinguished by their unique organisational structures, not by the assets they hold. |

| Investment funds are made up of two entities: the fund and the management company. | The fund holds investment assets and the management company holds management assets. |

| The fund and the management company have different owners. | The fund and the management company have different owners. |

| The separation of funds and managers benefits investors in the funds. | The separation of funds and managers benefits investors in the funds. |

| The separation of funds and managers restricts investors' rights to control their managers and to share in their managers' profits and liabilities. | The separation of funds and managers restricts investors' rights to control their managers and to share in their managers' profits and liabilities. |

| Investors accept these restrictions because of certain common features of investment funds. | Investors accept these restrictions because of certain common features of investment funds. |

| Common features of investment funds include powerful investor exit rights and economies of scope and scale. | Common features of investment funds include powerful investor exit rights and economies of scope and scale. |

What You'll Learn

- The separation of funds and managers is a defining feature of investment funds

- Investment funds are distinguished by their organisational structure, not their assets

- The separation of funds and managers benefits investors by restricting their rights to control their managers

- The separation of funds and managers is efficient because it maximises the aggregate value of investment enterprises

- The separation of funds and managers facilitates the operation of multiple funds

The separation of funds and managers is a defining feature of investment funds

The Separation of Funds and Managers: A Defining Feature of Investment Funds

The separation of funds and managers has three important effects:

- It limits the exposure of fund assets to management companies' liabilities and creditors.

- It restricts fund investors' rights to claim management companies' residual earnings or profits.

- It prevents fund investors from exercising residual control over management companies.

This structure is advantageous for fund investors because it maximises the aggregate value of investment enterprises, increasing the total wealth available to everyone involved. It allows managers to obtain greater profits and, in turn, enables investors to benefit from lower fees and better returns with reduced risk.

The separation of funds and managers is particularly efficient in investment funds due to three key features:

- Exit rights and performance incentives: Most fund investors have strong exit rights, and fund managers have strong performance incentives, which together substitute for control. Fund investors can exit by withdrawing their money, refusing to pay managers' fees, and investing elsewhere if they are unhappy.

- Precision in risk-tailoring: Fund investors desire exposure only to the risks of investment assets, not the risks of management businesses.

- Economies of scope and scale: Fund managers can achieve economies of scope and scale by simultaneously managing multiple funds, which would not be possible without the separation of funds and managers.

The separation of funds and managers is a central phenomenon in the investment fund industry, and its functions and implications are far-reaching. It illuminates the purpose of investment fund regulation and suggests that the definition of an investment fund should be based on its organisational structure, not just the nature of its assets. This understanding also refutes the claims of skeptics who argue that fund investors would be better off if they employed their managers directly.

Graph Savings: A Smart Investment Strategy?

You may want to see also

Investment funds are distinguished by their organisational structure, not their assets

The separation of funds and managers is beneficial to investors in the funds, as it restricts their rights to control their managers and limits their exposure to the managers' profits and liabilities. This paradoxical structure is efficient for three reasons:

- Most fund investors have strong exit rights and are protected by strong incentive compensation systems, so control is more efficiently in the hands of management company investors.

- Fund investors have a strong desire for precision in risk tailoring. They want exposure only to the risks of investment assets, not the risks of management businesses.

- Fund managers can achieve economies of scope and scale by operating multiple funds simultaneously.

The separation of funds and managers is a defining feature of investment funds, and it is more important than the nature of their assets. This organisational structure has far-reaching implications for the regulation of investment funds and how they are understood.

Maximizing Your Investment Portfolio: Strategies for Success

You may want to see also

The separation of funds and managers benefits investors by restricting their rights to control their managers

The separation of investment funds and managers is a defining feature of investment funds, including mutual funds, hedge funds, private equity funds, and their cousins. This structure benefits investors by restricting their rights to control their managers and limits their exposure to the managers' profits and liabilities.

The separation of funds and managers is a unique organisational structure that distinguishes investment funds from ordinary companies. It involves placing investment assets and liabilities into one entity (the "fund") and management assets and liabilities into a different entity (the "management company" or "adviser"). This separation benefits investors in a paradoxical way, as it restricts their control over managers and their exposure to managers' profits and liabilities.

The separation of funds and managers is advantageous for three main reasons. Firstly, fund investors have strong exit rights, which substitute for control. They can exit by withdrawing their money and refusing to pay managers' fees, similar to how product buyers can exit by refusing to buy more products. Secondly, fund investors have a strong desire for precision in risk tailoring. They want exposure only to the risks of investment assets, not the risks of management businesses. Thirdly, fund managers can achieve economies of scope and scale by simultaneously managing multiple funds, which is facilitated by the separation of funds and managers.

The separation of funds and managers has far-reaching implications for the understanding of investment fund regulation. It sheds light on the functions of the Investment Company Act of 1940, which addresses the peculiar problems created by the separation of funds and managers, in addition to securities investing. This understanding also suggests that the definition of an investment fund should be based on both the nature of its assets and its organisational structure, rather than just the former.

In conclusion, the separation of investment funds and managers benefits investors by restricting their rights to control their managers. This restriction is efficient and advantageous due to strong exit rights, the desire for precision in risk tailoring, and the ability to achieve economies of scope and scale by managing multiple funds simultaneously.

Understanding Portfolio Investment Partnerships: A Comprehensive Guide

You may want to see also

The separation of funds and managers is efficient because it maximises the aggregate value of investment enterprises

The separation of investment funds and managers is a defining feature of investment funds. This structure benefits investors in the funds by restricting their rights to control their managers and limiting their exposure to the managers' profits and liabilities. This paradoxical arrangement is efficient for investment funds for three reasons.

Firstly, most fund investors have strong exit rights and fund managers have strong performance incentives. These features substitute for control, and as a result, control is more efficiently placed in the hands of management company investors than fund investors. Secondly, fund investors have a strong desire for precision in the tailoring of risk. They want exposure only to the risks of investment assets, not the risks of management businesses. Thirdly, fund managers can achieve economies of scope and scale by operating multiple funds simultaneously. This simultaneous management is only possible when fund investors' control rights and exposure to managers' earnings and liabilities are restricted by the separation between funds and managers.

The separation of funds and managers maximises the aggregate value of investment enterprises and increases the total wealth available to everyone who contracts with them. This pattern permits managers to obtain greater profits and, in turn, enables investors to obtain lower fees and better returns with fewer risks.

Actuaries: Investment Portfolio Management, a Necessary Skill?

You may want to see also

The separation of funds and managers facilitates the operation of multiple funds

The separation of investment funds and managers is a defining feature of investment funds, and it facilitates the operation of multiple funds in several ways. Firstly, it prevents the spillage of risks across funds by keeping investment and management assets separate. This limits the exposure of fund assets to management companies' liabilities and creditors. Secondly, it allows management companies to continue as going concerns even when their individual funds have liquidated. This is especially important for private equity funds, which liquidate every few years. Lastly, it enables the efficient resolution of conflicts of interest among multiple funds by giving management companies the authority and incentives to resolve these conflicts.

The separation of funds and managers is a unique organisational structure that benefits investors by restricting their rights to control their managers and share in their profits and liabilities. This structure is advantageous because it maximises the aggregate value of investment enterprises, increasing the total wealth available to everyone involved. By separating funds and managers, investors gain lower fees, better returns, and reduced risks.

The separation of funds and managers is nearly universal among investment funds, including mutual funds, hedge funds, private equity funds, and venture capital funds. This structure has evolved over time through natural selection rather than deliberate choice, as competitive pressures have forced investment funds to adopt this pattern to remain efficient and competitive.

In conclusion, the separation of funds and managers facilitates the operation of multiple funds by preventing risk spillage, maintaining management companies as going concerns, and addressing conflicts of interest. This structure ultimately benefits investors by maximising value, reducing fees, and improving returns while minimising risks.

Savings, Investments, and the Economy's Vital Balance

You may want to see also

Frequently asked questions

Separating the investment vehicle and the investment manager restricts the investors' rights to control their managers and to share in their managers' profits and liabilities. This benefits the investors in the funds as it maximises the aggregate value of investment enterprises, increasing the total wealth available to everyone contracting with them.

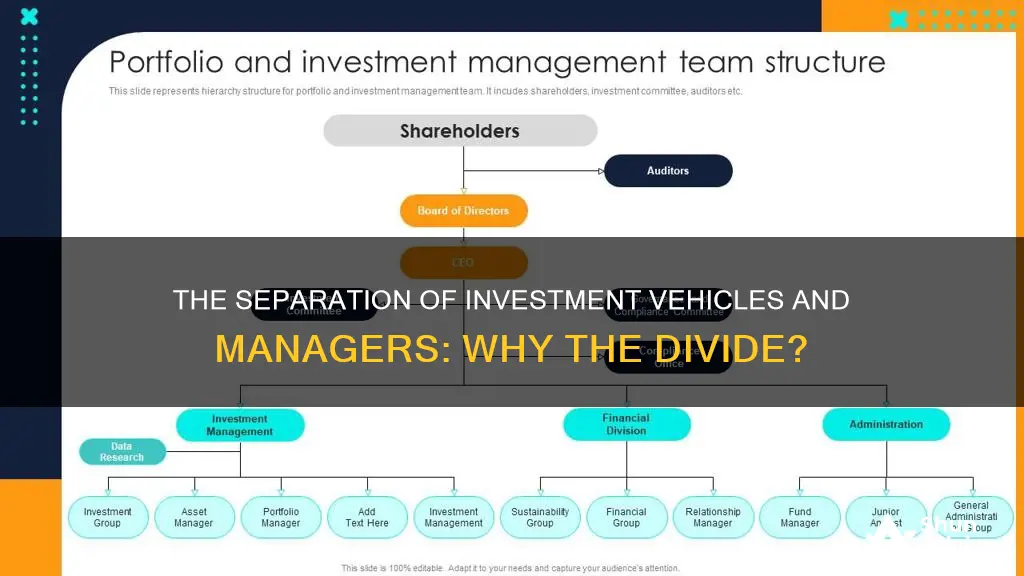

Investment funds are distinguished by their unique organisational structures, which separate investment assets and management assets into different entities with different owners. The investments belong to "funds", while the management assets belong to "management companies".

This pattern of organisation produces two functional features: the use of separate entities to hold investment assets and management assets, and the construction of separate ownership for those entities. These features result in three important limits on fund investors' rights and risks with respect to management companies.