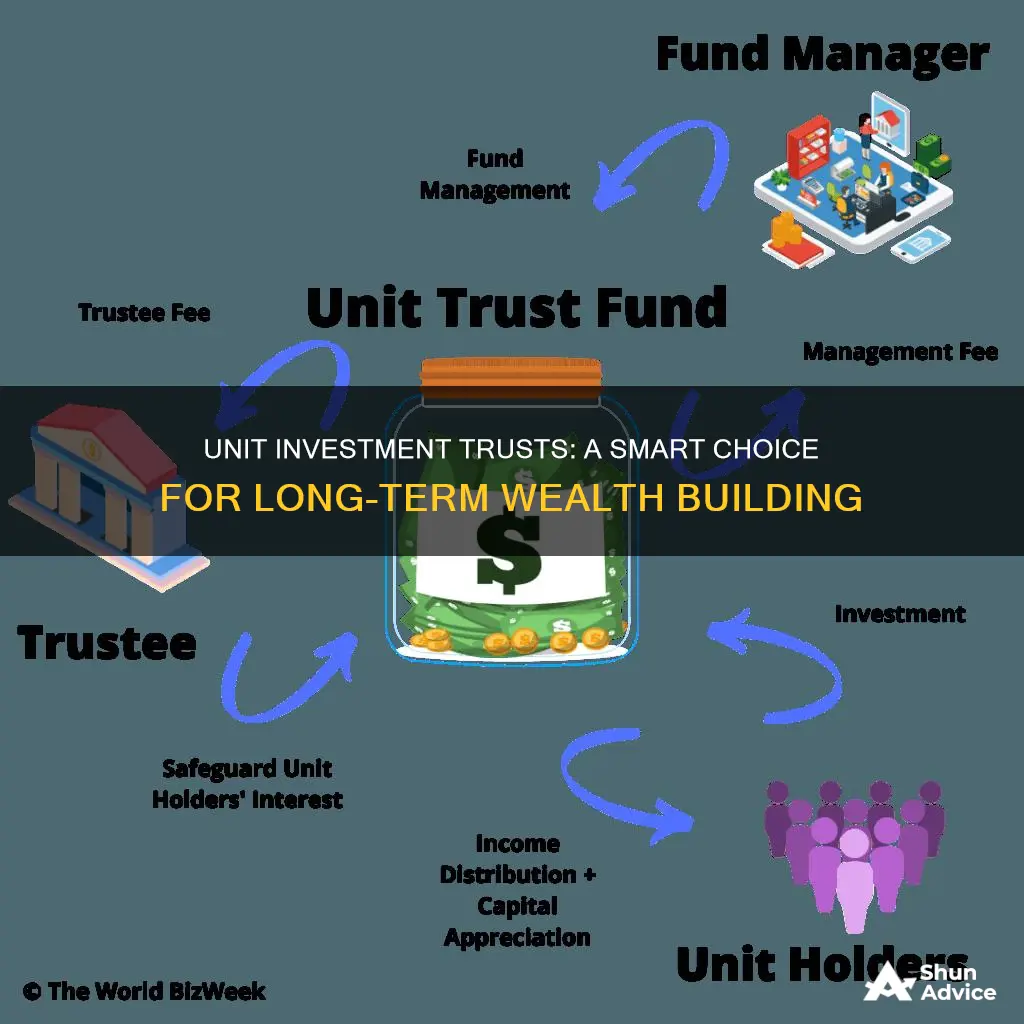

Unit Investment Trusts (UITs) are a form of collective investment that pools investors' money into a single fund, which is then managed by a fund manager. UITs are similar to open-ended and closed-end mutual funds, in that they consist of collective investments where multiple investors combine their funds to be managed by a portfolio manager. UITs are bought and sold directly from the company that issues them and are not actively traded, meaning securities are not bought or sold unless there is a change in the underlying investment. UITs are also required to disclose their portfolios regularly, providing investors with transparency into their holdings and investment strategies.

| Characteristics | Values |

|---|---|

| Investment type | Stocks, bonds, securities, mortgages, cash equivalents, property funds, etc. |

| Management | Managed by a fund manager, who is appointed by the trustee |

| Investment strategy | Passive investment, not actively traded |

| Risk | Not principal or capital-guaranteed |

| Returns | Capital gains, dividends, income, growth |

| Fees | Initial charge, annual management charge, trustee fees, sales charge |

| Liquidity | Good liquidity, units can be sold at any time |

| Tax | Tax-efficient, investors pay income tax on dividends |

| Accessibility | Low minimum investment requirements |

| Suitability | Long-term investment, not suitable for short-term access to funds |

What You'll Learn

Low minimum investment requirements

Unit investment trusts (UITs) are a type of investment vehicle that pools money from multiple investors to purchase a fixed portfolio of securities, such as stocks or bonds. One of the key advantages of UITs is that they often have low minimum investment requirements, making them accessible to a wide range of investors.

UITs are similar to both open-ended and closed-end mutual funds in that they consist of collective investments where investors combine their funds to be managed by a portfolio manager. However, unlike mutual funds, UITs have a stated expiration date based on the investments held in their portfolio. When the portfolio terminates, investors receive their share of the UIT's net assets.

Another key difference between UITs and mutual funds is that UITs are not actively traded. This means that securities are only bought or sold in response to a change in the underlying investment, such as a corporate merger or bankruptcy. This passive investment strategy provides investors with greater predictability and transparency into their holdings.

The low minimum investment requirements of UITs make them an attractive option for individuals looking to invest in a diversified portfolio of securities with a small initial investment. This accessibility, combined with the simplicity and predictability of UITs, makes them a popular choice for investors seeking a hands-off, long-term investment strategy.

Velocity Investments: Settling the Storm

You may want to see also

Passive management means lower fees

Unit Investment Trusts (UITs) are generally passively managed, meaning that they are not actively traded. This passive management strategy results in lower fees for investors.

Passively managed funds tend to charge lower fees than actively managed funds. Actively managed funds are more expensive to operate because they require fund managers to employ various investing strategies and make buying/selling decisions for the portfolio's securities. These fund managers need to be compensated for their time and expertise, which results in higher management fees. In contrast, passive management does not involve active management or frequent trading, so it incurs lower fees and expenses.

The fees for actively managed funds typically range from 1% to 2% of the assets under management (AUM), while passively managed funds usually charge below 1%. This difference in fees can significantly impact investors' net returns over time.

In addition to management fees, investors should also consider other costs associated with investing in UITs, such as initial charges, trustee fees, and trading costs. However, due to their passive management, UITs generally have lower overall fees compared to actively managed funds, making them an attractive option for cost-conscious investors.

Investments with Fortnightly Dividends

You may want to see also

Tax efficiency

Unit Investment Trusts (UITs) are generally structured as pass-through entities for tax purposes, meaning they don't pay taxes at the trust level. Instead, income, gains, and losses are passed through to the investors, who are responsible for paying taxes on their share. This can result in greater tax efficiency for investors, as they may be able to minimise their capital gains taxes.

In the case of South Africa, there are specific tax considerations for investors in unit trusts. Income distributions from unit trusts are generally treated as taxable income for the investor, and are subject to income tax. Capital gains tax is also applicable when selling units, and dividend withholding tax may be applicable for unit trusts that invest in dividend-paying stocks. However, South Africa offers tax-free investment accounts, which allow individuals to invest in unit trusts with certain tax benefits, such as no income tax, capital gains tax, or dividend withholding tax.

UITs are also similar to exchange-traded funds (ETFs) in terms of tax efficiency, as they are not actively traded, meaning securities are not bought or sold frequently, resulting in lower turnover and potentially fewer capital gains. This passive investment strategy can provide tax benefits for investors.

Securities Spending: Investment or Consumption?

You may want to see also

Predictable performance

Unit Investment Trusts (UITs) are a type of investment vehicle that pools money from multiple investors to purchase a fixed portfolio of securities, such as stocks or bonds. They are often favoured by investors seeking a predictable performance and steady income. Here's why:

Fixed Portfolio and Passive Investment Strategy

UITs offer a fixed portfolio of securities, typically stocks or bonds, that are selected by professional investment managers. Once the portfolio is established, it generally remains unchanged until the UIT's predetermined termination date. The passive investment strategy employed by UITs means that the securities are not actively traded. Securities are only bought or sold in response to changes in the underlying investments, such as corporate mergers or bankruptcies. This passive approach provides investors with predictability and visibility into their holdings, allowing them to know exactly what securities are held and the associated risks.

Predictable Income

The fixed nature of UITs, particularly bond UITs, provides investors with predictable income. Bond UITs are designed to generate predictable monthly income, making them attractive to investors seeking steady cash flows. The income payments from bond UITs are fairly consistent as the bonds in the trust do not frequently change. As each bond matures, the principal is returned and income payments continue from the remaining bonds in the trust.

Defined Maturity and Termination

UITs have a stated expiration date, often based on the maturity of the underlying investments. This defined maturity provides investors with a clear timeline for managing their investments. At termination, investors receive their proportionate share of the UIT's net assets.

Lower Risk and Volatility

Bond UITs, which are more popular than stock UITs, tend to experience less fluctuation in value. This lowers the volatility of the investment and provides stability to the portfolio. Stock UITs, on the other hand, are more vulnerable to market risks and are therefore less predictable.

Tax Efficiency

UITs are typically structured as pass-through entities, which means they do not pay taxes at the trust level. Instead, income, gains, and losses are passed through to the investors, who are responsible for paying taxes on their share. This structure can result in greater tax efficiency for investors.

The Passive Investment Time Bomb: When the Bubble Bursts

You may want to see also

Diversification

Unit Investment Trusts (UITs) are a great way to diversify your investment portfolio. By pooling money from multiple investors to purchase a fixed portfolio of securities, UITs allow investors to gain exposure to a wide range of investments without the need for active management. This means that investors can access a diversified portfolio of securities with a low initial investment requirement.

One of the main benefits of investing in a UIT is the diversification it provides. A UIT holds a fixed portfolio of securities, which reduces the risk associated with investing in individual stocks or bonds. By spreading the investment across different securities, investors can mitigate the impact of any single security's poor performance on their overall portfolio.

While UITs do provide some diversification, it is important to note that they typically invest in a specific market sector or asset class. This means that they may not provide the same level of diversification as more broadly diversified investments. Additionally, the fixed nature of UITs means that investors have little control over the investments made by the trust, and poor performers may be retained.

However, UITs can still be a great way to diversify your investments, especially if you are looking for a simple, passive investment strategy. UITs are typically structured as pass-through entities, which means they do not pay taxes at the trust level, resulting in greater tax efficiency. UITs also have low minimum investment requirements, making them accessible to a wide range of investors.

Overall, UITs offer a unique opportunity to gain exposure to a diversified portfolio of securities, providing investors with the potential for steady income and capital appreciation.

Mortgage or Investment: Where Should Your Money Go?

You may want to see also