Boston Dynamics is a robotics company that has captured the imagination of investors, robot enthusiasts, and everyone in between. The company, founded in 1992, initially focused on developing realistic training tools for the US military. Today, it has broadened its horizons and is developing a full line of robots for both military and commercial use. Boston Dynamics is not a publicly traded company, but it is majority-owned by Hyundai, a publicly traded company. Therefore, investors can gain exposure to Boston Dynamics by investing in Hyundai.

| Characteristics | Values |

|---|---|

| Company Type | Private |

| Industry | Robotics, AI |

| Specialisation | Building machines designed to replicate the movement of humans and animals |

| Founders | Marc Raibert, former professor at MIT |

| Current Owner | Hyundai (80%) and SoftBank (20%) |

| Valuation | $1.1 billion |

| Revenue | $20 million – $40 million |

| Competitors | Mushiny Intelligence, Automata Technologies |

| IPO Status | No plans for an IPO |

What You'll Learn

Boston Dynamics' cutting-edge robotics technology

Boston Dynamics is a leading robotics company that develops highly mobile robots with a broad range of applications. The company's cutting-edge robotics technology is exemplified by its three dynamically stable, legged robots: Spot, Stretch, and Atlas. These robots can perform a wide range of tasks and have been deployed in commercial and academic settings, giving Boston Dynamics more real-world experience than any other robot developer.

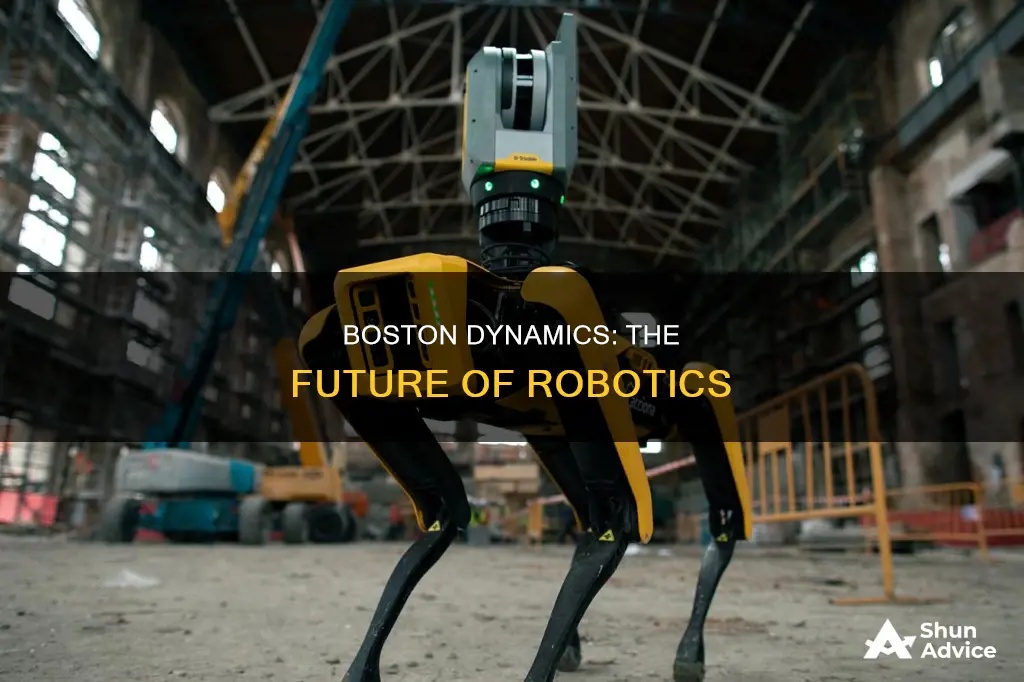

Spot, the four-legged robotic dog, is Boston Dynamics' most well-known creation. Spot has attracted widespread attention and is the advanced robot with the most widespread industrial adoption. It has found uses in various industries, including oil and security, thanks to its agile design and easy-to-use interface. Spot has also been combined with the ChatGPT chatbot to create an enhanced interactive experience.

Another of Boston Dynamics' signature robots is Atlas, a two-legged robot initially known for its dancing capabilities. Recently, Atlas has demonstrated more practical capabilities that could prove extremely useful on future construction sites.

Boston Dynamics is also pairing its robotics technology with AI, creating massive growth potential and a vast number of real-life applications. The company's robots can replicate human and animal movements, making them useful for navigating difficult terrain and unsafe environments.

The company's early talent was drawn from MIT, and it has grown over the years to develop several specialist robots. Boston Dynamics has been owned by several large businesses, including Alphabet, SoftBank, and most recently, Hyundai, which acquired the company to further its robotic development programs and smart mobility solutions strategy.

While Boston Dynamics is not publicly traded, investors can gain indirect exposure to the company by investing in Hyundai, which owns an 80% stake in Boston Dynamics.

Madoff Victims: Lives Destroyed

You may want to see also

The company's pairing of robotics with AI

Boston Dynamics is a leading robotics company that has developed three dynamically stable, legged robots (Spot, Stretch, and Atlas) that can perform a variety of tasks. The company is at the cutting edge of robotics technology, pairing robotics with AI, two industries with massive growth potential and a wide range of real-life applications.

The company's robots are designed to replicate human and animal movements, making them useful for navigating difficult terrain and unsafe environments. For example, their four-legged robotic dog, Spot, has been used in the oil industry and for security. Boston Dynamics has also experimented with combining Spot with the ChatGPT chatbot for an enhanced interactive experience.

The pairing of robotics with AI allows Boston Dynamics to develop highly advanced robots with a great deal of commercial value. The company's robots can be used for a variety of tasks, from carrying a worker's tools and cleaning a house to performing complex tasks in construction sites. The combination of robotics and AI enables these machines to navigate challenging environments, interact with humans, and perform tasks that require advanced dexterity and intelligence.

The company's focus on robotics with AI capabilities positions it well to capitalize on the growing demand for automation and intelligent machines across various industries, including military, commercial, and industrial sectors. The integration of AI also enhances the adaptability and functionality of their robots, making them more attractive to potential customers.

In summary, Boston Dynamics' pairing of robotics with AI has resulted in innovative machines with diverse capabilities and real-world applications. This combination of cutting-edge technologies offers significant growth potential and investment opportunities, even though the company is still privately owned and working towards profitability.

Nike: A Smart Investment Choice?

You may want to see also

Boston Dynamics' acquisition by Hyundai

Boston Dynamics is a leading robotics company that has developed three dynamically stable, legged robots (Spot, Stretch, and Atlas) that can perform a variety of tasks. It has deployed thousands of its robots in commercial and academic settings, giving it more real-world experience than any other robot developer. The company is still in the early stages of developing deployable robots that can help companies automate more tasks. It has tremendous growth potential as robots become more mainstream.

In 2021, Hyundai Motor Group acquired a controlling interest in Boston Dynamics from SoftBank, which had purchased the company from Google (Alphabet X) in 2017. The deal valued Boston Dynamics at $1.1 billion, with Hyundai acquiring an 80% stake and SoftBank retaining the remaining 20%. This acquisition was in line with Hyundai's strategic transformation into a Smart Mobility Solution Provider, with a focus on future technologies such as autonomous driving, artificial intelligence, Urban Air Mobility, smart factories, and robots.

By acquiring Boston Dynamics, Hyundai aimed to leverage the robotics company's expertise to enhance its manufacturing, logistics, construction, and automation capabilities. Boston Dynamics, on the other hand, could benefit from Hyundai's expertise in mass manufacturing and scaling production. This partnership is expected to create a robotics value chain, from robot component manufacturing to smart logistics solutions, and support Boston Dynamics' expansion of its product line and global sales.

While Boston Dynamics is not a publicly traded company, investors can gain exposure to the robotics industry by investing in Hyundai or its competitors, such as ABB, iRobot, or Intuitive Surgical. However, it is important to note that Boston Dynamics likely represents a small portion of Hyundai's overall business value, and investing in Hyundai primarily for exposure to Boston Dynamics may not be a sound investment strategy.

Who Invests in the Stock Market?

You may want to see also

Boston Dynamics' previous ownership by Alphabet and SoftBank

Boston Dynamics has been owned by several large companies over the last decade, including Alphabet and SoftBank.

In 2013, Boston Dynamics was purchased by Alphabet Inc. (then known as Google) for an undisclosed sum. The company was one of nine startups acquired by the tech giant as it built out its own robotics division, known internally as Replicant. However, Alphabet's interest in robotics appeared to wane following the departure of Android co-founder Andy Rubin in 2014, and the Replicant division was disbanded.

In June 2017, Alphabet sold Boston Dynamics to the Japanese conglomerate SoftBank Group for an undisclosed sum. SoftBank, the maker of the friendly Pepper robot, was keen to deepen its move into the robotics field. The acquisition was welcomed by Boston Dynamics' founder and CEO, Marc Raibert, who said:

> We at Boston Dynamics are excited to be part of SoftBank’s bold vision and its position creating the next technology revolution, and we share SoftBank’s belief that advances in technology should be for the benefit of humanity.

SoftBank's CEO, Masayoshi Son, also expressed his enthusiasm for the deal, stating:

> Smart robotics are going to be a key driver of the next stage of the Information Revolution, and Marc and his team at Boston Dynamics are the clear technology leaders in advanced dynamic robots. I am thrilled to welcome them to the SoftBank family and look forward to supporting them as they continue to advance the field of robotics and explore applications that can help make life easier, safer and more fulfilling.

In December 2020, SoftBank sold an 80% stake in Boston Dynamics to the Hyundai Motor Group for approximately $880 million, retaining a 20% stake through an affiliate. The deal was finalised in June 2021, with Hyundai taking a controlling stake in the company. The acquisition was expected to benefit both Hyundai and Boston Dynamics, with Hyundai gaining an edge in manufacturing and the development of self-driving cars, and Boston Dynamics gaining access to Hyundai's expertise in mass manufacturing and scaling production.

Young Investors: Why the Apathy?

You may want to see also

The company's military applications

Boston Dynamics, an American engineering and robotics design company, has had a long history of military applications, with its early development almost entirely thanks to US military funding. The company has designed and developed robots that can be used in the defence and security sectors.

One of the company's early projects was BigDog, a quadrupedal robot designed for the US military with funding from the Defense Advanced Research Projects Agency (DARPA). BigDog was envisioned as a robotic pack mule to accompany soldiers in terrain too rough for vehicles. It was designed to carry 150 kg alongside a soldier at 6.4 km/h, traversing rough terrain at inclines up to 35 degrees. However, the project was shelved as the robot was deemed too loud for combat.

Boston Dynamics then developed the Legged Squad Support System (LS3), also known as AlphaDog, a militarised version of BigDog. The LS3 was ruggedised for military use, with the ability to operate in hot, cold, wet, and dirty environments. It could react to visual or oral commands and use an onboard GPS system, along with computer vision, to guide itself through terrain. The LS3 was capable of marching for 32 km before running out of fuel, outperforming pack mules.

In addition to these projects, Boston Dynamics has also created other robots with potential military applications, such as the Cheetah, a four-footed robot that can gallop at speeds of up to 45 km/h, and LittleDog, a small quadruped robot developed for DARPA. The company's robots have been trialled by police departments and the French military for reconnaissance purposes, always under remote human control and without weaponisation.

While Boston Dynamics has pledged not to weaponise its creations, the company does not rule out their use in surveillance and reconnaissance alongside military or law enforcement units. The company's terms and conditions, ethical principles, and an open letter spearheaded by Boston Dynamics and co-signed by five other robotics companies outline their commitment to non-weaponisation.

Retirement Planning: Many Left Behind

You may want to see also

Frequently asked questions

Boston Dynamics is a leading robotics company that has developed three dynamically stable, legged robots (Spot, Stretch, and Atlas) that can perform a variety of tasks. The company has deployed thousands of its robots in commercial and academic settings, giving it more real-world experience than any other robot developer. It has tough growth potential as robots become more mainstream.

Boston Dynamics is not a publicly traded company and is majority-owned by Hyundai (80%) and SoftBank (20%). However, you can invest in Boston Dynamics through Hyundai (HYMTF) or SoftBank (SFTBY).

When Hyundai completed its acquisition of Boston Dynamics in 2021, it valued the company at $1.1 billion.

Boston Dynamics is a private company, and as such, financial information is hard to come by. It is also unclear how close the company is to profitability. There is also the potential for overvaluation in early trading if the company goes public. Additionally, Boston Dynamics could face competitive challenges from larger tech companies investing heavily in robotics and AI.