There are several investment products available for college savings, each with its own advantages and disadvantages. Here are some of the most popular options:

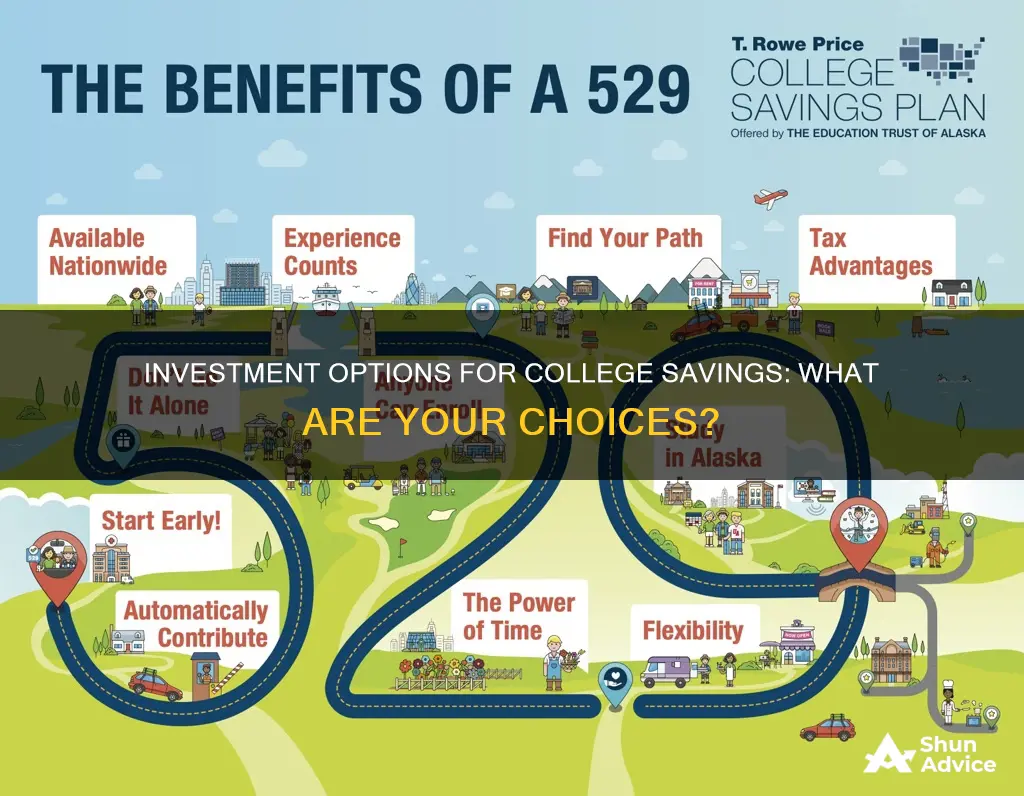

529 Plans: These are tax-advantaged education savings accounts that offer both federal and state tax benefits when used for qualified education expenses. There are two types of 529 plans: the education savings plan and prepaid tuition plans. The former can be used for any education-related expenses, while the latter is restricted to tuition and mandatory fees.

Coverdell Education Savings Accounts (ESAs): These are tax-advantaged investment accounts that offer lower fees and more investment options than 529 plans. However, they have income and contribution limits, and funds must be used by the time the beneficiary turns 30 to avoid penalties.

Roth IRAs: While primarily used for retirement savings, Roth IRAs can also be used for college savings. They offer tax advantages and a broad range of investment options. However, they have contribution limits and may impact financial aid eligibility.

Custodial Accounts (UGMA/UTMA): These are brokerage accounts opened by an adult for a child, who gains control of the account at a certain age. They offer investment flexibility and can be used for expenses beyond college tuition. However, they can reduce financial aid packages and may be subject to the kiddie tax.

U.S. Savings Bonds: These are considered safe investments backed by the U.S. government. They offer tax benefits when used for education expenses, but the returns are typically small.

Mutual Funds: These are diversified investments that pool money from many investors to buy stocks, bonds, and other securities. They offer higher returns than some other options but may impact financial aid eligibility due to capital gains distributions.

| Characteristics | Values |

|---|---|

| Investment product | 529 plan |

| Coverdell ESA | |

| Roth IRA | |

| Mutual funds | |

| U.S. savings bonds | |

| UGMA/UTMA accounts | |

| CDs | |

| High-yield savings account | |

| General investing account |

What You'll Learn

529 college savings plans

A 529 plan is a tax-advantaged savings account designed to be used for a beneficiary's education expenses. It is a state-sponsored investment plan that enables you to save money for a beneficiary and pay for education expenses. You can withdraw funds tax-free to cover almost any type of college expense. 529 plans may offer additional state or federal tax benefits.

There are two types of 529 plans: 529 tax advantage and 529 prepaid plans. The 529 tax advantage plan is the most popular 529 plan and has strong tax advantages. Your investments grow tax-free, and you can also withdraw funds tax-free for education expenses such as tuition, room and board, and assigned textbooks. You can use withdrawals from education savings plan accounts at any college or university, and some trade schools. You can also use your education savings plan to pay up to $10,000 per year, per beneficiary, for tuition at any public, private, or religious elementary or secondary school.

The 529 savings accounts allow you to set aside after-tax contributions that grow tax-free, similar to a Roth IRA but with much higher contribution limits. The proceeds can be used for qualified educational expenses, such as tuition, room and board, and books. However, non-qualified expenditures, such as general living expenses and buying a car, will be taxed and accrue a 10% penalty.

The 529 prepaid tuition plans allow you to "lock in" tuition costs and avoid the impact of increasing fees. By paying in advance for all or part of the costs of attending a particular university or group of institutions participating in a particular plan, you can avoid future tuition hikes. For example, you might pay for eight semesters at today's rates, which will allow you eight semesters in the future, even if the costs are higher.

The pros of 529 plans include high contribution rates, generally with no household income limits or age restrictions, and beneficiary flexibility. The account can be designated and changed for the benefit of any individual's education expenses, even your own. The cons of 529 plans are that if the child decides not to go to college or receives a full scholarship, the money may be unavailable for other purposes. Additionally, stock market exposure can impact returns in a down market, especially close to when you plan to withdraw the funds.

Saving and Investing: Biblical Principles for Financial Wisdom

You may want to see also

Coverdell Education Savings Accounts (ESAs)

Coverdell ESAs offer tax-free investment growth and withdrawals when funds are used for qualified education expenses. This includes not only college costs but also certain K-12 expenses, such as books, supplies, equipment, tutoring, and special needs services. The inclusion of K-12 expenses sets Coverdell ESAs apart from other savings plans like 529 plans, which are limited to $10,000 in tax-free withdrawals for K-12 tuition expenses.

Coverdell ESAs have a maximum contribution limit of $2,000 per child per year and are only available to families below a specified income level. For single filers, the modified adjusted gross income (MAGI) limit is $95,000 for the full $2,000 contribution, which is then gradually phased out for MAGIs between $95,000 and $110,000. For joint filers, the limit is $190,000 for the full contribution amount, which is phased out for MAGIs between $190,000 and $220,000.

The designated beneficiary of a Coverdell ESA must be under the age of 18 when the account is established, unless they are a special needs beneficiary. All funds must be withdrawn by the time the beneficiary turns 30, unless they are a special needs beneficiary. If the beneficiary dies before turning 30, the remaining amount must be distributed within 30 days.

Coverdell ESAs offer more investment flexibility than 529 plans, allowing account holders to self-direct their investments. However, they have lower contribution limits and are only available to families below a certain income threshold.

S-Corp Savings: Investing for Growth and Security

You may want to see also

Custodial accounts under UGMA/UTMA

There is no limit to how much you can invest in a custodial account. The value of the account is removed from the donor's gross estate. Earnings and gains are taxed to the minor and subject to the "kiddie tax", where unearned income over $2,500 (in 2023) for certain children up to age 23 is taxed at the parent's rate.

The student will gain rights to the account once they have reached the legal age and can use the money at their discretion, which may differ from the parent's original intentions. Custodial accounts are counted as student assets on the FAFSA, which means they can reduce a student's aid package by 20% of the account value.

Custodial accounts are a good option for minors who need help with college savings and may need to spend the money on extra expenses outside of the normal course of a college student's budget.

Yotta Savings: A Smart Investment Strategy for Your Money

You may want to see also

Qualified US savings bonds

US savings bonds are federally tax-deferred and state tax-free. Series EE and I bonds purchased after 1989 may be redeemed federally tax-free for qualifying higher-education expenses, making them an ideal way to save for college.

There are some rules for purchasing bonds for college. Bond buyers must be at least 24 years old, and parents can purchase bonds for their children, but the bonds must be registered in the parent's name. There are also annual income limits and annual purchase limits. For example, in 2016, individuals could purchase up to $20,000 in online/electronic savings bonds and up to $5,000 in Series I paper savings bonds.

There are also rules for using savings bonds for college. The interest earned on the bonds can be used tax-free for college if the funds are used for qualified educational expenses for a parent or dependent child. This includes tuition and fees for courses that count toward a degree or certificate program. The expense must occur in the same tax year in which the bonds are redeemed, and the principal and interest from the bonds must be used.

Savings bonds can also be transferred to a 529 account or ESA with no penalty. You may deduct the interest earned on the bond(s) from your gross income for the tax year you completed the transfer.

From Saving to Investing: Strategies for Your Financial Journey

You may want to see also

Roth IRAs

A Roth IRA is a personal finance tool used for retirement that offers tax advantages. While it's not a great college savings tool, it can be used for this purpose. Here's what you need to know about using a Roth IRA for college savings:

Advantages

- Contributions can be withdrawn at any time, for any reason, without incurring taxes or penalties.

- Withdrawals are exempt from penalties when used to pay for qualified education expenses (like tuition, fees, books, and room and board).

- There is a broad range of investment options available.

- The value of retirement accounts is not counted as an asset on the FAFSA.

- For 2024, the maximum investment allowed is $7,000 ($8,000 for taxpayers aged 50 and over).

Disadvantages

- Contribution limits may not cover the costs of a four-year, in-state college education and student loan debt.

- Withdrawals could impact financial aid eligibility.

- Contributions don't qualify for tax deductions.

- A Roth IRA requires regular monitoring, like a checking account.

- The typical 10% early withdrawal penalty on earnings is waived when the funds are spent on qualified higher education expenses, but you will owe income tax on the earnings.

- Using a Roth IRA could mean less money for retirement.

- You can only contribute a certain amount per year to all your IRAs combined, so money you save for college in an IRA is money you can't save for retirement.

- Your earnings are subject to a 5-year holding period.

- If you take money out of a Roth IRA before you've owned the account for 5 years, you'll owe ordinary income tax on the earnings, plus a 10% penalty.

- Your financial aid package could take a hit as money you withdraw from a Roth IRA will be considered income for that year and weigh against you much more heavily the following year.

Home Purchase: Investment or Saving Strategy?

You may want to see also

Frequently asked questions

A 529 plan is a tax-advantaged investment vehicle similar to a Roth IRA. There are two types of 529 plans: the education savings plan (also called the college savings plan) and prepaid tuition plans. The former can be used for any and all education expenses, including books and room and board, whereas the latter can only be used to cover tuition and mandatory fees.

The pros of a 529 plan are that there are no income restrictions, and contributions can be used by the beneficiary at any time throughout their life. The cons are that contributions can only be used for qualified education expenses, and non-education expenses are taxed.

A Coverdell ESA is a tax-advantaged college savings plan that offers tax-free interest earnings and distributions for qualified educational expenses. The pros are that there is a wide range of investment options available, and the value of the account is counted as a parent asset on the FAFSA. The cons are that there are income restrictions, and the maximum contribution is $2,000 per beneficiary per year.

Qualified U.S. savings bonds are debt securities issued by the Department of Treasury. They are considered a low-risk investment because they are backed by the full faith and credit of the U.S. government. The pros are that they are federally tax-deferred and state tax-free, and Series EE and I bonds are tax-free for qualifying higher education expenses. The con is that there is a maximum investment of $10,000 per year, per owner, per type of bond.