The concept of savings equalling investment in equilibrium is a cornerstone of Keynesian economics, as outlined in John Maynard Keynes' The General Theory of Employment, Interest and Money. In this theory, savings (S) and investment (I) are considered equal, with savings defined as income minus consumption, and investment defined as the addition to the stock of real capital. This equilibrium is a stable state for the economy, assuming all savings are invested and vice versa.

Keynes' theory differs from classical economics, which posits that the equality of savings and investment is achieved through changes in interest rates to attain full employment. Keynes, however, argues that this equality is a condition of equilibrium at any level of employment, usually less than full employment. He identifies two types of equality: accounting equality and functional equality. Accounting equality refers to the static relationship between savings and investment, where they are always equal in national income accounts. Functional equality, on the other hand, is a dynamic concept where the equality of savings and investment is achieved through changes in income levels.

What You'll Learn

Keynes' General Theory

In his book *The General Theory of Employment, Interest and Money*, John Maynard Keynes laid out his theory that savings and investment are necessarily equal in amount. This equality, he argued, arises from the general equality of aggregate demand and aggregate supply, or, in other words, the equality of total demand in the economy and aggregate supply.

Keynes' theory of savings and investment equality was a departure from classical economic thinking, which held that cyclical swings in employment and economic output create profit opportunities that individuals and entrepreneurs would have an incentive to pursue, thus correcting imbalances in the economy. In contrast, Keynes believed that during recessions, business pessimism and certain characteristics of market economies would cause aggregate demand to plunge further.

In Keynes' view, unemployment arises whenever entrepreneurs' incentive to invest fails to keep pace with society's propensity to save. The levels of saving and investment are necessarily equal, and income is therefore held down to a level where the desire to save is no greater than the incentive to invest.

Keynes' theory of savings and investment equality has been a source of confusion for many writers and readers, as he seemed to offer conflicting statements about the relationship. At times, he asserted that savings always equal investment, while at other places in his *General Theory*, he wrote that savings equal investment only in equilibrium. This dual approach has sparked great debate and controversy among economists.

The main source of confusion, according to some, is the failure to realize that while savings and investment are always equal, they are not necessarily in equilibrium. If the economy is in motion and variables are in a normal functional relationship, then savings and investment are equal and may also be in equilibrium. However, if there are lags in consumption-expenditure production, for example, savings and investment, though equal, will not be in equilibrium.

Keynes' theory of savings and investment equality, along with his other ideas, had a profound impact on economic thought and continues to be influential today.

Savings and Investment: Understanding the National Identity

You may want to see also

Classical economists' view

Classical economists believe in the existence of a fully employed economy where saving and investment are always equal. They see the rate of interest as a strategic variable that brings about this equality.

The classical view is that if saving and investment are equal at a given time, they will be brought into equilibrium by automatic changes in the rate of interest. Given the rate of investment, if saving increases, then the rate of interest will fall. This will cause an increase in investment demand but a decrease in the volume of saving, ultimately bringing about equality between saving and investment.

Conversely, when saving decreases, the rate of interest will rise to encourage more saving and discourage investment. Thus, classical economists see the rate of interest as the equilibrating variable between saving and investment.

Moreover, classical economists believe that equality between saving and investment can only occur at a point of full employment. This is known as a special full-employment equilibrium, where the rate of interest is the equilibrating variable.

Classical economists also believe that saving and investment are a function of the rate of interest. Algebraically, this can be expressed as S = f(R) and I = f(R), where R is the rate of interest, and S and I are equal.

In a period of less than full employment, the inequality between saving and investment can be corrected by adjusting the rate of interest. When the rate of interest rises, saving rises and investment declines, and vice versa.

Classical economists visualise a scenario where, if saving is less than investment, a rise in the rate of interest will bring about a decline in investment and an increase in saving until they are equal again. Conversely, when saving is more than investment, the rate of interest falls, investment increases, and saving declines until they are equal once more.

This classical notion of monetary equilibrium suggests that savings will automatically flow into an equal amount of investment through changes in the interest rate, resulting in a full-employment level of income.

It is important to note that while classical economists agree with Keynesian economics on the equality of saving and investment, they differ in their approaches and views on the underlying mechanisms.

Home Purchase: Investment or Saving Strategy?

You may want to see also

Accounting equality

In the matrix of any national income accounting, savings and investments are always identically equal. This is because total income in a given period equals total output, and income that is not spent on goods (i.e. savings) is identical in size with the quantity of goods produced that are not bought with current income (i.e. investment).

In other words, income = consumption + savings, and output = consumption + investment. But income = output, therefore, investment = savings.

Keynes defined savings as the excess of income over consumption, and investment as the addition made to the stock of real capital, or the unconsumed output in a given period. Thus, in money terms, current investment is equal to the value of that part of the current output that is not consumed.

Symbolically, the savings and investment equality can be proved as follows:

- Savings = Income – Consumption

- Income = Consumption + Investment

- Since Income – Consumption is common to both, therefore, Savings = Investment

- Income = Consumption + Savings, but Savings = Income – Consumption

- By substituting the value of Income as Consumption + Investment, we get, Income = Consumption + (Income – Consumption)

- Therefore, Income = Consumption + Investment

However, it is important to note that while investment and savings are always equal, they are not always in equilibrium. The definitional equality of savings and investment holds regardless of whether the economy is in or out of equilibrium, or whether national income is constant or changing.

Keynes' Views

In his 'General Theory', Keynes stressed that aggregate investment always equals aggregate saving. However, he presented a different theory from that of classical economists on this issue. He rejected the classical postulate of the rate of interest being a strategic or equilibrating variable in bringing about the equality between investments and saving at full employment.

According to Keynes, the saving-investment equality is a condition of equilibrium at any level of employment, and not necessarily the full employment level. In fact, it is usually at less than full employment.

Classical Economists' Views

Classical economists believed in the economy's equilibrium at full employment. In their view, saving-investment equality is brought about by the mechanism of the rate of interest. Given the rate of investment, if saving increases, then the rate of interest will fall. With the decline in the rate of interest, investment demand will rise, but the fall in the rate of interest will adversely affect the volume of saving. Through expansion in investment and contraction in saving, equality between saving and investment will be achieved.

The classical notion of monetary equilibrium is one in which savings flow automatically into an equal amount of investment via changes in the interest rate to give a full-employment level of income.

National Saving Certificates: Smart Investment Strategies

You may want to see also

Functional equality

Keynes introduced the concept of functional equality of saving and investment, which emphasises the behaviour of the economy as a whole, making the concepts of saving and investment dynamic.

In the functional or scheduled sense, there is a saving schedule and an investment schedule, and the equality between investment and savings is a consequence of changes in the level of income. To Keynes, equality between saving and investment function is an indispensable condition of equilibrium. No level of national income can be sustained without the equality of aggregate saving and aggregate investment.

In his concept of functional equality, savers and investors react to income variations in such a way that their desire to save and to invest is expected to be harmonised in the very process of these reactions. Thus, if saving exceeds investment, income will fall until the saving out of the lower income is equal to the reduced investment. Similarly, if investment increases, income will rise until the saving out of the higher income is equal to the increased investment.

The equilibrium level of national income is the observable level of income where there is a corresponding equality between "observable" savings and "observable" investment. For given saving and investment schedules, there is only one equilibrium level of income corresponding to the equality between saving and investment.

Accounting Equality vs Functional Equality

While the accounting equality of saving and investment represents the statistical result of the behaviour of the entire economic system in a given period, the functional equality of saving and investment introduces income as the equilibrating variable. The accounting equality holds good regardless of whether the economy is in or out of equilibrium, or whether national income is constant or changing.

Keynes' Views on Saving and Investment Equality

In his "General Theory", Keynes stressed that aggregate investment always equals aggregate saving. However, he presented a different theory from that of the classical economists on this issue. He rejected the classical postulate of the rate of interest being a strategic or equilibrating variable in bringing about the equality between investments and saving at full employment.

According to Keynes, the saving-investment equality is a condition of equilibrium at any level of employment, and not necessarily always the full employment level. In his view, savings and investment are brought into equality by income changes. Thus, he treated the level of income as the strategic or equilibrium variable that effectuates saving-investment equality.

Retirement Planning: Understanding 401(k) Investment and Savings Plans

You may want to see also

Saving-investment relations

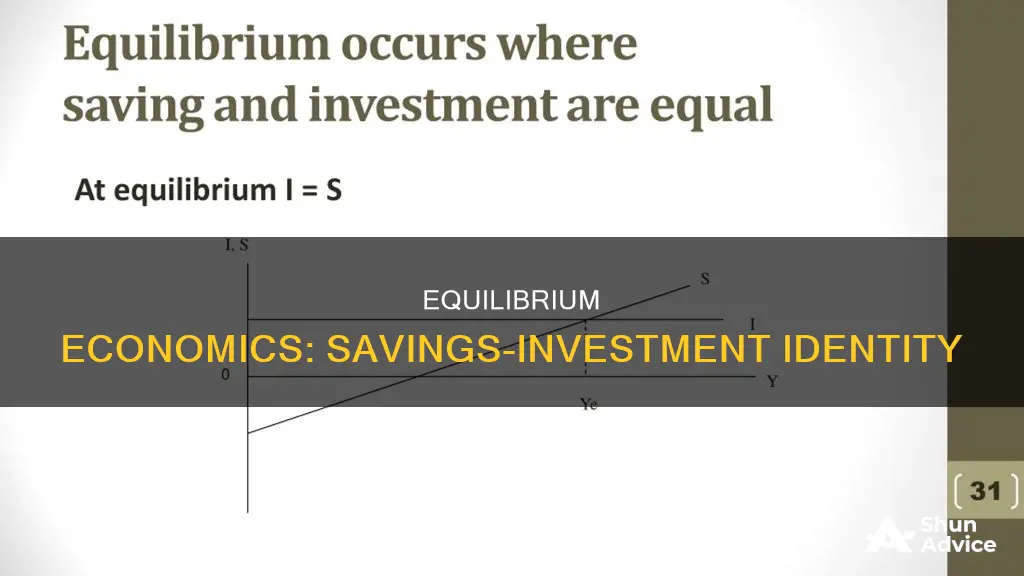

The equilibrium level of income, output, and employment in an economy can be determined using the Saving-Investment (S-I) Approach. This approach states that equilibrium is achieved when planned saving (S) equals planned investment (I). The point at which the saving and investment curves intersect represents this equilibrium.

The classical economists, including Prof. Hansen, believed that saving and investment equality is brought about by the rate of interest. They argued that when savings tend to exceed investments, the interest rate falls to discourage savings and encourage investment, thus restoring equilibrium. Classical economists also believed that this equality between saving and investment occurs at full employment income.

However, John Maynard Keynes, in his 'General Theory', challenged the classical view. He defined saving and investment in a way that they are always equal (S = I), which is known as accounting equality. This equality is derived from the general equality of aggregate demand and aggregate supply (Y = C + I), where equilibrium is reached when total demand equals aggregate supply. Keynes further argued that saving and investment equality is not necessarily always at full employment but can occur at less than full employment.

Keynes introduced a dynamic perspective by considering the functional equality of saving and investment, where the equality is a consequence of changes in the level of income. He emphasised that income changes, rather than interest rates, are the strategic variable that brings about saving-investment equality. In his view, investment depends on dynamic factors such as population growth, technological progress, and business expectations, making it unpredictable and autonomous, while savings are stable and induced. Thus, fluctuations in investment lead to variations in income, which in turn bring about equality between saving and investment.

Accounting Equality vs. Functional Equality

It is important to distinguish between the accounting equality and functional equality of saving and investment. Accounting equality refers to the static result of the behaviour of the entire economic system in a given period. It is based on the definitions of saving and investment and holds true regardless of whether the economy is in or out of equilibrium. On the other hand, functional equality emphasises the dynamic behaviour of the economy as a whole, introducing income as the equilibrating variable.

In summary, the S-I Approach illustrates how equilibrium in an economy is achieved when planned saving equals planned investment. While classical economists attributed this equality to interest rate changes, Keynesian economics emphasises the role of income changes and allows for equality at less than full employment. The accounting equality and functional equality of saving and investment provide complementary perspectives on the relationship between saving and investment in an economy.

Maximizing Small Savings: Smart Strategies for Investing Wisely

You may want to see also

Frequently asked questions

The Keynesian Theory states that the equilibrium situation is expressed in terms of Aggregate Demand (AD) and Aggregate Supply (AS). This equilibrium is attained when savings (S) are equal to investment (I).

The equilibrium level of income in an economy is established when planned savings are equal to planned investment.

Savings means storing money for future use, whereas investment means putting money into financial instruments to grow it over time.