The National Saving and Investment Identity is a macroeconomic analysis that explores the relationship between a nation's trade balance and the international flow of savings and investments. It highlights the connection between a country's financial capital supply and demand, with a focus on domestic savings, investments, and government spending. This relationship is expressed algebraically, emphasising that the quantity of financial capital supplied must equal the quantity demanded. The identity provides insights into how changes in domestic savings, investments, and government spending impact a nation's trade balance and overall economic health.

What You'll Learn

- How a nation's domestic saving and investment levels determine its trade balance?

- The supply and demand sides of financial capital

- How a trade surplus or deficit affects the flow of financial capital?

- How government borrowing affects the trade balance?

- How changes in the budget surplus or deficit impact the trade balance?

How a nation's domestic saving and investment levels determine its trade balance

The National Saving and Investment Identity is a macroeconomic analysis that views trade balances and international flows of savings and investments in the context of a nation's overall levels of savings and financial investment. It is a useful way to understand the determinants of the trade and current account balance.

In a nation's financial capital market, the quantity of financial capital supplied must equal the quantity of financial capital demanded for the purpose of making investments. A country's national savings comprise the total of its domestic savings by households and companies (private savings) as well as the government (public savings).

The demand for financial capital (money) is represented by groups that are borrowing the money, including businesses and the federal government. There are two main sources of supply and demand for financial capital in the US economy: saving by individuals and firms, and the inflow of financial capital from foreign investors.

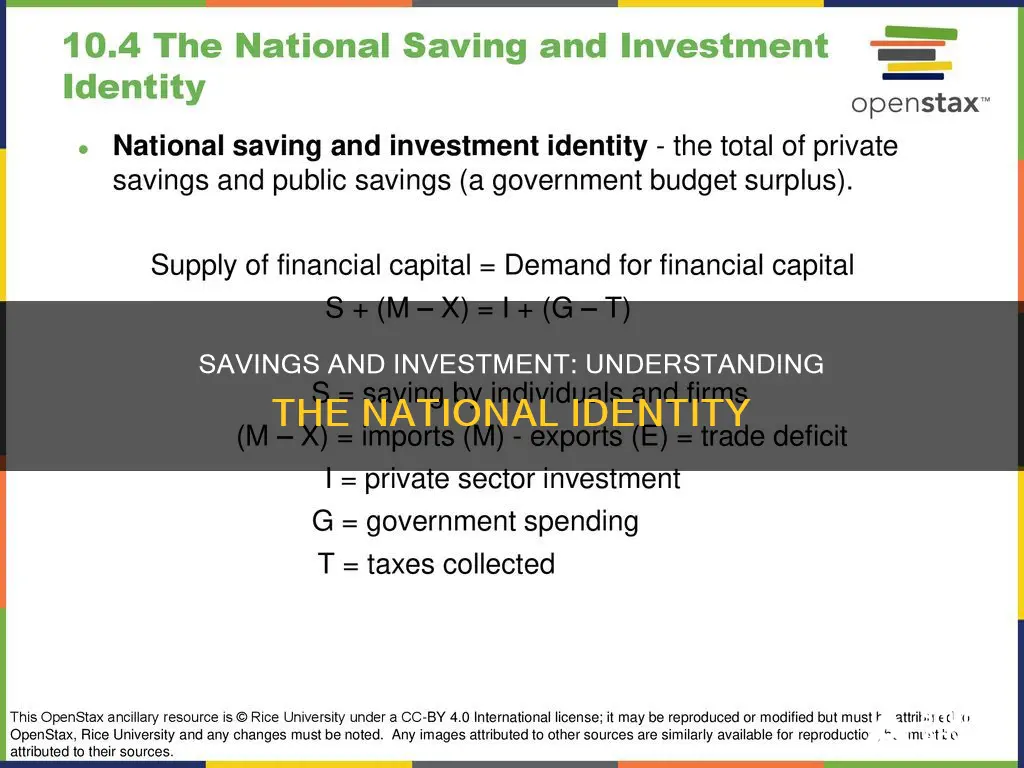

The National Saving and Investment Identity can be expressed algebraically as:

> [latex]\begin{array}{rcl}\text{Supply of financial capital}& \text{ = }& \text{Demand for financial capital}\\ \text{S + (M - X)}& \text{ = }& \text{I + (G - T)}\end{array}[/latex]

Where:

- S is private savings

- T is taxes

- G is government spending

- M is imports

- X is exports

- I is investment

Certain components of the identity can switch between the supply and demand sides. For example, if a country is running a government budget surplus, it will appear on the left (saving) side of the equation. If a country is running a trade surplus, it will involve an outflow of financial capital to other countries.

One insight from the National Saving and Investment Identity is that a nation's levels of domestic saving and investment determine its balance of trade. In the case of a trade deficit, the identity can be rewritten as:

> [latex]\begin{array}{rcl}\text{Trade deficit}& \text{ = }& \text{Domestic investment - Private domestic saving - Government (or public) savings}\\ \text{(M - X)}& \text{ = }& \text{I - S - (T - G)}\end{array}[/latex]

In this case, domestic investment is higher than domestic saving, and the extra financial capital for investment comes from abroad.

In the case of a trade surplus, the identity can be written as:

> [latex]\begin{array}{rcl}\text{Trade surplus}& \text{ = }& \text{Private domestic saving + Public saving - Domestic investment}\\ \text{(X - M)}& \text{ = }& \text{S + (T - G) - I}\end{array}[/latex]

Here, domestic savings are higher than domestic investment, and the extra financial capital is invested abroad.

This connection between domestic saving and investment and the trade balance is why economists view the balance of trade as a macroeconomic phenomenon. The National Saving and Investment Identity shows that the balance of trade is not determined by the performance of specific sectors of an economy or by trade laws and regulations.

The identity also provides a framework for understanding what causes trade deficits to rise or fall. For example, an increase in domestic investment will lead to a higher trade deficit, while an increase in domestic savings will lead to a lower trade deficit.

In summary, the National Saving and Investment Identity illustrates the relationship between the supply and demand of financial capital in a nation's economy and how this relates to the balance of trade. It provides insights into how changes in domestic saving and investment levels can impact a nation's trade balance.

Savings or Investments: Open Economy, Open Question

You may want to see also

The supply and demand sides of financial capital

The supply side of financial capital in the US economy has two main sources: savings by individuals and firms, known as S, and the inflow of financial capital from foreign investors, equal to the trade deficit (M – X), or imports minus exports.

The demand side of financial capital also has two main sources: private sector investment, I, and government borrowing, G, which occurs when government spending is higher than the taxes collected, T.

The national savings and investment identity equation is:

Supply of financial capital = Demand for financial capital

S + (M – X) = I + (G – T)

In this equation, the supply of financial capital must always equal the demand for financial capital. This relationship is true by definition because, in a macro economy, the quantity supplied and demanded must be equal.

The national savings and investment identity can be rearranged to understand the balance of trade. In the case of a trade deficit, the equation can be rewritten as:

Trade deficit = Domestic investment – Private domestic saving – Government (or public) savings

M – X) = I – S – (T – G)

Here, domestic investment is higher than domestic saving, and the extra financial capital for investment comes from abroad.

In the case of a trade surplus, the equation becomes:

Trade surplus = Private domestic saving + Public saving – Domestic investment

X – M) = S + (T – G) – I

In this scenario, domestic savings are higher than domestic investment, and the excess financial capital is invested in other countries.

The national savings and investment identity demonstrates that the balance of trade is determined by a country's levels of domestic saving and investment. It also provides a framework for understanding how changes in investment, savings, or the budget surplus/deficit will impact the trade balance. For example, an increase in the budget deficit may result in a decrease in domestic investment, an increase in private savings, or a rise in the trade deficit.

The national savings and investment identity is a useful tool for understanding the determinants of the trade and current account balance, and it highlights the connection between trade balances and international flows of savings and investments.

National Savings and Investments: A Secure Financial Future

You may want to see also

How a trade surplus or deficit affects the flow of financial capital

The national saving and investment identity is an approach that views trade balances and their associated financial capital flows in the context of a nation's overall savings and financial investment. It is based on the relationship that the total quantity of financial capital supplied from all sources must equal the total quantity of financial capital demanded. This relationship is expressed in the following equation:

[latex]\begin{array}{rcl}\text{Supply of financial capital}& \text{ = }& \text{Demand for financial capital}\\ \text{S + (M - X)}& \text{ = }& \text{I + (G - T)}\end{array} [latex]

Here, S is private savings, T is taxes, G is government spending, M is imports, X is exports, and I is investment.

Now, to understand how a trade surplus or deficit affects the flow of financial capital, let's consider the impact of each scenario:

Trade Surplus

A trade surplus occurs when a country's exports exceed its imports, resulting in a positive trade balance. In this case, the trade sector will involve an outflow of financial capital to other countries. This means that the country has a surplus of domestic financial capital that can be invested abroad. For example, if Country A has a trade surplus of $100 billion, it means that Country A is exporting $100 billion more than it is importing. This $100 billion surplus can then be invested in other countries, leading to an outflow of financial capital from Country A.

Trade Deficit

On the other hand, a trade deficit occurs when a country imports more goods than it exports, resulting in a negative trade balance. In this case, the country is a net borrower from abroad, as it needs to bring in financial capital from foreign sources to fund its domestic investment. For instance, if Country B has a trade deficit of $50 billion, it means that Country B is importing $50 billion more than it is exporting. To bridge this gap, Country B may borrow funds from foreign investors, leading to an inflow of financial capital into the country.

Impact on Financial Capital Flows

Both trade surpluses and deficits have implications for the flow of financial capital:

- Trade Surplus: A trade surplus can lead to an outflow of financial capital as domestic investors put their funds into other countries. This occurs when a country's domestic financial capital exceeds its investment needs, allowing it to invest abroad.

- Trade Deficit: A trade deficit indicates that a country's domestic investment exceeds its domestic savings, including both private and government savings. As a result, the country needs to borrow financial capital from foreign sources, leading to an inflow of capital into the country.

In summary, the national saving and investment identity illustrates that a trade surplus results in an outflow of financial capital as investors put their funds abroad, while a trade deficit leads to an inflow of financial capital as the country borrows from foreign sources to fund its investment needs. These international flows of financial capital encompass various forms of investment, such as the purchase of real estate, companies, stocks, and bonds.

Where to Find National Savings and Investments

You may want to see also

How government borrowing affects the trade balance

The National Saving and Investment Identity is a framework that illustrates the relationships between the sources of demand and supply in financial capital markets. It is based on the principle that the total quantity of financial capital supplied in the market must equal the total quantity of financial capital demanded. This relationship is expressed through the following equation:

[latex]\begin{array}{rcl}\text{Supply of financial capital}& \text{ = }& \text{Demand for financial capital}\\ \text{S + (M - X)}& \text{ = }& \text{I + (G - T)}\end{array} [latex]>

Where:

- S = Private savings

- T = Taxes

- G = Government spending

- M = Imports

- X = Exports

- I = Investment

When a government borrows, it becomes a demander of financial capital. This can occur when government spending is higher than the taxes collected, resulting in a budget deficit. In this case, the government borrows funds from investors by selling treasury bonds. Consequently, government borrowing can impact the trade balance, which is the difference between a country's imports and exports.

The impact of government borrowing on the trade balance depends on the sources of funding. There are three possible sources: households saving more, private firms borrowing less, or borrowing from foreign financial investors. When a government borrows from foreign investors, it directly affects the trade balance. This borrowing is reflected in the trade deficit, as it represents an inflow of foreign financial capital.

For example, if a government runs a budget deficit, it may need to borrow money from foreign investors to cover its spending. This borrowing increases the demand for financial capital and is included in the trade deficit calculation. As a result, the trade deficit will increase, assuming all other factors remain constant.

Conversely, if a government runs a budget surplus, it acts as a saver and supplier of financial capital. In this case, the government surplus is included in the supply of financial capital, and the trade deficit calculation will be lower. Therefore, a government surplus can lead to a lower trade deficit or even a trade surplus.

The relationship between government borrowing and the trade balance is complex and dynamic. Changes in government borrowing can impact private savings and investment, which can also affect the trade balance. For instance, if a government borrows more, it may crowd out private investment by competing for limited funds in the financial market. This could lead to a decrease in private investment, which would then reduce the demand for imports and improve the trade balance.

Additionally, government borrowing can influence exchange rates. When a government borrows from foreign investors, it may lead to an appreciation of the domestic currency. This can make imports cheaper and exports more expensive, improving the trade balance. However, if the borrowing causes concerns about the country's economic health, it could also lead to a depreciation of the currency, making imports more expensive and exports more competitive, thereby worsening the trade balance.

In summary, government borrowing can directly and indirectly affect the trade balance. The direct impact occurs when a government borrows from foreign financial investors, increasing the trade deficit. Indirectly, government borrowing can influence private savings, investment, and exchange rates, which in turn can impact the demand for imports and exports, further affecting the trade balance.

Saving Relationships: Worth the Investment?

You may want to see also

How changes in the budget surplus or deficit impact the trade balance

The National Saving and Investment Identity is an economic concept that explains the relationship between a country's financial capital supply and demand. It is expressed algebraically as:

Supply of financial capital = Demand for financial capital

S + (M - X) = I + (G - T)

Where:

- S = Private savings

- T = Taxes

- G = Government spending

- M = Imports

- X = Exports

- I = Investment

This equation highlights that a country's domestic savings (private and public) and investment levels influence its balance of trade. When a country experiences a budget surplus or deficit, the government's position in this equation shifts between being a supplier or demander of financial capital.

Impact on Trade Balance:

Budget Surplus:

When a government runs a budget surplus, tax revenues (T) exceed government spending (G), resulting in positive net savings (T - G > 0). In this case, the government contributes to the supply of financial capital in the country. This increases the overall supply of financial capital in the economy, which can lead to a trade surplus.

A trade surplus occurs when a country's exports exceed its imports (X - M > 0). The excess financial capital from the budget surplus can be invested abroad, leading to an outflow of capital from the domestic economy. This outflow of capital reduces the demand for imports and increases the availability of capital for domestic investment. As a result, the country's trade balance improves, and the trade deficit decreases.

Budget Deficit:

On the other hand, during a budget deficit, government spending (G) is greater than tax revenues (T), resulting in negative net savings (T - G < 0). In this scenario, the government becomes a demander of financial capital, borrowing funds to finance the deficit. This increases the overall demand for financial capital in the economy, which can lead to a trade deficit.

A trade deficit occurs when a country's imports exceed its exports (M - X > 0). The increased demand for imports, coupled with higher government spending, leads to an inflow of foreign financial capital to fund the deficit. This inflow of capital increases the supply of financial capital in the domestic economy, which can be used for investment purposes. Consequently, the trade deficit widens.

Dynamic Nature:

It is important to note that the relationship between budget surpluses/deficits and trade balances is complex and dynamic. While changes in budget positions can influence trade balances, other factors, such as private savings and investment levels, also play a significant role. Additionally, the impact of budget changes on trade balances may vary depending on the specific economic conditions and policies in place.

In summary, while budget surpluses can contribute to trade surpluses by increasing the supply of financial capital and encouraging investment abroad, budget deficits can lead to trade deficits by increasing the demand for imports and foreign financial capital. However, the overall economic environment and the interaction of various factors within the National Saving and Investment Identity equation should be considered to fully understand the impact on the trade balance.

Graph Savings: A Smart Investment Strategy?

You may want to see also

Frequently asked questions

The national savings and investment identity is an equation that describes the relationship between the supply of and demand for financial capital in a country's market. The equation is: Supply of financial capital = Demand for financial capital.

The components of the national savings and investment identity are:

- Private savings (S)

- Taxes (T)

- Government spending (G)

- Imports (M)

- Exports (X)

- Investment (I)

The national savings and investment identity helps us understand the balance of trade by showing that a country's levels of domestic saving and investment determine its balance of trade. If a country has a trade deficit, it means that domestic investment exceeds domestic saving, and capital is flowing into the country from abroad. If a country has a trade surplus, it means that domestic savings exceed domestic investment, and the excess financial capital is invested in other countries.