The Bitcoin Investment Trust (GBTC) is a grantor trust that is not registered with the SEC and does not trade on an exchange. It is traded on the over-the-counter market, which has less stringent participation rules than traditional exchanges. The trust is managed by Grayscale Investments, a unit of Barry Silbert's Digital Currency Group. As of January 2021, GBTC held 638,906,600 shares representing 0.00094950 Bitcoin per share. The trust's performance is highly correlated with the price of Bitcoin, making it a simple way to gain exposure to the cryptocurrency. However, GBTC's 2% annual fee and its trading on the OTC market, which can be challenging in terms of liquidity, are important considerations for investors.

| Characteristics | Values |

|---|---|

| Type of investment vehicle | Grantor trust |

| Registration with SEC | Not registered under the Investment Company Act of 1940 |

| Trading | Trades on the over-the-counter market |

| Annual fee | 2% of assets |

| Management | Managed by Grayscale Investments, a unit of Barry Silbert's Digital Currency Group |

| Number of Bitcoins held | 177,037 as of Jan. 29, 2023 |

| Trading correlation with Bitcoin | GBTC moves in the same direction as Bitcoin but with less magnitude |

| Liquidity | Approximately 3-4 million shares per day under normal market conditions |

What You'll Learn

The Bitcoin Investment Trust (GBTC) is a grantor trust, not an ETF

As a grantor trust, GBTC is subject to different tax rules than ETFs. The taxation of grantor trusts is based on the investor's cost basis versus cash received, rather than the carrying value of the trust's assets. This means that cash redemptions by grantor trusts are taxable events for the redeeming shareholder only and not for the trust itself or non-redeeming shareholders.

GBTC used to be the only choice for investors looking to trade Bitcoin on the stock market, but as of January 10, 2024, it was converted to an ETF. It is now the largest Bitcoin ETF but also has the highest fees. As a trust, GBTC charged a high annual fee of 2% of assets.

In summary, while GBTC is now an ETF, it is important to understand the differences between grantor trusts and ETFs in terms of structure, regulation, and tax implications.

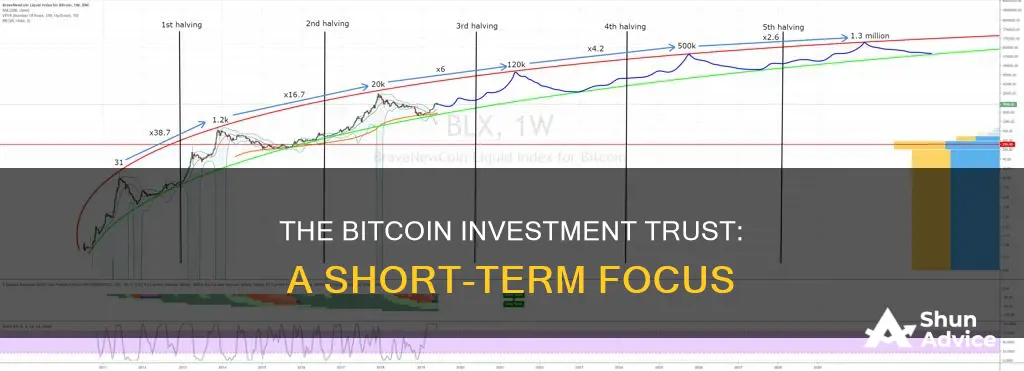

The Ultimate Guide to Bitcoin Investment Timing

You may want to see also

GBTC is managed by Grayscale Investments

The Grayscale Bitcoin Trust ETP (GBTC) is an exchange-traded product that is not a fund registered under the Investment Company Act of 1940 and is not subject to regulation under that Act. GBTC is solely and passively invested in Bitcoin, with the investment objective of reflecting the value of Bitcoin held by the Trust, less expenses and other liabilities.

GBTC was created as a private placement over a decade ago and is sponsored by Grayscale, one of the world's leading crypto asset managers with over a decade of experience operating crypto investment products. It has a long operating history as the first publicly-traded Bitcoin fund in the US and the first spot Bitcoin exchange-traded product to commence trading in the country.

Grayscale Investments, LLC, is the primary listing market for GBTC. The trust is managed by Grayscale, which charges an annual management fee of 1.50%, including all costs associated with the administration and safekeeping of the underlying Bitcoin. There are no other fees.

Grayscale enables investors to access the digital economy through a family of regulated and future-forward investment products. Founded in 2013, the company has a proven track record and deep expertise as the world's largest crypto asset manager. Investors, advisors, and allocators turn to Grayscale for single-asset, diversified, and thematic exposure.

Bitcoin Investment: Smart Move or Risky Gamble?

You may want to see also

GBTC has higher fees than other Bitcoin ETFs

The Grayscale Bitcoin Trust (GBTC) is the world's largest Bitcoin ETF. It was converted from a trust to an ETF on January 10, 2024, and now carries a 1.5% fee, which is much higher than its competitors. Before the conversion, it charged a 2% yearly fee.

Grayscale Bitcoin Trust's high fees have resulted in outflows of more than $12 billion since January 2024, as investors are deterred by the costs. The company has stated that it intends to bring fees down over time as the crypto ETF market matures. Grayscale's CEO, Michael Sonnenshein, has also mentioned that the firm is considering introducing a "mini" version of its flagship product, which would have a materially lower fee.

Grayscale's high fees can be attributed to its position as the only Bitcoin stock on the market for a long time. However, with the emergence of rival ETFs, such as Bitwise, BlackRock, and Fidelity, charging significantly lower fees, GBTC is likely to experience more outflows as investors seek more competitive options.

In summary, GBTC has higher fees than other Bitcoin ETFs, and this has led to outflows and could potentially result in a decrease in its investor base. However, Grayscale is considering reducing fees and introducing more affordable versions of its product to remain competitive in the market.

Who Owns Bitcoin? Exploring Population Investment Percentages

You may want to see also

GBTC is the only Bitcoin stock on the market

The Grayscale Bitcoin Trust (GBTC) is currently the only Bitcoin stock on the market. It is a trust run by Grayscale that holds 638,906,600 shares, representing 0.00094950 Bitcoin per share as of January 2021. People can buy shares of the trust, with each share representing the ownership of a little under 0.001 Bitcoin.

GBTC used to be the only choice for investors looking to trade Bitcoin on the stock market, and they had to pay a premium to do so. However, as of January 10, 2024, GBTC was converted to an ETF (exchange-traded fund) and was joined by many other Bitcoin ETFs. While GBTC is now the largest ETF in this space, it also has the highest fees.

As the only Bitcoin stock on the market, GBTC is a unique investment opportunity for those looking to gain exposure to Bitcoin without buying it directly. However, it is important to note that GBTC is not a true common stock. Instead, shareholders own part of an open-ended grantor trust, which holds a fixed portfolio of Bitcoin. This means that GBTC is subject to different regulations and investor protections than traditional stocks.

The price of GBTC tends to be driven by investor sentiment and can be highly volatile. It generally moves in line with the price of Bitcoin but can also trade at a premium or discount to its underlying Bitcoin holdings. At times, GBTC has traded at a large discount, providing an opportunity for investors to buy Bitcoin at a lower price.

In summary, while GBTC is the only Bitcoin stock on the market, investors should carefully consider the risks and regulations associated with grantor trusts, as well as the volatility of the Bitcoin market, before investing.

Bitcoin Buying vs Investing: What's the Difference?

You may want to see also

GBTC is immediate, and your spending isn’t limited

The world of cryptocurrency can be a bit like the Wild West, with its own unique challenges and complexities. For those who are new to the space or are casual investors, navigating this landscape can be daunting. This is where GBTC comes in.

GBTC, or The Bitcoin Investment Trust, is a trust run by Grayscale that allows investors to buy shares representing ownership of a fraction of a Bitcoin. It is immediate and convenient, especially for those who don't want the hassle of trading cryptocurrency on an exchange. With GBTC, there are no limits on spending, making it a more accessible option for those looking to invest in Bitcoin.

One of the key advantages of GBTC is that it eliminates the need for a digital wallet and the complexities of converting USD to cryptocurrency. While trading Bitcoin usually involves fees and limitations, GBTC offers a simpler and faster way to invest, without the same transaction fees. It is a good option for those who want to trade quickly and easily from their traditional brokerage accounts.

However, it's important to note that GBTC is not without its drawbacks. It tends to trade at a premium, and there are also annual fees involved. Additionally, GBTC is subject to the emotions of the market, sometimes changing wildly while Bitcoin remains stagnant, and vice versa.

In conclusion, while GBTC has its pros and cons, it is a good option for those who want immediate and unlimited access to investing in Bitcoin without the complexities of the cryptocurrency world. It offers a convenient way to gain exposure to cryptocurrency, making it a popular choice for casual investors.

Fidelity 401(k) and Bitcoin: Investing in Crypto

You may want to see also

Frequently asked questions

The Bitcoin Investment Trust (GBTC) is not a traditional investment fund, it is a grantor trust. It is not registered with the SEC and does not trade on an exchange, instead, it trades on the over-the-counter market. This means that GBTC is subject to less stringent rules than traditional funds, but it also means that it may not be available on all trading platforms.

The Bitcoin Investment Trust charges a high annual fee of 2% of assets, which is significantly more than most ETFs. This fee is paid to the sponsor of the trust, Grayscale Investments, and results in the value of the trust being diminished over time.

The performance of the Bitcoin Investment Trust (GBTC) is generally correlated with the price of Bitcoin and other Bitcoin investments, such as mining companies. However, there are times when GBTC does not get as much leverage as other Bitcoin investments, which can result in missed profits for traders. Therefore, GBTC may be more suitable for long-term investors who are less concerned with short-term price movements.