Corporations generally do not invest in mutual funds because they are subject to various restrictions on ownership and operations. S corporations, for example, are restricted to a maximum of 100 shareholders, who must be individuals or specific types of estates or trusts. They can only issue one class of stock and are required to distribute profits and losses equally among shareholders. These limitations make it challenging for corporations, especially larger ones, to utilize mutual funds as an investment vehicle.

| Characteristics | Values |

|---|---|

| Control | Corporations may prefer to retain control over their investment decisions and not leave it to a fund manager. |

| Diversification | Corporations may not need the diversification offered by mutual funds as they can invest in multiple stocks themselves. |

| Fees | Corporations may want to avoid the fees associated with mutual funds. |

| Tax | Corporations may not benefit from the tax advantages offered by mutual funds. |

What You'll Learn

- Corporations are taxed on their profits, and shareholders are taxed again when they receive dividends

- Mutual funds have fees and expenses that lower overall returns

- Corporations may not be able to influence the fund manager's decisions

- Mutual funds may not offer enough diversification for a corporation

- Corporations may prefer to invest in themselves

Corporations are taxed on their profits, and shareholders are taxed again when they receive dividends

Corporations are complex entities that make investment decisions based on various factors, including tax implications. One such consideration is the potential double taxation that can occur when corporations invest in mutual funds. Here is an explanation of this concept:

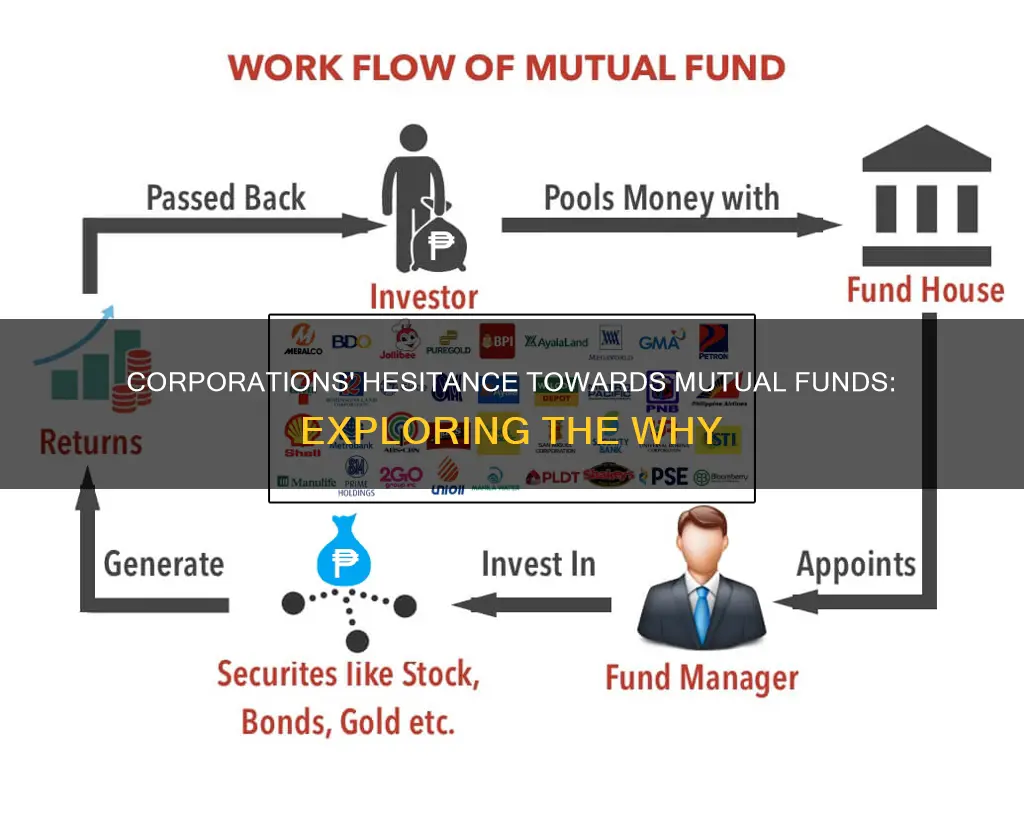

Mutual funds, by design, pool money from multiple investors to purchase a diversified portfolio of assets, providing individual investors with access to a wide range of investments. When a corporation invests in a mutual fund, it becomes one of the multiple investors contributing to the fund. However, the taxation process for corporations and their shareholders is more intricate.

Corporations are taxed on their profits, and this taxation occurs at the corporate level. Subsequently, when dividends are distributed to shareholders, those shareholders are taxed again on the income they receive. This scenario results in a form of double taxation, which can be a deterrent for corporations considering investing in mutual funds.

To illustrate, imagine Corporation XYZ invests in a mutual fund. If the mutual fund generates profits, Corporation XYZ will be taxed on its share of those profits. Then, when Corporation XYZ receives dividends from the mutual fund, it may have to pay taxes again on that income. This double taxation can significantly impact the overall return on investment for the corporation.

It is important to note that the specific tax implications can vary depending on the jurisdiction and the structure of the corporation. For example, in the context of S corporations in the United States, while there is no restriction on the stocks or funds they can own, the taxation process is different. S corporations file an abbreviated tax return, and their shareholders report the company's profits or losses on their personal tax returns. This approach helps avoid the double taxation issue to some extent.

In summary, the prospect of double taxation is a crucial factor for corporations to consider when deciding whether to invest in mutual funds. The taxation of corporate profits and the subsequent taxation of dividends received by shareholders can influence the overall return on investment and, therefore, shape the investment strategies of corporations.

Mutual Fund Minimums: Why the Barrier to Entry Exists

You may want to see also

Mutual funds have fees and expenses that lower overall returns

Mutual funds are a popular investment choice due to their professional management, diversification, affordability, and liquidity. However, one notable drawback is the fees and expenses associated with these funds, which can significantly impact overall returns.

Mutual funds charge various fees, including annual fees, expense ratios, and commissions. The expense ratio, for instance, covers operating expenses such as management fees, administrative costs, and marketing expenses. While competition has driven down expense ratios over the years, they still represent a notable proportion of an investor's returns. For example, equity mutual fund investors incurred an average expense ratio of 1.04% in 1996, but this figure dropped to 0.44% by 2022.

Sales charges or "loads" are another type of fee that mutual funds may charge when buying or selling shares. Front-end loads are charged when purchasing shares, while back-end loads are assessed if shares are sold before a certain date. Redemption fees are also common, designed to discourage short-term trading and are usually limited to 2% by the U.S. Securities and Exchange Commission (SEC).

The impact of these fees on overall returns cannot be overstated. Even small differences in fees can lead to significant differences in returns over time. For instance, consider an investment of $10,000 in a fund with a 10% annual return and annual operating expenses of 1.5%. After 20 years, the investment would be worth roughly $49,725. However, if the same investment were made in a fund with the same performance but lower expenses of 0.5%, the final value after 20 years would be $60,858.

Therefore, investors should carefully evaluate the fees and expenses associated with mutual funds before investing. By understanding and comparing the fee structures of different funds, investors can make more informed decisions and maximize their overall returns.

Mid-Cap Funds: Smart Investment Timing for Optimal Returns

You may want to see also

Corporations may not be able to influence the fund manager's decisions

When investing in mutual funds, investors give control to the fund manager, who makes decisions about capital gains and individual holdings. If an investor disagrees with some of the fund manager's holdings or decisions, there is not much they can do other than pick a new fund. This lack of control may be a disadvantage for corporations that want to have a more hands-on approach to their investments and maintain decision-making power.

Additionally, mutual funds require a small annual fee or expense ratio, which is built into the fund and taken off the value of each share. This management fee may be a consideration for corporations, especially if they have a large amount of capital invested in mutual funds.

Furthermore, mutual funds may not provide the level of diversification that a corporation is seeking. While mutual funds offer instant diversification by holding a wide range of stocks, most funds focus on companies that fit specific parameters, such as market cap or exposure to a certain sector. As a result, even after investing in a mutual fund, corporations may still need to diversify their portfolios by investing in multiple funds or other asset classes.

In summary, corporations may be hesitant to invest in mutual funds because they cannot influence the fund manager's decisions, have limited control over their investments, incur management fees, and may need to invest in multiple funds to achieve their desired level of diversification.

Artificial Intelligence: Mutual Funds for Future Tech Investors

You may want to see also

Mutual funds may not offer enough diversification for a corporation

While mutual funds offer diversification by pooling money from multiple investors to purchase a range of securities, they may not offer enough diversification for a large corporation.

Corporations are often large entities with diverse business areas and revenue streams. They may have access to significant financial resources and expertise in various industries, which enables them to diversify their investments across different asset classes and sectors. On the other hand, mutual funds typically invest in a specific type of security, such as stocks, bonds, or a combination of both. While mutual funds can provide exposure to a diversified portfolio of stocks or bonds, it may not be sufficient for a corporation seeking to diversify its investments across multiple asset classes and sectors.

Additionally, corporations may have specific investment objectives and risk tolerances that may not be adequately addressed by mutual funds. Corporations often have complex financial structures and unique investment needs that require customized investment strategies. They may seek to invest in assets that are not typically included in mutual funds, such as derivatives, commodities, or alternative investments.

Furthermore, corporations tend to have different regulatory and tax considerations than individual investors. They may have specific requirements for managing their cash flow, optimizing their tax liabilities, and adhering to corporate governance guidelines. Mutual funds, which are designed for individual investors, may not offer the necessary flexibility and customization to meet these unique corporate needs.

Moreover, corporations often have access to their own financial expertise and resources. They may have an in-house team of investment professionals who can actively manage their investment portfolio. By investing directly in the market, corporations can maintain greater control over their investment decisions, risk management strategies, and long-term financial goals.

In summary, while mutual funds offer diversification and professional management for individual investors, they may not provide the level of diversification, customization, and control that a large corporation requires for its investment portfolio. Corporations often have unique investment objectives, risk tolerances, and regulatory considerations that may be better addressed through direct investments or customized investment strategies tailored to their specific needs.

Robo Advisors: Index Fund Investing Strategies Explored

You may want to see also

Corporations may prefer to invest in themselves

Secondly, corporations may prefer to invest in themselves to avoid the fees associated with mutual funds. Mutual funds typically charge annual fees, expense ratios, or commissions, which can reduce the overall returns on investments. By investing directly in stocks or other assets, corporations can avoid these additional costs and potentially increase their investment profits.

Additionally, corporations may have specific investment objectives or risk tolerances that may not align with those of mutual funds. Mutual funds often have predefined investment strategies and goals, and investors must choose funds that match their own objectives and risk appetite. Corporations that invest in themselves have the flexibility to make investment decisions that align directly with their own goals and risk tolerance levels.

Furthermore, corporations may prefer to invest in themselves to achieve better diversification across different asset classes. While mutual funds offer instant diversification within a particular asset class, such as stocks or bonds, corporations may seek to diversify their investments across a broader range of asset classes. By investing in themselves, corporations can allocate their capital across various investments, including stocks, bonds, real estate, and precious metals, among others.

Lastly, corporations may have access to better investment opportunities that are not available to mutual funds. For example, a corporation may have inside information or expertise in a particular industry that gives them an edge in the market. By investing in themselves, they can take advantage of these opportunities to potentially generate higher returns.

Target Date Funds: Understanding Your Investment Options

You may want to see also

Frequently asked questions

Corporations are separate entities from mutual funds and have different investment objectives and strategies. Corporations also have more stringent regulatory requirements and may not be able to comply with the rules governing mutual funds.

Mutual funds offer instant diversification, as many funds hold hundreds of stocks across different sectors and industries. This diversification helps to lower the risk of losing money if one company fails. Mutual funds are also more hands-off and require less work, as a dedicated fund manager oversees the portfolio.

Investing in mutual funds means giving up some control to the fund manager. You may not agree with all the holdings in a mutual fund and will have to wait until the end of the day to sell your shares. Mutual funds also charge management fees, which can impact overall returns.

Mutual funds charge annual fees, expense ratios, or commissions, which are taxed as ordinary income and can lower overall returns. Capital gains from mutual funds are also taxed, and the tax liability depends on the investor's tax bracket.

Stocks are more appropriate for investors who can actively monitor their portfolios and the stock market for opportunities. Mutual funds are better suited for those who want a fund manager to make investment decisions on their behalf. It is also possible to invest in both stocks and mutual funds to balance risk and potential returns.