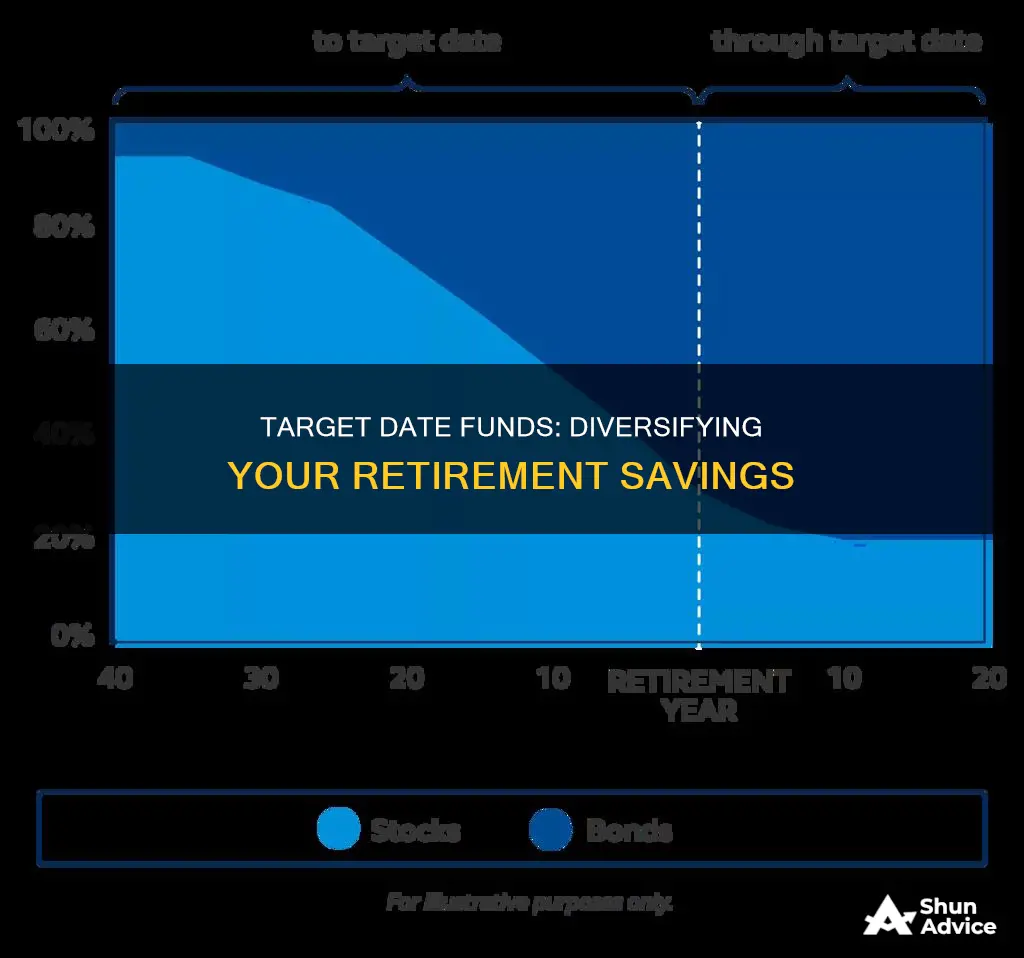

Target-date funds are designed to be a one-stop shop for retirement savings, with investors meant to park their nest egg in one fund, generally based on their retirement year, which automatically shifts from stocks to bonds over time. However, some investors use multiple target-date funds, which may be unnecessary and could even be detrimental.

Some investors may choose to invest in multiple target-date funds to afford them the most flexibility in retirement. However, this strategy can be overly complex and may not provide the desired benefits. The idea of target-date funds is to provide a built-in glide path, so investors don't have to worry about moving towards safer assets as they approach retirement. By stacking multiple funds, investors would effectively be taking the average of the group, which could complicate their portfolio.

Additionally, investing in multiple target-date funds may skew an investor's asset allocation and inadvertently increase their investment risk. For example, if an investor allocates half of their 401(k) assets to a target-date fund and the rest to aggressive growth funds, the target-date fund would automatically adjust over time, but the 50% stock holding would remain constant.

While there may be valid reasons for some investors to hold multiple target-date funds, such as tailoring their asset allocation to a more specific degree, it is generally recommended to stick with a single fund to keep things simple.

What You'll Learn

Target-date funds can co-exist with other funds in a portfolio

Some investors choose to add non-target-date funds to their portfolio to make it more aggressive or more conservative. For example, an investor may want to retain the aggressive nature of their portfolio by introducing a riskier pure stock investment as their target-date investment becomes more conservative over time.

Additionally, investors may build a "mixed" portfolio to add customization. A single target-date fund may not contain a particular key ingredient found in other funds, so adding a non-target-date fund can increase diversification and help investors achieve their specific financial goals.

However, it is important to note that target-date funds are designed to be standalone investments, comprising a broadly diversified portfolio in just one investment. Therefore, adding multiple funds may not always be beneficial and can sometimes lead to overlapping or conflicting strategies.

Furthermore, while target-date funds are meant to simplify the investment process, adding multiple funds can increase complexity, especially if the funds have different target dates. This can make it challenging to manage your portfolio and may not provide any additional benefits.

In conclusion, while target-date funds can co-exist with other funds in a portfolio, investors should carefully consider their financial goals, risk tolerance, and the potential benefits and drawbacks of adding multiple funds before making any investment decisions.

Investing Funds: Where to Start for Maximum Returns

You may want to see also

Target-date funds are designed to be standalone investments

Target-date funds are designed to be a one-stop shop for investors. They are meant to be a single investment, a "standalone" option that comprises a broadly diversified portfolio in just one fund.

The funds are designed to put retirement savings on autopilot. Investors simply need to park their money in one fund, generally based on their retirement year, and the fund will automatically shift from stocks to bonds over time. This is known as a "glide path".

However, some investors add other funds to their portfolio to make it more aggressive or conservative, or to add diversification. For example, an investor might want to retain the aggressive nature of their portfolio by introducing a riskier pure stock investment as their target-date fund becomes more conservative.

Some investors also build a "mixed" portfolio to add customisation. A single target-date fund may not contain a particular key ingredient that may be found in other funds.

While target-date funds are designed to be standalone, it is possible to combine them with other funds to meet specific investment goals. However, this strategy may add unnecessary complexity and could inadvertently skew one's asset allocation over time.

Mutual Funds and Investment Trusts: What's the Difference?

You may want to see also

Target-date funds are already diversified

Target-date funds are designed to be a one-stop shop for investors. They are already diversified and are meant to be standalone, comprising a broadly diversified portfolio in just one investment.

Each Vanguard target-date portfolio, for example, invests in several other Vanguard stock and bond mutual funds. These funds are already diversified, so there is no need to invest in multiple target-date funds to achieve diversification.

However, some investors may choose to add non-target-date funds to their portfolio to make it more aggressive or more conservative. For instance, an investor may want to retain the aggressive nature of their portfolio by introducing a riskier pure stock investment as their target-date investment becomes more conservative over time.

It's important to note that investing in multiple target-date funds may inadvertently skew one's asset allocation over time and increase investment risk. Therefore, it is generally recommended to stick with a single target-date fund that aligns with your retirement goals and risk tolerance.

Index Funds: Creative Planning for Long-Term Success

You may want to see also

Target-date funds can be used to sample the waters

Target-date funds can be used to "sample the waters" of investing, especially for those who are new to investing or who want to take a "set it and forget it" approach. They are designed as a one-stop shop, standalone investment that automatically adjusts its asset allocation over time based on an investor's retirement timeline. This can be helpful for those who don't want to actively manage their investments or worry about rebalancing their portfolio.

However, it's important to note that target-date funds are not completely hands-off, and investors should still regularly review their investments to ensure they are on track to meet their financial goals. Additionally, while target-date funds offer a diversified portfolio, they may not be tailored to an individual's specific needs or risk tolerance. As such, some investors may choose to add non-target-date funds to their portfolio to increase diversification or make their portfolio more aggressive or conservative.

For example, an investor with a non-target-date portfolio may consider adding a target-date fund to "sample the waters" of this type of investment strategy. This can provide them with exposure to a diversified portfolio of stocks and bonds that automatically adjusts over time. On the other hand, an investor with a target-date portfolio may add non-target-date funds to further customise their portfolio and make it more suited to their specific goals and risk tolerance.

While target-date funds can be a good starting point for investors, it's important to remember that they may not be suitable for everyone. Some investors may prefer to have more control over their asset allocation and may choose to build a customised portfolio using a variety of investment vehicles. Additionally, it's important to note that investing in multiple target-date funds with different retirement dates may not provide additional benefits and could potentially increase risk.

Equity Investment and Equity Funding: What's the Difference?

You may want to see also

Target-date funds can be used to diversify an extreme portfolio

Target-date funds are an increasingly popular way to invest for the future, especially for retirement planning. They are designed to be a standalone investment, offering a broadly diversified portfolio in a single fund. However, they can also be used alongside other funds in a portfolio to further diversify an investor's holdings.

Target-date funds are mutual funds or exchange-traded funds that automatically rebalance and reallocate assets as an investor gets closer to their target date, typically retirement. The fund management company adjusts the asset mix, shifting from riskier investments such as stocks to more conservative investments like bonds and cash. This gradual shift is known as the "glide path."

While target-date funds are designed to be standalone investments, they can also be used in conjunction with other funds to customise a portfolio. Some investors add non-target-date funds to make their portfolio more aggressive or more conservative. For example, as a target-date fund becomes more conservative as it approaches its target date, an investor may want to introduce a riskier pure stock investment to maintain the aggressive nature of their portfolio.

Target-date funds can also be added to non-target-date portfolios to "sample the waters" or to add a layer of diversification. This is especially beneficial for "extreme" portfolios that contain either 100% or 0% equities. By adding a target-date fund, investors immediately strengthen the diversification of their portfolio, as target-date funds invest in a variety of stock and bond mutual funds.

For instance, if an investor has a portfolio that is 100% stocks, adding a target-date fund will introduce bonds, creating a more diversified portfolio. Similarly, if an investor has a portfolio with 0% stocks, adding a target-date fund will increase equity exposure, providing the potential for higher returns.

In conclusion, while target-date funds are designed as standalone investments, they can also play a role in diversifying extreme portfolios. By adding a target-date fund, investors can either introduce stocks to a portfolio with no equity exposure or include bonds in a portfolio that is 100% stocks. This helps to reduce risk and volatility while potentially enhancing returns.

Wide Moat Fund: Investing in Quality Businesses

You may want to see also

Frequently asked questions

No, target-date funds are designed to be a single investment. If you want to be more aggressive, you can pick a year further out than your retirement date. Multiple dates won't do much for you.

Investing in additional funds may skew your asset allocation and inadvertently increase your investment risk. For example, if you allocate half of your 401(k) assets to a target-date fund and the rest to aggressive growth funds, the target-date fund would automatically adjust over time but the 50% stock holding would remain constant.

Some investors will add non-target-date funds to their portfolio to make it more aggressive or more conservative. Target-date funds can also co-exist with other funds in the same portfolio to increase diversification.