Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup. Index funds are a passive investment strategy, meaning they don't require active management and are therefore a low-cost way to track a specific group of investments. They are also more diversified than individual stocks, which means they carry less risk.

| Characteristics | Values |

|---|---|

| Type of fund | Mutual or exchange-traded fund (ETF) |

| Investment strategy | Passive |

| Investment aim | To mirror the performance of a market index |

| Management style | Not actively managed |

| Investment selection | Based on the index |

| Risk | Lower than individual stocks |

| Performance | Often outperform actively managed funds |

| Cost | Low fees |

| Tax | Tax-efficient |

| Suitability | Long-term investment |

| Investment amount | No minimum required |

Low fees

Index funds are a great investment option for those seeking a low-cost way to build wealth over the long term. Here are some reasons why investing in a value index fund is advantageous in terms of low fees:

Lower Costs and Expense Ratios

Index funds typically have lower expense ratios compared to actively managed funds because they are passively managed. The expense ratio is a critical factor to consider when investing, as it represents the fees deducted from each fund shareholder's returns as a percentage of their overall investment. Index funds, such as the Vanguard S&P 500 ETF, have low expense ratios, often as low as 0.03% to 0.05%. In contrast, actively managed funds usually have higher expense ratios, ranging from 0.44% to over 1.00%.

Minimal Investment Research

Index funds require minimal investment research on the part of the investor. You can rely on the index fund's portfolio manager to mirror the performance of the underlying index over time. This passive management strategy means you don't need to spend time actively picking securities or timing the market.

Lower Transaction Costs

Index funds have lower transaction costs than actively managed funds. Since index funds trade as little as possible to keep costs low, they incur fewer transaction fees and commissions. This passive management strategy further contributes to their overall low-fee structure.

Tax Efficiency

Index funds are also tax-efficient compared to many other investments. They generally don't buy and sell their holdings as frequently as actively managed funds, resulting in fewer capital gains distributions, which can reduce your tax bill. Additionally, index funds have a tax advantage due to their ability to choose from various lots when selling a particular security, allowing them to sell the lots with the lowest capital gains and tax liability.

Broad Market Exposure and Diversification

Index funds provide broad market exposure and diversification across various sectors and asset classes. This diversification helps to lower your overall investment risk. By investing in a value index fund, you gain access to a diversified portfolio of stocks or bonds, reducing the chances of significant losses if something negative happens to a single company or sector.

In summary, investing in a value index fund offers a range of benefits, including lower fees, minimal investment research, lower transaction costs, tax efficiency, and broad market exposure and diversification. These factors make value index funds an attractive option for investors seeking a low-cost, passive investment strategy with potential for solid long-term returns.

RIA Mutual Fund Investment: What's the Catch?

You may want to see also

Tax efficiency

Index funds are considered highly tax-efficient for a few reasons. Firstly, they generally don't have to buy and sell their holdings as often as actively managed funds, so they avoid generating capital gains that can increase an investor's tax bill. Secondly, index funds buy new lots of securities whenever investors put money into the fund, which means they can choose from various lots when selling a particular security. They can then sell the lots with the lowest capital gains and reduce their tax liability. This makes index funds more tax-efficient than actively managed funds, which tend to have higher turnover rates and, consequently, higher capital gains distributions.

Index funds' passive management strategy also contributes to their tax efficiency. Because they aim to mirror the performance of a specific market index, they don't need to actively pick securities or time the market. As a result, they have lower expenses and fees than actively managed funds, which have larger staffs and conduct more complicated and frequent trades.

Additionally, index funds' broad diversification can help minimize tracking errors, reducing the difference between the fund's performance and its target index. This can lead to lower costs and potentially lower taxes for investors.

Overall, the tax efficiency of index funds is one of their key advantages, making them a popular choice for investors seeking low-cost, passive investments that can provide solid returns over the long term.

Mutual Fund Investment: Answers to Your Questions

You may want to see also

Long-term gains

Index funds are a great investment for building wealth over the long term. Here are some reasons why investing in a value index fund is a good idea for long-term gains:

Index funds are a passive investment strategy, meaning they aim to mirror the performance of a specific market index, such as the S&P 500. This means that, over time, index funds have the potential to provide strong returns without the need for active management. This passive management strategy also results in lower fees compared to actively managed funds, which can lead to better long-term returns for investors.

Index funds are also highly diversified, investing in a broad range of stocks or bonds that make up a specific market index. This diversification helps to reduce risk and provides investors with exposure to a wide variety of companies and sectors. By investing in a value index fund, you can benefit from the long-term growth of well-established companies that offer dividend payments.

Additionally, index funds require minimal investment research, as you can rely on the fund's portfolio manager to match the performance of the underlying index. This makes them a great option for investors who want a simple, low-maintenance way to build wealth over time.

Index funds are also tax-efficient compared to other investments. Their lower turnover rates result in fewer capital gains distributions, making them more tax-efficient than actively managed funds.

Finally, index funds are a great way to build your portfolio over time. You can invest regularly, ignoring short-term ups and downs, and benefit from the market's long-term growth.

Overall, investing in a value index fund can be a great way to achieve long-term gains, providing diversification, low fees, and strong returns over time.

Mutual Fund Liquidity: Why More Liquid Investments Are Needed

You may want to see also

Diversification

Index funds provide broad market exposure and diversification across various sectors and asset classes, depending on their underlying index. For example, the S&P 500 index fund includes 500 of the top companies in the U.S. stock market, while the Nasdaq Composite Index fund includes 3,000 stocks listed on the Nasdaq exchange. By investing in an index fund, you gain exposure to a diverse range of companies or assets, reducing your risk compared to investing in individual stocks or assets.

Index funds are passively managed, meaning they aim to replicate the performance of the index they track rather than actively selecting stocks or timing the market. This passive management strategy helps keep costs low, as there is no need for a large staff of active fund managers, analysts, or traders. As a result, index funds typically have lower expense ratios than actively managed funds.

In addition to broad market index funds, there are also sector indexes tied to specific industries, country indexes that target stocks in specific nations, and style indexes emphasizing value-priced stocks. These more focused index funds can provide investors with exposure to specific sectors or trends while still offering the benefits of diversification.

Overall, diversification is a key advantage of investing in index funds, as it helps to reduce risk and provide exposure to a broad range of companies or assets.

Maximizing SRS Funds: Where to Invest for Optimal Growth

You may want to see also

Passive investing

Index funds are a passive investment strategy. They are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup.

Index funds are passive investments that use a long-term strategy without actively picking securities or timing the market. They are considered a passive management strategy because they don't need to actively decide which investments to buy or sell. They are often used to help balance the risk in an investor's portfolio, as market swings tend to be less volatile across an index compared with individual stocks.

Index funds are a low-cost, easy way to build wealth. They are less expensive than actively managed funds and typically carry less risk than individual stocks. They are a great investment for building wealth over the long term, which is why they are popular with retirement investors.

Index funds have lower expenses and fees than actively managed funds. Because they are passively managed, they don't need research analysts and others to choose stocks or time trades, and they trade holdings less frequently, meaning lower transaction fees and commissions. As a result, they can charge less than their actively managed peers.

Index funds are also more tax-efficient than actively managed funds. They generate less taxable income because they buy and sell holdings less often. They also have more tax flexibility because they buy new lots of securities whenever investors put money into the fund, so they can sell the lots with the lowest capital gains and the lowest tax liability.

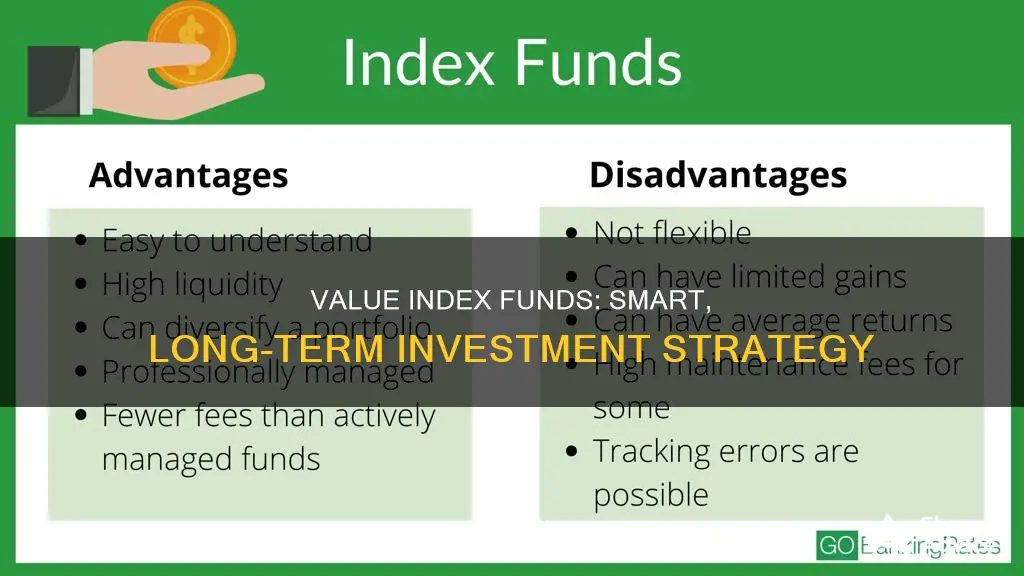

Despite the benefits of index funds, they are not for everyone. One drawback is that they rise and fall with the market, so they can be volatile in a down market. They also lack the flexibility to pivot away from underperforming stocks or take advantage of new opportunities.

Index Investing: Outperforming Mutual Funds with Less Risk

You may want to see also

Frequently asked questions

Index funds are a great way to get exposure to the stock market without excessive fees or dependence on any individual stock's performance. They are also a good way to build a diversified portfolio without having to research individual stocks.

Index funds are low-cost, easy to invest in, and often perform very well. They are also tax-efficient and have lower investment risk due to diversification.

Index funds are not for everyone. They do not offer the chance to beat the market and can be volatile in the short term. They also come with a lack of flexibility as they are designed to mirror a specific market.

When choosing a value index fund, look for one with low costs and one that closely tracks the performance of the index. Also, consider any limitations or restrictions on the fund and whether the fund provider has other index funds you're interested in.