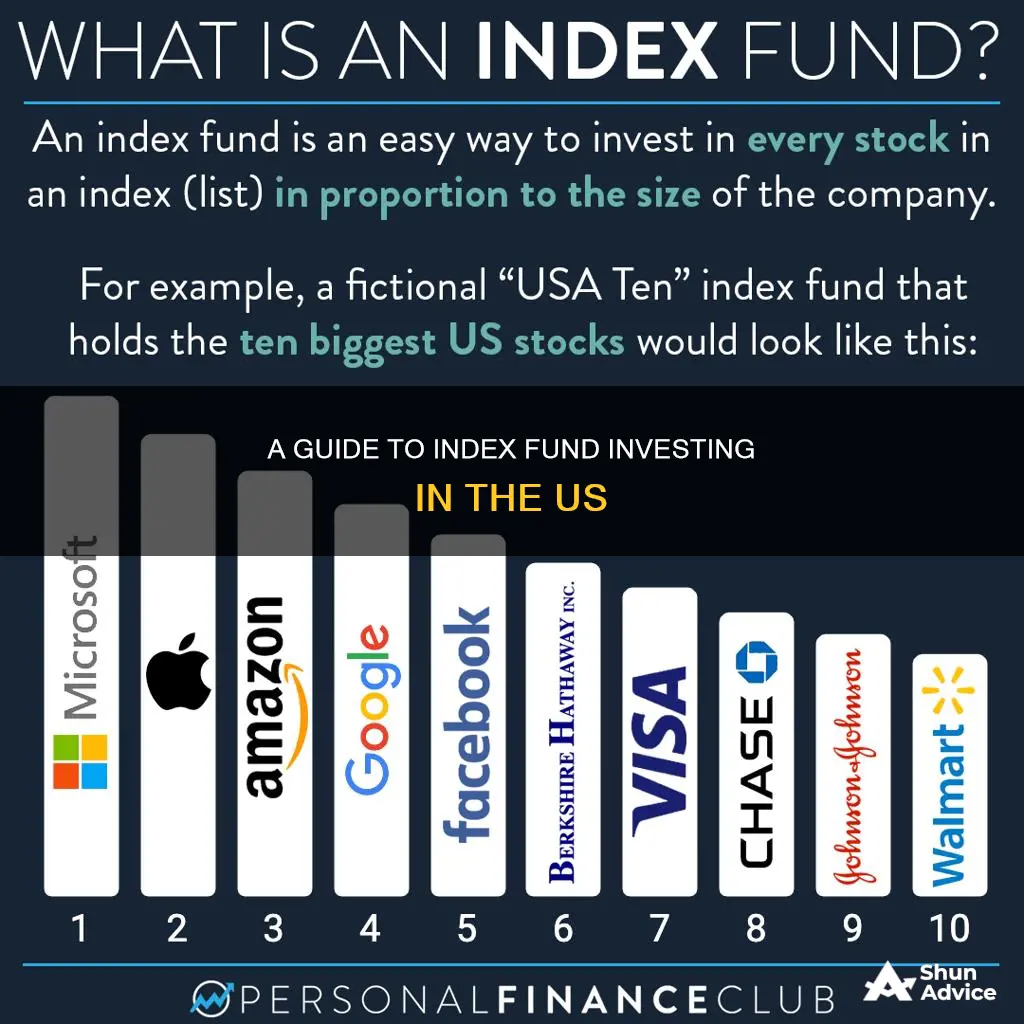

Index funds are a type of investment vehicle, such as a mutual fund or exchange-traded fund (ETF), that tracks a market index such as the S&P 500 or the Russell 2000. They are a low-cost, easy way to build wealth, and are popular with retirement investors. Index funds are considered a passive management strategy, meaning they don't need to actively decide which investments to buy or sell. They are also highly diversified, lowering the overall risk of investing.

| Characteristics | Values |

|---|---|

| Definition | A type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. |

| Benefits | Low fees, tax advantages, low risk, broad market exposure, diversification, historical performance |

| Drawbacks | Lack of flexibility, lack of downside protection, automatically including all securities in an index, market-cap weighting |

| Types | Equity index funds, bond index funds, international index funds, sector-specific index funds |

| How to invest | 1. Research and analyze index funds; 2. Decide which index fund to buy; 3. Purchase your index fund |

What You'll Learn

Choose an index

There are hundreds of indexes to choose from, but the most popular is the S&P 500, which includes 500 of the top companies in the US stock market.

Other popular indexes include:

- Dow Jones Industrial Average: Tracks the 30 largest US firms

- Nasdaq Composite: Tracks over 3,000 tech stocks

- Russell 2000: Tracks 2,000 smaller companies

- Wilshire 5000 Total Market Index: Tracks nearly 7,000 publicly traded US companies

- MSCI EAFE Index: Tracks performance of large- and mid-cap stocks of firms based in 21 developed nations outside the US and Canada

You can also find sector indexes tied to specific industries, country indexes that target stocks in specific nations, style indexes emphasising fast-growing companies or value-priced stocks, and other indexes that limit their investments based on their own filtering systems.

When choosing an index, consider the following:

- Location: Do you want to invest in companies in a specific country or region?

- Business: Which market sector do you want to invest in?

- Market opportunity: What opportunity does the index fund present?

Choose the right fund for your index

Once you've chosen an index, you can find at least one index fund that tracks it. For popular indexes like the S&P 500, you might have a dozen or more choices. To choose the right fund, ask yourself the following questions:

- Which index fund most closely tracks the performance of the index?

- Which index fund has the lowest costs?

- Are there any limitations or restrictions on an index fund that prevent you from investing in it?

- Does the fund provider have other index funds you're interested in using?

Index Funds: Diversified, Low-Cost, Long-Term Investment Strategy

You may want to see also

Select a fund with low costs

Index funds are a passive investment strategy that aims to mirror the performance of a designated market index, such as the S&P 500. They are a low-cost, easy way to build wealth over the long term. When selecting an index fund to invest in, it is important to consider one with low costs. Here are some things to keep in mind:

- Expense Ratio: The expense ratio is the cost of managing the fund, expressed as a percentage of the fund's total assets. This is one of the main costs associated with index funds and can eat into your investment returns over time. Look for index funds with low expense ratios, as this will maximize your net returns.

- Management Fees: Index funds are passively managed, meaning they aim to replicate the performance of a specific index rather than actively picking stocks. As a result, they generally have lower management fees than actively managed funds. However, some index funds may have higher management costs than others, so it is important to compare these fees before selecting a fund.

- Transaction Costs: Index funds also incur transaction costs when they buy or sell securities. These costs can vary depending on the fund, so be sure to consider this when making your selection.

- Account Minimums and Investment Minimums: While some brokerages may not have account minimums, there may still be investment minimums for specific index funds. Be sure to review these requirements before deciding where to invest.

- Fund Size: Generally, larger index funds have lower fees. This is because they are able to spread their costs across a larger number of investors.

- Brokerage Fees: If you plan to purchase an index fund through a brokerage, be sure to consider the trading costs. Some brokerages may charge higher commissions or transaction fees, which can impact your overall investment returns.

- Bid-Ask Spread: When purchasing an index fund through a brokerage, you may also want to consider the bid-ask spread, which is the difference between the price a buyer is willing to pay and the price a seller is willing to accept. This can impact the overall cost of your investment.

By carefully considering these factors and comparing costs across different index funds, you can select a fund with low costs that aligns with your investment goals and helps you build wealth over time.

Index Investing: Outperforming Mutual Funds with Less Risk

You may want to see also

Invest through a brokerage or fund provider

Investing in an index fund through a brokerage or fund provider is a straightforward process. Here's a step-by-step guide:

Step 1: Choose a Brokerage or Fund Provider

Select a brokerage firm or a fund provider, such as Vanguard or Fidelity, to facilitate your investment in index funds. These companies offer a range of index funds that track different indexes, such as the S&P 500 or the Russell 2000. They provide the platform and tools necessary to research and invest in index funds.

Step 2: Open an Investment Account

To begin investing, you'll need to open an investment account with your chosen brokerage or fund provider. This could be a traditional brokerage account, an individual retirement account (IRA), or a Roth IRA. Each of these account types has its own advantages and tax implications, so consider consulting a financial advisor to determine which is most suitable for your circumstances.

Step 3: Research and Select Index Funds

Once your account is set up, it's time to research and select the specific index funds you want to invest in. Consider factors such as the index being tracked (e.g., S&P 500, Dow Jones Industrial Average), the fund's fees and expense ratios, and the fund's past performance relative to the index. It's important to remember that past performance doesn't guarantee future results, but it can provide insight into how closely the fund tracks the index.

Step 4: Place Your Investment Order

After deciding on the index fund(s) that align with your investment goals, you can place your investment order through your brokerage or fund provider's platform. Specify the amount you wish to invest, whether as a fixed dollar amount or by indicating the number of shares you want to purchase. Keep in mind that the share price and your budget will influence the number of shares you can buy.

Step 5: Monitor Your Index Fund Investments

While index funds are considered passive investments, it's important to periodically review their performance. Ensure that your index fund is mirroring the performance of its underlying index. Compare the fund's returns to the benchmark index's performance during similar time periods. Don't panic if they aren't identical, as fees and taxes will impact the results. However, if the fund consistently underperforms relative to the index, consider reevaluating your investment choices.

Emergency Fund Placement: Where in Your Portfolio?

You may want to see also

Diversify your portfolio

Diversifying your portfolio is a crucial step in investing, and index funds can be a great way to achieve this. Here are some tips to help you diversify your portfolio using index funds:

- Choose a variety of asset classes: Diversification is about spreading your investments across various sectors and asset classes. When selecting index funds, opt for those that cover different asset classes such as stocks, bonds, real estate, and commodities. This will ensure that your portfolio is not overly concentrated in one area, reducing risk.

- Consider different market indexes: Different market indexes, such as the S&P 500, Dow Jones Industrial Average, Russell 2000, or international indexes, can provide exposure to different segments of the market. By investing in index funds that track these various indexes, you can diversify your portfolio geographically and across different company sizes.

- Combine index funds with other investment vehicles: While index funds offer built-in diversification, combining them with other investment vehicles can further enhance your portfolio's diversity. Consider adding individual stocks, exchange-traded funds (ETFs), or mutual funds that complement your index funds.

- Focus on asset allocation: Allocate your investments across different asset classes, such as stocks, bonds, and cash, in proportions that align with your risk tolerance and investment goals. This will ensure your portfolio is diversified and aligned with your financial objectives.

- Vary your index fund providers: Consider investing in index funds from different fund providers. Each provider may have unique rules for fund construction, and diversifying across providers can help capture different market opportunities.

- Regularly review and adjust your portfolio: Diversification is an ongoing process. Regularly review the performance of your index funds and make adjustments as needed. Stay informed about market conditions and the companies your index funds invest in. This will help you identify when it's time to cut losses or rebalance your portfolio.

- Be mindful of fees: Index funds are known for their low fees, but these can vary across providers. Be mindful of expense ratios, trading commissions, and other costs associated with index funds. Ensure that the fees you're paying align with the level of service and performance you're receiving.

5G Funds: Where to Invest and How

You may want to see also

Monitor and adjust

Once you've invested in an index fund, it's important to monitor your portfolio and make adjustments as necessary to ensure it remains aligned with your financial goals. Here are some key considerations for monitoring and adjusting your index fund investments:

- Performance Evaluation: Regularly assess the performance of your index fund by comparing its returns to that of the underlying index it tracks. While you shouldn't expect identical returns, any significant underperformance or deviation from the index's performance may be a cause for concern. Remember to consider the impact of fees and taxes, which can affect the overall returns.

- Expense Ratio and Fees: Keep a close eye on the expense ratio and other fees associated with your index fund. These costs can impact your investment returns over time, so it's important to ensure they remain competitive and in line with the industry average. If fees start stacking up, you may want to reconsider your investment choices.

- Diversification and Rebalancing: Index funds offer built-in diversification, but it's important to periodically review your portfolio to ensure it remains properly diversified. Consider investing in multiple index funds tracking different indexes to spread risk across various markets and asset classes. Additionally, work with a financial advisor to monitor your portfolio for rebalancing. This involves adjusting the weightings of your investments to ensure they remain aligned with your desired asset allocation.

- Market Trends and Adjustments: Stay informed about market trends and be prepared to make adjustments when necessary. While index funds are passive investments, they are still subject to market risks. If you anticipate a significant market shift or correction, consult with your financial advisor to discuss potential adjustments to your portfolio.

- Seek Professional Advice: Consider seeking advice from a financial advisor or investment professional. They can provide guidance in selecting the right index funds, monitoring performance, and making adjustments to your portfolio as needed. This is especially important if your financial situation is complex or you have specific investment goals.

- Long-Term Focus: Remember that index funds are typically long-term investments. Don't get too caught up in short-term market fluctuations. Focus on the long-term performance and ensure that your index fund investments align with your overall financial plan and risk tolerance.

TSP F Fund: Best Times to Invest and Why

You may want to see also

Frequently asked questions

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them.

Index funds seek to match the performance of an underlying index they’re tracking. For example, an S&P 500 index fund will hold the stocks that make up the S&P 500 index in an effort to match its performance.

Index funds are a low-cost, easy way to build wealth. They are passively managed, so they don't need to actively decide which investments to buy or sell. They are also well-diversified, reducing risk.

One drawback of index funds is their lack of flexibility. They are designed to mirror a specific market, so they decline in value when the market does. They also automatically include all the securities in an index, which may include overvalued or weak companies.

You can buy an index fund directly through an index-fund provider like Vanguard or Fidelity, or through other brokerage accounts and certain investment apps.