Investing in Apple Inc. (AAPL) over the long term can be a lucrative strategy for several reasons. Firstly, Apple has a strong track record of innovation and product leadership, consistently introducing groundbreaking technologies that drive demand for its products. This has led to a loyal customer base and a competitive advantage in the market. Secondly, the company's financial performance has been impressive, with steady revenue growth and increasing profitability. Apple's diverse product portfolio, including iPhones, iPads, Macs, and wearables, provides a stable and reliable source of income. Additionally, the company's strong balance sheet and commitment to returning value to shareholders through dividends and share buybacks make it an attractive long-term investment. Lastly, Apple's focus on sustainability and corporate social responsibility initiatives can further enhance its appeal to investors seeking ethical and responsible investment opportunities.

What You'll Learn

- Strong Brand Loyalty: Apple's brand loyalty fosters a dedicated customer base, ensuring long-term sales and market share

- Innovative Product Pipeline: Apple's continuous innovation in hardware and software positions it for sustained growth and market leadership

- Diverse Revenue Streams: Beyond iPhones, Apple's diverse product portfolio, including services and wearables, diversifies its revenue sources

- Robust Financial Position: Apple's strong balance sheet and cash flow enable strategic investments and long-term growth initiatives

- Leadership and Vision: Tim Cook's leadership and strategic vision guide Apple's long-term success and market dominance

Strong Brand Loyalty: Apple's brand loyalty fosters a dedicated customer base, ensuring long-term sales and market share

Apple Inc. has cultivated a remarkable level of brand loyalty that is a cornerstone of its long-term success and a compelling reason for investors to consider it a valuable asset. This loyalty is a result of Apple's consistent focus on delivering exceptional products and experiences that resonate deeply with its customers.

The company's ability to create a dedicated customer base can be attributed to several key factors. Firstly, Apple's commitment to innovation and design excellence is unparalleled. With each new product release, Apple sets a high bar for itself, ensuring that its offerings are not just functional but also aesthetically pleasing and user-friendly. This attention to detail and emphasis on quality have created a perception of Apple products as premium, desirable, and reliable. Customers who invest in Apple devices often become advocates, praising the brand's ability to provide a seamless and enjoyable user experience.

Secondly, Apple's ecosystem plays a significant role in fostering brand loyalty. The company's strategy of creating a cohesive ecosystem across its devices, including iPhones, iPads, Macs, and Apple Watch, encourages customers to remain within the Apple environment. This ecosystem approach provides a seamless experience, allowing users to seamlessly transfer data, sync content, and access services across multiple devices. As a result, customers are more inclined to continue using Apple products, even as their needs evolve, ensuring a steady stream of long-term sales.

Moreover, Apple's focus on privacy and security has further strengthened its brand loyalty. In an era where data privacy is a growing concern, Apple has positioned itself as a leader in protecting user data. The company's commitment to giving users control over their information and its transparent approach to data handling have earned it a reputation for trustworthiness. This trust factor encourages customers to continue choosing Apple products, even as they become more aware of the potential risks associated with other brands.

The impact of this strong brand loyalty is twofold. Firstly, it ensures a consistent and reliable customer base, which is crucial for long-term sales and market share. Apple's ability to retain customers means that it can forecast demand more accurately, optimize production, and maintain a steady revenue stream. Secondly, brand loyalty contributes to a positive word-of-mouth effect, where satisfied customers become brand ambassadors, promoting Apple products within their social circles. This organic growth of the customer base is invaluable and contributes to Apple's position as a market leader.

In summary, Apple's brand loyalty is a powerful force that drives its long-term success. By consistently delivering exceptional products, creating a cohesive ecosystem, and prioritizing user privacy, Apple has cultivated a dedicated customer base that is highly engaged and loyal. This loyalty is a key investment advantage, ensuring a stable and growing market presence for Apple in the highly competitive technology industry.

Notes Receivable: Short-Term Investment or Long-Term Liability?

You may want to see also

Innovative Product Pipeline: Apple's continuous innovation in hardware and software positions it for sustained growth and market leadership

Apple's commitment to innovation is a key factor in its long-term investment potential, especially when considering its diverse and robust product pipeline. The company has a history of introducing groundbreaking products that not only disrupt markets but also create entirely new categories. This strategic approach to product development ensures that Apple remains at the forefront of the technology industry, capturing a significant share of the market.

One of the most notable aspects of Apple's innovative product pipeline is its focus on both hardware and software advancements. In the hardware sector, Apple has consistently pushed the boundaries of design and functionality. The introduction of the iPhone revolutionized the smartphone industry, and subsequent models have continuously improved upon this foundation. With the latest iPhone models, Apple has emphasized camera technology, display quality, and battery life, ensuring that users receive a premium experience. Additionally, Apple's commitment to sustainability is evident in its use of recycled materials and energy-efficient designs, which not only appeals to environmentally conscious consumers but also positions the company as an industry leader in corporate responsibility.

In the software realm, Apple's ecosystem is a powerful differentiator. iOS, iPadOS, and macOS are tightly integrated, providing a seamless user experience across devices. The App Store offers a vast selection of applications, ensuring that users have access to a wide range of tools and services. Furthermore, Apple's focus on privacy and security has been a significant selling point, attracting users who value data protection. The company's ongoing development of new software features and services, such as Apple Pay, Apple Health, and iCloud, further enhances the overall user experience and encourages long-term engagement.

Apple's innovative product pipeline extends beyond its core devices. The company has been investing heavily in augmented reality (AR) and virtual reality (VR) technologies, which have the potential to transform various industries. Apple's ARKit and upcoming VR/AR headset, rumored to be called 'Apple Reality', could revolutionize gaming, education, and professional applications. Moreover, Apple's interest in autonomous systems and self-driving cars, as hinted at by its acquisition of Drive.ai, suggests a future where Apple's technology plays a pivotal role in transportation.

By consistently introducing innovative products and services, Apple is well-positioned to drive long-term growth. The company's ability to create new markets and capture a significant market share is a testament to its innovative spirit. Investors can benefit from Apple's strong brand, loyal customer base, and diverse product portfolio, which collectively contribute to its sustained success and market leadership. As Apple continues to innovate, it is likely to maintain its competitive edge, making it an attractive long-term investment opportunity.

Unraveling the World of Short-Term Investments: Strategies and Benefits

You may want to see also

Diverse Revenue Streams: Beyond iPhones, Apple's diverse product portfolio, including services and wearables, diversifies its revenue sources

Apple's long-term investment potential is often discussed, and one of the key factors that investors find appealing is the company's ability to diversify its revenue streams. While the iPhone remains a significant contributor to Apple's success, the company has strategically expanded its product portfolio to include a range of services and wearables, which has led to a more resilient and sustainable business model.

The introduction of Apple's ecosystem of services has been a game-changer. Services such as Apple Music, iCloud, Apple Pay, and the App Store have become integral parts of the Apple experience. These services not only provide additional revenue streams but also foster customer loyalty and engagement. For instance, Apple Music has gained a massive user base, offering a competitive alternative to other streaming services. Similarly, Apple Pay has revolutionized digital payments, providing a secure and convenient way for users to make transactions. By offering these services, Apple creates a network effect, encouraging users to stay within the Apple ecosystem, thus increasing its long-term value.

In addition to services, Apple's wearable devices, such as the Apple Watch and AirPods, have become significant revenue drivers. The Apple Watch, in particular, has gained traction as a health and fitness tracker, appealing to health-conscious consumers. This product not only generates sales but also collects valuable user data, which can be utilized for future product development and personalized experiences. Moreover, the success of AirPods, a popular wireless headphone, has further solidified Apple's position in the wearable technology market. These wearables not only contribute to the company's top-line growth but also enhance the overall user experience, making Apple a preferred brand.

By diversifying its product offerings, Apple has successfully reduced its reliance on the iPhone. While the iPhone remains a flagship product, the company's focus on services and wearables has opened up new avenues for revenue generation. This diversification strategy has not only made Apple's business model more resilient but has also positioned it for long-term growth. Investors can benefit from this diversified approach as it provides a more stable investment opportunity, especially when the smartphone market becomes increasingly competitive.

In summary, Apple's investment potential is strengthened by its diverse revenue streams, which extend beyond the iPhone. The company's strategic expansion into services and wearables has created a robust and sustainable business. This approach not only ensures a steady flow of revenue but also positions Apple to capitalize on emerging trends in technology and consumer preferences. As such, investors can have confidence in Apple's long-term prospects, given its ability to adapt and diversify.

Long-Term Investment: Is It a Continuing Operation?

You may want to see also

Robust Financial Position: Apple's strong balance sheet and cash flow enable strategic investments and long-term growth initiatives

Apple Inc. boasts a robust financial position that is a cornerstone of its long-term investment appeal. The company's strong balance sheet and consistent cash flow generation provide a solid foundation for strategic investments and future growth. With a substantial amount of cash on hand, Apple can fund its ambitious initiatives without the need for external financing, which is a significant advantage in a competitive market. This financial strength allows Apple to make bold moves, such as acquiring innovative startups, expanding into new markets, and investing in cutting-edge technologies, all of which contribute to its long-term growth trajectory.

The company's balance sheet is characterized by its low debt-to-equity ratio, indicating a financially stable and well-managed business. Apple's ability to manage its liabilities effectively ensures that it can weather economic downturns and maintain its operations during challenging times. This financial stability is particularly attractive to investors seeking a reliable, long-term investment opportunity. Moreover, Apple's consistent cash flow from operations is a testament to its operational efficiency and market dominance. The company's ability to generate substantial cash flow year after year enables it to reinvest in its business, fund research and development, and return value to shareholders through dividends and share repurchases.

Strategic investments are a key aspect of Apple's long-term growth strategy. The company has a history of acquiring smaller, innovative businesses that complement its core offerings, such as Beats Electronics and Coherent. These acquisitions have not only expanded Apple's product portfolio but also brought valuable expertise and technology into the fold. By investing in strategic acquisitions, Apple can accelerate its growth, diversify its revenue streams, and maintain its competitive edge in the market. Additionally, Apple's cash flow allows it to invest in research and development, ensuring that it remains at the forefront of technological innovation.

Apple's long-term growth initiatives are fueled by its commitment to innovation and market leadership. The company consistently invests in research and development to create new products and services that captivate consumers and drive revenue growth. Whether it's enhancing the iPhone's camera technology, developing new services like Apple Music and Apple Pay, or expanding its ecosystem with accessories and wearables, Apple's focus on innovation is a key differentiator in the highly competitive technology industry. This commitment to innovation ensures that Apple remains a desirable investment, as it continues to capture market share and maintain its position as a market leader.

In summary, Apple's robust financial position, characterized by a strong balance sheet and consistent cash flow, is a significant factor in its long-term investment appeal. This financial strength enables Apple to make strategic investments, acquire innovative businesses, and fund its research and development efforts, all of which contribute to its sustained growth. With a history of successful acquisitions and a commitment to innovation, Apple is well-positioned to continue its long-term growth trajectory, making it an attractive investment opportunity for those seeking stability and long-term value.

Apple's Surprising Short-Term Investment Move: A Quick Look

You may want to see also

Leadership and Vision: Tim Cook's leadership and strategic vision guide Apple's long-term success and market dominance

Tim Cook's leadership and strategic vision have been pivotal in guiding Apple's long-term success and market dominance. Since taking over as CEO in 2011, Cook has demonstrated exceptional leadership skills, building upon the foundation laid by the late Steve Jobs. His strategic vision focuses on innovation, design, and a customer-centric approach, ensuring Apple remains at the forefront of the technology industry.

One of Cook's key strengths is his ability to make strategic decisions that prioritize long-term growth over short-term gains. He has consistently invested in research and development, pushing the boundaries of technology and design. Under his leadership, Apple has launched groundbreaking products like the iPhone, iPad, and Apple Watch, each pushing the limits of what was thought possible in terms of user experience and functionality. These innovations have not only driven Apple's success but have also set industry standards, solidifying Apple's position as a market leader.

Cook's leadership style is characterized by a deep understanding of the company's values and a commitment to delivering exceptional products. He has fostered a culture of innovation and collaboration, encouraging employees to think creatively and take risks. By empowering his team, Cook has created an environment where ideas are valued, and employees are motivated to contribute to Apple's success. This culture has resulted in a steady stream of innovative products and services, ensuring Apple's continued dominance in the market.

In addition to his focus on innovation, Cook has also shown a strong commitment to corporate social responsibility. He has implemented sustainable practices across Apple's operations, aiming to minimize the company's environmental impact. Cook's leadership has resulted in Apple becoming a leader in eco-friendly technology, further enhancing its brand image and attracting environmentally conscious consumers.

Cook's strategic vision extends beyond product development. He has successfully navigated Apple through various market challenges, including supply chain disruptions and intense competition. His ability to make timely decisions and adapt to changing market conditions has ensured Apple's resilience and long-term sustainability. By focusing on a balanced approach to growth, Cook has positioned Apple to thrive in a rapidly evolving technological landscape.

In summary, Tim Cook's leadership and strategic vision have been instrumental in Apple's long-term success and market dominance. His commitment to innovation, design, and corporate responsibility, coupled with his ability to make strategic decisions, has solidified Apple's position as an industry leader. Investors can have confidence in Apple's future prospects, knowing that Cook's leadership will continue to drive the company's success and create value for shareholders.

Maximizing Your $50K: Short-Term Investment Strategies for Quick Returns

You may want to see also

Frequently asked questions

Apple is a technology giant with a strong brand, a loyal customer base, and a history of innovation. The company's diverse product portfolio, including iPhones, iPads, Mac computers, wearables, and services like Apple Music and iCloud, has contributed to its consistent growth and market leadership. Apple's focus on design, user experience, and privacy has set it apart in the highly competitive tech industry. Its strong financial position, with a robust balance sheet and consistent cash flow, allows for strategic investments in research and development, product diversification, and shareholder returns.

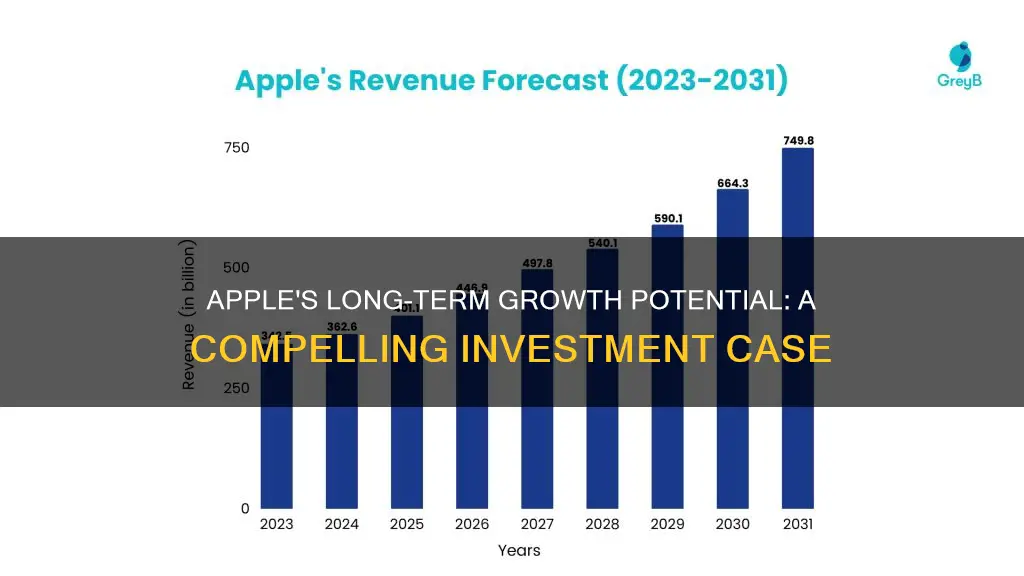

Apple's stock has demonstrated impressive long-term performance, with a significant appreciation over the past decade. The company's ability to consistently introduce new products, improve its services, and expand its market share has driven its stock price higher. Key factors influencing Apple's long-term growth include its strong ecosystem, where products and services work seamlessly together, attracting and retaining customers. Additionally, Apple's focus on privacy and security, its commitment to sustainability, and its expansion into new markets, such as healthcare and autonomous vehicles, could further enhance its growth prospects.

While Apple has a strong track record, there are some risks to consider. The company's reliance on a few key products, particularly the iPhone, could impact its profitability if there are significant shifts in consumer preferences or market trends. Additionally, Apple's high valuation and limited dividend policy might make it less attractive compared to other stocks with higher yields. Investors can mitigate these risks by diversifying their portfolios, regularly reviewing Apple's financial performance and market position, and staying informed about industry trends and potential disruptions.