Endowment funds are a great way to support charitable activities and non-profit organisations. They are a form of investment portfolio, with initial capital coming from donations, and are established to fund charities, non-profit institutions, and community initiatives. Endowment funds are typically used by universities, churches, hospitals, and charities. They are an effective way to generate revenue for these organisations, as the principal value of the fund is kept intact, while the investment earnings can be distributed as grants. Endowment funds also offer tax benefits, as donations are often tax-deductible. By investing in endowment funds, donors can support causes they care about on a long-term basis.

| Characteristics | Values |

|---|---|

| Purpose | Funding charitable activities |

| Beneficiaries | Nonprofit organisations |

| Donations | Tax-deductible |

| Donors | Individuals or institutions |

| Types | Term, restricted, unrestricted, quasi |

| Management | Internal or external financial managers |

| Investments | Stocks, private companies, credit instruments, real estate, mutual funds, etc. |

| Performance | Varies by size |

What You'll Learn

Tax benefits

Endowment Funds: Tax Benefits

Endowment funds are a critical source of funding for non-profit organisations such as universities, religious groups, and museums. They are typically established as trusts, keeping them independent of the organisations they support. Endowment funds are also a popular way for high-net-worth individuals to contribute to specific causes while receiving tax benefits.

Tax-Deductible Donations

Donations to endowment funds are tax-deductible for individuals and companies. This means that donors can reduce their taxable income by contributing to these funds, providing an incentive for giving.

Tax-Exempt Status for Endowments

Endowments are often set up to benefit tax-exempt organisations, such as charities, educational institutions, or religious groups. In these cases, the endowment itself qualifies for tax-exempt status, and any accrued earnings are not taxed.

Endowments provide non-profit organisations with a source of ongoing funding from dividends, interest, and capital gains generated by the fund's assets. This tax-free income allows these organisations to fund their operations and programs without relying solely on tuition fees, donations, or other sources of income.

Tax Treatment of Payouts

While endowment payouts are typically not taxed, if the funds are passed into the hands of an individual, such as a scholarship recipient or employee, those payouts may be subject to taxation. The taxation of these payouts depends on the applicable laws of the state in which the endowment or business operates.

Long-Term Tax Benefits

Endowment funds are designed to last in perpetuity, with only the investment returns spent from year to year. This structure provides long-term tax benefits, as the principal amount remains intact and continues to generate tax-free income for the supported organisation.

In summary, endowment funds offer a range of tax benefits for donors, the endowments themselves, and the organisations they support. These tax advantages contribute to the attractiveness of endowments as a vehicle for charitable giving and long-term funding for non-profit organisations.

Robo Advisors: Index Fund Investing Strategies Explored

You may want to see also

Long-term financial stability

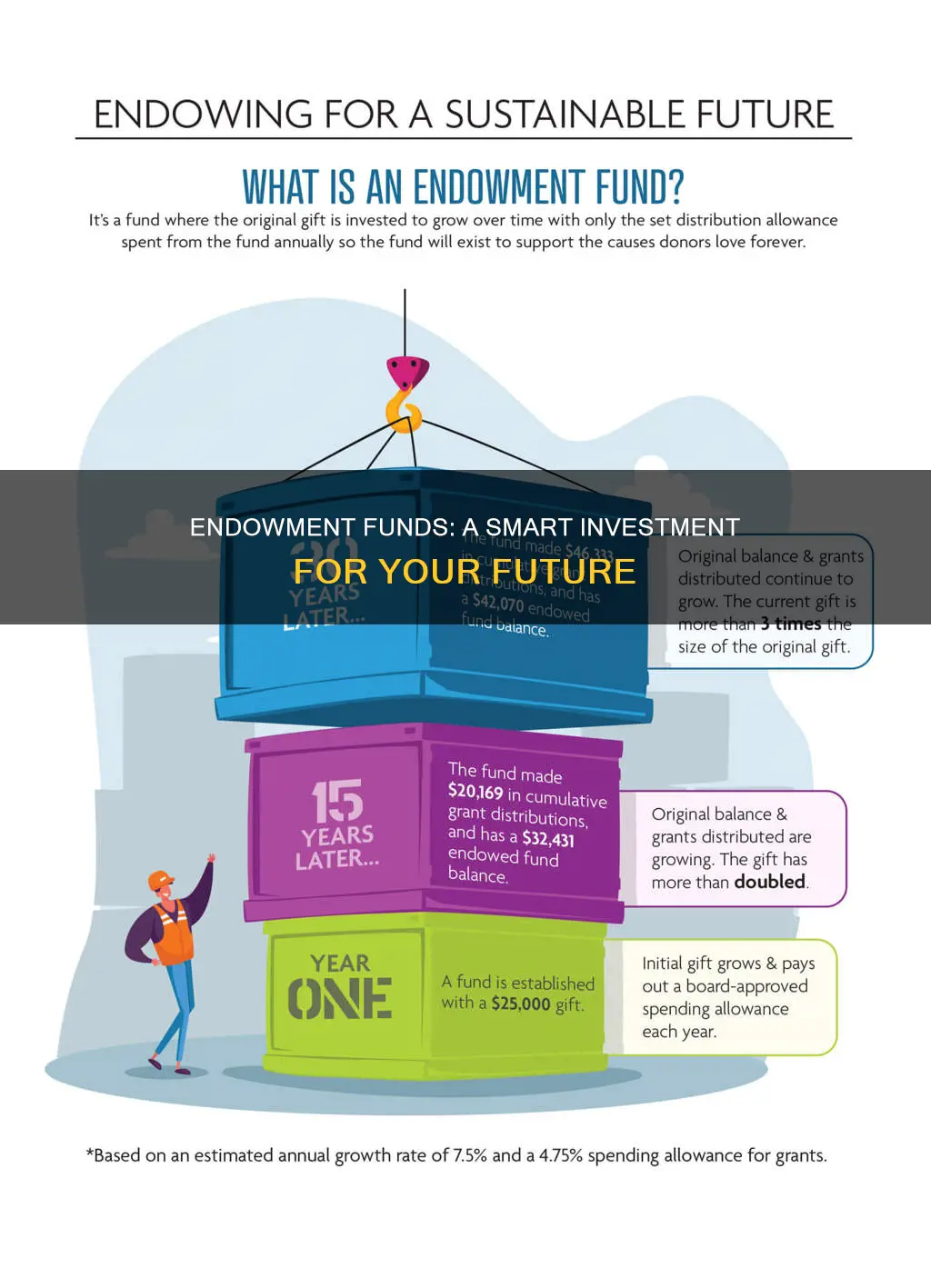

Endowment funds are an excellent way to ensure long-term financial stability for nonprofit organisations. They are typically established as trusts, keeping them independent of the organisations they support, and are designed to be held permanently. This means that donors can support causes they care about in perpetuity.

The principal value of an endowment fund is kept intact, while the investment income or earnings are used for charitable grants to nonprofits. This ensures that the fund can continue to grow over time and provide a stable source of funding for the designated nonprofit organisation.

Endowment funds are often used by universities, churches, hospitals, and charities to support various academic, operational, and charitable initiatives. For universities, endowment funds are crucial for ensuring the institution's long-term financial stability. The funds may be allocated to scholarship programs, faculty positions, research endeavours, and facility enhancements. Nonprofit organisations, such as charities, hospitals, and community foundations, use endowment funds to secure sustained financial backing for their charitable activities.

The goal of an endowment fund is to provide a sustainable source of income for charitable activities while preserving the principal amount for long-term support. This approach ensures that the fund can continue to generate returns and provide ongoing support for nonprofit organisations and community initiatives.

By investing in endowment funds, donors can contribute to the financial stability of nonprofit organisations and ensure that their designated causes are supported over the long term.

How to Choose the Right Managed Funds

You may want to see also

Support for charitable activities

Endowment funds are established to fund charitable and nonprofit institutions such as churches, hospitals, and universities. They are typically structured with intact principals and investment income available for use. The major difference between an endowment fund and a typical investment fund is that the beneficiary of an endowment fund is a non-profit organisation instead of individual investors.

Endowments are a great way to support charitable activities as they are a source of sustainable income for non-profit organisations. Endowment funds are invested to generate revenue for charitable activities. The principal value of the endowment fund is kept intact, while the investment earnings can be used for charitable grants to non-profits. Thus, an endowment fund can be held permanently, allowing donors to support causes they care about in perpetuity.

Donations to endowment funds are tax-deductible. Institutions and individuals can donate both cash and non-cash assets – such as stock, mutual funds or real estate – to fund the endowment.

Endowments can be used to support a variety of charitable activities, including:

- Scholarships and fellowships

- Research and teaching

- Community development

- The environment

- Social services

- Retention and recruitment of faculty

- Clinical practice, research and public education

- Facility enhancements

CEF Funds: Where the Rich Invest Their Money

You may want to see also

Sustainable growth

The principal amount of an endowment fund is typically kept intact, while the investment income can be used for specific purposes. This structure ensures that the fund can continue to generate revenue for its designated charitable causes in perpetuity. This is particularly important for universities, which often rely on endowment funds to support academic and operational initiatives and ensure their long-term financial stability.

Endowments are also used by hospitals, churches, and other non-profit organisations to secure sustained financial backing for their activities. The funds are usually established as trusts, keeping them independent of the organisations they support. This independence allows for more flexibility in investment strategies and helps to ensure the fund's longevity.

To achieve sustainable growth, endowment funds are often diversified across various asset classes, including alternatives such as private equity, infrastructure, timberland, and real estate. This diversification helps to manage risk and optimise returns. Additionally, endowment funds may employ external investment managers to make investments in public stocks, private companies, credit instruments, and real estate on their behalf. These managers are chosen based on their ability to meet investment objectives and parameters, with a focus on ethical and environmental, social, and governance (ESG) criteria.

By combining factor-based technology, risk management tools, and deep investment experience, endowment funds strive to improve cost and capital efficiency while generating unique alpha. This approach has been shown to deliver superior long-term outcomes, ensuring the continued growth and impact of the endowment fund and the organisations and causes it supports.

Mutual Funds: Exploring Superior Investment Opportunities

You may want to see also

Impact on community initiatives

Endowment funds are crucial for supporting community initiatives. They are established to fund charitable and nonprofit institutions such as churches, hospitals, and universities. The funds are used for various purposes, including scholarships, research, public services, and other charitable activities.

For example, Brown University's endowment fund contributes significantly to the university's financial aid budget each year. The fund also supports the retention and recruitment of faculty, clinical practice, research, and public education to address urgent health needs. Additionally, the endowment fund at the University of Texas, with a market value of $45 billion, plays a vital role in supporting the university's academic and operational initiatives.

Endowment funds are not limited to educational institutions. They are also utilised by hospitals, charities, and community foundations to secure sustained financial support for their charitable activities. These funds may focus on community development, environmental initiatives, education, or social services. For instance, the San Diego Foundation manages over 1,300 endowment funds totalling more than $890 million. These funds are crucial for supporting community initiatives in the region, addressing critical needs such as equitable access to outdoor spaces.

Endowment funds have a significant impact on community initiatives by providing a sustainable source of funding for charitable activities. The funds are invested to generate revenue, with the principal amount remaining intact while the earnings are used for grants and support. This structure ensures long-term financial stability and continuous backing for nonprofit organisations and community initiatives chosen by the donors.

Overall, endowment funds play a crucial role in supporting and enhancing community initiatives by providing a stable source of funding for charitable activities, contributing to the well-being and development of communities across various sectors.

Hedge Fund Managers: Why Shun Sustainable Investing?

You may want to see also

Frequently asked questions

An endowment fund is an investment portfolio that is established to fund charitable and nonprofit institutions such as churches, hospitals, and universities. The initial capital for an endowment fund comes from donations, which are tax-deductible.

Unlike typical investments, the beneficiaries of an endowment fund are nonprofit organizations rather than individual investors. The principal value of the fund is kept intact, while the investment earnings are used for charitable grants to nonprofits. This allows donors to support causes they care about on a permanent basis.

The goal of an endowment fund is to provide a sustainable source of income for charitable activities by investing a principal amount and using the generated earnings for grants and support. By preserving the principal amount, endowment funds ensure long-term financial stability and continuous support for nonprofit organizations.

Contributions to an endowment fund are typically tax-deductible, providing donors with immediate tax benefits. Endowment funds also allow donors to support specific causes or the overall mission of an organization, ensuring that their donations have a lasting impact.

Endowment funds are designed to generate revenue for charitable activities, rather than for individual investors. They are typically structured with intact principals, and the investment income is available for use by the nonprofit organization. Endowment funds also tend to have lower risk levels and more liquidity concerns than other types of investments, such as mutual funds and hedge funds.