Hedge funds are a risky investment option that employs complex strategies to generate returns. They are often considered exclusive investment opportunities for high-net-worth individuals. While hedge funds aim to deliver high returns, they have historically underperformed stock market indices, raising the question of why investors would choose to allocate their capital to these funds. This paragraph introduces the topic of why investors opt for hedge funds despite their low returns and will be followed by an in-depth exploration of the motivations and benefits that drive investment decisions in this space.

| Characteristics | Values |

|---|---|

| Returns | Low compared to the S&P 500 |

| Risk | High |

| Fees | High |

| Liquidity | Low |

| Accessibility | Only for high-net-worth individuals |

| Regulation | Loose |

What You'll Learn

High fees and low returns

Hedge funds are often associated with high fees and low returns. The standard fee structure for hedge funds is "2 and 20", meaning they charge a 2% management fee and a 20% performance fee. These fees can eat into overall returns, especially when compared to index-based ETFs and mutual funds, which have average expense ratios of 0.13%.

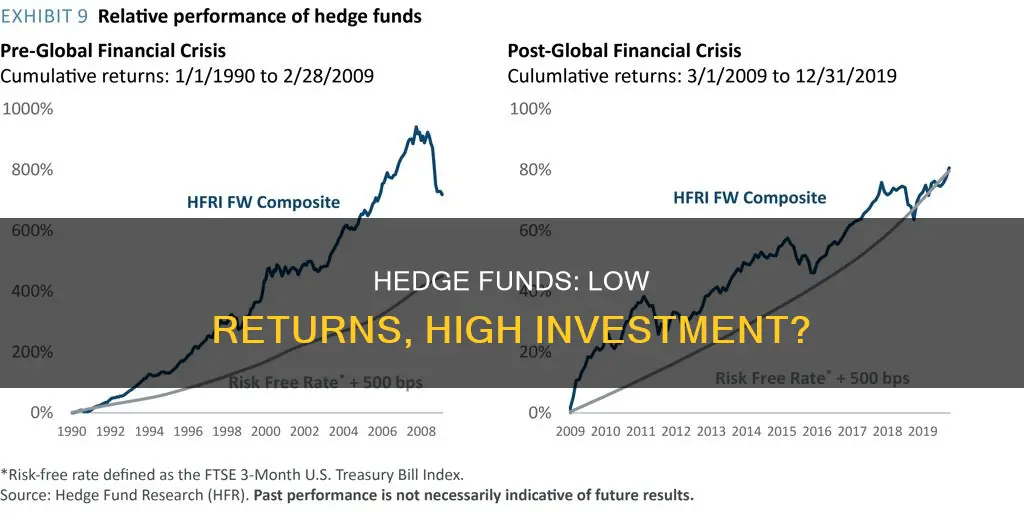

Hedge funds have historically underperformed stock market indices. From January 2009 to January 2019, hedge funds only beat the S&P 500 in a single year: 2018. During that same period, the S&P 500 rose by 12.5% annually on average, while hedge funds averaged returns of 6.1%.

The high fees and low returns of hedge funds have led some investors to question their value. In 2015, the Dutch pension fund PFZW, Europe's second-biggest pension fund, announced it would stop investing in hedge funds due to their high costs and uncertain returns. Similarly, the California Public Employees' Retirement System (CalPERS), the largest public pension fund in the US, exited its hedge fund program, citing complexity and cost as reasons for the decision.

The underperformance of hedge funds relative to the market has also been noted. A survey published in FTfm in January 2015 revealed that just one of the top five hedge funds outperformed the S&P 500 total return index over a one-year period. This underperformance has led some to question why they should invest in hedge funds when they could simply buy a mutual fund product or track an index using Exchange-Traded Funds (ETFs).

Despite the high fees and low returns, hedge funds continue to attract investors due to their potential for higher returns, diversification benefits, and ability to generate unique return streams. However, investors need to carefully consider the cost-benefit calculation before investing in hedge funds.

Hedge Fund Managers: Why Shun Sustainable Investing?

You may want to see also

Complexity and high costs

Investing in hedge funds is often associated with high costs and complexity. Hedge funds are typically organised as private partnerships and located offshore for tax and regulatory reasons. They are exempt from most disclosure and regulation requirements that apply to mutual funds and banks. This lack of regulation means that hedge funds can employ aggressive investment strategies, such as leveraged, debt-based investing and short-selling, and they can purchase types of assets that other funds can't invest in, like real estate, art and currency.

Hedge funds also carry hefty fees. They typically charge an asset management fee of 1-2% of the amount invested, plus a performance fee of 20% of the fund's profit. These fees can eat into overall returns.

Hedge funds are also complex in terms of their investment strategies. They employ a wide range of strategies, including the use of leverage, derivatives, or alternative asset classes to boost returns. They can be more opaque and risky than traditional investments, and investors need to understand the cost-benefit calculation of a fund's strategy and value proposition before investing.

Hedge funds are also complex in terms of their structure. They are often limited partnerships of private investors, and they require a high minimum investment or net worth. They are typically aimed at wealthy, institutional investors, such as pension funds and insurance companies.

The complexity and high costs associated with hedge funds have led some large pension funds, such as the California Public Employees' Retirement System (CalPERS), to exit their hedge fund programs. CalPERS cited the desire to reduce complexity and the high fees associated with hedge funds as reasons for their decision.

In summary, while hedge funds can provide potential benefits such as higher returns and diversification, they also come with complex structures, high fees, and regulatory complexities that potential investors need to carefully consider.

Best Index Funds to Invest in: A NerdWallet Guide

You may want to see also

High-risk strategies

Hedge funds are considered a risky investment choice. They are loosely regulated by the SEC and employ aggressive investment strategies, such as leveraged, debt-based investing and short-selling. They can also invest in non-traditional assets like real estate, art, and currency.

Hedge funds are often regarded as "high-risk partnerships that use speculative techniques". This is because they combine short-selling and leverage, which are both considered risky practices when used in isolation. However, Alfred Winslow Jones, who launched the first hedge fund in 1949, showed how these instruments could be combined to limit market risk.

Hedge funds are also considered risky because they are often correlated with equities. This means that they can be just as volatile as the stock market, but with higher fees. Hedge funds typically employ a "2 and 20" fee system, with a 2% management fee and a 20% performance fee. These fees can eat into overall returns, especially when compared to the average expense ratio of 0.13% for index-based ETFs and mutual funds.

Additionally, hedge funds are less liquid than stocks or bonds, with investors often required to keep their money in the fund for at least a year (known as the lock-up period).

Despite the risks, hedge funds can be attractive to investors because they offer the potential for higher returns, especially in bear markets. Hedge funds aim to produce returns regardless of market conditions, which can appeal to investors looking to earn returns even when the market is down.

In summary, hedge funds employ high-risk strategies that can lead to higher returns but also come with higher fees, less liquidity, and more volatility when compared to traditional investments.

Bernie Madoff's Ponzi Scheme: Avoiding Client Fund Investments

You may want to see also

Lack of liquidity

Liquidity is a crucial factor when considering an investment in hedge funds. Hedge funds are known for their lack of liquidity, which means that investors may have limited access to their money for extended periods. This is due to the lock-up period typically imposed by hedge funds, during which investors are restricted from selling their shares and withdrawing funds. The lock-up period can last for at least a year, and even after that, withdrawals may only be permitted at specific intervals such as quarterly or biannually. This illiquidity can be a significant disadvantage for investors who may need access to their funds for various reasons.

The lack of liquidity in hedge funds is often justified by the complex and risky investment strategies employed by fund managers. These strategies may involve investing in non-traditional and illiquid assets, such as derivatives, private investments, or real estate. Additionally, hedge funds often use leverage, which further increases the risk and may require a longer time horizon to manage effectively. Fund managers aim to generate higher returns by taking on these complex strategies and less liquid investments. They aim to produce returns regardless of market conditions, which can be appealing to investors seeking consistent returns even during bear markets.

However, the lack of liquidity can be a significant drawback for investors who value flexibility and access to their funds. It is important for investors to carefully consider their investment goals and risk tolerance before committing to hedge funds. The lock-up period and limited liquidity can restrict an investor's ability to react to market changes or adjust their investment strategy promptly. This lack of flexibility may be unsuitable for investors who prefer to have more control over their investments and the ability to make changes as needed.

Furthermore, the high fees associated with hedge funds can compound the issue of illiquidity. Hedge funds typically charge a management fee of 1-2% and a performance fee of 20% of the profits. These fees can eat into the overall returns, and if the fund underperforms, investors may find themselves locked into an investment that is not meeting their expectations. The complex nature of hedge fund investments and the lack of liquidity can make it challenging for investors to exit their positions without incurring significant costs or waiting for the lock-up period to end.

In conclusion, the lack of liquidity in hedge funds is a crucial factor for investors to consider. While hedge funds offer the potential for higher returns through complex strategies and less liquid investments, the trade-off is limited access to funds and reduced flexibility. Investors need to carefully evaluate their investment goals, risk tolerance, and liquidity needs before deciding to invest in hedge funds. Understanding the lock-up period and the potential impact on their ability to withdraw funds is essential when considering an investment in hedge funds.

The Best Places to Invest in Exchange-Traded Funds Directly

You may want to see also

Lack of transparency

Hedge funds are often regarded as risky investments. They are loosely regulated by the SEC and employ complex and risky investment strategies. They are also known for their lack of transparency.

Hedge funds are typically organised as private partnerships and located offshore for tax and regulatory reasons. They are exempt from most disclosure and regulation requirements that apply to mutual funds and banks. This lack of transparency can make it difficult for investors to fully understand the risks and potential returns associated with hedge fund investments.

Hedge funds are not required to publicly disclose their financial performance, investment strategies, or asset positions. They are also not subject to the same registration and reporting requirements as mutual funds, which can make it challenging for investors to access information about hedge funds.

Additionally, hedge funds often have complex fee structures, including management fees and performance fees, which can be difficult for investors to understand. The high fees associated with hedge funds can also eat into overall returns.

Furthermore, hedge funds may have lock-up periods, during which investors are unable to withdraw their money. This lack of liquidity can be a concern for investors who may need access to their funds.

Despite the lack of transparency, some investors are attracted to hedge funds due to the potential for high returns, especially during bear markets. Hedge funds can employ aggressive investment strategies and invest in a wide range of assets, including real estate, art, and currency.

However, it is important for investors to carefully consider the risks and conduct thorough due diligence before investing in hedge funds.

Singapore's Sovereign Wealth: Where Does the City-State Invest?

You may want to see also

Frequently asked questions

Hedge funds are a risky investment choice and require a high minimum investment or net worth. They are loosely regulated by the SEC and charge higher fees than conventional investment funds. However, they can be attractive to investors because they are actively managed funds that focus on alternative investments and commonly use risky investment strategies. Hedge funds can also serve as a good diversification tool for an existing portfolio of stocks and bonds.

Hedge funds can provide diversification benefits and generate unique return streams with reduced sensitivity or correlation to public markets. They can also utilize a broader range of investment techniques than most traditional strategies, including short selling securities, investing in non-traditional assets, employing leverage, and capitalizing on investments that cannot be owned in a liquid vehicle.

Hedge funds are considered a risky investment choice due to their use of complex investing strategies, such as the use of leverage, derivatives, or alternative asset classes. They also come with high fee structures and can be more opaque and risky than traditional investments. Additionally, hedge funds may have lock-up periods where investors are unable to withdraw their money for a certain amount of time.