Luxembourg is a leading investment fund centre in Europe, with over €4.3 trillion in assets under management (AuM). It is the largest global distribution centre for investment funds, and its funds are offered in more than 70 countries worldwide.

Luxembourg's investment fund industry is a world leader in cross-border fund distribution, with a particular focus on Europe, Asia, Latin America and the Middle East. Many funds benefit from the European passport, which means that funds and their managers that comply with the UCITS Directive or the AIFM Directive can be marketed to investors in the European Economic Area (EEA).

The country has a well-established fund industry with a reputation for attracting large cross-border investment platforms and prominent fund and asset managers. It also has a flexible company law regime, a robust regulatory framework, and a credible and reputable regulator.

Luxembourg offers a broad range of investment vehicles, combining different legal forms, fund regimes, tax qualifications and regulatory frameworks. The country's funds cover all key categories, currencies, regions and sectors, providing an opportunity for investors to make their financial resources grow faster, especially when interest rates on savings accounts are low.

| Characteristics | Values |

|---|---|

| Leading investment fund centre | Europe's largest, second largest in the world |

| Funds | Cover all key categories, currencies, regions and sectors |

| Investment fund | A company that invests and manages your capital |

| Fund manager | A professional who picks the right investments at the right time |

| Fund types | Passively and actively managed funds |

| Passively managed funds | Pre-set investment rule, aim to track the performance of a particular market, region or sector |

| Actively managed funds | Investment policy that offers some degree of leeway to the fund manager |

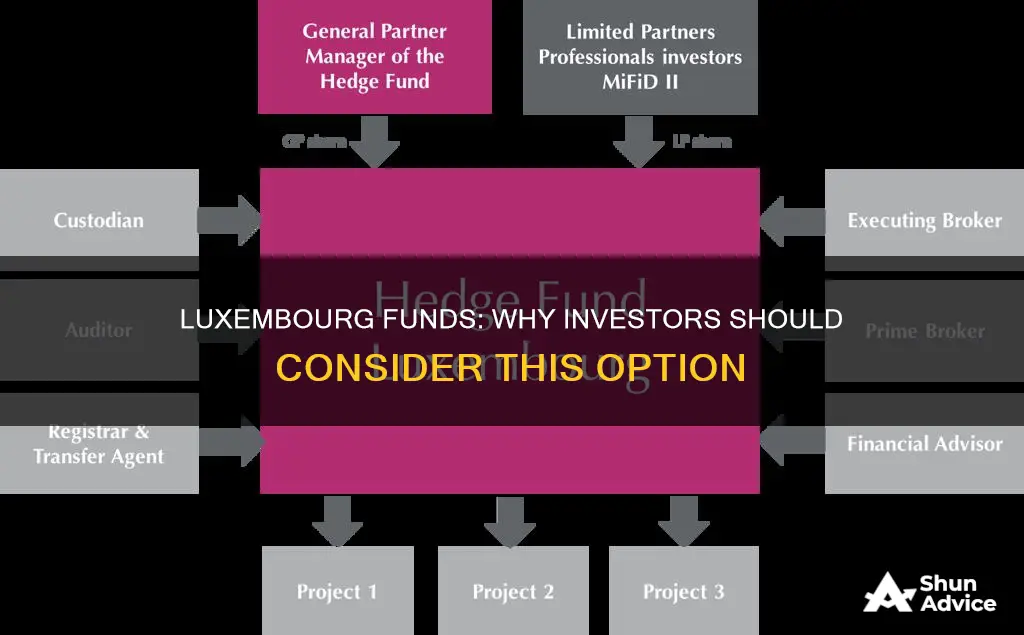

| Hedge funds | A special type of active fund which uses complex strategies, instruments and investment techniques to seek performance |

| Advantages | Access to a diversified portfolio, access to investments that would not be possible otherwise, relieve you of the monitoring and management for the investments they cover |

| Disadvantages | No control over investment funds, cannot influence individual purchases and sales within the portfolio, unknown exact composition of the fund |

| Regular investment plans | Designed for novices and experienced investors, enable you to invest a small sum of money on a regular basis into one or several funds according to your investor profile |

| Investor-friendly ecosystem | Well-established fund industry centre for over 30 years, attracts large cross-border investment platforms and reputable prominent fund and asset managers |

| Toolbox for investment fund structure types | Broad range of investment vehicles which combine different legal forms, fund regimes, tax qualifications and regulatory frameworks |

| Business presence in Luxembourg | Over 3,600 investment funds representing over 14,500 fund units |

What You'll Learn

Access to China's onshore capital market

Luxembourg is a global hub for cross-border investments and a gateway for Chinese investment flows. It is the largest investment fund centre in Europe and the second-largest in the world, with over €4.3 trillion in assets under management (AuM). Luxembourg is also the primary domicile for European investment funds launched by Chinese asset managers.

Luxembourg has been successful in attracting asset managers to domicile their China-focused investment funds in the country. Excluding Chinese domestic funds, it represents the largest domicile for investment funds investing in Chinese capital markets in terms of assets under management, attracting 45.8% of assets globally and 80.3% of assets in a European context.

Numerous funds have an investment policy that is focused on global emerging markets, the Asian region, or China specifically. This is why RMB-denominated assets have accumulated in the portfolios of many Luxembourg-based funds. These international RMB fund promoters include many of the most prestigious names in the industry, such as Aberdeen, BlackRock, Fidelity, First State, HSBC, JPMorgan, Schroders, and Deutsche Bank.

Luxembourg is also the first European jurisdiction to authorise the use of an RQFII quota in the context of a UCITS fund. In 2015, the People's Bank of China granted Luxembourg a 50 billion RMB RQFII quota, confirming the country's role as a major Renminbi hub. UCITS funds can invest up to 100% of their net assets in China A-shares, giving investors in such UCITS funds unparalleled access to the A-share market.

Luxembourg has also been successful in attracting Chinese banks, with seven major Chinese banks, including the Bank of China and the Industrial and Commercial Bank of China, choosing Luxembourg as their principal European domicile.

Smart Strategies for Choosing the Right Mutual Fund

You may want to see also

Investor-friendly ecosystem

Luxembourg has been a well-established fund industry center for over 30 years, with a reputation for attracting large cross-border investment platforms and reputable prominent fund and asset managers. The country boasts a long-term stable ecosystem, a robust regulatory framework, credible and reputable regulators, and a flexible company law regime.

Luxembourg has historically catered to the needs of the funds industry, spanning from back-office to front-office services. The country's international and multilingual workforce (English is widely spoken) has helped attract local AIFMs (Alternative Investment Fund Managers) and third-party service providers.

A strong business market has been built over the years with Germany, and now many German investors use Luxembourg real estate funds when investing cross-border. Additionally, many sovereign wealth and large pension funds have established investment platforms, holding companies, and feeder funds in Luxembourg because of the regulatory controls, tax and legal frameworks, and ease of doing business. High-net-worth individuals and family offices also increasingly utilize Luxembourg for the same reasons.

Luxembourg's investment fund industry is a world leader in cross-border fund distribution, with Luxembourg-domiciled investment structures distributed in over 70 countries. Many Luxembourg funds benefit from the European passport, which means that funds (and their managers) that comply with the UCITS Directive or the AIFM Directive can be marketed to investors in the European Economic Area (EEA) following a simple notification procedure.

Equity Income Funds: Smart Investment for Steady Returns

You may want to see also

Stability and reputation

Luxembourg is the largest investment fund centre in Europe and the second-largest in the world after the US. As of October 2020, the assets under management of Luxembourg-domiciled funds stood at EUR4,674.665 billion. This makes it the largest global distribution centre for investment funds, with its funds offered in more than 70 countries worldwide.

Luxembourg's investment fund industry has proven its resilience, especially during the COVID-19 crisis. The ability to quickly adapt to remote working models, the smooth communication from the government and relevant bodies, and the flexible tax and regulatory regime have all contributed to its stability.

The country has a long-standing reputation for attracting large cross-border investment platforms and prominent fund and asset managers. This is supported by its robust regulatory framework, credible and reputable regulator, and flexible company law regime.

Luxembourg has also historically catered to the needs of the funds industry, offering both back-office and front-office services. The country's international and multilingual workforce, with English widely spoken, has further added to its appeal, attracting local AIFMs (Alternative Investment Fund Managers) and third-party service providers.

The stability and reputation of Luxembourg's investment funds are further enhanced by its strong connections with China. It serves as the principal European domicile for seven major Chinese banks and is the global hub for cross-border investments and a gateway for Chinese investment flows.

The country's investment funds cover all key categories, currencies, regions, and sectors, providing an opportunity for investors to make their financial resources grow faster, especially in times of low-interest rates on savings accounts.

Maximizing Returns: Managed Funds for Long-Term Investment Strategies

You may want to see also

Wide range of investment vehicles

Luxembourg is the leading investment fund centre in Europe, with over €4.3 trillion in assets under management (AuM). It is also the second-largest fund domicile in the world after the USA. The funds cover all key categories, currencies, regions, and sectors, and are offered in more than 70 countries.

Luxembourg has a broad range of investment vehicles, combining different legal forms, fund regimes, tax qualifications, and regulatory frameworks. The choice of investment vehicle depends on the nature of the target assets, the type of target investors, and the region and manner in which the alternative investment fund (AIF) will be marketed.

- Undertaking for Collective Investment (UCI): Governed by the UCI Law, these are open to retail investors in Luxembourg but benefit from the European passport under the AIFM Directive only for professional investors.

- Specialised Investment Fund (SIF): Governed by the SIF Law, these are reserved for well-informed investors and can be freely marketed to professional investors in other EEA member states.

- Investment Company in Risk Capital (SICAR): Governed by the SICAR Law, these are appropriate for investment vehicles that invest their assets in securities representing "risk capital". There are no restrictions on the type of assets as long as they qualify as "risk capital".

- Reserved Alternative Investment Fund (RAIF): Governed by the RAIF Law, these are similar to SIFs but are not subject to direct supervision by the Commission de Surveillance du Secteur Financier (CSSF) and do not require prior CSSF approval.

- Non-regulated ordinary commercial company (Soparfi): Governed by the 1915 Law, these are unregulated investment funds that are not subject to CSSF supervision and do not require prior approval.

- Special Limited Partnership (SCSp): Introduced in 2014, these are popular fund entities for alternative investments, including real estate. They offer contractual freedom and flexibility.

- Undertaking for Collective Investment in Transferable Securities (UCITS): These are subject to detailed asset eligibility, liquidity, and diversification requirements. They can only invest in transferable securities and other liquid financial instruments authorised by the UCI Law.

Each of these investment vehicles has its own legal, regulatory, and tax considerations, providing investors with a diverse range of options to suit their specific needs and strategies.

The Best Time to Invest in Funds: Morning or Evening?

You may want to see also

Operational efficiency

Luxembourg is the largest investment fund centre in Europe and the second-largest in the world. It is also the largest global distribution centre for investment funds, with its funds offered in more than 70 countries worldwide. The country has a strong reputation for attracting large cross-border investment platforms and reputable prominent fund and asset managers.

Luxembourg's investment funds are known for their operational efficiency, with a flexible company law regime and a robust regulatory framework. The country's funds cover all key categories, currencies, regions, and sectors, providing investors with a diversified portfolio.

The Grand Duchy is quick to adapt to market needs and has a broad range of investment vehicles, including traditional structures and innovative alternatives. For example, the Special Limited Partnership (SCSp), introduced in 2014, is a popular fund entity for alternative investments, offering contractual freedom similar to that of an Anglo-Saxon limited partnership.

Additionally, Luxembourg has an international and multilingual workforce, with English widely spoken, making it easier to attract local AIFMs (Alternative Investment Fund Managers) and third-party service providers.

The country's funds are also supported by efficient business operations. During the COVID-19 crisis, the Luxembourg investment fund sector demonstrated resilience by swiftly transitioning to remote working models. The government, tax authorities, and the Financial Sector Supervisory Body (CSSF) provided clear and regular communication, helping to maintain smooth business operations.

Best Mutual Funds: Where to Invest Smartly

You may want to see also