Municipal bonds, also known as munis, are debt securities issued by local and state governments to fund public projects such as schools, roads, and bridges. They are often exempt from federal taxes and sometimes state and local taxes too, making them attractive to investors in higher tax brackets. Municipal bonds are considered a relatively safe investment, with a low default risk compared to corporate bonds. They are also a good option for investors who want to hold on to their capital while creating a tax-free income source. However, it's important to note that municipal bonds are not entirely risk-free, and there is always the possibility of the issuer failing to make interest payments or repay the principal upon maturity.

| Characteristics | Values |

|---|---|

| Interest rate | Fixed |

| Interest payments | Semi-annual |

| Tax advantages | Exempt from federal income tax and may be exempt from state and local taxes |

| Risk | Relatively safe, but subject to interest-rate risk, credit risk, inflation risk, liquidity risk, call risk, and default risk |

| Issuers | State, local, and county governments |

| Buyers | Individuals, mutual funds, and exchange-traded funds |

| Types | General obligation bonds and revenue bonds |

What You'll Learn

Tax advantages

Municipal bonds are often exempt from federal income tax, and in some cases, investors can benefit from further exemptions on state and local taxes if they reside in the state where the bond is issued. This makes municipal bonds particularly attractive to investors in higher tax brackets, as the tax exemption enhances the bond's return.

Municipal bonds are also known to have a low level of default risk relative to other bond types.

Municipal bond funds can be a good investment, but only if you're in a higher tax bracket and are investing in a taxable account.

Municipal bonds can be purchased as stand-alone investments or bundles through an online broker. Robo-advisors also offer municipal bonds as part of their portfolio mix.

Municipal bonds are debt obligations issued by government entities. When you buy a municipal bond, you are loaning money to the issuer in exchange for a set number of interest payments over a predetermined period. At the end of that period, the bond reaches its maturity date, and the full amount of your original investment is returned to you.

Municipal bonds are available in both taxable and tax-exempt formats, but the tax-exempt bonds tend to get the most attention because the income they generate is, for most investors, exempt from federal and, in many cases, state and local income taxes.

Municipal bonds are good for people who want to hold on to capital while creating a tax-free income source.

Bond Fund Benefits: Diversify and Gain with Less Risk

You may want to see also

Low default risk

Municipal bonds are considered a low-risk investment option. While they are not entirely risk-free, they have a low default risk compared to other bonds.

Default risk is the possibility that the issuer of a bond will be unable to make interest payments or repay the principal upon maturity. Municipal bonds have a low default risk because they are issued by government entities, which can raise taxes to cover outstanding debts. General obligation bonds, for instance, are backed by the "full faith and credit" of the issuer, meaning they have the power to tax residents to pay bondholders.

Additionally, revenue bonds, which are backed by revenues from specific projects or sources, are also considered relatively safe. For example, a facility delivering water or treating sewage is likely to have more dependable revenue than a project that relies on consumer spending.

The low default risk of municipal bonds makes them an attractive investment option, particularly for those in higher tax brackets. The interest earned on municipal bonds is often exempt from federal, state, and local taxes, resulting in tax benefits for investors.

However, it is important to note that municipal bankruptcies and defaults do occur, and investors should carefully evaluate the creditworthiness of the bond issuer before making a purchase. Credit rating agencies like Moody's, S&P, and Fitch can help investors assess the risk of default by providing ratings based on the issuer's ability to meet its debt obligations.

Mutual Fund Strategies: Deposits and Investments Timeline

You may want to see also

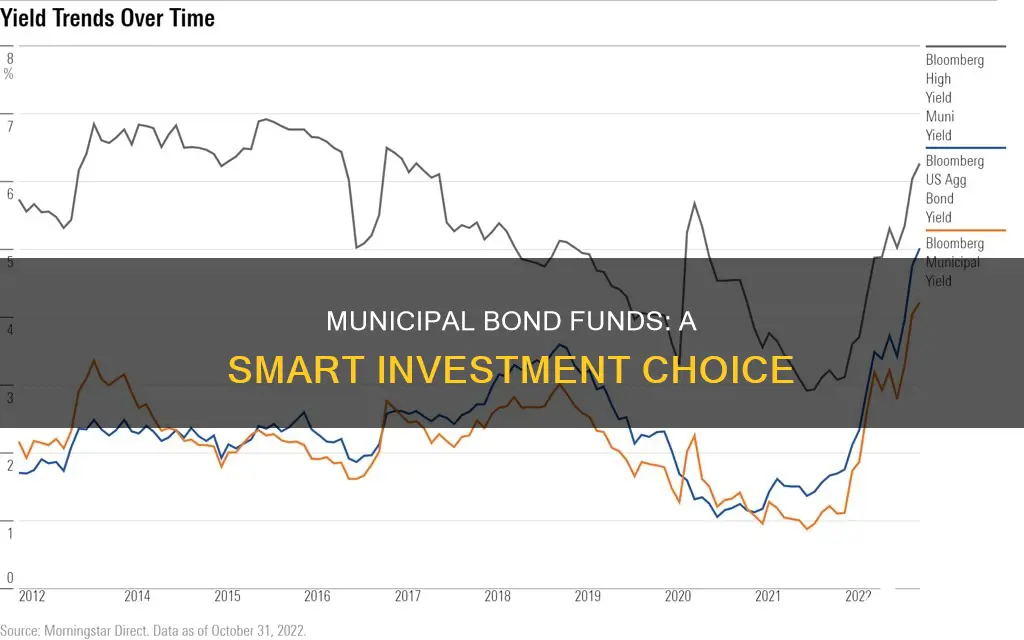

Interest rates

Municipal bonds are susceptible to interest rate risk, like all fixed-income securities. If interest rates rise, the market prices of existing bonds will typically decline, even if there is no change in the coupon rate and maturity. Bonds with longer maturities are more susceptible to changes in interest rates than bonds with shorter maturities.

Municipal bonds are often exempt from most taxes, which makes them attractive to people in higher income tax brackets. However, the interest rates for tax-exempt municipal bonds are usually lower than on taxable fixed-income securities with similar maturities, credit qualities, and other items. Municipal bonds are therefore a good investment for those in a higher tax bracket.

The interest rate of most municipal bonds is paid at a fixed rate, which does not change over the life of the bond. However, the underlying price of a particular bond will fluctuate in the secondary market due to market conditions. Changes in interest rates and interest rate expectations are generally the primary factors involved in municipal bond secondary market prices.

When interest rates fall, newly issued bonds will pay a lower yield than existing issues, which makes the older bonds more attractive. Investors who want the higher yield may be willing to pay more to get it. Likewise, if interest rates rise, newly issued bonds will pay a higher yield than existing issues. Investors who buy the older issues are likely to do so only if they get them at a discount.

If you buy a bond and hold it until maturity, market risk is not a factor because your principal investment will be returned in full at maturity. Should you choose to sell prior to the maturity date, your gain or loss will be dictated by market conditions, and the appropriate tax consequences for capital gains or losses will apply.

Index Investing: Outperforming Mutual Funds with Less Risk

You may want to see also

Safety

Municipal bonds are considered a relatively safe investment option, particularly for those in higher tax brackets.

Municipal bonds, also known as "munis", are debt securities issued by local, county, and state governments. They are often exempt from federal taxes, and sometimes state and local taxes, making them a good option for those looking to minimise their tax liability. The interest on municipal bonds is usually semi-annual, and the principal is returned on the maturity date.

General obligation bonds are issued by states, cities, or counties and are backed by the "full faith and credit" of the issuer, meaning they have the power to tax residents to pay bondholders. Revenue bonds, on the other hand, are not backed by government taxing power but by revenues from a specific project, such as tolls or lease fees.

Municipal bonds are considered a safe investment because of their low default risk compared to other bonds, such as corporate bonds. The default rate for investment-grade municipal bonds over the past decade was 0.10%, compared to 2.25% for similarly-rated corporate bonds.

However, it is important to note that municipal bonds are not entirely risk-free. There is still a chance that the issuer could fail to make interest payments or repay the principal upon maturity, as seen in the cases of Detroit in 2014 and Puerto Rico in 2018. Credit rating agencies such as Moody's, S&P, and Fitch can help investors evaluate the risk of each bond.

Additionally, municipal bonds carry interest rate risk, liquidity risk, and call risk, which should be considered before investing.

Mutual Fund Investors: Owners of a Diverse Portfolio

You may want to see also

Diversification

Municipal bonds, or "munis", are debt securities issued by local, county, and state governments to fund day-to-day operations and finance public projects such as roads, bridges, schools, and hospitals. They are often exempt from federal taxes and sometimes state and local taxes, making them attractive to investors in higher tax brackets.

Municipal bonds come in two main types: general obligation bonds and revenue bonds. General obligation bonds are issued by states, cities, or counties and are backed by the taxing power of the issuer. Revenue bonds are backed by the revenues generated by the project the bond is funding, such as tolls from a bridge or tunnel, or ticket sales from a stadium.

Within these categories, there are further variations. For example, insured bonds are municipal bonds insured by policies from commercial insurance companies, while taxable municipal bonds are issued for projects that do not provide a significant public benefit and are therefore not eligible for federal tax exemption. Zero-coupon bonds are issued at a discount and accrue interest over time, with the full value paid at maturity.

When investing in municipal bonds, it is important to consider the creditworthiness of the issuer and the project's revenue stream. While municipal bond defaults are rare, they do occur, as seen in Detroit in 2014 and Puerto Rico in 2018. Credit rating agencies such as Moody's, S&P, and Fitch can help investors evaluate the risk of default.

Municipal bonds can be purchased individually or through mutual funds or exchange-traded funds (ETFs). Investing in municipal bond funds provides broader diversification across many different bonds, bond sectors, and geographic regions. This diversification helps to reduce the overall risk of the investment portfolio.

In summary, municipal bond funds offer investors a way to diversify their portfolios, balance risk, and take advantage of tax benefits. By investing in a range of municipal bonds with different credit ratings, projects, bond types, and risk profiles, investors can reduce their exposure to any single investment and benefit from the stability of this asset class.

Best Index Funds: Where to Invest Your Money

You may want to see also

Frequently asked questions

Municipal bond funds are debt securities issued by local, county, and state governments to fund day-to-day operations and public projects such as roads, bridges, schools, and hospitals.

Municipal bond funds offer tax advantages, making them appealing to investors in higher tax brackets. They are also considered a relatively safe investment with low default rates.

Municipal bond funds are subject to interest rate risk, credit risk, liquidity risk, and inflation risk. There is also a chance, albeit small, of the issuer defaulting on payments.

Municipal bond funds can be purchased as stand-alone investments or bundles through an online broker or robo-advisor. They can also be bought through mutual funds or exchange-traded funds (ETFs).