Index funds are a great investment for building wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the S&P 500. An index fund will have the same investments as the index it tracks, and its performance will closely mirror that of the index.

IRAs, on the other hand, are a type of retirement account that provides tax advantages for retirement investors. The two main types are traditional IRAs and Roth IRAs. Traditional IRAs are tax-deferred, meaning contributions are tax-deductible, but withdrawals are taxed. Roth IRAs, on the other hand, have no tax deductions for contributions, but qualified withdrawals are tax-free.

Both index funds and IRAs have their advantages and disadvantages, and deciding which one to invest in depends on your financial goals and risk tolerance. Index funds are a more hands-off investment, while IRAs offer more flexibility in terms of investment options and tax benefits.

| Characteristics | Values |

|---|---|

| Type of fund | Mutual fund or exchange-traded fund (ETF) |

| Investment strategy | Passive, aims to replicate the returns of a designated stock market index |

| Investment options | Individual stocks, bonds, mutual funds, or ETFs |

| Risk | Lower risk due to diversification, but still possible to lose money |

| Fees | Low fees, but some funds may have sales loads or expense ratios |

| Returns | Historically, index funds have made solid returns, but there is no guarantee of future performance |

| Tax advantages | Tax-efficient, generate less taxable income, and offer tax-free growth in a Roth IRA |

| Suitable for | Beginners or experienced investors looking for a low-cost, diversified investment option |

What You'll Learn

Index funds vs. IRA: pros and cons

Index funds are a great investment for building wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the S&P 500. They are considered a passive management strategy because they don't require active decision-making about which investments to buy or sell. Index funds are also low-cost, easy to invest in, and provide good returns over time.

On the other hand, an Individual Retirement Account (IRA) is a tax-advantaged investment account that allows your investments to grow without being taxed. There are two main types of IRAs: traditional IRAs and Roth IRAs. Traditional IRAs are tax-deferred, meaning contributions are tax-deductible, but withdrawals are taxed. Roth IRAs, on the other hand, have contributions that are not tax-deductible, but qualified withdrawals are tax-free.

Index Funds: Pros

- Low-cost and easy way to build wealth

- No active management required

- Good returns over time

- Immediate diversification

- Lower risk compared to individual stocks

Index Funds: Cons

- May not be suitable for investors who want to beat the market

- Can be volatile, especially during economic downturns

- Limited control over the stocks in the fund

IRA: Pros

- Tax advantages: tax-deductible contributions or tax-free withdrawals

- No taxes on capital gains or dividends

- Ability to buy individual stocks or choose from a variety of mutual funds

- No contribution limits or restrictions on withdrawals

IRA: Cons

- Limited to $7,000 annual contributions ($8,000 for investors over 50)

- Early withdrawal penalty of 10% if withdrawn before the age of 59.5

- Income limits and qualification restrictions for certain types of IRAs

Hedge Funds: Low Returns, High Investment?

You may want to see also

How to invest in an index fund

Index funds are a great investment for building wealth over time, especially for retirement. They are a group of stocks that mirror the performance of an existing stock market index, such as the S&P 500 or the Nasdaq Composite.

- Have a goal for your index funds: Know what you want your money to do for you. If you're looking for a short-term investment, index funds may not be the best option. However, if you're looking to let your money grow slowly over time, particularly for retirement, index funds are a great option.

- Research index funds: There are various types of index funds based on company size, geography, business sector, asset type, and market opportunities. You can choose to invest in a broad stock market index or customise your fund mix to get more exposure to specific markets.

- Pick your index fund: This often boils down to cost. Index funds are cheap to run because they are automated to follow shifts in value in an index. However, don't assume that all index funds are cheap. They still carry administrative costs, which are subtracted from each fund shareholder's returns as a percentage of their overall investment.

- Decide where to buy your index fund: You can purchase an index fund directly from a mutual fund company or a brokerage. Exchange-traded funds (ETFs) are like mini mutual funds that trade like stocks throughout the day. Consider factors such as fund selection, convenience, trading costs, impact investing, and commission-free options when choosing where to buy.

- Buy the index fund: You will need to open an investment account, such as a brokerage account, individual retirement account (IRA), or Roth IRA, to purchase the fund. You can then decide how much you want to invest and how many shares you want to buy.

- Keep an eye on your index fund: Index funds are passive management strategies, so you don't need to monitor them as actively as other investments. However, it is important to check that your index fund is mirroring the performance of the underlying index. Also, keep an eye on the fees to make sure they don't start stacking up over time.

Should I invest in an individual index fund or an IRA?

An IRA, or Individual Retirement Account, is a type of investment account that offers tax advantages for saving for retirement. It is a popular option for those who want to choose their own investments and have more control over their retirement savings.

When deciding between investing in an individual index fund or an IRA, consider your financial goals, risk tolerance, and the level of control you want over your investments. Both options can be great choices for building wealth over time, but they have different features and benefits that may align better with your specific needs and preferences.

Index Funds: Halal or Haram?

You may want to see also

How to invest in an IRA

An individual retirement account (IRA) is a great way to save and invest for retirement. Here is a step-by-step guide on how to invest in an IRA:

Step 1: Choose between an online broker and a robo-advisor

Firstly, you need to decide whether you want to select your own investments or use a digital investment platform that makes investment decisions for you based on your preferences. If you choose the former, you will need an online broker like Fidelity, Charles Schwab, or Merrill Edge, where you can pick and choose from a menu of investment assets. If you choose the latter, you can go for a robo-advisor platform like Wealthfront or Betterment, or select a robo-advisor managed by a financial firm like Schwab Intelligent Portfolios or Fidelity Go.

Step 2: Decide where to open an IRA

Once you've decided whether to go for a self-directed IRA or a robo-advisory IRA, you need to select a financial firm. If you want all your finances under one roof, you might choose an investment advisor that offers both self-directed investing and robo-advisory options. When deciding where to open an IRA, investigate annual management fees, investment minimums, available investments, customer service options, and customer reviews.

Step 3: Choose an IRA account type to invest in

Next, choose the type of IRA that best fits your tax and financial situation. Understand that Roth and traditional IRAs have eligibility limits, depending on your income and whether you have a workplace retirement account. A traditional IRA might be preferable if you expect to be in a lower tax bracket in retirement, whereas a Roth IRA might be better if you are in a low tax bracket now and are happy to pay taxes now rather than in retirement.

Step 4: Open an account

Opening an IRA account involves providing personal documentation to support your identity, such as your full name, address, telephone number, social security number, driver's license number, beneficiary information, and employer information. You will also need to provide information about your investment objectives and risk tolerance.

Step 5: Fund your account

To fund your IRA account, you will need to link an existing financial account. You can do this by navigating to the external transfer section of your bank's website and inputting the requested information about your newly opened IRA.

Other considerations

When deciding how much to invest in your IRA, it is generally best to contribute the maximum amount allowable by law annually. You should also consider the types of investments you select, as these will determine how much your IRA earns. In general, a well-diversified IRA invested in a mix of stock and bond ETFs can be expected to earn between 6% and 8% per year on average, depending on your asset allocation. Finally, review the IRA management fees and the expense ratios for the ETFs or mutual funds you select—lower fees enable more of your money to grow and compound in the investment markets.

Small-Cap Funds: When to Invest and Why

You may want to see also

What are the best index funds?

Index funds are a great way to build wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index.

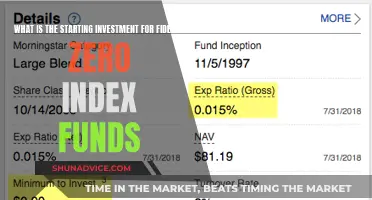

Fidelity ZERO Large Cap Index

The Fidelity ZERO Large Cap Index fund is a mutual fund with no expense ratio. It tracks the Fidelity U.S. Large Cap Index, which is very similar to the S&P 500. This fund is a great option for investors looking for a broadly diversified index fund at a low cost.

Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF is one of the largest funds on the market, backed by Vanguard, a powerhouse in the fund industry. With an expense ratio of just 0.03%SPDR S&P 500 ETF Trust

The SPDR S&P 500 ETF is one of the most popular ETFs, having been founded in 1993. It tracks the S&P 500 and is sponsored by State Street Global Advisors. With an expense ratio of 0.095%, this fund is a great option for investors looking for a well-diversified and low-cost fund.

IShares Core S&P 500 ETF

The iShares Core S&P 500 ETF is one of the largest ETFs, sponsored by BlackRock, one of the largest fund companies. This fund tracks the S&P 500 and has an expense ratio of just 0.03%. It is a great choice for investors looking for broad diversification and low costs.

Schwab S&P 500 Index Fund

The Schwab S&P 500 Index Fund is sponsored by Charles Schwab, a well-respected name in the industry. With a strong record dating back to 1997 and an extremely low expense ratio of 0.02%, this fund is a great option for investors seeking broad diversification and low fees.

Shelton NASDAQ-100 Index Direct

The Shelton NASDAQ-100 Index Direct ETF tracks the performance of the largest non-financial companies in the NASDAQ-100 Index, which are primarily tech companies. With an expense ratio of 0.52%, this fund offers investors exposure to the tech industry and growth-oriented companies.

Invesco QQQ Trust ETF

The Invesco QQQ Trust ETF is another index fund that tracks the performance of the largest non-financial companies in the NASDAQ-100 Index. Managed by Invesco, this fund has delivered strong returns and has an expense ratio of 0.20%.

Vanguard Russell 2000 ETF

The Vanguard Russell 2000 ETF tracks the Russell 2000 Index, which consists of about 2,000 of the smallest publicly traded companies in the U.S. With an expense ratio of 0.10%, this fund offers investors broad exposure to small-cap companies at a low cost.

Vanguard Total Stock Market ETF

The Vanguard Total Stock Market ETF covers the entire universe of publicly traded stocks in the U.S., including small, medium, and large companies across all sectors. With an expense ratio of just 0.03%, this fund is a great option for investors seeking broad diversification and low costs.

SPDR Dow Jones Industrial Average ETF Trust

The SPDR Dow Jones Industrial Average ETF Trust tracks the Dow Jones Industrial Average, consisting of 30 large-cap stocks. With an expense ratio of 0.16%, this fund offers investors exposure to blue-chip companies at a low cost.

Loaded Fee Mutual Funds: When to Invest and Why

You may want to see also

What are the best IRA funds?

When it comes to choosing the best IRA funds, there are several options and strategies to consider. Here are some recommendations and factors to keep in mind:

Vanguard Funds

Vanguard offers a diverse range of funds that are often recommended for IRA investors. Here are some of their top funds:

- Vanguard Wellesley Income Fund Investor Shares (VWINX): This fund offers a conservative blend of income generation and capital preservation, investing one-third in stocks and two-thirds in bonds. It has a high 30-day SEC yield of 3.7% and charges a low expense ratio of 0.23%. The minimum investment required is $3,000.

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX): This fund tracks the CRSP US Total Market Index, providing exposure to over 3,600 domestic stocks. It has a low turnover rate and has been tax-efficient, making it a good choice for a Roth IRA.

- Vanguard Dividend Growth Fund (VDIGX): This fund holds 42 stocks across various sectors, including healthcare, technology, and consumer staples. It focuses on top companies like Microsoft and Northrup Grumman Corp., aiming to grow their dividends over time. The expense ratio is 0.30%, and the minimum investment is $3,000.

- Vanguard Total International Stock Market (VXUS): This fund tracks an index of global stocks, excluding the US. It has an annual cost of $7 for a $10,000 investment.

- Vanguard Total Bond (BND): This fund tracks an index of various bonds and has an annual cost of $3 for a $10,000 investment.

Other Recommended Funds

In addition to Vanguard, there are other highly-rated funds from different providers that are worth considering:

- Fidelity Blue Chip Growth Fund (FBGRX): This fund is actively managed by Fidelity, focusing on blue-chip stocks that are well-established and exhibit growth traits. It has a higher expense ratio of 0.47% but has consistently outperformed the Russell 1000 Growth Index.

- Schwab US REIT ETF (SCHH): This ETF provides exposure to REITs, known for their favourable dividend payouts, at a low expense ratio of 0.07%. It tracks the Dow Jones Equity All REIT Capped Index, investing in various REIT sub-sectors like self-storage, office, retail, and data centres.

- Avantis Moderate Allocation ETF (AVMA): This ETF provides exposure to global equities (65%) and fixed income (35%). It tends to overweight smaller, potentially undervalued companies and has a 30-day SEC yield of 2.6% with a net expense ratio of 0.21%.

- IShares Bitcoin Trust ETF (IBIT): This ETF offers exposure to Bitcoin, providing aggressive growth potential. It has a low 30-day median bid-ask spread of 0.03% but comes with high volatility.

- Dodge & Cox International Stock Fund (DODFX): This fund holds a portfolio of equity securities issued by medium-to-large non-US companies with strong growth potential, according to Morningstar. It has an expense ratio of 0.62% and a minimum investment of $1,000 for IRAs.

- FPA Crescent Fund (FPACX): This fund holds a mix of bonds, stocks, and cash equivalents, including US government bonds and shares of Comcast and Alphabet. It aims to generate equity-like returns over the long term with lower risk. The expense ratio is 1.09%, and the minimum investment is $1,500.

Factors to Consider

When selecting the best IRA funds, it's important to consider the following:

- Asset Allocation: Diversify your portfolio by investing in different types of assets, such as stocks, bonds, and cash. The specific mix will depend on your risk tolerance and investment goals.

- Risk Tolerance: Consider your time horizon and comfort with risk. Generally, younger investors can take on more risk by investing a larger proportion of their portfolio in stocks, while older investors may want to shift towards more conservative investments like bonds.

- Fees and Expenses: Pay attention to expense ratios, management fees, and transaction costs, as these can eat into your investment returns over time. Index funds are known for their low costs.

- Tax Efficiency: Roth IRAs offer tax-free growth and withdrawals, making them attractive for long-term investments. Consider the tax implications of dividends and capital gains when choosing funds.

Coronation Funds: A Guide to Smart Investing

You may want to see also

Frequently asked questions

An index fund is a group of stocks that aims to mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index. Index funds are considered a passive management strategy because they don't require active decision-making about which investments to buy or sell.

Index funds are a low-cost, easy way to build wealth. They are also well-suited for beginners because you don't need to know much about investing or financial markets to do well.

You can invest in an index fund by opening and funding a brokerage account. You can buy shares of ETFs on the open market, and most brokers also allow you to invest directly in mutual funds. Alternatively, you can automate your index fund investing by opening an account with a robo-advisor.

IRA stands for Individual Retirement Account. It is a type of retirement account that provides tax advantages for retirement investors. The two main types of IRAs are traditional IRAs and Roth IRAs, which have different tax implications.

It depends on your financial goals and time horizon. If you are saving for retirement and comfortable with a long-term investment horizon, an IRA may be a good option. If you are looking for more flexibility and short-term investments, a brokerage account might be a better choice.