Private equity funds are a popular investment option for high-net-worth individuals and institutional investors due to their potential for high returns. They are a form of investment that takes place outside of the public stock market, allowing investors to gain an ownership stake in private companies. By investing in private equity, individuals can diversify their portfolios and aim for higher returns than the public market might provide. Private equity funds typically involve three parties: the investors who supply the capital, the private equity firm that manages and invests that money, and the companies the private equity firm invests in.

One key distinction to consider before investing in private equity is that private equity valuations are not influenced by the larger market. Private companies are allowed more flexibility in their accounting practices compared to publicly traded companies, which must adhere to strict regulations set by the Securities and Exchange Commission. As a result, private equity funds offer higher returns but come with greater risk.

Private equity firms play a significant role in fostering innovation and driving growth in dynamic sectors, particularly technology. They identify undervalued or under-managed companies, implement improvements, and then sell them for a maximum return. This buying to sell strategy is a key advantage of private equity firms, allowing them to maximise their profits.

While private equity investing offers attractive returns, it is important to note that it requires a high degree of risk tolerance and the ability to handle substantial illiquidity. The minimum investment requirements are typically very high, ranging from a few hundred thousand to several million dollars, making it inaccessible to most average investors.

In conclusion, private equity funds offer a potentially lucrative opportunity for those with the financial means and risk appetite to invest.

| Characteristics | Values |

|---|---|

| Returns | Historically, private equity funds have outperformed public equity funds. |

| Risk | Private equity is a high-risk investment with substantial illiquidity. |

| Diversification | Private equity can help diversify a portfolio by mitigating public market and cyclical risk. |

| Access | Private equity firms have access to a larger pool of unknown opportunities. |

| Ownership | Private equity firms take on a level of active ownership, which can include restructuring and running the company. |

| Alignment of interests | Private equity fund managers earn a percentage of the fund's profits, aligning the interests of the manager with those of the investors. |

| Long-term approach | Private equity investments take a long-term approach to capitalising new businesses, developing innovative business models and restructuring distressed businesses. |

| Control | Private equity funds have more control over the companies they invest in, allowing them to make active decisions to react to market cycles. |

What You'll Learn

- Private equity funds historically result in higher returns than public markets

- Private equity funds are a way to diversify your portfolio

- Private equity funds are attractive to high-net-worth individuals

- Private equity funds are a source of funding for early-stage, high-risk ventures

- Private equity funds are not easily accessible for the average investor

Private equity funds historically result in higher returns than public markets

Private equity funds have historically resulted in higher returns than public markets. This is due to a variety of reasons, including the nature of private equity as a high-risk, high-reward investment, the strategies employed by private equity firms, and the differences in governance structures between private and public markets.

Firstly, private equity falls under the category of alternative asset classes and is considered a high-risk, high-reward investment option. Private equity firms pool raised or borrowed funds to obtain ownership positions in smaller companies with growth potential. This model allows private equity to access a larger pool of unknown opportunities that are not subject to the same scrutiny as public companies. By investing in these companies at an early stage, private equity firms can benefit from higher returns as the companies succeed.

Secondly, private equity firms employ a "`buy to sell`" strategy, which involves acquiring undervalued or under-managed businesses, increasing their value, and then selling them for a maximum return. This approach differs from public companies, which typically "buy to keep" and may dilute their returns by holding onto businesses even when their growth tapers off.

Additionally, private equity firms take on active ownership roles, providing advisory services, assistance, and restructuring to the companies they invest in. They also have specialised value creation teams dedicated to maximising the return on their investments. This level of involvement and value-adding is not typically seen in public equity investments.

Furthermore, private equity funds have more robust governance structures than public markets. They have greater control over the companies they invest in, allowing them to make strategic decisions and react to market cycles. As a result, private equity funds are often better positioned to weather downturns and generate higher returns over the long term.

Comparisons between private and public equity returns show that private equity has consistently outperformed public equities over most of the past 20 years. For example, private equity produced average annual returns of 10.48% over the 20-year period ending on June 30, 2020, while the S&P 500, a benchmark for public equity performance, returned 5.91% during the same period.

However, it is important to note that private equity investments come with higher fees and a higher degree of risk. Investors considering private equity should carefully evaluate their risk tolerance and ensure they have the ability to handle the illiquidity associated with these investments.

Mutual Fund Lump Sum Investments: Where to Begin?

You may want to see also

Private equity funds are a way to diversify your portfolio

Private equity funds are often used by institutional investors and high-net-worth individuals to diversify their portfolios and target higher returns than those offered by public companies. The funds are typically managed by private equity firms, which combine capital from multiple investors to invest in various private companies or businesses.

One of the main advantages of private equity funds is the potential for higher returns compared to other investment options. Private equity funds have historically outperformed public equity and other traditional asset classes in terms of returns. This is because private equity firms focus on acquiring undervalued or under-managed companies, increasing their value, and then selling them for a maximum return.

Additionally, private equity funds can help to diversify a portfolio by mitigating public market and cyclical risk. They represent an asset class with a lower correlation to public market movements, as private equity managers invest directly in private companies and work with them to increase their value over the long term. This long-term approach to investing in new businesses, developing innovative business models, and restructuring struggling companies results in lower correlations with public equity funds, making private equity funds attractive for diversification.

However, it is important to note that private equity funds come with a high degree of risk and require substantial capital. They are typically illiquid investments, and investors should be prepared to hold them for the long term, often for at least ten years.

Mutual Funds vs Property: Where Should You Invest?

You may want to see also

Private equity funds are attractive to high-net-worth individuals

Private equity funds have historically outperformed public equity, as well as other traditional asset classes, due to their unique characteristics. They have access to a larger pool of unknown opportunities that are not subject to the same scrutiny as public companies, allowing them to invest at an earlier stage and benefit from higher returns. Private equity firms also take on a more active ownership role, often restructuring and running the company to increase its value. Additionally, private equity funds have a stronger alignment of interests with investors as the fund managers earn a percentage of the profits, ensuring their interests are aligned with those of the investors.

Another advantage of private equity funds is their ability to diversify a portfolio and mitigate risk. By investing in private companies and working with them to increase their value, private equity managers create long-term approaches that are less correlated with public equity funds. As a result, private equity funds are more likely to weather downturns and provide greater modulation of risk and return within a portfolio.

However, it is important to note that private equity investing is very risky and illiquid. It requires a high degree of risk tolerance and the ability to handle substantial illiquidity. Investors should be prepared to lose all their money and hold their investments for at least 10 years.

Best HDFC Mutual Funds: Where to Invest Smartly

You may want to see also

Private equity funds are a source of funding for early-stage, high-risk ventures

Private equity funds are managed by private equity firms, which act as advisers. These firms pool together money from investors and use it to make investments on behalf of the fund. The funds are raised from institutional investors, such as hedge funds, pension funds, university endowments, and high-net-worth individuals.

One of the key advantages of private equity funds is their ability to provide access to a larger pool of companies, including those that are not yet publicly traded. This allows investors to get in on the ground floor, which, while risky, can lead to higher returns. Private equity firms also have the resources to perform thorough due diligence on these investment opportunities.

Another benefit of private equity funds is the level of active ownership they provide. Private equity firms often take on a significant role in the management and direction of the companies they invest in, with the goal of increasing their value. They may bring in specialised value creation teams dedicated to maximising the long-term return on investment.

Private equity funds also offer better alignment of interests between fund managers and investors. Private equity fund managers typically earn a percentage of the fund's profits, known as "carry", in addition to a management fee. This structure ensures that the interests of the fund manager are aligned with those of the investors, as they only profit when the fund performs well.

While private equity funds offer the potential for high returns, it is important to note that they are high-risk investments. They are typically illiquid, with investors often required to hold their investments for several years before realising any returns. Additionally, there is a high degree of risk associated with the investments themselves, as early-stage ventures may fail or struggle to succeed.

In summary, private equity funds provide a source of funding for early-stage, high-risk ventures by offering access to a larger pool of companies and active ownership by private equity firms. While these funds offer the potential for high returns, they also carry significant risk, and investors should carefully consider the risks and illiquidity associated with this type of investment.

International Company Funds: Where to Invest Your Money

You may want to see also

Private equity funds are not easily accessible for the average investor

Private equity funds are considered alternative investments, and they are often only available to institutional and accredited investors or those with a high net worth. The high minimum investment requirements make it challenging for the average investor to access private equity opportunities.

Additionally, private equity investing can be very speculative and risky. There is no guarantee that the companies invested in will succeed, and there are limited protections for investors if the ventures fail. Private equity investments also tend to be illiquid, meaning it can take a year or more to sell these investments. As such, investors need to have a high degree of risk tolerance and the ability to handle substantial illiquidity to succeed in private equity markets.

Furthermore, private equity funds have a finite term of 10 to 12 years, and the money invested is typically locked in for this period. Investors should be prepared to hold their investments for at least ten years to avoid losing out as companies emerge from the acquisition phase, become profitable, and are eventually sold.

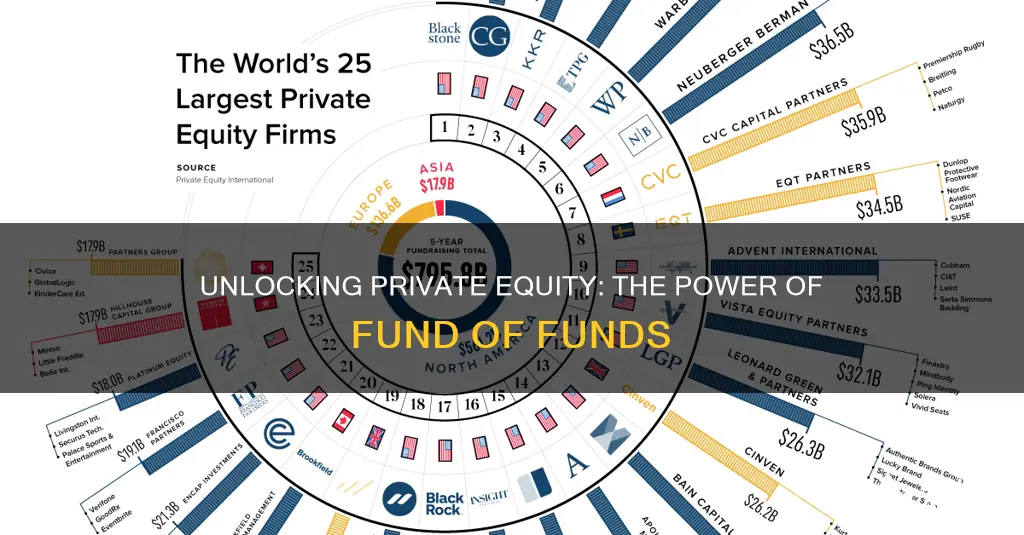

While there are some non-direct ways to invest in private equity, such as funds of funds, exchange-traded funds (ETFs), and special purpose acquisition companies (SPACs), these options may still have high minimum investment requirements or additional layers of fees and expenses.

Money Market Funds: When to Invest for Maximum Returns

You may want to see also